Disclaimer: This article has been paid for by Alta Copper. See disclosures at the bottom of the page.

Disclaimer: This article has been paid for by Alta Copper. See disclosures at the bottom of the page.

If you were to glance at the news cycle over the last few months, you’d be forgiven for thinking nothing much is happening at Alta Copper (ATCU.T). The company has been quiet of late — no flashy headlines, no deal-making frenzies, no splashy promotions. Just retooling, raising dollars, and the occasional boardroom shuffle.

It’s the kind of silence that investors often misread as stagnation, but the cleaver folks see as an engine revving.

Two things have been in the works for some time; Securing a social license with local communities, and organizing its first major exploration program in over a decade.

Beneath the surface, it would appear this is a company deep in execution mode. That quiet is a reflection of a strategic shift.

In 2024, Alta crossed a critical threshold that few noticed: On a project that has incredible potential, it secured environmental approvals, drill permits, and community groundwork that took years of methodical effort. Now, it’s laying the groundwork for a further 40,000 meters of drilling that will be conducted in phases over the next two years on that same project, that could define the next chapter in its story.

The last time Alta drilled at Cañariaco Norte was in 2013, and the drill holes weren’t deep, but US$125 million of cumultative expenditures have been spent on the ground.

This time, the targets are longer, higher-grade, and potentially game-changing — but you can’t just charge in, especially in Peru, where community relations can make or break a project.

So, while the market has been yawning and moving on to the next lithium meme or graphite fad, Alta has been quietly prepping to get at one of the world’s few remaining district-scale copper assets not already owned by a major.

And now, with former President Trump’s announcement this week that he’ll seek to impose tariffs on imported copper, the entire copper world just got weird.

A tailwind from Washington

The proposed copper tariffs are an inflection point. While intended to revive US mining, their short-term effect is likely to disrupt supply chains and raise copper prices.

And copper — already in a long-term bull market thanks to electrification, data centers, and energy transition infrastructure — doesn’t need much help from politics to get hot.

When you add this kind of policy pressure, you ignite price speculation, hoarding, and urgency. Juniors with near-term production potential and a large, defined resource become extremely attractive to off-takers, traders, and majors looking to secure long-term supply. Copper importers from places like China suddenly look away from the US and zero in on laces like Peru.

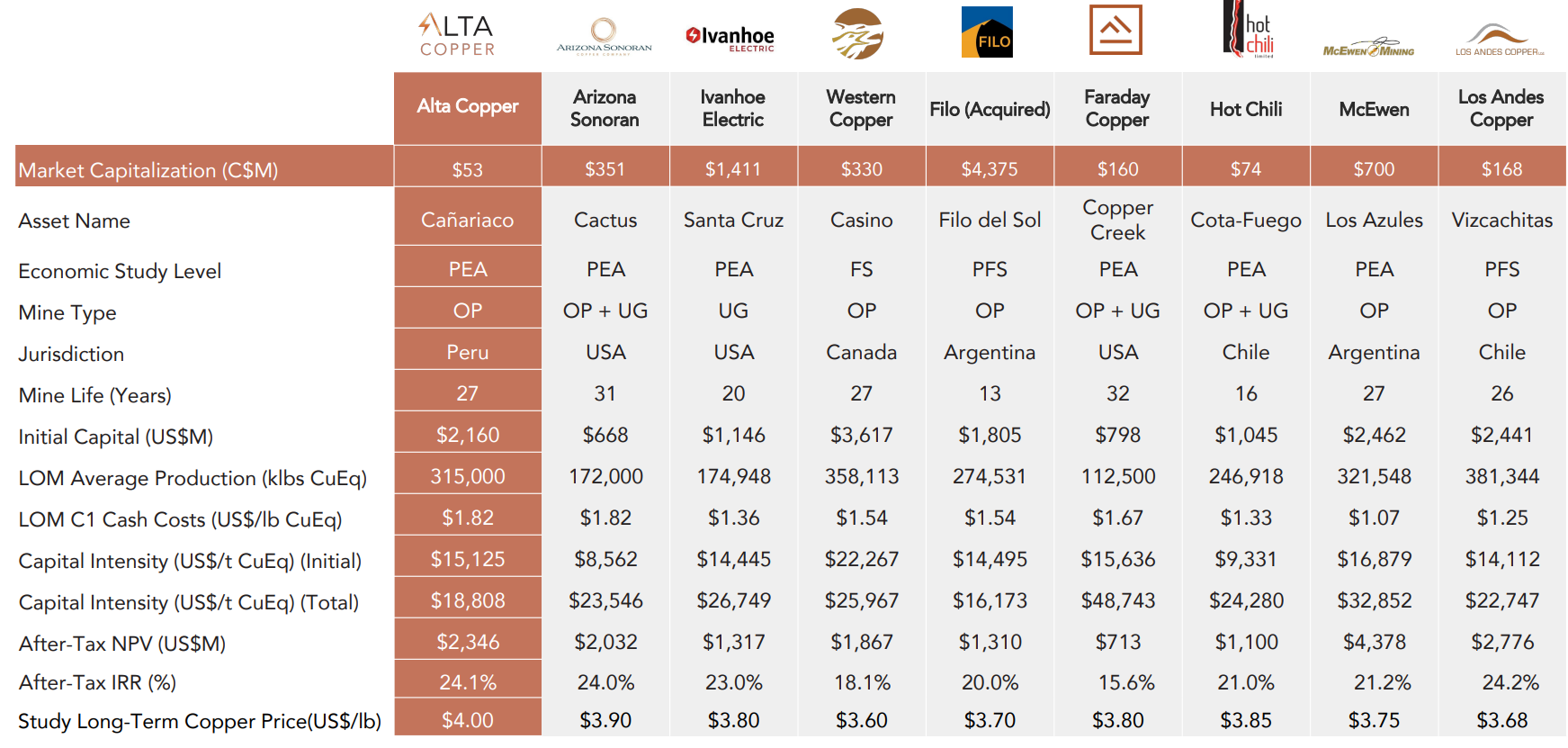

Alta sits right in that sweet wheelhouse: a seemingly massive deposit, clean metallurgy, a defined resource, and — crucially — one of the lowest capex intensity profiles in its peer group.

So why is the market still ignoring it?

My take is, it isn’t ignoring it so much as forgetting it. Alta’s project hasn’t drilled in over a decade and that puts it in the memory hole.

But that is also precisely what sets the stage for some asymmetric upside. Once drills turn, once visuals are released, once assays start to roll in — the silence breaks and people will be saying, “where the heck did this come from?”

And with Fortescue, a multi-billion dollar major, already holding over 35% of Alta’s stock, you can bet they’re lying in wait.

Three reasons to pay attention to Cañariaco

1. Immense leverage to copper.

This is not a small project. Cañariaco has over 14.2 billion pounds of copper, 4 million ounces of gold and 95 million ounces of silver in the measured, indicated and inferred categories, across its Norte and Sur zone. At $4.00/lb copper, across all of its inferred, indicated, and measured resources and zones, the after-tax net present value is already $2.3 billion. At $4.50? It jumps to $3.2 billion. That means every $0.25 rise in the copper price adds roughly $425 million in value, and today’s price is $5.64. That’s enormous leverage.

2. Fortescue’s silent sponsorship.

Juniors get invested in by the big boys all the time, but Fortescue isn’t just some passive investor. They’ve participated in nearly every financial raise at Alta since 2020, they hold board-level access, and recently increased their stake through placements at a premium to market — with no warrants attached. That’s not dumb money. It’s patient, strategic capital — and possibly a prelude to a larger role down the line.

3. Capital-efficient development.

At just $2.2 billion in capex, Alta’s project is cheaper to build than many of its peers on a per-pound basis. The low strip ratio, surface mineralization, and established infrastructure nearby all contribute to making this a low-risk, high-reward project from an engineering and economic standpoint.

While we’re being real here; the risks worth watching

1. Peru is stable — until it isn’t.

While Peru has long been a mining-friendly jurisdiction, its political climate is prone to swings. Right now, the government is pro-mining, actively encouraging investment, and cutting red tape. But the situation can change quickly. Alta’s progress depends on maintaining good community relationships and staying ahead of policy shifts, but that’s exactly where the company is focusing its time currently.

2. Pre-revenue equals dilution.

Alta is not yet generating income, and to move this project forward, more money will be needed. While Fortescue may eventually take the lead, there’s a real risk of shareholder dilution if the company raises capital without strategic backing or favorable market conditions. That’s the tradeoff of a deep-value opportunity — it needs patient capital, but copper has been attracting that of late.

The bottom line

- Cañariaco Norte Resource:

- Measured & Indicated: 9.3B lbs Cu, 2.2M oz Au, 60.4M oz Ag

- Inferred: 2.4B lbs Cu, 0.5M oz Au, 16.9M oz Ag

- Cañariaco Sur Resource:

- Inferred: 2.5B lbs Cu, 1.3M oz Au, 17.6M oz Ag, 24.0M lbs Mo

- 2024 Preliminary Economic Assessment: NPV(8%) = $3,197M NPV at $4.50/lb Cu, IRR=28.9%

- Potential timeline to production: 2028-2029

Also:

- Preliminary Economic Assessment (“PEA”) showing Robust Economics → Completed May 2024

- Reconstitution of Board of Directors and Senior Management Changes → July 2024

- Drill Permit Application (“DIA” & “ESIA”) Submitted December 2023 → Approved October 2024

- Certificates of Non-Existence of Archaeological Remains (“CIRAS”) → Received October 2024

- Start of Exploration Activities & Community Agreement – Advancing on Schedule

And:

- Project expenditures: $125m

- Market cap: $53m

That’s a hell of a buy-in price and, if you compare other players, it’s clear a lot of value is yet to be priced in.

Alta Copper is the kind of company that the market rediscovers all at once. One big intercept, one strategic deal, or one strong copper rally — and suddenly the stock isn’t trading at pennies on the pound anymore.

In a copper market increasingly defined by scarcity, resource nationalism, and explosive demand growth, Alta holds a project that checks nearly every box: scale, economics, jurisdiction, backing, and timing. And now, with geopolitics potentially disrupting global supply chains, its quiet progress may soon be anything but.

For those willing to get in before the headlines return, Alta may be one of the few genuine sleepers left in the copper space… at least today.

— Chris Parry

FULL DISCLOSURE: Equity.Guru/Parry Research has a marketing agreement with Alta Copper and may purchase stock in the company. EG/PR does not make buy/sell recommendations but you should consider any coverage with a client company as potentially conflicted and any investment you make in a public company as having inherent risk so please consult your investment advisor.

Leave a Reply