Disclaimer: This article has been paid for by Standard Uranium. See disclosures at the bottom of the page.

Disclaimer: This article has been paid for by Standard Uranium. See disclosures at the bottom of the page.

Prismo Metals (CSE: PRIZ) is not a big resource explorer. In fact, at a $6m market cap, it’s on the smaller side.

So when a little guy like that can raise a half million bucks in a sluggish market, and be fighting off more, that’s noteable.

Prismo just announced it closed an upsized financing of $575,000, a notable boost for a junior looking to impress upon folks that it’s uhdervalued.

For a company like Prismo, this isn’t just a line item – it’s fuel for the drills, sampling programs, and mapping that move a project forward.

So what’s the plan now that the cash is in the bank? Let’s break it down.

A Portfolio with Options

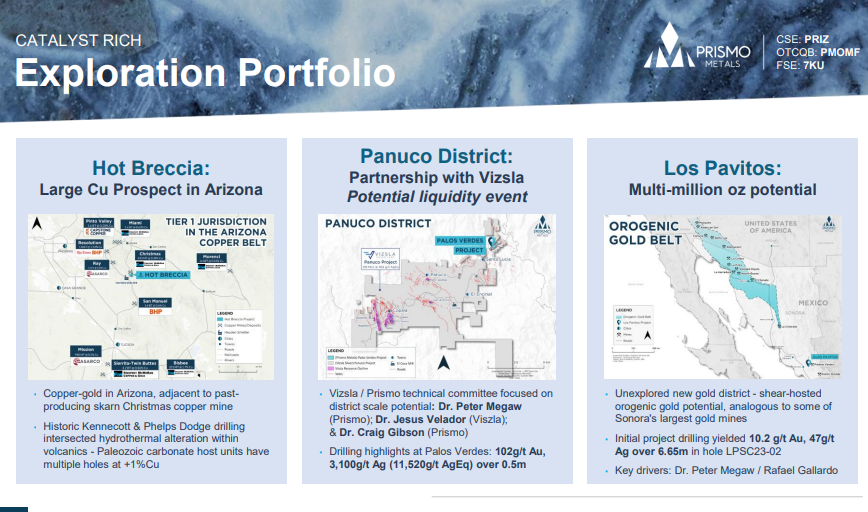

Prismo isn’t a one-project gamble. Its assets are spread across copper, silver, gold, and even antimony in two mining-friendly jurisdictions – Arizona and Mexico. That diversification matters, because one discovery doesn’t have to carry the whole company.

-

Hot Breccia (Arizona copper): Right in the Arizona Copper Belt, surrounded by majors like BHP and Rio Tinto. The rocks here are similar to what’s seen at Resolution, one of the world’s largest undeveloped copper deposits. Historical drilling already hit significant copper, and recent geophysics showed a big, deep conductive anomaly – the kind of feature that could hide a major orebody.

-

Silver King & Ripsey (Arizona silver & antimony): Historic high-grade mines that produced serious silver in their day – tens of ounces per ton when 1 ounce was enough to get attention. No modern exploration has touched them in decades, which is rare in Arizona. The early plan calls for mapping, sampling, and then drilling to see how much high-grade mineralization remains.

-

Palos Verdes (Mexico silver-gold, partnered with Vizsla Silver): This one has already delivered eye-catching numbers, like 102 g/t gold and 3,100 g/t silver (11,520 g/t silver equivalent) over half a meter. With Vizsla as both a shareholder and technical partner, Prismo is positioned in a district that’s already seeing billion-dollar development plans.

That’s three meaty dice rolls in which others have already paid for the dice, rolled, and got good numbers.

Why the Financing Matters

Junior exploration is simple math: no money, no drilling. The $575,000 financing, while not massive by major-mining standards, is meaningful for Prismo because its share count is relatively tight at 71.5 million shares and insiders own 31.6%. This isn’t a bloated company burning cash on overhead; it’s lean, with a track record of stretching exploration dollars, and can do plenty with that little addition to the bottom line.

And it’s not just the amount raised, but the upsized nature of the financing. Upsized means investor interest exceeded initial expectations – not something every junior can claim in this market.

What’s Coming Next

With the cash now secured, expect boots on the ground and drills spinning where it counts:

-

Silver King & Ripsey: The plan includes dewatering old shafts, collecting bulk samples for metallurgical work, and drilling about 1,000 meters to test the pipe-like ore body and nearby targeta.

-

Hot Breccia: Fully permitted and drill-ready, with a 5,000-meter program planned to target known mineralization and that deep geophysical anomaly. This is where discovery potential can translate into real value if the rocks deliver.

-

Palos Verdes: Deeper drilling is on deck, following up on those bonanza-grade hits and stepping out into new ground identified by the joint technical committee with Vizsla.

Bottom Line

Prismo Metals has just reloaded its treasury and lined up work that can generate real news flow over the coming quarters. For investors, this means we’re shifting from waiting for money to waiting for results, and that’s a place where share prices can get volatile.

The projects have history, grade, and jurisdiction on their side – now it’s about execution. If the company can turn those historic high-grade showings and fresh anomalies into confirmed resources, today’s $5.7 million market cap could start to look pretty modest.

The drills and crews will tell that story soon enough. For now, Prismo has the cash, the plan, and the portfolio to make the next few months worth watching.

— Chris Parry

FULL DISCLOSURE: Equity.Guru/Parry Research has an agreement with Prismo Metals and may purchase stock in the company. EG/PR does not make buy/sell recommendations but you should consider any coverage in which we show the Equity.Guru client company badge as being potentially conflicted, and any investment you make in a public company as having inherent risk. This content was approved by the company before publishing.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured company and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, government regulations concerning production, the size and growth of the market, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

Leave a Reply