Disclaimer: This article has been paid for by Standard Uranium. See disclosures at the bottom of the page.

Disclaimer: This article has been paid for by Standard Uranium. See disclosures at the bottom of the page.

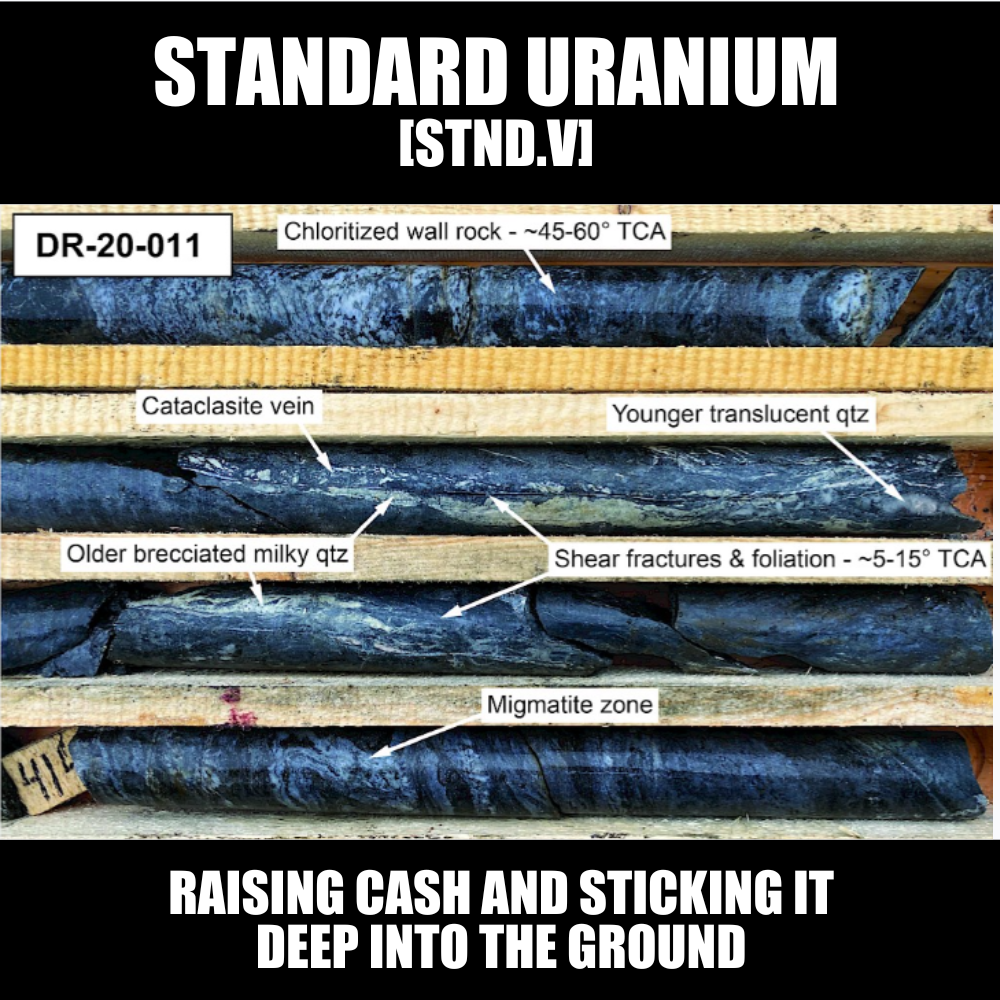

Standard Uranium (TSX-V: STND) is gearing up to put drill steel back into the ground at its Davidson River project in Saskatchewan’s southwest Athabasca Basin — ground they’ve been polishing for years in the hope of hitting something that registers heavy on the machines that go ding.

The Setup

They’ve locked in drill permits, inked agreements with local First Nations (Clearwater River Dene Nation), lined up vendors, and circled early September 2025 for a 4–6 week diamond drill program.

The targets? Warrior, Bronco, and Thunderbird conductor corridors — areas they’ve just mapped in 3D with a fancy Fleet Space “exosphere multiphysics” survey. That’s a lot of syllables, but the gist is: they’ve got new, high-res subsurface imagery showing basement structures and alteration zones that could be uranium-rich.

In Athabasca uranium hunting, that’s the equivalent of having X-ray glasses telling you where the football might be buried. It’s not a guarantee, but it beats drilling blind.

The Raise

To get the drills turning, they’re doing a non-brokered private placement — up to $3.5M. Units at $0.08, flow-through units at $0.10. Each comes with a half-warrant at $0.15, good for two years. Money goes to drilling and keeping the lights on.

Why This Drill Program Matters

Davidson River is no backwater patch. It’s on trend from two of the Athabasca Basin’s headline acts — NexGen’s Arrow and Fission’s Triple R. These are high-grade uranium deposits in an area known for producing some of the richest ore on Earth. If Davidson River coughs up even a sniff of that kind of mineralization, Standard’s market cap could re-rate fast.

They’ve drilled 39 holes here since 2020 — no barnburner hits yet, but they’ve hit the right rock types, alteration, and structures that typically run with uranium in this district. This new program is about using fresh geophysics to thread the needle.

The Risk Reality

Let’s be clear: this is still exploration. Uranium in the Athabasca is high reward because it’s also high risk. Plenty of juniors burn through drill programs without finding a meaningful deposit. But this crew know the land well (they’ve got experience at NexGen), they’ve been building to this program for some time, and they’re sounding confident.

Why Pay Attention Anyway

-

First mover with Fleet’s tech in SW Athabasca. This multiphysics approach has worked elsewhere in the Basin to tag targets linked to discoveries.

-

Location, location, location — right next to uranium royalty territory.

-

Clear runway — permits, agreements, vendors in place; the only thing left is to drill.

-

Cheap paper — if you believe in the story, $0.08 with warrants gives leverage to a hit, especially as the stock hit $0.21 as recently as June.

Bottom Line

This is the moment Standard Uranium has been pointing at for three years. They’ve got new eyes on old ground, new tech, a fully permitted drill plan, and just enough cash (once the raise closes) to take their best shot. In a sector where one hole can make or break you, September’s results are definitely going to tell us a story.

— Chris Parry

Leave a Reply