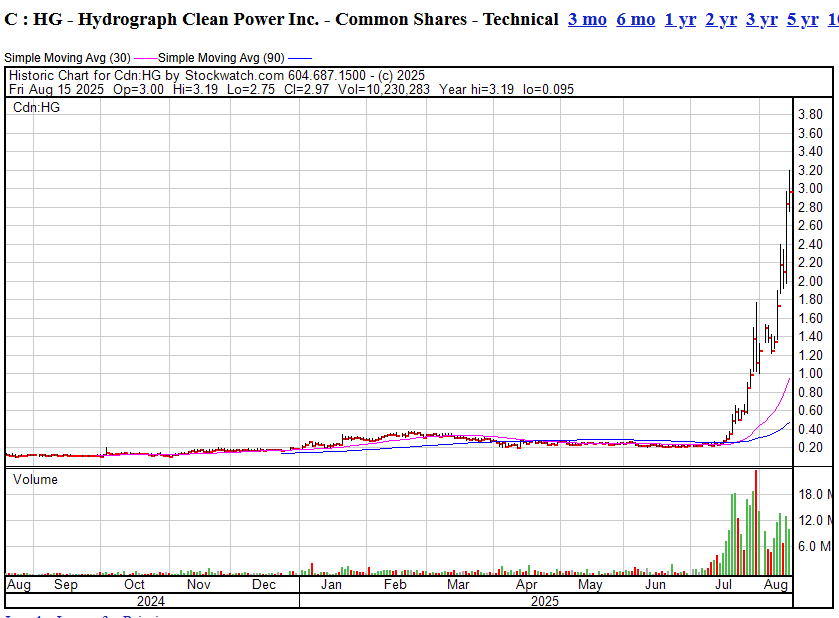

HydroGraph Clean Power Inc. (HG.C) is a nanomaterials company focused on producing graphene – a one-atom-thick “super material” – using a novel detonation-based process. It’s also on an absolute fucking tear, backed by a promotional campaign that has been nothing if not persistent.

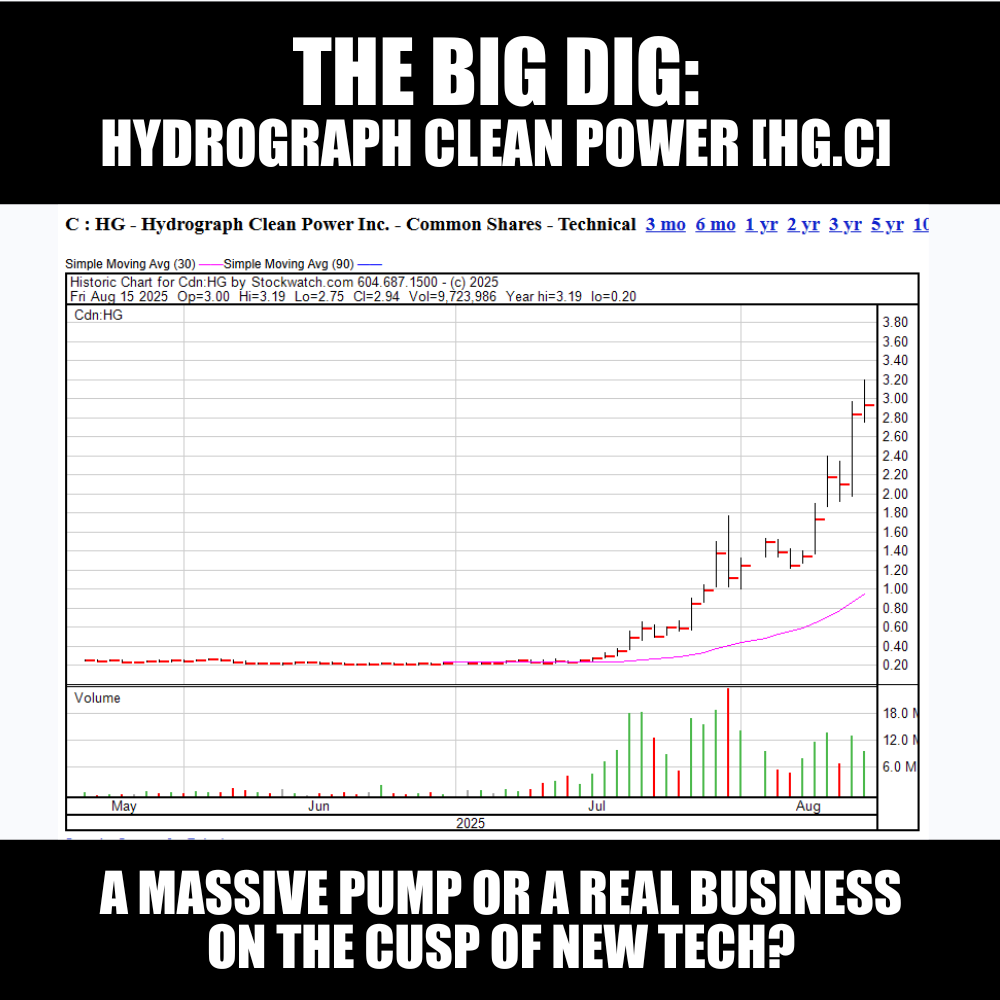

HG is up, like, a bunch.

$0.20 to $3.20 in under a month. Shell guys are buying yachts, no doubt.

Most recent financings are all ridiculously in the money.

- Dec 12 2024, $2.7m @ $0.16

- June 11 2024: $2.6m @ $0.116

- Qpril 5 2024 $869k @ $0.074

Warrants? Long ago cashed in. Paper: All free trading. No crushing overhangs.

Management fees are fair. Nobody is milking this thing for country club fees.

Stock action: Wild. Several recent circuit breaker halts., ‘company doesn’t know why the stock is moving’ announcements, all the things that raise the hair on the back of an investor’s neck..

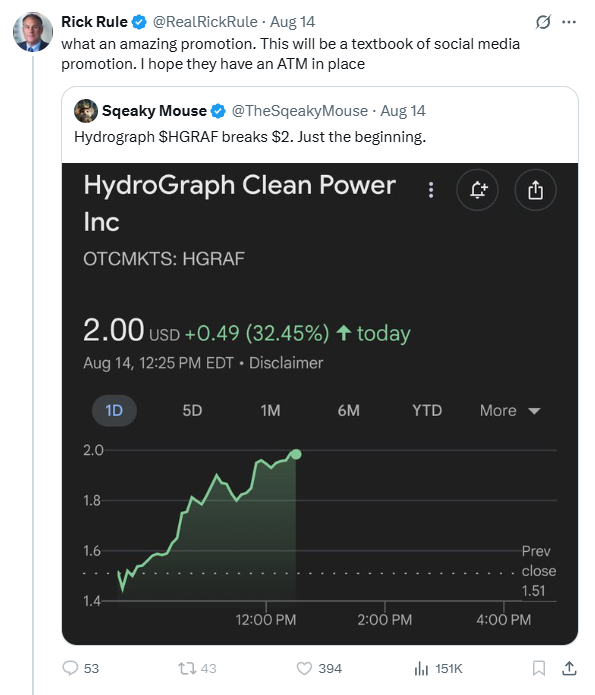

But a recent discussion on Twitter between Rick Rule and one of the guys behind the deal picked up some notice recently.

On one side, Rule, the resource pragmatist, noting the ‘pump’ was an epic one.

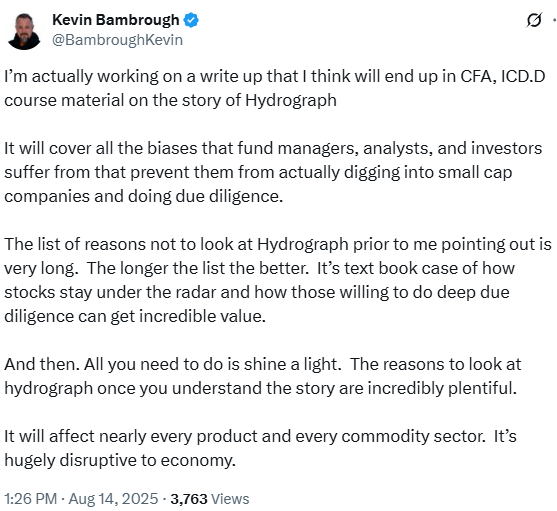

On the other, Kevin Barmbrough, claiming the old guard misseds this one because of their own biases.

Which brings us to an important question: Is Hydrograph just a promote, or is there something to it that actually makes it ‘hugely disruptable to the economy.’

DON’T LOOK AT ME, I’M NOT INVOLVED

Not a client company, not in my portfoio, but I am interested.

Some people think any promotion of a public company is inherently evil, that the whole business is made up of scumbags and reprobates, like a Vancouver-based Star Wars cantina.

The other side of that are the companies that scoff at promoton, insist that ‘the market will sort it out’, and are later stunned – shocked! – that the market didn’t give two shits.

I remain right down the middle. Promotion is my business, but responsible promotion is where I’ve excelled. The perfect ‘pump’ is a long, slow walk upstairs that builds out a shareholder base as it goes, always remaining liquid enough that folks can exit without a ‘dump’ if they so choose.

To be very upfront about it – that’s not Hydrograph right now. This run is fast, hard, and I’d be shocked if it were sustainable, simply because the returns notched to date are going to be too irresistable for some folks sitting on a fortune to avoid cashing in.

The true test of the company as it stands will be how many people load up when the inevitable profit taking happens, and whether their number is large enough that they resist gravity.

It should be noted, the company has jacked its way through one round of profit taking already, in late July, before going on another rip, so credit where it’s due.

BUT IS IT REAL? IS THERE ANY THERE THERE?

Founded in 2017 to commercialize a patented method from Kansas State University, HydroGraph claims its technology yields ultra-pure, few-layer graphene at low cost and with minimal environmental footprint. The company is now scaling up production and engaging potential customers across industries (energy storage, composites, lubricants, coatings) as it transitions from R&D to commercialization. Below, we’ll examine:

-

Graphene Production Technology: Is HydroGraph’s process scientifically valid, scalable, and economically viable? We assess their claims (purity, energy efficiency, scalability, IP) versus academic literature and conventional graphene methods (like CVD or graphite exfoliation).

-

Competitive Landscape: How does HydroGraph compare to key graphene producers NanoXplore, First Graphene, G6 Materials, etc.? We compare production methods, product purity, capacity, target markets, and cost metrics.

-

Investor Considerations: Key catalysts (near- and long-term), current valuation relative to expectations, major risks (market adoption, execution, supply chain), and the credibility of management’s claims about partnerships, licensing, and traction.

I should repeat here – I have no dog in the fight. Nobody has cut any cheques, nor has anyone been asked to.

HydroGraph’s Graphene Production Technology – Validity & Viability

Patented “Detonation” Process (SDG Technology)

HydroGraph’s core technology is the Synthetic Detonated Graphene (SDG) process, originally developed at Kansas State University. The method involves filling a sealed chamber with a hydrocarbon gas (like acetylene) mixed with oxygen, then igniting it with a spark plug to create a controlled detonation. The extreme heat and pressure from the micro-explosion crack the hydrocarbon into carbon, forming graphene, while the hydrogen component is released as gas.

Chris Sorensen, the KSU physicist who invented the process, describes it as “viable” for mass production – requiring just a single spark and common gases, with much lower energy input than traditional methods. The only inputs are acetylene (or other carbon-containing gas) and oxygen, and no catalysts or toxic chemicals are needed, avoiding the acids, metal catalysts, and high temperatures (>1000°C) used in other graphene processes.

This makes the process relatively safe and eco-friendly, with no solvent waste and near zero emissions reported.

HydroGraph licensed this patented detonation process exclusively from KSU and built it into a product platform called “Hyperion.”

The Hyperion detonation system is modular and compact, essentially a small reactor (or “detonation chamber”) that can be run repeatedly to produce batches of graphene. Management notes the process is digitally controlled and highly reproducible, yielding identical batches of graphene in each detonation cycle.

Notably, the rapid energy release means the reaction is self-powered after ignition – the chemical energy of the gas fuels graphene formation, so external energy input per batch is minimal. This unique approach was recognized when HydroGraph became one of the first companies to earn the Graphene Council’s “Verified Graphene Producer” certification.

A third-party inspection confirmed that HydroGraph’s process consistently produces 99.8% carbon-pure graphene in repeatable batches, at low cost and with negligible environmental impact. This independent validation, from what I can tell, speaks to the scientific credibility of the technology.

Purity, Quality and Academic Backing

[Nerd alert, if you haven’t figured that out yet]

One of HydroGraph’s bold claims is that its graphene is of exceptionally high quality – specifically 99.8% pure carbon content, with very few layers (on the order of 1–5 layers per particle) and no metallic or oxygen impurities. Traditional graphene production often struggles with impurities or thicker “graphitic” stacks. For example, many commercial “graphene” powders are actually multi-layer graphite platelets (10+ layers or containing >10% non-carbon content). HydroGraph’s detonation graphene, sometimes called “fractal graphene,” has been third-party verified to meet true graphene standards (the Graphene Council certification uses the ISO graphene material classification).

Scientific literature supports the plausibility of such a process. Sorensen’s team published research on detonation-synthesized graphene. In one peer-reviewed study, detonating acetylene with oxygen in a chamber produced nanoscale graphene in a range of ~5–30 layers (depending on oxygen-fuel ratio), and the authors noted the method’s scalability for industrial production.

Continued R&D improved the graphene quality over time – HydroGraph’s current claim of “1–5 layers” suggests process optimizations (e.g. faster quenching of the carbon soot or adjusted gas mixtures) that yield thinner layers than early experiments. The absence of catalysts in the detonation means the product is essentially pure carbon (no metal contaminants), and any oxygen present likely forms surface functional groups (HydroGraph mentions a “reactive shell” graphene variant with carboxylic groups).

Importantly, even if the raw output of the detonation includes some larger carbon fragments, the company can refine or classify the powder to ensure only graphene nanoplatelets are sold. An Investing News Network report in 2017 noted that an acetylene-oxygen spark method produced unrefined carbon chunks that required additional processing – HydroGraph’s consistent 99.8% purity implies they have solved those refinement challenges for a market-ready product.

From an energy and cost standpoint, the detonation process appears very compelling. Sorensen highlighted that energy required per gram of graphene is far lower than in conventional routes, since “all it takes is a single spark” and the chemical reaction does the rest. Internal figures from HydroGraph’s investor materials claim energy usage around 2.7 MJ/kg of graphene, versus 180–900 MJ/kg for other production methods.

While these specific numbers should be taken with caution (they’re not yet in a peer-reviewed context), the qualitative point stands: SDG is far less energy-intensive. Moreover, the feedstock gases (acetylene or other hydrocarbons) are relatively cheap and abundant, and the only byproduct is hydrogen gas, which in theory could be captured and used/sold as a clean fuel (aligning with the company’s “Clean Power” moniker). In practice, the hydrogen output per batch is not huge, but it underscores that the process yields two products (graphene and hydrogen) with no direct carbon emissions. This positions HydroGraph as an environmentally friendly solution – and there aren’t many of those in the graphene space

Scalability and Economic Viability

A critical question is whether HydroGraph’s production can scale from lab/pilot to industrial volume at viable cost. Detonation synthesis is by nature a batch process, but it can be run in rapid repetition or in parallel reactors. The company’s strategy is to deploy multiple small modular reactors (detonation chambers) that are portable and can be installed on-site at manufacturing locations.

Each chamber is reported to produce up to 10 tons of graphene per year of the flagship “fractalline” graphene.

In 2023–2024 HydroGraph built its first commercial-scale unit in Manhattan, KS (near KSU) with this ~10 tpa capacity, and as of mid-2025 it has been running and supplying sample quantities to clients. Scaling up, the company announced plans for a larger factory in Texas that will house next-generation reactors expected to output ~25 tons/year of graphene (targeted by 2025–26). Long term, management indicates the modular approach allows relatively quick capacity additions (they estimate 2–3 months to deploy a new detonation unit) and that capital expenditure per unit is low, enabling a capex-efficient scale-up path.

For example, roughly US$10–15 million in capex could outfit enough capacity to yield ~$100 million in annual graphene sales at scale, according to investor deck figures.

Economically, if HydroGraph’s process achieves its promised throughput and low operating cost, the cost-per-gram of graphene could undercut most competitors. The company markets its product as possibly “the most cost-effective graphene in the market”.

THE PRICING QUESTION:

Industry-wide, graphene prices vary widely by type: bulk graphene nanoplatelets (lower grade) might sell for $100–1000/kg, while high-purity monolayer graphene (CVD-grown) can exceed $10,000/kg.

HydroGraph’s graphene, being both high-purity and produced in bulk, aims to hit the sweet spot of premium quality at commodity pricing. While exact pricing isn’t disclosed, one reference point is NanoXplore (a competitor) projecting ~$10/kg at very large scale – HydroGraph might not reach that immediately, but if energy and feedstock costs are minimal, they could be competitive even at early volumes.

It’s worth noting the graphene market is still young and price-sensitive – many potential users have held off until costs come down and supply scales up. HydroGraph’s ability to drop the cost barrier could greatly aid adoption, provided the material meets performance specs.

Bottom Line (Tech): HydroGraph’s detonation-based graphene production is scientifically sound and patented, with validation from reputable third parties. It produces real graphene (few-layer, high purity) as opposed to the “graphite powders” sold by some unverified suppliers. The process is inherently scalable in modular increments and appears to offer both environmental and cost advantages – using little energy, no toxic inputs, and yielding hydrogen as a bonus.

BUT:

The key technical challenge ahead is execution at scale: ensuring that as throughput rises to tens or hundreds of tons, the quality remains consistent and equipment operates safely/reliably (handling repeated mini-explosions requires robust engineering controls). Thus far, HydroGraph has de-risked the fundamentals (proof-of-concept done, pilot running). The coming 12–18 months will show if they can transition to commercial production without hiccups – a critical step in proving economic viability beyond the lab.

Competitive Landscape: HydroGraph vs. Graphene Industry Peers

Graphene is attracting many players globally, each with different production techniques. HydroGraph faces competition from both established graphene producers and emerging startups. Below is a comparison of HydroGraph and select competitors in the bulk graphene/carbon nanomaterial space:

Key competitors to examine:

-

NanoXplore Inc. – Canada-based, one of the largest volume graphene producers (graphene nanoplatelets supplier).

-

First Graphene Ltd. – Australian company producing graphene (branded PureGRAPH) from natural graphite.

-

G6 Materials Corp. – U.S./Canada-based company focusing on graphene oxide and graphene-based composites.

Each competitor differs in production method (bottom-up synthesis vs top-down exfoliation), purity and form of graphene, scale of operations, target markets, and cost structure. The table below summarizes these differences:

| Company | Production Method | Graphene Product & Purity | Current Scale (Capacity) | Target Markets / Uses | Notes / Cost Base |

|---|---|---|---|---|---|

| HydroGraph (CSE: HG) | Detonation of hydrocarbon gas (acetylene + O₂ sparked in chamber) – bottom-up synthesis of carbon atoms. | “Fractal” Graphene powder, 99.8% carbon pure; Few-layer (1–5 layers) graphene nanoplatelets with no metallic impurities. | ~10 tons/year pilot line (Kansas) now; scaling to 25 t/yr at new planned plant. Modular reactors allow future multi-100 t capacity. | Additive for lubricants, industrial coatings & composites, energy storage (battery/supercapacitor electrodes), concrete additives. | Low energy, no solvents (green process). Co-produces hydrogen gas. Aims for low $ per kg pricing (high margins ~70% projected at scale). Exclusive license on detonation IP (barrier to entry). |

| NanoXplore (TSX: GRA) | Graphite exfoliation (proprietary mechanical/chemical processes). Developing new dry exfoliation process using waste graphite feedstock. | Graphene nanoplatelets (GNP) powders (few-layer graphene stacks). High carbon purity (>99% C) but some oxygen functionalization; various grades (GrapheneBlack™, etc.). | 4,000 t/year nameplate capacity (Montreal plant) currently; expanding to 8,000+ t/year with new dry-process lines. One of the largest producers globally. | Polymer composites & plastics (masterbatch pellets), automotive parts (lightweight plastics), lithium battery anodes, coatings. Also supplies graphene-enhanced batteries through a JV. | Vertically integrated – also makes end products (composites). Aggressive cost focus: at full scale, aims for ~$10/kg graphene cost (vs ~$50/kg historically). New dry process expected to halve production capex and approach carbon black costs. |

| First Graphene (ASX: FGR) | Graphite exfoliation (uses ultra high-grade Sri Lankan vein graphite as raw material). Likely employs mechanical and chemical exfoliation with an environmentally-friendly proprietary method (no harsh acids). | PureGRAPH™ graphene powders (few-layer graphene with lateral sizes of 5–50 µm). Carbon purity ~99% (metal impurities <0.3%, Si <1 ppm). Typically <10 layers thick per sheet (verified as FLG). | 100 tons/year pilot plant in Australia (Henderson) since 2017; positioning to scale further. Wants to be in the lowest cost quartile of producers. | Cement/concrete additives (to strengthen and cut CO₂ footprint), rubber and plastics (wear liners, fire retardant composites), coatings & paints, energy storage (has a supercapacitor R&D program). | Owns graphite supply chain (secure raw material). Markets itself as “lowest cost, highest quality” bulk graphene from mineral sources. Has demonstrated real-world deployments (e.g. graphene-enhanced mining equipment and concrete trials). Pricing competitive with other GNPs; focuses on industry partnerships for adoption. |

| G6 Materials (OTCQB: GPHBF) | Chemical exfoliation to Graphene Oxide (GO) and reduction to graphene. Operates a wet-chemistry reactor for GO production and labs for making graphene-based composites. | Graphene Oxide and rGO products (high surface area, oxygen-bearing graphene for use in formulations). Also produces graphene-enhanced resins, inks, and materials rather than raw graphene powder in bulk. | Pilot-scale – new GO reactor (installed 2021) increased capacity 5× but output is in tens of kilograms range. Overall production floor ~4,000 sqft for graphene products. (Much smaller scale than above peers.) | Air filtration media (graphene-based HVAC filters for VOC/virus removal), epoxy resins and polymers (enhanced with graphene for strength/UV resistance), 3D-printing materials, and lab-scale materials for R&D. | Focuses on value-added products over bulk sales. Leverages a portfolio of graphene IP (from Graphene Laboratories). Higher product pricing per unit (GO can sell for $100s/kg) but not cost-competitive for large-volume commodity use. G6’s strategy is to use graphene to create innovative products (e.g. air purifiers) to drive its revenue. |

Sources: Company filings and websites; Verified Graphene Producer program reports einpresswire.com; Frost & Sullivan and press releases for capacity/cost claims frost.com , wholesaleinvestor.com.

Key Differentiators & Competitive Positioning

-

Tech angle – HydroGraph’s detonation process builds graphene from carbon-rich gas, not mined graphite. That means no leftover mineral impurities and flexibility to use almost any carbon feedstock (even biogas or waste gas). Purity is the selling point here.

-

Where they stand vs. the big boys – NanoXplore and First Graphene crank out way more volume right now. NanoXplore is all-in on commoditizing graphene as a plastic additive and chasing cost parity with carbon black. First Graphene mixes quality and cost advantage by owning its own graphite mine. HydroGraph isn’t trying to fight them in bulk yet – they’re chasing high-margin niches where quality wins, like lubricants, batteries, or energy storage.

-

Performance niche – Case in point: HydroGraph’s graphene in Volfpack Energy’s supercapacitors reportedly beat activated carbon by 4×. That kind of result can justify a higher price per kilo and builds early adoption in performance-critical markets.

-

Product form – HydroGraph makes few-layer, small-particle “fractal” graphene. First Graphene sells larger platelet sizes (better for reinforcement in concrete/composites). NanoXplore’s nanoplatelets tend to be thicker stacks with functional groups (helpful for plastics dispersion). G6 sells graphene oxide, a different beast entirely. HydroGraph’s “reactive” graphene is pitched as combining oxide’s bonding chemistry with pure graphene’s conductivity – if it works, that’s a big edge.

-

Margins – Management talks about ~70% profit margins at scale. That’s high, but depends on them keeping costs low and selling into markets willing to pay for quality. NanoXplore will likely run thinner margins but massive volume. First Graphene benefits from low raw material costs but still competes with Chinese producers on price.

-

Global competition – China’s already pumping out graphene nanoplatelets and oxide at industrial scale, targeting batteries and coatings. Any real boom in demand will attract every supplier worldwide. HydroGraph’s moat will have to be IP and performance.

-

Smart partnerships – Deals with University of Manchester’s GEIC and Fraunhofer aren’t just for PR. They’re aimed at building real-world applications so customers know how to integrate the product. Without that, spec sheets alone won’t close sales.

Investor Considerations

From an investor’s perspective, HydroGraph offers a high-potential but early-stage opportunity in the graphene space.

The key factors:

Near-Term Catalysts

- First real contracts – Management says 60+ companies are “testing” their graphene. I doubt every one of them is actively running trials, but even a fraction converting would show the tech has legs. We’ll find out soon enough – those tests will either become orders or they won’t. First long-term supply or offtake agreements are expected late 2025. A big-name customer (coatings, battery, concrete) signing a multi-year deal would instantly validate the model and move the stock.

- Texas plant build-out – Plans are in motion for a 25 tpa graphene facility in Texas. Site, financing, construction, commissioning – all worth watching. Any upgrade to reactor design that boosts throughput or cuts costs would be a bonus. Scaling without delays is key to proving they can meet demand and execute at size.

- Partnership outputs – Work with the Graphene Engineering Innovation Centre (GEIC) in Manchester kicked off in late 2023, aimed at pushing applications in composites, batteries, coatings. Deliverables to watch for: prototypes, published performance data (e.g., stronger concrete tests, better battery metrics), and extended European research links like the Fraunhofer Institute project.

- Value-add products – Moving beyond raw “fractal” graphene into graphene ink for printed electronics and graphene-enhanced carbon fiber for 3D printing. If they land a partner for the conductive ink (sensors, RFID) or show their graphene meaningfully lifts battery performance, it opens new verticals and adds optionality to the story.

Long-Term Catalysts

-

Mass adoption of graphene-enhanced products – The macro driver is the graphene market, pegged to hit ~$2.5B by 2028. As auto, energy, construction, and other sectors prove out the benefits, order sizes could jump. A big win here would be securing a major, multi-line customer (e.g., a lubricant brand reformulating its whole line, or a concrete supplier baking it into infrastructure projects). Early work in high-performance niches gives HydroGraph an entry point before chasing bulk/commodity sales once costs fall further.

-

Licensing or JV potential – Core plan is in-house production, but the IP could be monetized through licensing or joint ventures. Hyperion units are modular/compact, so they could be dropped into customer facilities or regional hubs. A licensing deal with a materials giant or energy player (especially one interested in the hydrogen byproduct) would be a fast, capital-light way to scale and validate the tech. None signed yet, but the door is open.

-

Hydrogen tie-in – The process makes hydrogen as a byproduct. At large scale, this could be captured and sold, or used in-house. If carbon credits or hydrogen subsidies gain weight, this secondary stream could add value. It’s not a near-term revenue source, but it fits the clean-energy narrative and ESG screens.

-

Uplist / institutional money – HydroGraph trades on the CSE and OTCQB. Consistent revenue could justify a TSX or Nasdaq uplist, boosting liquidity and broadening the investor base. Strategic investment or large grants (for scaling green manufacturing) are also possible once technical and commercial proof points are in place.

Valuation and Market Sentiment

HydroGraph is very much a pre-revenue company as of 2025, so its $750 million valuation is based on future potential rather than current earnings.

At a $750m cap, one could argue that future profits, should they be any, are all WELL priced in – for instance, NanoXplore (with actual revenues and large capacity) enjoys two thirds of the market cap of HydroGraph. Investors aren’t waiting, however.

The stock did list via RTO in late 2021 at a time of enthusiasm, but since then it has traded in penny-stock territory until the explosion in value over the last month.

In practical terms, the current valuation assumes a probability of success – if HydroGraph secures $5–10m in annual sales with strong growth trajectory, the valuation could re-rate but, frankly, shouldn’t, at least not upwards. The big spike seen recently has 10x’ed the stock and disassociated the valuation from its likely profitability pver the next few years.

The case for it to sustain that valuation – or even go up – can only be made if you believe HydroGraph will scale quickly, cheaply, and take so much market share – and create new markets – that it will become an inherent part of a lot of other industries. I’m not sure I buy into that. Not yet, anyway, and not without competition, patents or not.

Key Risks and Challenges

Despite the attractive story, there are significant risks to consider:

-

Market Acceptance Risk: The history of graphene commercialization has been marked by hype outpacing reality in the 2010s, leading to some skepticism in industry. Many potential customers will need extensive proof that HydroGraph’s graphene consistently delivers the promised improvements in their specific application. Integrating a new nano-additive into established products often requires re-engineering formulations, qualifying the material for safety/regulatory compliance, and long test cycles. There’s a risk that adoption takes longer than expected, even if the material is good – as seen with other “miracle materials,” initial excitement can be tempered by practical challenges. HydroGraph will need to provide strong technical support and data to convert tests into actual orders. The lack of universal graphene standards historically led to confusion (what one supplier calls “graphene” might be different from another’s). HydroGraph’s certifications help here, but end-users may still move cautiously, doing their own due diligence. Nobody wants to change their existing ingredient mix before they’re sure Hydrograph will be able to supply them reliably.

-

Execution and Scale-Up Risk: Moving from a 10 ton pilot to full commercial production is non-trivial. Engineering challenges could include: maintaining uniform quality with faster cycle times, managing heat and pressure in larger-scale detonations, automating material collection (to avoid any oxidation or contamination), and ensuring worker safety and regulatory compliance (handling gas explosions, even small ones, will require robust safety protocols and likely environmental permits). Any hiccup – e.g. a reactor failure or sub-par batch – could delay deliveries or require design tweaks. As a small company, HydroGraph must execute this scale-up with limited resources; operational setbacks or cost overruns would pose a financial strain. The company’s plan to have multiple units also means it must demonstrate the repeatability of its process in new installations, not just the prototype unit.

-

Financial and Funding Risk: Until substantial revenues kick in, HydroGraph is dependent on its cash reserves and the ability to raise capital. Building the new factory, funding R&D, and scaling staff will likely burn cash in the near term. While a financing at today’s prices would be beneficiak, it would also pull a handbrake on the big run. There’s also the risk of needing more capital than anticipated if commercialization is slower (for instance, if the first big contracts slip to 2026, the company might need bridge financing). On the flip side, a timely contract win could also open doors to non-dilutive financing (such as debt or strategic investment) – but until then, investors should monitor HydroGraph’s cash runway, noted qs 7 months by my calculations. As of the last update, the company had secured some grant funding (e.g. from Fraunhofer) and had a relatively low-cost operation (the Kansas pilot is not capex-heavy), but the Texas expansion will require investment.

-

Competition and Technological Risk: While HydroGraph’s IP is unique, competition in the graphene field is intense and global. Companies like NanoXplore, First Graphene, Haydale, Versarien, Directa Plus, and numerous startups are all vying to be the supplier of choice for different applications. It’s possible that a competitor’s material could achieve a similar result in a target application at a lower price, impeding HydroGraph’s market penetration. For example, if NanoXplore’s massive scale drives the price of decent-quality graphene so low, some customers might opt for the cheaper (if slightly lower quality) option for cost-sensitive uses. Additionally, other advanced materials (carbon nanotubes, novel 2D materials like MXenes, etc.) could compete as additives offering similar benefits. HydroGraph must stay ahead by emphasizing its purity and performance – and ideally by securing patents not just on production but on specific uses of its graphene (to lock in a moat in certain applications). The company does hold or license several patents (for graphene inks, 3D printing composites, etc.); leveraging those into proprietary products will be important to avoid being undercut by a commodity graphene scenario in the future.

-

Supply Chain and Scaling of Inputs: While acetylene and oxygen are common industrial gases, any supply issues or price spikes in these (or any specialized component of the detonation system) could impact production cost. Unlike graphite-based peers, HydroGraph isn’t tied to mining supply – which is good – but it does rely on industrial gas logistics. It will need to secure reliable sourcing of high-purity acetylene (or propane/methane depending on what they use) especially as it scales to multiple reactors. Fortunately, these are widely available commodities, but energy prices could have some effect on feedstock costs. On the customer side, logistics of delivering graphene (a light, voluminous powder) to clients in various locations is something to consider – the company’s idea of decentralized production (making graphene near the point of use) could mitigate this and is a unique selling point if executed.

-

Regulatory and ESG: Graphene materials, being nanomaterials, are subject to evolving regulations regarding health and safety. While carbon itself is not toxic, fine powders can pose inhalation risks. HydroGraph will need to ensure it meets all worker safety standards and any environmental regulations for nanoparticle handling. Also, as it markets “green” aspects, it must substantiate those claims (the Graphene Council verification and lack of emissions help here). Any unforeseen regulatory changes (for example, tighter rules on nanomaterial use in EU or requirement of specific labeling) could add compliance costs. That said, HydroGraph’s profile is generally positive on ESG – reduction of waste, enabling energy savings in end-use, etc. – which is more an opportunity than a risk if managed well.

In summary, HydroGraph Clean Power represents a potentially disruptive force in graphene manufacturing, with a scientifically validated technology and now the critical task of translating that into commercial success. The coming year (2025) is indeed “pivotal” as the CEO describes – it should reveal whether HydroGraph can secure the first beachhead in the market. Investors should watch for concrete signs of traction (contracts, production milestones) as indicators that the company is overcoming the typical startup risks.

If HydroGraph executes, it could enjoy a strong first-mover advantage in high-purity graphene at scale. If challenges emerge, the company’s small size means risks are magnified. As always, a balanced approach is warranted: the technology gap HydroGraph is addressing is real (industries need consistent, pure graphene to unleash the material’s promise), but the commercial gap remains to be fully bridged.

BOTTOM LINE: Yes it’s interesting tech and yes it’s been an efficient pump.

But this sort of thing helps nobody.

Sources: HydroGraph and competitor press releases and websites; KSU research news; Graphene Council certification news; Investing News Network and Frost & Sullivan reports; CEO interviews (Streetwise Reports); Reddit investor analyses

— Chris Parry

FULL DISCLOSURE: As mentioned aboce, no dog in the fight.

Leave a Reply