Back in 2018, I wrote often about a medtech company called Vitalhub (VHI.T).

Essentially, they were at the starting point of what we now know as TELE-MEDICINE.

Here’s me, back before it moved to the big board:

We talked these guys up and the stock doubled.

Then it drifted because people didn’t really get telemedicine’s importance yet.

But we never wavered. In fact, we wrote up Vitalhub a whopping 44 TIMES.

Long after our marketing contraqct with them ended, we kept writing about them because you guys had bought in and we wanted you to stay in.

So, you’re still in there?

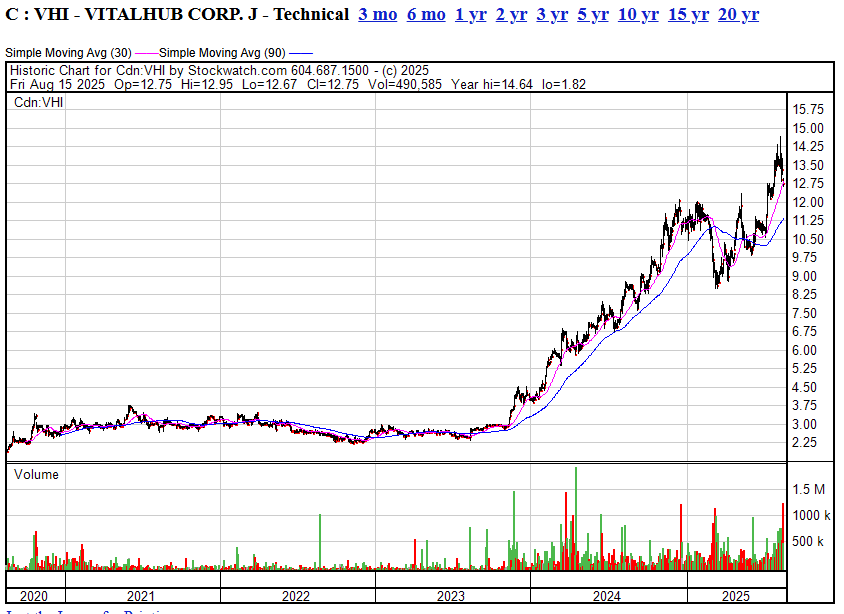

GOOD. Congrats on the 10x.

$1.50 to $14.25?

WE TOLD YA SO.

Note: Their big rise didn’t come as a covid response, though that most definitely brought us all to the telemedicine altar.

No, VHI went viral (sorry) by picking up a ton of competing assets that either brought market share or expandability of their software, and used that to drive revenue and pick up more contracts, mostly government contracts that repeat and are paid on time.

What They’ve Bought So Far

VHI is basically a roll-up machine in healthcare/tech. They’re not out there wildcatting for gold or reinventing the wheel — they’re buying software companies that already serve hospitals, clinics, and care facilities. Over the last while, they’ve scooped up:

-

Patient Flow & Bed Management tools (systems that help hospitals track who’s in what bed, who’s being discharged, where the bottlenecks are).

-

Electronic Health Records (EHR) & Case Management systems for mental health, social services, and community care providers.

-

Care Coordination & Scheduling platforms — software that makes sure patients, doctors, nurses, and resources line up without chaos.

-

Data Analytics and Business Intelligence products — dashboards that let healthcare providers see what’s working and what’s not.

-

Smaller bolt-ons in document management, compliance, and risk assessment for the healthcare world.

The strategy is clear: pick up niche healthcare IT players, integrate them, and sell a “full suite” solution across multiple care sectors.

What Actually Makes Them Money

Lots of moving parts in the portfolio, but three buckets clearly drive most of the revenue:

-

Subscription & SaaS (Software-as-a-Service) – recurring software licenses are the bread and butter. Hospitals and care orgs pay monthly or annually for access. Sticky revenue, predictable cash flow.

-

Patient Flow / Capacity Management – tools that help hospitals deal with overcrowding, waitlists, and resource allocation. Demand for these has spiked post-COVID when every health system realized how fragile they are.

-

Electronic Records & Case Management Systems – especially in behavioral health and community services. Governments and agencies are modernizing these outdated systems, and VHI is winning contracts there.

Implementation services, one-time licenses, and consulting add some gravy, but the recurring SaaS is the engine.

The Next 6–12 Months: What’s Coming

VHI’s outlook is shaped by two main things: ongoing contract wins and more M&A. Here’s what to expect:

-

Steady Growth from Recurring Revenue: They’ve got a high percentage of sales locked in as subscriptions. That’s predictable growth quarter to quarter. Expect small but steady climbs, not fireworks.

-

Cross-Selling: The more companies they acquire, the more products they can cross-sell into the same customer base. Hospitals are sticky once you’re in the door — nobody wants to switch IT systems mid-crisis.

-

More Acquisitions: This is their DNA. They’ll likely keep picking off niche health-tech companies, especially ones with SaaS platforms. Every new deal means new recurring revenue added to the pile.

-

Government & Public Sector Contracts: VHI leans heavily on public healthcare, which is both a blessing and a curse. Once you’re in, it’s stable money. But budgets and timelines can be slow. Expect more announcements of new provincial or regional health authority wins.

-

Earnings Visibility: They’re in a sweet spot where investors like them — predictable SaaS, healthcare tailwinds, and a proven M&A strategy. Unless they massively overpay for an acquisition or botch an integration, the story over the next year is “slow, steady, reliable growth.”

Bottom Line

Vitalhub isn’t a moonshot stock — it’s not trying to hit a drill hole or invent teleportation. It’s building a dependable, cash-flowing healthcare IT empire piece by piece. The next year should bring more of the same: small acquisitions, steady SaaS growth, and contract wins, which makes the recent down swing from $14 to $12 a nice potential entry point..

For investors, the attraction is predictability in a sector (healthcare) that isn’t going away. The tradeoff is you’re not going to see a ten-bagger overnight — but you might see one over the coming few years, just like you did in the last few.

— Chris Parry

FULL DISCLOSURE: No commercial connection, just happy we got them a start

Leave a Reply