After a decade-plus talking about public companies, one of the hardest things for me to do on an ongoing basis has been to steer clear of easy short term wins that leave a bad taste over the long haul. The public markets rise and fall, and some companies on the markets are both winners AND losers, depending on your entry and exit points, but for a guy like me to stay at the top of his game for as long as I have relies on my being able to identify and avoid ‘Vancouver deals.’

Or, at least, if not ‘avoid,’ at least recognize them for what they are and get out of before they go south.

Vancouver deals come at you ten at a time and they’re almost always less about the asset and more about the marketing of that asset. They last three months and 28 days, because the cheap paper goes free trading at four months and then everyone’s out looking for the next deal.

If I’m honest, you can make money on those deals, if you’re into game theory and gambling on what other people are thinking, but you can also get trapped on the wrong side of a suddenly halted promote, or a disappearing insider, or a cobbled together ‘short report’ from someone who couldn’t get in on the cheap paper.

Life in the Canadian markets is a rat maze filled with rats fighting over one piece pf cheese, but the guys that bring you REAL deals, with good bones and good people and real business models, and that have the patience to play them out over a year or more if necessary without abandoning them at the first sign of a dip – when you find one of those guys, you keep them close.

THE SMALLCAP HABIBI

Mo Elsaghir is one of those guys. Alberta-based and never off his phone, Mo came to me a few years ago wanting to show me a company he was into that he thought deserved more love. He told me he respected my reputation and opinion and that he had a real one he thought I’d like and that, if I hit it off with the CEO, maybe they’d be interested in working with me.

He introduced me to said CEO, who talked a good game, and while I didn’t get a deal of my own out of it, I did take a little taste of what I considered to be cheap stock and made money off the ensuing valuation rise.

Mo repeated the dose on another deal shortly thereafter, with the same result. No marketing deal, but a compelling story that I wrote about anyway because my readers like wins and this was that.

The months since have seen Mo and I form the quintessential symbiotic relationship; he respects my insight and ability to tell a story if I like it, and I respected his insight, contacts, and determination to only be involved in the right kind of deals that I won’t find myself having to apologize to my readership for later.

We’ve formalized that relationship some over the last year, with Mo regularly bringing me in on things he’s considering being involved with, to cast a second set of eyes on the deal before he goes in, and offer my thoughts. He has a strong backroom team doing that due diligence and I’m happy to be part of that process. If I like something, I’ll share it. If I don’t, I won’t.

But here’s the thing: Mo’s shooting 5 from 7 in the last year, and the two that haven’t lifted yet are revving their engines.

Bull market or otherwise, those kind of results are ridiculous. Mo’s got the hot hand.

Don’t believe me? Here are some of those long range, good bones, good people deals.

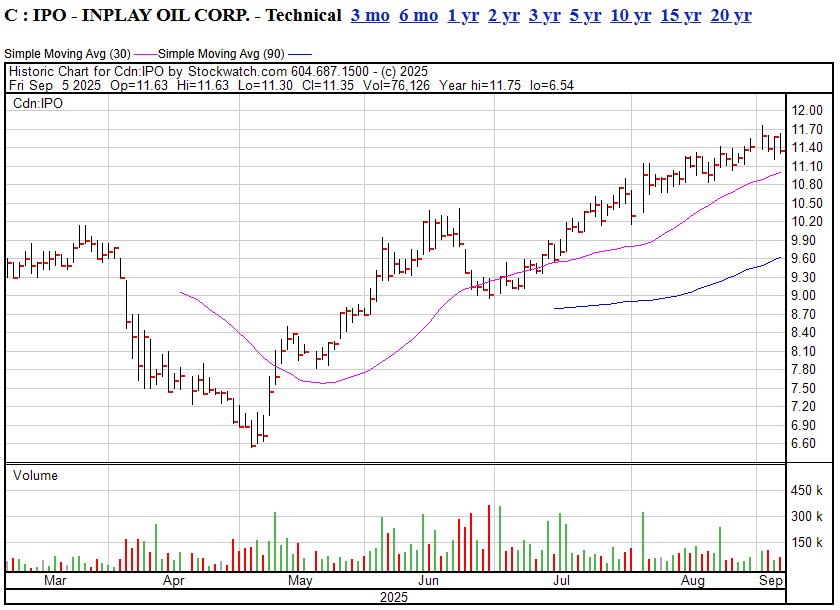

InPlay Oil Corp. (TSX: IPO)

Business Focus & Market Opportunity: InPlay Oil is a junior oil and gas producer concentrating on light crude oil in west-central Alberta. The company’s strategy has centered on accretive acquisitions and optimizing its light-oil assets. In May 2025, shortly after a roll-back,m when everyone was taking dumps on IPO, the company closed a “highly accretive” Pembina asset acquisition to boost output, expanding its production base at a time of robust oil prices. When Mo came in, the cojmpany needed a re-org. It got it.

Stock Performance (CAD): Over the past six months, and after hitting lows post-roll back, IPO has been a giant in the making, almost doubling to sit now around $11.50. And if that’s not enough, InPlay pays a substantial monthly dividend ($0.09 per share monthly, or 9.43% annually on today’s price), which is free money all day.

Investor Sentiment: Investors have been encouraged by InPlay’s strong dividend payout and disciplined growth. The company’s double-digit dividend yield is a key attraction, signaling confidence inongoing cash flows. Furthermore, management’s strategy of balancing equity and debt for acquisitions has kept the balance sheet manageable. The recent asset purchase in Pembina is seen as a vote of confidence in InPlay’s operational capability, and this expansion – alongside sustained dividends – is resonating positively with investors looking for yield and growth in the energy sector.

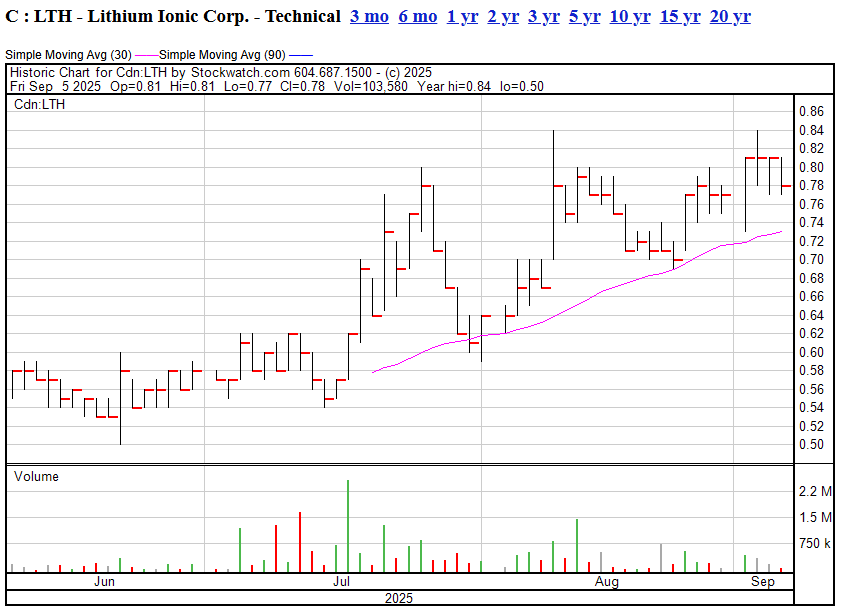

Lithium Ionic Corp. (TSXV: LTH)

Business Focus & Market Opportunity: Lithium Ionic is an emerging lithium exploration and development company with a large land package (~17,000 hectares) in Brazil’s “Lithium Valley” of Minas Gerais. Its flagship Bandeira project is near established lithium mines (including Sigma Lithium’s operation). They’ve rapidly grown their resource base – an updated NI 43-101 resource in May 2025 significantly increased overall lithium reserves – and they’re advancing towards construction of a mine. The company has even engaged engineering partners to prepare for production startup. With surging demand for battery-grade lithium driven by electric vehicles, Lithium Ionic’s focus on a mining-friendly district positions it well to capitalize on the global EV battery supply chain needs.

Stock Performance (CAD): It trades around C$0.80 per share, off from highs earlier this year – but well up from the $0.50 range of three months ago. In fact, after a strong rally in Q1 2025 (when its market cap jumped by ~$25 million in a week, the share price consolidated, as has been the regular occurance in the lithium space for a while. Every step up over the last three months has had to fight through selling, but the fact they’re actually nearing production and not just endlessly raising and drilling gives this deal extra cred and has seen the stock price push through with regularity.

Investor Sentiment: The market remains constructive on Lithium Ionic’s project milestones. Investors took particular note when the company secured a US$266 million funding LOI from U.S. EXIM Bank – covering 100% of the Bandeira project’s capex. This substantial prospective financing (announced in late 2024) underscored confidence in the project’s viability. Additionally, insiders have added to their positions on market dips, aligning with shareholders. What’s resonating now is Lithium Ionic’s transition from explorer to developer: progress on permits, resource growth, and strategic financing have earned the stock bullish analyst coverage (e.g. a C$2.00 price target by BMO Capital). In short, investors see Lithium Ionic as a well-financed play on the lithium boom, with tangible steps toward near-term production in a stable jurisdiction. Progress = points.

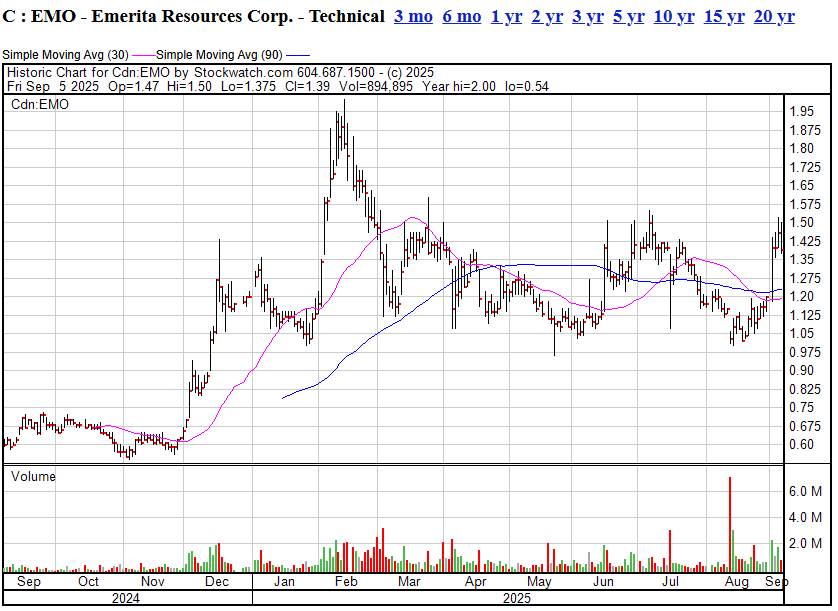

Emerita Resources Corp. (TSX-V: EMO)

Business Focus & Market Opportunity: Emerita Resources is a Canadian mineral exploration company focused on high-grade polymetallic deposits in Spain’s Iberian Pyrite Belt, one of the world’s most prolific base-metal districts. Emerita’s flagship Iberian Belt West (IBW) project hosts several deposits (La Romanera, La Infanta, El Cura) rich in zinc, lead, copper, silver and gold. The company had also been pursuing the Aznalcóllar asset (a massive past-producing zinc-lead mine) through government tender, which has resulted in ongoing legal claims that are coming to a head and *could* see the company awarded said tender. The market opportunity for Emerita lies in Europe’s push for domestic critical metals – EU legislation now prioritizes local sourcing of zinc and copper, potentially streamlining permits for IB. Emerita’s substantial resource base and location in a mining-friendly region of Spain position it to feed into Europe’s supply chain for years.

Stock Performance (CAD): Emerita’s stock has appreciated significantly in the past six months. It currently trades around C$1.40, roughly double where it was in early spring. The uptrend accelerated over the summer of 2025 as Emerita secured key financing: in August the company closed a C$25 million equity raise at $1.05 per unit, fortifying its treasury for development. This financing (backed by major resource investors) and an expanded credit facility have propelled the stock upward with the lawsuit serving as a free potential gamechanger. Year-to-date, EMO has been a top performer on the TSX Venture, reflecting renewed investor optimism.

Investor Sentiment: Market sentiment on Emerita is markedly positive, driven by the company’s strengthened financial position and project advancements. Investors have been encouraged by Emerita’s ability to secure a US$50 million project credit facility from Nebari to advance IBW and resource updates have shown that IBW’s deposit size and grades are improving, underpinning that project’s economics. The involvement of well-known mining financiers – for example, Eric Sprott increasing his stake in Emerita – has further bolstered credibility. What resonates most is that Emerita is moving decisively from explorer toward mine development, regardless of the litigation outcome: it has the capital, government support, and growing resources to potentially make the Iberian Belt West a cornerstone European zinc-lead-silver mine in coming years. Mo came in on this one at $0.40, so he’s already delivered a massive win, and it’s just getting started.

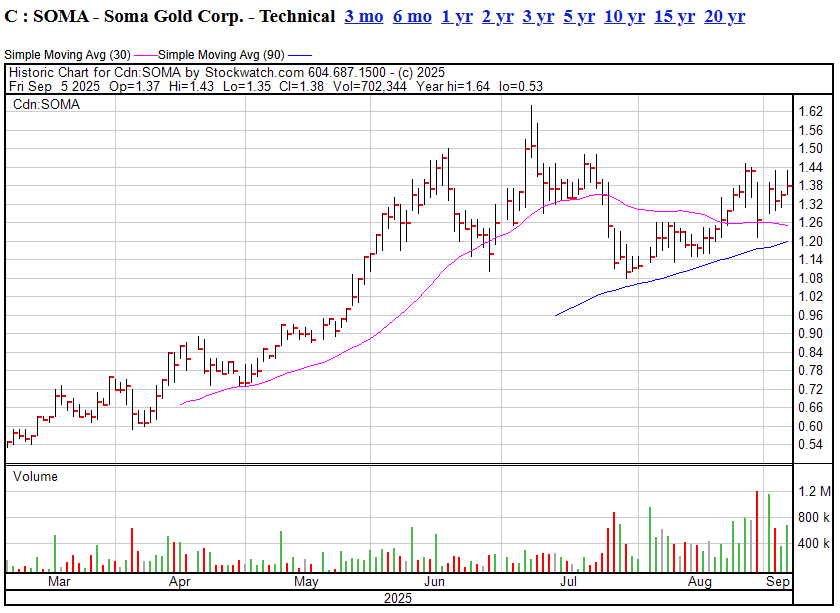

Soma Gold Corp. (TSX-V: SOMA)

Business Focus & Market Opportunity: Soma Gold is a gold mining company operating in Antioquia, Colombia, with two adjacent underground mines and a centralized milling facility. Commercial production at its newest mine (Cordero) began in 2023, and Soma is now producing approximately 25,000–30,000 ounces of gold per year at its El Bagre mining complex. The company’s strategy centers on steadily streamlining the balance sheet while expanding high-grade production and exploring near-mine targets. In addition to organic growth, Soma is eyeing strategic acquisitions – for example, it recently agreed to acquire the fully-permitted Escondida gold mine to boost output. The broader market opportunity for Soma stems from robust gold prices and the company’s presence in a well-known Colombian gold belt (Segovia/Antioquia) with ample small-mine consolidation potential. As a junior producer, Soma offers investors direct leverage to gold with ongoing production (cash flow) and exploration upside.

6-Month Stock Performance (CAD): Soma Gold’s stock has been one of the standout performers among junior gold equities over the last year. The share price has surged from about C$0.42 in late 2024 to the mid-C$1.30s recently, though it has pulled back slightly from a 52-week high of ~C$1.64 in July 2025. In the past six months alone, Soma’s stock roughly doubled as the company delivered consistent quarterly production and positive drilling results. For instance, news in June 2025 of high-grade drill intercepts at the Cordero mine (7.5 g/t Au over 6m) confirmed the potential to extend mine life at depth, which helped support the share rally. Soma’s market capitalization now sits around $125 million at the current price, reflecting investors’ re-rating of the company from explorer to established producer.

Investor Sentiment: Investors are enthusiastic about Soma Gold’s execution and growth trajectory. The company has hit its stride by meeting production targets and achieving profitability, which is resonating in an environment where many gold juniors are still in exploration phase. Soma’s ability to generate cash flow has funded aggressive exploration – a strategy yielding success as new high-grade zones (e.g. the “Venus Gap” at Cordero) are being discovered. The market also values Soma’s consolidation strategy in Colombia; its plan to acquire additional nearby mines and increase mill throughput suggests an avenue to scale up beyond ~30,000 oz/year. In short, Soma is seen as a growth-oriented gold producer with improving fundamentals, and its stock performance reflects that optimism. The combination of rising output, exploration upside, and strong gold prices continues to underpin positive investor sentiment. What they promised is what they’ve delivered.

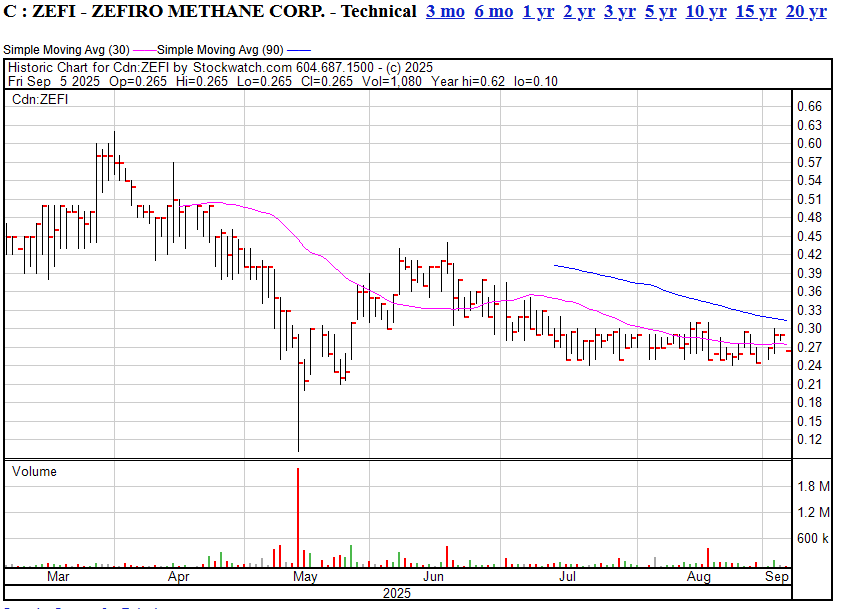

Zefiro Methane Corp. (NEO: ZEFI)

Business Focus & Market Opportunity: Zefiro Methane is an environmental services company targeting a unique niche: the mitigation of methane emissions from orphaned and abandoned oil & gas wells. Zefiro’s core business is to plug and remediate orphan wells in North America and generate carbon credits from the prevented methane emissions. Methane is a greenhouse gas over 25 times more potent than CO₂, and there are an estimated 4 million orphan wells in the U.S. alone emitting methane. This gives Zefiro a vast market opportunity with strong regulatory tailwinds – governments have allocated billions (e.g. a $4.7 billion U.S. federal program) to fund well plugging efforts. Zefiro has positioned itself as a fully integrated player in this space by acquiring specialized well-plugging firms and securing pre-sales of carbon credits. In essence, the company turns an environmental liability into sellable carbon offsets, aligning with global emissions reduction initiatives.

Stock Performance (CAD): Zefiro Methane went public in April 2024 at C$1.50 per share, but since then the stock has faced pressure. Over the past six months, ZEFI’s share price has traded downward into the ~$0.25–$0.30 range, reflecting the challenges many early-stage clean-tech ventures encounter after an IPO. At roughly C$0.30 today, the stock is down sharply (~80%) from its IPO price, but that’s the opportunity Elsaghir has spotted. Much of the decline occurred in late 2024; more recently the price appears to be finding a floor around the mid-20-cent level and while trading volumes are modest, the stock’s starting to lock in revenue – for instance, confirmation that Zefiro sold its first batch of orphan-well carbon offsets to a major buyer (EDF) has provided incremental support and validation to the market. A good old fashioned ‘buy low while you can’ story.

Investor Sentiment: The market is cautiously optimistic about Zefiro’s mission but remains in “show-me” mode regarding execution. On one hand, investors recognize the strong ESG narrative: Zefiro addresses climate change by tackling methane leaks, and its model could generate significant carbon credit revenue as voluntary carbon markets mature. The company’s progress in securing partnerships and offtakers is encouraging – notably, Zefiro’s agreement to supply carbon offsets to EDF (a large European utility) demonstrated commercial traction. Additionally, management’s aggressive expansion (two strategic acquisitions in 2023 and even an appearance at the UN Climate Conference) signals ambition. However, the steep post-IPO stock drop means investors are looking for steady execution and revenue ramp-up to rebuild confidence. A ‘show me’ deal, but they’re starting to show you.

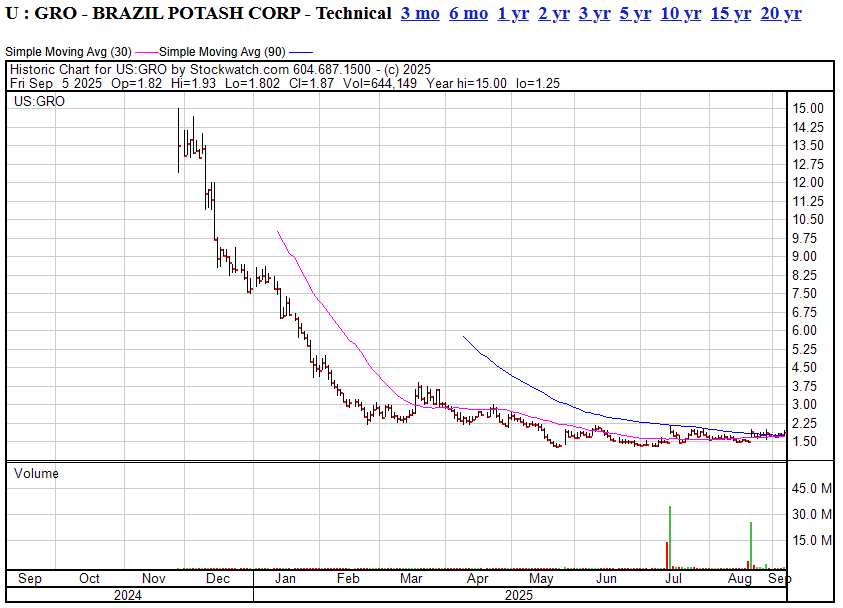

Brazil Potash Corp – (GRO:NYSE American)

Business Focus & Market Opportunity: Brazil Potash is advancing the Autazes potash project in Amazonas, aiming to supply up to ~2.4 Mt/yr into Brazil’s heavily import-dependent fertilizer market. Commercial de-risking has accelerated: a 10-year take-or-pay offtake with Keytrade for up to ~900k t/yr now lifts binding commitments to ~60% of planned output, alongside AMAGGI volumes; management says talks could lift coverage toward ~91% at peak. On the infrastructure/financing side, a $200m power-line MOU + $20m strategic equity with Fictor Energia and a $75m equity line with Alumni Capital add optionality to fund early works. The company is also nurturing community relations with the Mura Indigenous Council, which recently invited leadership to its annual cultural festival—important context for permitting/social license.

Stock Performance: The shares are ~US$1.88 today vs ~US$15 on the day it launched, and while that’s a rough looking chart, there are two things to note: 1) the insiders at that starting point were institutions that remain in the deal, reflecting ongoing confidence after earlier hype; 2) Mo came in post-fall off and showed me the company when it was < $2, which is where it remains, only now it has some runs on the board. Notably, volume and price spiked right after the Keytrade offtake went definitive—suggesting the market is reacting mostly to bankability milestones (offtake, grid power, financing tools) and near-term construction optics now, rather than looking over its shoulder to losses made by others. Starting to firm up.

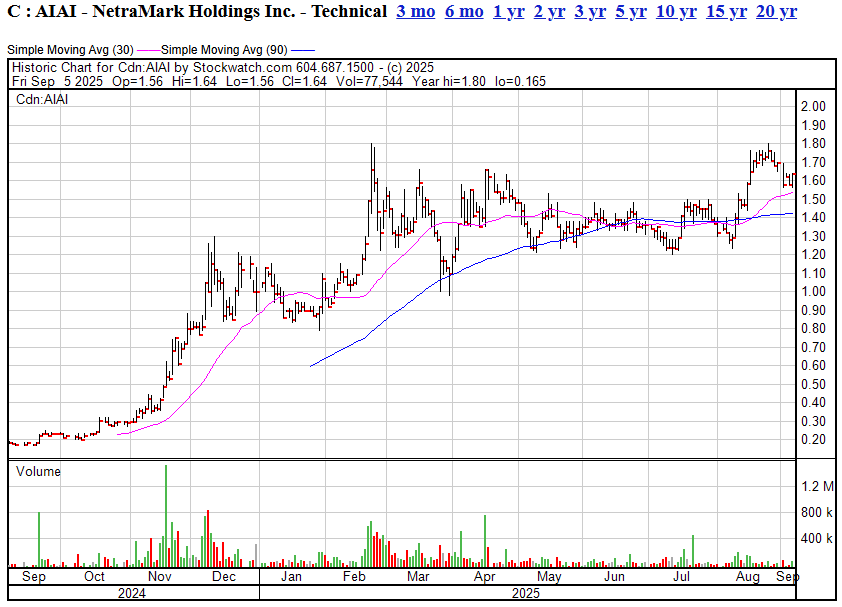

NetraMark Holdings – (AIAI.C)

Business Focus & Market Opportunity: NetraMark is an AI/ML platform company focused on clinical-trial analytics (NetraAI, Health Atlas, NetraPlacebo). The pitch: help pharma identify clinically meaningful subpopulations, reduce placebo effects, and rescue/plan smaller, faster studies. In June, NetraMark released a preprint claiming material outperformance vs. ChatGPT and DeepSeek on subpopulation discovery, the sort of datapoint that gets buy-side attention even before revenue scales. The company has also announced funded collaboration with the Ontario Brain Institute and other BD wins, while reporting 2024 revenue growth from a small base. Collectively, proof points + partnerships are what the market is rewarding right now.

Stock Performance: ~+21% in CAD, from C$1.31 (Mar 5 close) to C$1.58 (last close). The tape shows a powerful spring/summer trend—trading through C$1.60–1.80—from a 52-week floor of C$0.165 as AI-in-trials became a thematic magnet. While many of the deals Elsaghir has put in front of me were under-appreciated stocks that needed to find an audience to begin their climb, this one is already zooming. The opportunity here isn’t to ride a ten cent stock to a buck, it’s to lock in long term growth potential that, if all goes the way it’s been headed, could be a generational win.

Investor Sentiment: Credible technical validation (the preprint), institutional collaborations (OBI), and a simple story (AI that can fix R&D attrition) that converts easily into investor memos. Watch for new SaaS contracts or marquee pharma case studies as the next catalysts.

Bottom line:

Much of the market these days rewards not real business, but short term flips; a heavily promoted mining project years away from production rather than one nearing the production pay-off, or a tech deal with the right buzz words over a tough-to-explain deal that may have real world application. Why I’ve highlighted Elsaghir today is his approach to deals is long term in focus and self-fulfilling.

When people know you’re not going to fuck a deal up the first moment you can turn a personal profit on it, they’ll bring you their good stuff. When they know your group has earned the trust of buyers, they’ll come to you with gold. And when they see that your portfolio moves up more often, consistently, slowly, in an orderly way, rather than up and down like a heart attack monitor, retail investors can trust that they won’t lose their skin following you in.

All too often, market guys can’t help themselves.. they’ve got to be first out, even if it ruins the deal behind them for the guys they brought in.

But working alongside a guy who hangs in for the long haul, who helps companies correct course and brings them support WITHOUT the giant fall offs that usually come when profiteers race for the exits… that’s an all too rare way to do business, and it’ll never go out of style.

C.

Leave a Reply