Disclaimer: This article has been paid for by Prismo Metals. See disclosures at the bottom of the page.

Disclaimer: This article has been paid for by Prismo Metals. See disclosures at the bottom of the page.

It was early Monday and my head was pounding. Market guys like to schedule meetings on the west coast on east coast time, but it wasn’t just the early hour eating my brain. My kid managed to share his flu with me and it was just beginning to take hold, so talk of drill holes and porphyrys and historic this and potential that was barely penetrating the low buzz in my front lobes.

I walked into the downtown Vancouver cafe at the agreed upon time and mainlined an Americano while Prismo Metals (PRIZ.C) CEO Alain Lambert introduced me to his CXO, Craig Gibson.

I pegged Gibson as a geologist from 50 yards away. I’d wager most geologists would rather show up at a meeting in fishnet stockings than a business suit, which isn’t an insult – they’re used to fleece jackets and heavy boots, and their idea of a good time is picking through a ditch and lifting rocks, not sipping cafe lattes.

So Gibson began showing me through his investor deck and a funny thing happened; the fog in my head begn to clear. As he went from project to project and put each into laymans terms, my self hatred shifted, replaced by growing interest.

I’ve looked over Prismo and its properties several times in the past, and written them up more than once, but there’s something to be said for being walked through a historic tale by a tour guide who knows every rock.

And even has a couple in his pocket.

Yep, a first for me; hearing about the project from the guy who found it, brought it to the company, and has actual rocks from the site in his jacket pocket, wrapped in kleenex and shimmering under the fluorescent lights.

Gibson knows these projects inside and out, and he walks through them with understated understanding. “This one’s for now, that one’s for later” he says, flipping pages. “If the world goes nuts for copper, we’ve got copper opportunities. Silver? Right here. Gold? No problem.”

I’m not a geologist, so for the last twelve years I’ve been on a self-directed journey of discovery where some of the most learned and qualified people in the business have patiently explained rocks to me. My job is to then turn those explanations into a storyline that the layman can understand, but Gibson connected the dots for me perfectly.

Here’s the tale of the tape:

Palos Verdes (Mexico gold and silver)

Palos Verdes (Mexico gold and silver)

Palos Verdes is Gibson’s legacy project, one that he brought to the company and wants to see out. It’s a high-grade epithermal vein within Vizsla Silver’s prolific Pánuco district. Drilling (over 6,000m in 33 holes) has returned bonanza results, including 0.5 m at 102 g/t gold and 3,100 g/t silver.

Surrounded by Vizsla’s big money concessions, the project is strategically positioned for consolidation if Prismo can show consistent results, but Visla is right there helping the company get to that point. A joint technical committee with Vizsla provides geological guidance and access to deeper targets and they’ve even let Prismo drill from pads on their concessions.

So why did the historic miners stop mining? Partly because the drills have never gone deeper than 300m because there was plenty of shallow stuff for them to go for, but also because the grades needed for 1880’s miners to do okay economically were a lot higher than what’s needed now. Deeper drilling is already planned.

With proven bonanza intercepts and proximity to infrastructure, and a very real likelihood of bigger boys being super interested, Palos Verdes is Prismo’s most advanced project. Near-term value lies in additional drilling to extend high-grade shoots and potential corporate developments, as Vizsla progresses toward district-scale production later this decade.

Hot Breccia (Arizona copper)

Hot Breccia (Arizona copper)

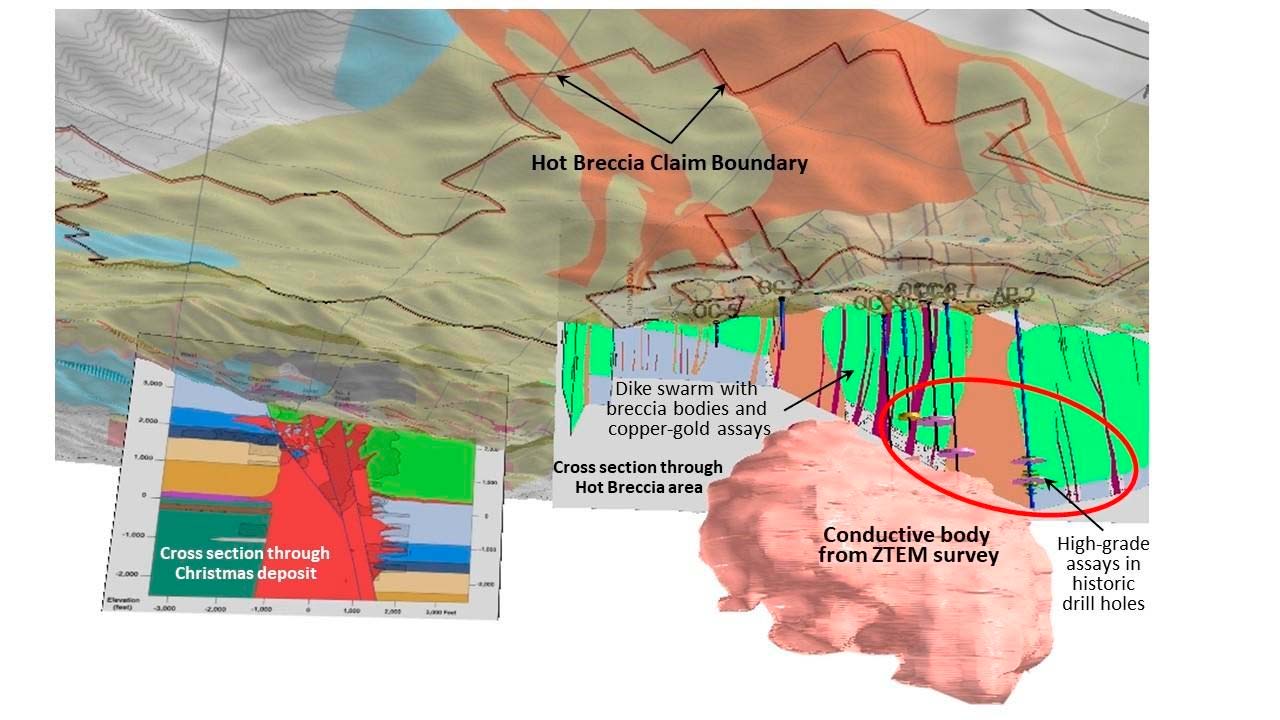

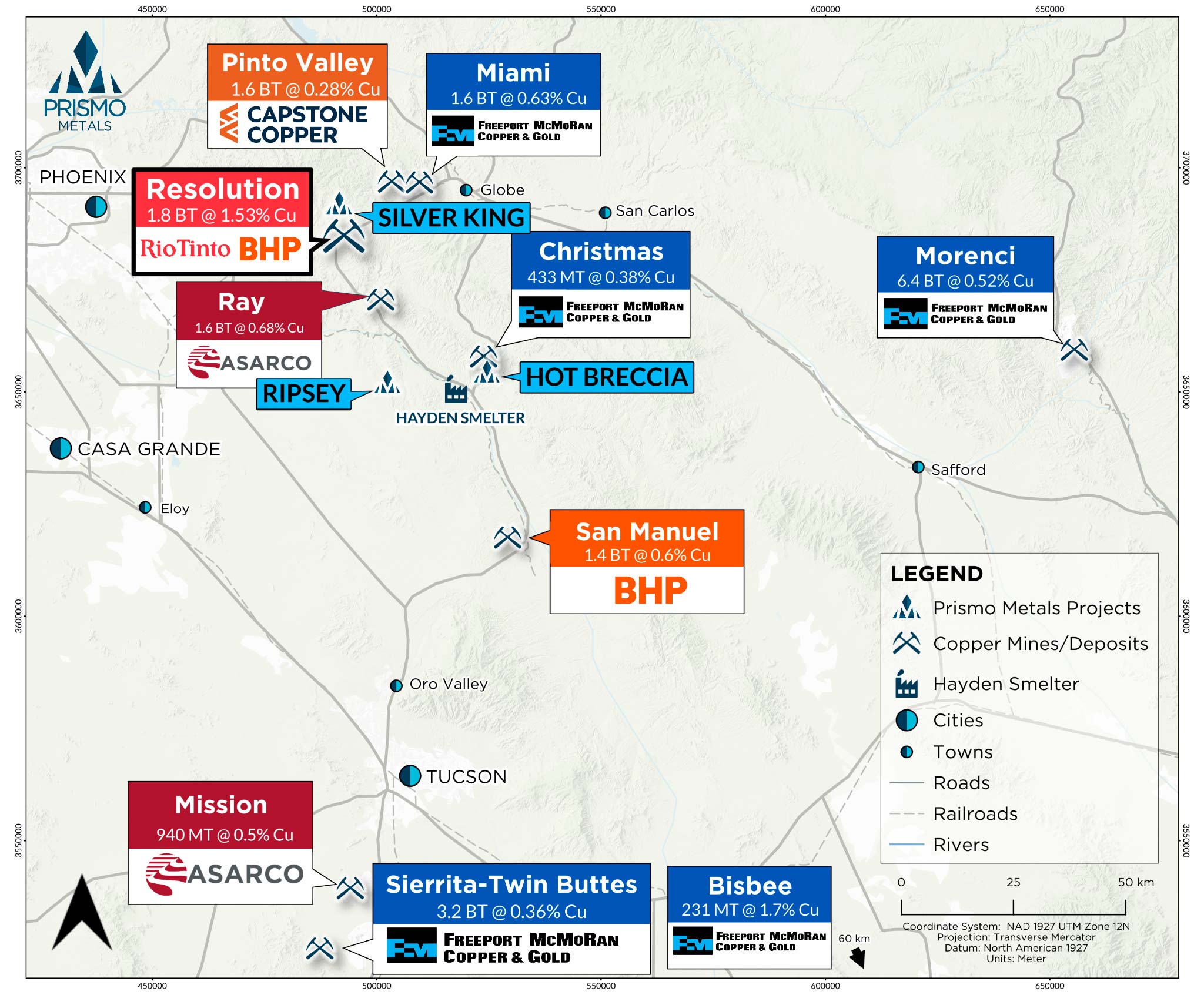

Hot Breccia is a large porphyry/skarn copper target located in Arizona’s world-class Copper Belt, near Resolution, Ray, and the historic Christmas Mine. Historic drilling by Kennecott and Conoco intersected >1% copper, with skarn zones grading up to 3.16%.

The TL/DR; on this is, the area is festooned with working mines. Like, they’re everywhere. There’s even a mill right next door.

But underground iw here it gets crazy; a 2023 ZTEM survey revealed a major deep conductive anomaly, interpreted as a buried porphyry system. The big pink lump to the left? That’s set alarm bells ringing and demands more drill holes.

The project is fully permitted with a 5,000-m drill program underway, marking the first holes in decades. Hot Breccia is early-stage but highly prospective: success could replicate Resolution-scale potential. For Prismo, it represents a high-risk, high-reward opportunity to attract major copper partners.

Silver King (Arizona silver)

Silver King (Arizona silver)

Silver King is a past-producing bonanza silver mine near Superior, Arizona, historically yielding 6Moz Ag at grades up to 1,900 g/t in the late 1800s.

Later samples confirmed extreme grades up to 18,250 g/t Ag and 15 g/t Au. The deposit is a steeply plunging breccia pipe hosted in quartz diorite, located just 3 km from the stonking big Resolution Copper seup.

Today, Prismo controls the enclave of claims entirely surrounded by Resolution’s holdings. As you can see on the map. the neighbourhood is dense.

The near-term plan is a 1,000-m drill program, shaft dewatering, and bulk sampling. Silver King offers near-surface high-grade potential with strategic significance in a tier-one mining district.

Ripsey (Arizona)

Ripsey is a historic polymetallic vein system in Arizona’s Copper Corridor, 20 km west of Hot Breccia, and of the four projects in play, it’s the one best described as ‘worth looking at later.’.

Mind you, if it’s all you had, it’d be super exciting in itself – Old workings traced a south-dipping vein for ~400 m along strike and 160 m depth. Modern chip and channel sampling has returned grades up to 15.9 g/t Au, 275 g/t Ag, 3% Cu, and 9% Zn. The project sits near ASARCO’s Ray mine and the historic Christmas mine, in an area with infrastructure and mining history.

But when you’re sitting on three other projects that have major potential, Ripsey gets left behind.

Ripsey has never been drilled with modern methods. so there’s a lot of interest in digging in soon, just not for a bit. Prismo plans mapping, sampling, and initial drilling to test continuity and grade at depth, offering discovery potential, soonish.

What’s interesting about our friend Mr Gibson is how excited he is by all of these projects. Realistic, sure, but as he sees it, he’s got four very real bets on the table. Prismo has multi metal options, near-term, mid-term, and long-term options, it’s never far from a town or a road or a mill, it’s got big neighbours looking fertively over the fence, and it’s in a macroeconomic metal bull market that wants exactly what it has – gold, silver, and copper.

That’s plenty enough to warrant putting a suit on.

— Chris Parry

Leave a Reply