One summer, vocationally and emotionally adrift, I fell in love with a tall older woman who wore metallic sparkles in her hair. She liked to tell stories. Her favorite one was about how we were going to get rich together.

Not embarrassing rich. Just rich-enough-not-to-give-a-fuck.

I believed in her. I gave her everything I had.

We were walking on the beach one evening when she suddenly shrunk, grew sideburns and vomited on the sand.

When I tried to comfort her, she slapped me hard on the cheek, told me she was leaving town and I was fool for believing her stories.

My lover’s name was gold.

Guess what?

The Bitch is Back!

No smile. No hug. She just walked up to me, handed me $65,000 and said, “There’s more to come”.

Every jilted fool like me who still owns gold stocks has a good summer.

On Thursday evening, gold prices hit their highest levels in six-years (USD $1,450) as investors anticipate an interest rate cut by the US Fed, and Washington and Tehran bark at each other.

Gold prices pulled back $20 today. Over the summer bullion has benefited from the fall in bond yields. Some sovereign bonds are now negative-yielding, meaning that investors are paying for the privilege of lending money to borrowers. In that environment, owning gold is a more attractive option (So is getting stabbed in the genitals).

And let’s not forget: the Fibonacci Retracement Chart indicates that the next support level is at – ha – I’m kidding! Fibonacci lines? This lady has stronger predictive powers:

We believe that the most significant medium and long-term catalyst to gold prices is debt.

The Federal Reserve has printed more than $2 trillion since the global economic crisis began in 2008, tripling the size of its balance sheet.

According to Bloomberg, “Global debt hit a record $184 trillion last year, equivalent to more than $86,000 per person — more than double the average per-capita income.”

To service the debt, governments are printing money. Supply and demand. Theoretically, an over supply of paper money, will cause its value to go down.

Do you know who believes in that theory?

Central Banks.

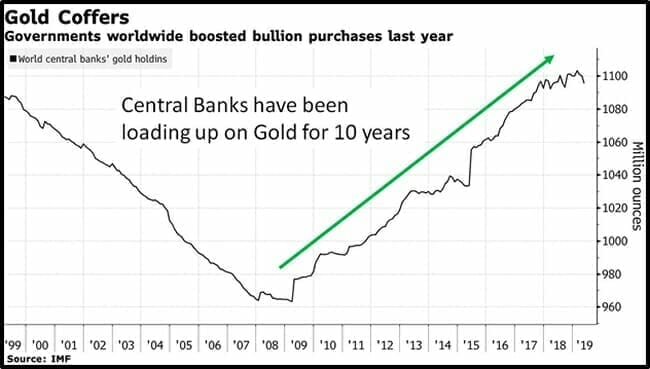

Last week the World Gold Council (WGC) announced that central bank gold demand is up 73% this year compared to 2018.

“Several emerging market central banks – including Russia, China, Turkey and Kazakhstan – have dominated buying for a few years now, and this is still the case in 2019,” stated the WGC.

“In a survey of central banks conducted by the World Gold Council and YouGov, 54% of respondents expect global holdings to climb in the next 12 months amid concerns about risks in other reserve assets,” stated Bloomberg on July 19, 2019.

Nations have expanded gold holdings by about 14% since 2009, with the hoard now valued at roughly $1.6 trillion. Authorities seek to diversify away from the dollar. Bullion holdings rose by 651.5 tons last year, the most since 1971.

If the central banks are right, and the collective weight of global debt catalyses a flight away from paper currency, the junior gold companies will go ballistic.

Equity Guru mining expert Greg Nolan has had a busy month promoting his book, “Highballer: Tales from a Treeplanting Life.”

Despite his book-promotional duties, Nolan is bringing us geological intel from companies like EmGold Mining (EMR.V) that “has a portfolio of assets in Nevada and Quebec.”

And Falcon Gold (FG.V) that has a number of gold, base and battery metals projects in its portfolio.

A couple of months ago, Nolan also told us about Black Rock Gold (BRC.V) that “holds a large, 4,537 hectare chunk of prospective terrain strategically located near the confluence of the Carlin Trend and the Northern Nevada Rift of north-central Nevada.”

“Blackrock’s Silver Cloud Property is located eight kilometers west of the Hollister mine which has a Measured and Indicated resource of 430K tonnes grading 16.6 g/t gold (208,000 oz’s of Au) and an Inferred resource of 180K tonnes grading 14.4 g/t gold (74,000 oz’s of Au).”

“If company management finds the resolve to move this project forward,” added Nolan, “Its sub-nickel share price should respond to the stimulus.”

Good call, Mr. Nolan.

What is the next gold junior stock to run?

Maybe Nexus Gold (NXS.V).

“Nexus dropped news yesterday that turned a few heads,” stated Nolan on March 6, 2019, “Judging by the volume, I suspect the market is waking up to the company’s latent discovery potential.”

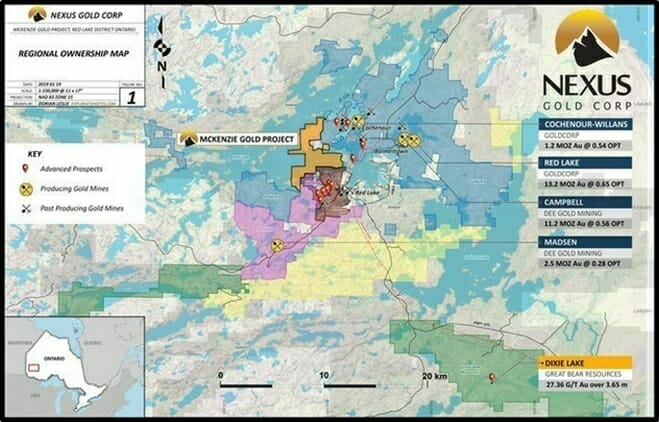

This frenzied trading activity was prompted by news out of the company’s McKenzie Gold Project, located in the prolific Red Lake Mining Camp of northwestern Ontario.

Red Lake, in case you are new to the gold mining arena, is known as “the high-grade gold capital of the world.” It’s where Goldcorp (now Newmont Goldcorp (NGT.TO)), once a lowly cash-starved ExplorerCo, gained prominence as a high-grade producer.

Positioned in the heart of the Red Lake Camp, the McKenzie Gold Project is surrounded by the likes of Newmont Goldcorp, Yamana (YRI.T), Pure Gold (PGM.V) and Premier Gold (PG.T).

This 2017 discovery lies approximately 100 meters west of a historical showing that assayed up to 212.8 g/t Au.

Although this vein is narrow and the strike length is unknown, it demonstrates the untapped potential of the McKenzie project (Red Lake is known for its narrow high-grade veins).

This morning, after I cashed my $65,000 cheque, I went out for coffee with gold.

She doesn’t do the metallic-hair-confetti-thing anymore.

She looked older, more reserved. I guess that’s what happens when you hang out with central bankers. At one point, she reached across the table and held both my hands in hers.

“We’re going to be rich,” she said, “I promise you.”

Oh yeah bitch?

Don’t tell me, show me.

– Lukas Kane

Full Disclosure: Nexus Gold is an Equity Guru marketing client.

Leave a Reply