The Canadian Securities Exchange is not known for rigorous compliance protocols.

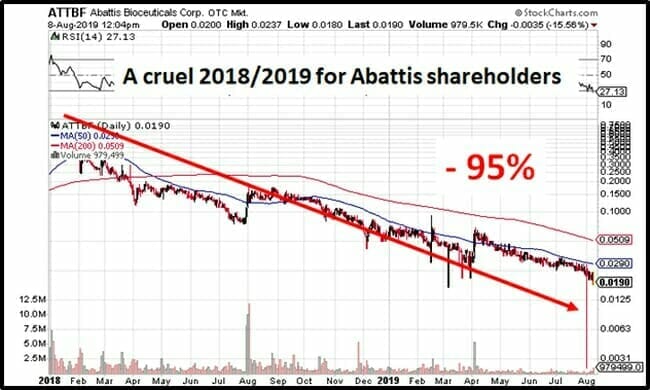

However, it does have some standards, and cannabis health product company Abattis Bioceuticals (ATT.C) was unable to meet them.

“The common shares of Abattis Bioceuticals Corp. will be delisted at the market close August 9, 2019,” stated the CSE.

The CSE originally halted Abattis on February 6, 2019, after the company failed to file year-end financials. A scheduled ATT conference call to explain the problem never occurred.

The history of Abattis is closely linked to notorious Bridgemark Financial, the targets of a recent class-action lawsuit.

The lawsuit seeks damages for unlawful conspiracy, secondary market misrepresentations and fraud, or disgorgement of the benefit the defendants obtained as a result of the scheme.

The scheme involves a quartet of West Vancouver penny stock promoters: BridgeMark Financial Corp. principal and chartered professional accountant Anthony Jackson; Justin Liu, a man known to operate illegal cannabis dispensaries; Cameron Paddock, a former NHL hockey player; and Aly Babu Mawji, a convicted fraudster (in Germany).

“Anthony Jackson, the principal of Bridgemark Financial, is at the centre of a massive, alleged scheme to defraud retail investors,” confirms Business in Vancouver.

In August, 2019 Abattis’ “total short interest was 241,500 shares.”

To review: on June 15, 2017, Abattis appointed Anthony Jackson as CFO.

According to the press release, Anthony Jackson is “the founder and principle at Bridgemark Financial.” The ATT shareholders were assured that Jackson “will report directly to Robert Abenante, President and CEO of Abattis.”

Over the years, Jackson has entered and exited CFO positions in a galaxy of publicly traded companies including Greatbanks Resources, Katipult Technology, Dorex Minerals, Global UAV Technologies, Crystal Exploration, Sandfire Resources America, Coronet Metals, Oil Optimization, Montego Resources, Metropolitan Energy, Kaneh Bosm, Tiller Resources, Mediterranean Resources, Altan Rio Minerals, Eyecarrot Innovations etc.

On February 8, 2018, Abattis announced that it purchased a 49% stake in CannaNUMUS Blockchain for $5 million cash and additional “milestone payments” of $2 million.

CannaNUMUS was “developing a cryptocurrency which will link investors with cannabis-producing companies.”

CannaNUMUS didn’t (doesn’t) appear to have a website. The domain www.cannanumus.com was registered on 2017-10-25 and is “parked” at SureSupport LLC Hosting.

CannaNUMUS was founded by Bridgemark operative Simran Gill.

“We looked at many companies to partner with and Abattis came out on top,” stated Gill. “Through their growing portfolio of downstream products and services, Abattis can offer synergistic value to the coin.”

Two days later, on February 10, 2018, Jackson was replaced as Abattis’ CFO.

Having supervised the $7 million purchase of a zombie company from a Bridgemark associate, Jackson’s work at Abattis was done.

Confused?

Dizzy?

Overwhelmed?

That’s exactly how the scam works.

The spotted hyena uses an attack mode called swarm intelligence to disorient and overwhelm its prey before ripping off chunks of its flesh.

In this world, the hyena’s name is Bridgemark Financial – and the prey is us, the retail investor.

The investor-rights group #AllSharesMatter claims there are 15 more members of the Bridgemark pack.

@anon: Why are all of these companies using 1199 West Hastings Street Vancouver? Who is Anthony Jackson? Who founded Bridgemark? Why are social media and websites being scrubbed and erased?

@DogsFerDev: Plenty of snickers about Anthony Jackson and Bridgemark. Their roots in the Vancouver market run deep and the stories of people they’ve fucked over are endless.

@wdv: “We will get these clowns. Bridgemark fucked with the wrong company shareholders!”

@BrettCross: If Bridgemark is a company you are invested in, then you should do some DD on some of their other plays.

Commentators on Ceo.ca claim that the “other plays” include $ITG $CRYP $AFI $BCFN $DNAX $NINE $UAV $ZNK $KBEV $MDM $MY $SUV $VAX $KCC $LEO $LIC $NSAU $NTM $QBOT $WRW $PLAY $EASY and $ATT.

On August 28, 2018, ATT announced plans to launch a new line of pain-relief products.

“We are very proud to have developed two products that safely reduce pain and modulate inflammation,” stated Dr. Brazos Minshew, then-president of the ATT Medical Advisory Board.

A registered “Health Coach,” Dr. Minshew believes that “every person is creative, resourceful and whole.”

In 2017, Dr. Minshew appeared on a fake news radio show that was shut down by the Federal Trade Commission (FTC) after is was determined that “Dr. Minshew is not actually an expert in neurology or brain science, as claimed in the radio ad.”

Sniff test?

Another fail.

The Investment Industry Regulatory Organization of Canada (IIROC) “writes the rules” and “investigates misconduct” in the public markets.

During the last 10 years, IIROC has amassed $32 million in uncollected fines.

IIROC is currently funded by the same companies it is regulating.

Self-serving, financially-educated young men can not be faulted for enriching themselves in this largely unpoliced ecosystem.

Like the spotted hyena, Bridgemark Financial has been mostly following the rules of nature, gleefully ripping off the flesh of retail investors. A day of reckoning finally came when the auditors couldn’t sign off the accumulated bullshit.

Starting tomorrow, Abattis is gone from the CSE.

Good riddance.

–Lukas Kane

Full Disclosure: Equity Guru has no financial relationship with any company mentioned in this article.

Leave a Reply