Newsfeeds are clogged with “the bottom’s here!” narrative and we’re already seeing a significant bump in positivity in the public markets including risk-on assets like cryptocurrency, but are we out of the woods?

This stream of social media ‘good news’ and bullish fervor comes as the yield curve inversion is in full swing. It might seem to be the profitable contrarian move to double-down on this perceived dip, but yield curve inversions have predicted every recession in the US since 1955.

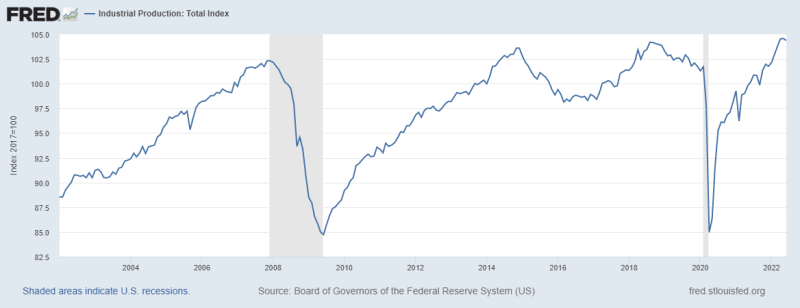

The stock market is due for a bloodletting as it has failed to follow the fundamental aspects of production. For instance, according to the following FRED graph, industrial production in the US has risen by approximately 17% since 2002.

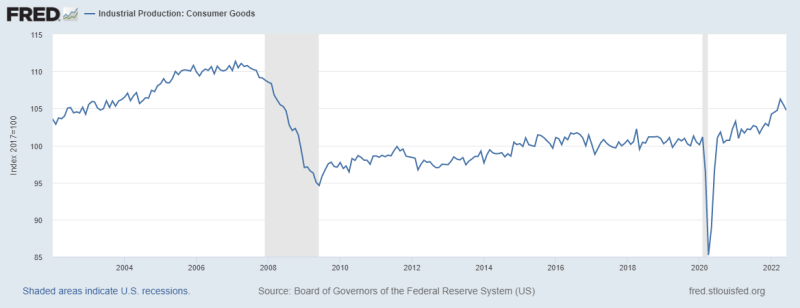

The production of consumer goods since 2002 has increased approximately 0.96%.

However, the SP 500 index has more than doubled in the same time while the Nasdaq rocketed more than 253%.

Admittedly, this is a cursory comparison, but not without merit. You may ask, if real production isn’t driving the market’s success, then what is?

I will keep my argument contained within the same time frame as the above graphs to remain relative. Quite simply, consumer and corporate debt.

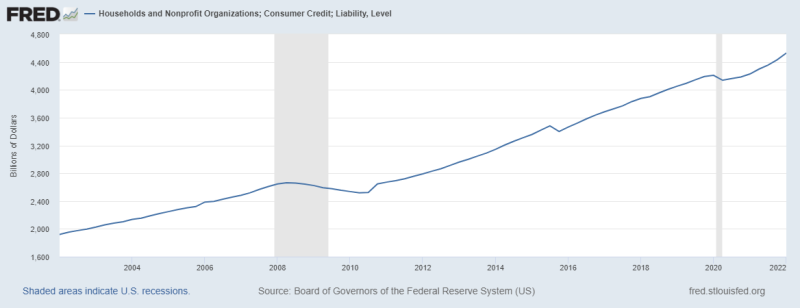

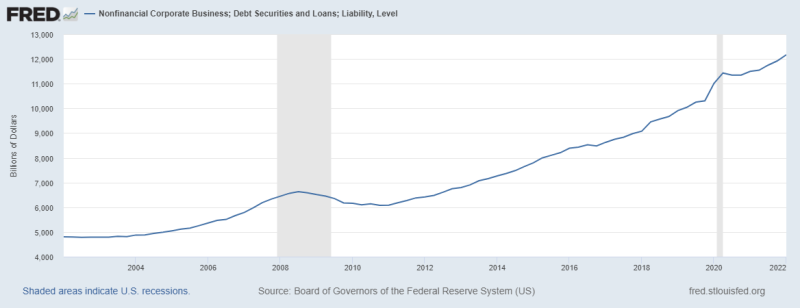

When the Fed initiated the first forms of Quantitative Easing in 2011 by buying long-term bonds and disposing their short-term counterparts, they managed to keep interest rates low, thus creating a pool of cheap cash that was immediately set upon by both businesses and private citizens.

Here are a couple of graphs from FRED visually illustrating this phenomenon. First, household and nonprofit organization credit and liability levels rose sharply after 2011, rising over 135% to $4.53 trillion USD from 2002 to 2022.

A similar ascent occurred in non-financial corporate business debt securities and loans liability levels, climbing 153% to $12.17 trillion between 2002 and 2022.

Citizens took their ‘free money’ and poured it into consumer goods while dumping the rest into the market because banks were no longer the place to get yield on your deposits.

Corporations took this opportunity to carry out share buyback programs, which were mostly illegal until 1982, or putting their money into other market investments as again, banks were not the preferred place of depositing your excess cash.

As you can see, the real market growth took place post 2011 and has rocketed since. However, since production remained at a real pace, market growth expanded beyond the fundamental foundations that supported its worth and stock valuations became fantastical.

You may argue that helicopter money on the back of Covid lockdowns have temporarily put a damper on the markets and good days are just around the corner, but I feel that point of view is superficial. Sure, the aforementioned external pressures helped bring on the pain, but the markets and the economy have been broken for a long time and the pandemic free money was merely the straw that broke the camel’s back.

What we’re experiencing right now in the markets and other assets like cryptocurrency, feels more like a dead cat bounce based on desperation than a long-term revival. Why?

First off, inflation. Since 2002, the dollar US citizens held in their wallet devalued just over 64% at approximately 2.53% per year. This year, we are looking at 9.06% with no signs of breaking.

China’s real estate market is imploding, and this will have a powerful knock-on effect for North Americans who have invested in land or own homes.

Used car loan defaults are on the rise. This is typically considered to be a canary in the coal mine when it comes to home mortgage defaults.

The rapidly shifting geopolitical landscape, most notably the deteriorating economic relations between the western world and China and Russia, is breaking down the financial status quo and possibly supplanting the US dollar’s status as a reserve currency.

Speaking of currency, Twitter is on fire with crypto maxis screaming that their particular brand of digital currency, i.e. bitcoin, will fix all these ills, if only we dug in deeper as investors and held tightly. Without mincing words, cryptocurrency is a dysfunctional solution looking for a problem and at worst, a massive pyramid scheme.

To start with, currency is only the top layer to the underlying economy and changing the current fiat system for a digital counterpart would only theoretically solve the scarcity issue, and even if it did, slamming on the brakes would present its own astronomical fallout.

Also, cryptocurrency cannot exist as an asset if it is to be used as real currency, just like paper fiat which in and of itself has no value other than the underlying factors of trust and valuation including such real things as GDP. Crypto is backed by nothing more than the electricity and processing power wasted in producing it.

I am not arguing that digital money isn’t part of our future, but what eventually arises will be miles different that what anyone envisions including the charlatan known as Michael Saylor, who took a savage beating in the dot com bust and is transferring his lack of prescience to back bitcoin.

So how long will our winter be if it continues? That is up for debate. Personally, I believe a lost decade is not only possible, but necessary to return the needle to some semblance of reality. However, there are good arguments made for two to three years of bad times.

I might be wrong, and you could make out like a bandit buying in today, but fundamental indicators don’t seem to be pointing in that direction. That said, you are your own captain, do your due diligence before making any investment decisions. Good luck to all because we’re going to need it.

–Gaalen Engen

Leave a Reply