Of all the stupid, tin-eared, extended news releases I’ve seen posted on a Monday morning, I’ve rarely seen one as stupid, tin-eared and extended as that sent out by Golden Leaf Holdings (GLH.C) this morning.

The big news out of a company whose share price has collapsed to a low it may soon be mathematically impossible to get lower than wasn’t that they’ve restructured debt, or acquired something in profit, or sacked the legions of staff they’ve been paying that seemingly can’t make money selling weed. No, their big news was, they’ve hired a CPO.

What’s a CPO, you might ask?

If only.

Golden Leaf has hired a Chief People Officer, which I guess is supposed to be jocular for ‘HR boss’

Golden Leaf Holdings Ltd. has appointed Jane Sullivan to the newly created role of chief people officer. Ms. Sullivan will lead the development and execution of the Company’s global people strategy, reporting to CEO Jeff Yapp.

Ms. Sullivan brings 30 years of experience in Human Resources, designing and executing people strategies across geographically dispersed organizations. She has designed and built scalable solutions for employee relations, talent acquisition, talent management, and leadership development. Her focus is achieving operational excellence through advanced human resources strategies.

Jesus Christ. Next they’ll be putting out news that Cheryl in Accounting is having a birthday and there’ll be cake in the break room but NOT FOR YOU, PHIL, not after ‘the incident.‘

But if you think the two paragraphs above was excessive, you haven’t seen the four others that followed, including quotes from anyone in earshot. I’ll save you the recap.

To be fair, I’m sure Ms Sullivan is excellent at her job and the company will be well HRed going forward. It seems like a wise hire.

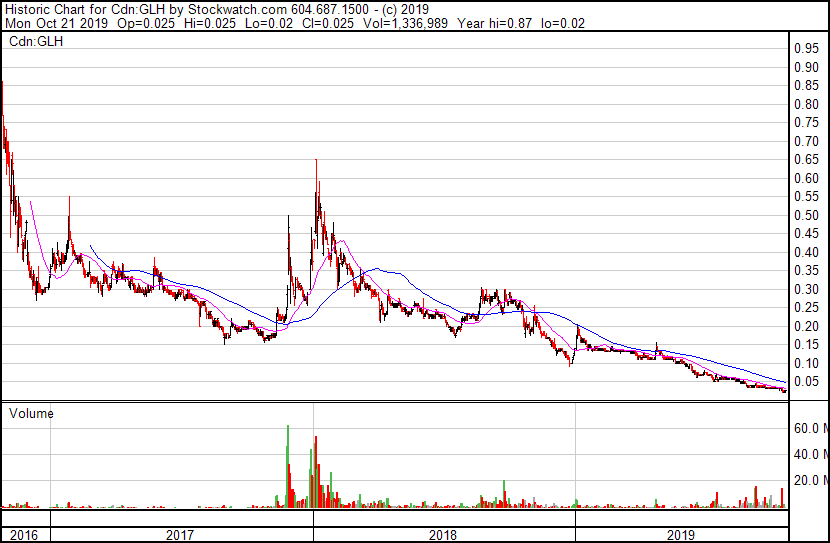

But who fucking cares when your stock chart is this?

Who knew that all they needed all this time was a better HR rep?

While, admittedly, there are few actual investors in GLH these days outside of debenture holders, those that do exist WANT NEWS OF A TURNAROUND, not all the great new hires you’re going to make now that you have an HR ninja in the room.

It’s been a terrible year for the company, and recently it’s only gotten worse.

But hey, maybe this has just been a bad year, like it has for a lot of companies. Admittedly, most aren’t trading at $0.025 per share, but let’s not take anything out of context.

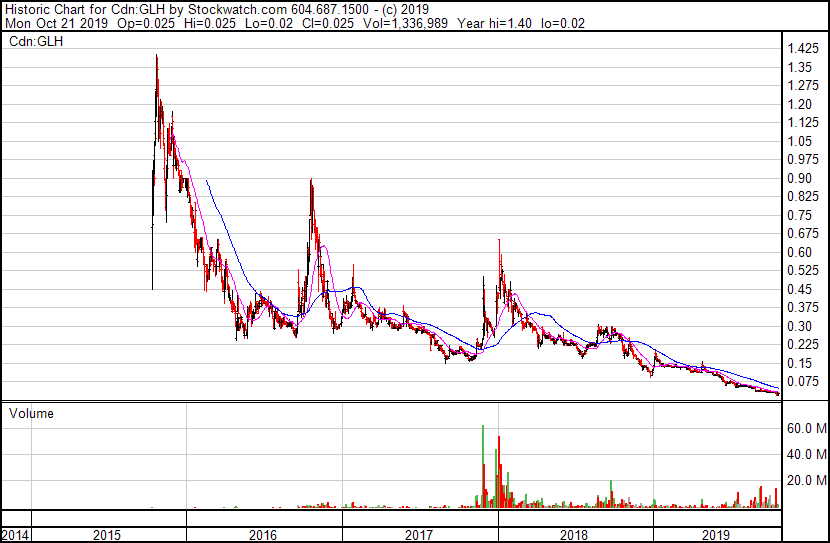

Okay, that’s a bad three years.

Maybe before that…

GLH is now a $21m market cap company, and that’s being generous because it also has long term debt of $19m.

Golden Leaf’s last ‘important’ news release before this ‘important’ news release was that they were starting a YouTube channel.

Wow. That’ll turn shit around:

This is a mind numbing level of deckchair shuffling while the ship goes under. How anyone on the GLH board can put up with this, in their name, is shocking.

The backstory:

GLH, when it went public in 2015, was SUCH a simple business model.

To paraphrase, ‘we have extraction machines, they make $X per month each in profit when working at full capacity, which they all are, and we sell everything they can extract, for a profit that we’re putting back into buying more machines. We’re going public to raise more money to buy more machines and sell more oil, all as quickly as we can.’

That was it, and I got behind it because, having met the crew and hearing the plan, it made a lot of sense. This was way back in the early days of the legal cannabis story and extraction wasn’t happening in Canada yet, but it was in Oregon where GLH was making its money.

Then they went public and every single aspect of the existing business got torched as a new CEO came in and spent all the money, raised more, spent more, raised more still, and spent more trying to figure out how to stop the rampant overspending.

Others were brought in, and acquired, with balance sheets to add to the books initially but incurring bigger debts to get there, and all of those acquisitions in the end were absolute toilet.

Now it’s four years later and nobody at this clusterfuck of a company has figured out yet that all you need to do to run a successful business is STOP WASTING YOUR DAMN MONEY.

Most of the content on ‘Chalice TV’ is over six months old and under a minute in length. It has 114 subscribers on Youtube. My 14 year old kid’s Youtube channel has more subscribers than Chalice TV. I’d arrange a consulting deal for him with GLH, but the last one I had with them I didn’t get paid for and they damn sure aren’t rolling in dough now.

Why would a cannabis company CEO spend his opening few months trying to turnaround a company with no money and a terrible reputation by hiring new people and releasing new media content instead of, I dunno, restructuring debt, lowering costs, and fixing the share price?

The new CEO has been there two months now.

Prior to joining Golden Leaf, Mr. Yapp served as the founder and CEO of Wutznxt, a strategic marketing and consulting firm that works with and advises companies from startups to Fortune 25 companies.

KEWL.

But hey, he’s buying stock in the company, so that’s good..

As part of their new roles, both Mr. Yapp and Mr. Varghese show further commitment to the company by each subscribing to 26,861,622 common shares at six cents per share, on a non-brokered basis, for a total of 53,723,244 common shares.

Though 71 per cent above the Friday, Aug. 30, close of 3.5 cents, this price reflects alignment with the debenture payments that were completed via an early conversion on Aug. 23, 2019. The issuance is being assisted through an interest-bearing loan to the executives.

So let me get this straight; the company is loaning money to the new CEO to buy company stock that is seriously underwater? Whyyyyy-a? What jiggeryfuckery is this?

In September of last year, GLH had over $5m in product sales for the quarter. The most recent quarter showed $4.3m in product sales.

The cost of sales, to be fair, has dropped by a few million between those quarters leading to a gross profit of $1.7m. But the total expenses in that quarter were just short of $4m, bringing a $3.4m net loss, or $400k more lost than in the previous quarter.

Folks have been waiting for GLH to get its numbers straight for years, and it has never – EVER – given anyone confidence that’s happening.

Towit:

| June 30, 2019 | December 31, 2018 | ||

| Current assets | $12,530,220 | $20,033,842 | |

| Current liabilities | $12,023,714 | $12,339,785 | |

| Working capital | $506,506 | $7,694,057 | |

| Long-term debt and notes payable* | $9,730,535 | $5,355,158 | |

| Share capital | $138,689,168 | $138,511,038 | |

| Deficit | ($106,421,794) | ($100,686,006) |

And if that’s not enough, from the most recent MD&A:

Consideration payable with face value of $9,527,350, related to the Chalice Farms acquisition, is owed to William Simpson, former CEO, Michael Genovese, former COO, and Gary Zipfel, Director.

William Simpson was CEO of Golden Leaf until the last few days of 2018. There have been FOUR other CEOs since he stepped down.

Golden Leaf Holdings Ltd. has hired William Kulczycki as its new chief executive officer and president. Former CEO and president William Simpson will remain with Golden Leaf on a full-time basis to assist Mr. Kulczycki and the board with strategic and day-to-day activities. [..] “I believe that my background and experience is well suited for leading a strong management team, improving the company’s business operations, and implementing a profitable, sustainable business model.” [Dec 27, 2018]

Five months later..

Golden Leaf Holdings Ltd. has appointed chief financial officer Karyn Barsa as chief executive officer and president of the company, succeeding William Kulczycki, effective immediately. [..] “The company is fortunate to have someone of Karyn’s background, experience and accomplishments to lead it to the next level.” [10 May, 2019]

Five weeks later..

Golden Leaf Holdings Ltd. has appointed John Varghese, presently a director of Golden Leaf, to succeed Karyn Barsa as interim president and chief executive officer of the company and lead the company through a strategic assessment of its management and operations. Ms. Barsa is no longer with the company. [June 17, 2019]

And then..

Jeffrey Yapp will succeed John Varghese as chief executive officer of Golden Leaf Holdings Ltd. Upon the resignation of Gary Zipfel on Sept. 2, Mr. Yapp joined the board of directors. Mr. Varghese, who served as interim CEO, will transition to the role of executive chairman and lead all capital-markets-related activities. [September 3, 2019]

If you think John Yapp’s first few moves were daft, there’s not a lot of incentive for him to get better. With four CEOs having sat in his office in a year, another one would likely be cataclysmic, so expect the board to put up with more weirdness as it emerges.

To be clear, any dollar shoveled into Golden Leaf today, tomorrow, and for the last three years, is, will be, and has been a destruction of wealth.

To paraphrase an old boss describing a day at the horse races, “Ya may as well just stay home, throw red wine all over your shirt, punch yourself in the face, and burn $500. At least you’ll have saved cab fare.”

— Chris Parry

FULL DISCLOSURE: Way, way back in the old days I was a consultant for this outfit, and I spent way too much time, reputation, and goodwill giving them the benefit of the doubt as they drunkenly stumbled from crisis to crisis. I see no way forward for them at all.

Leave a Reply