Tobacco giant, Altria Group (MO.NYSE), is lobbying in the United States for “matters pertaining to hemp and crop insurance,” among other things, seemingly aiming to pivot away from vaping amidst a national health emergency.

A lobbying report filed by The Russell Group listed its income for the quarter on behalf of Altria as $60,000, a figure rounded to the nearest $10,000.

Altria has had a spate of bad luck in recent months: The company’s Q3 earnings states its tobacco sales have declined in the most recent quarter.

Third Quarter

- Smokeable products segment reported domestic cigarette shipment volume decreased 6.6%, primarily driven by the industry’s rate of decline, retail share losses and trade inventory movements, partially offset by calendar differences.

- When adjusted for calendar differences, trade inventory movements and other factors, smokeable products segment domestic cigarette shipment volume decreased by an estimated 7%.

- When adjusted for calendar differences, trade inventory movements and other factors, total domestic cigarette industry volumes declined by an estimated 5.5%.

- Reported cigar shipment volume increased 4.1%.

Furthermore, investments outside of tobacco have not given Altria enough maneuverability to pivot away from their established market segment.

“The guidance assumes little-to-no adjusted earnings or cash contributions from the Cronos and JUUL investments,” according to Altria.

Worse, Altria’s association with JUUL–totaling a 35% stake–culminated in a staggering drop in share price coinciding with the outbreak of vaping-related illnesses in August 2019.

Altria said in a statement that it would be writing down $4.5B from its investment in JUUL, roughly one-third of its stake.

It seems like Altria is now trying to recoup some of its losses in the vaping sector by lobbying for increased financial protection for hemp farmers, a move which could benefit Cronos Group (CRON.T).

In August 2019, Cronos acquired four subsidiaries of Redwood Holding Group, a California-based company which makes and markets hemp-derived CBD products in the United States.

According to New Frontier Data, a data and market intelligence firm focused on the cannabis and hemp industries, total U.S. sales for hemp-derived products were approximately $1.1 billion in 2018, and are projected to more than double by 2022. Another recent report by market intelligence firm Brightfield Farms, estimated that the US CBD market would grow to $23.7 billion by 2023, up from a $5 billion market size in 2019.

Altria also formed a deal with Lexaria Biosciences (LXX.C) to develop nicotine delivery products which could also be used for CBD products.

According to the release, research “suggested that CBD absorption into human intestinal cells increased by 499 percent through the utilization of the DehydraTECH technology.”

Hemp not the ‘silver bullet’ some hope

Much ado has been made about hemp. Senate majority leader Mitch McConnell personally pressured the FDA to speed up its regulation of CBD in the hopes of assisting American farmers ailing under the U.S.-China trade war.

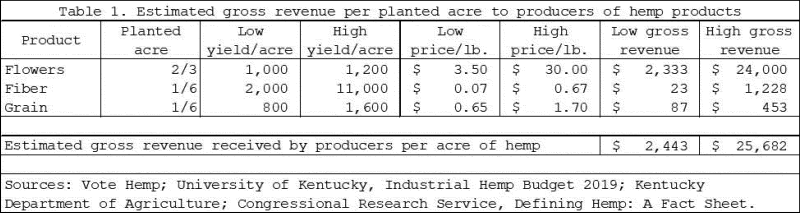

And for good reason: many states, including Kentucky, are looking for another cash crop as tobacco use wanes, and hemp CBD currently exceeds tobacco in price per pound.

Until recently, crop insurance, the kind Altria is lobbying for, wasn’t available for hemp farmers, making the switch from traditional crops a sizable risk.

The USDA’s interim ruling now allows for hemp farmers to access the same programs and grants available to their colleagues.

“Beginning not later than the 2020 reinsurance year, the Federal Crop Insurance Corporation [FCIC] shall offer coverage under the whole farm revenue protection insurance policy (or a successor policy or plan of insurance) for hemp (as defined in section 297A of the Agricultural Marketing Act of 1946 (7 U.S.C. 1639o)).”

But although domestic cultivation of hemp has now been given federal approval, experts warn hemp may not be the end-all answer to economic woes politicians and farmers are hoping for.

Tyler Mark, assistant professor of agricultural economics at the University of Kentucky, said the rush to adopt hemp as a cure-all crop in his state may leave some hopefuls disappointed.

“Let’s remove it completely from being a magic bullet. Let’s call it an additional tool in our tool belt,” Tyler said.

“We don’t understand the demand side of this crop yet so we don’t understand what the consumption will look like.”

Tyler references an article in kush.com which said the U.S. was producing eight times the amount of CBD it could reasonable consume, leading to a drop in prices.

Although Tyler said he hasn’t worked backwards through the math to confirm the publications assertions, he does outline a scenario in which a rush to cultivate hemp devalues the crop, granted the FDA continues to allow cultivation.

“I think long term of that happening is we’ll see production come in and as we normally do in a lot of other agriculture industries. We’ll oversupply, we’ll push the price down and we’ll level out some of those prices and remove some of the fantasy numbers that I see out there,” he said.

A surplus in cannabis production in Oregon made the state a pot smoker’s paradise, though this was due in part to federal law prohibiting interstate commerce of cannabis.

Hemp is not bound by such regulation, opening the door for national distribution, but whether or not CBD will replace more established farm staples remains to be seen.

–Ethan Reyes

Leave a Reply