Aramco IPO

Oil giant Aramco is gearing up for a valuation between $1.6 – $1.7 trillion for its initial public offering. While this is short of the initial $2 trillion mark the crown prince hoped for, it still boasts the world’s largest IPO offering.

The firm released a statement on Sunday aiming that it had priced the offering between 30 and 32 riyals, between $8 and $8.52 a share, and plans to sell a 1.5% stake (approx. 3 billion shares) in the IPO.

The target valuation comes in the midst of the firm’s aggressive push in the international markets to raise capital, hoping to raise funds from sovereign wealth funds, the middle east, Asia, and Europe.

For the nine months ended in September, the company posted a profit of $68 billion, exceeding the 2018 net figure of Apple Inc., the most profitable publicly-traded company. However, Aramco’s figure was down year over year by 18% amid weaker oil prices. Recent attacks on the oil facility in September hurt the firm by raising production costs in a bear market for oil.

A lower valuation for the company means the firm promises a higher dividend yield for investors. This provides compensation to shareholders who are investing in a public company that is still state-owned.

“The government may direct the company to undertake projects or provide assistance for initiatives outside [Aramco’s] core business, which may not be consistent with the company’s immediate commercial objectives or profit maximization,” the firm said in a press release

Powell meets Trump

We have previously talked about the nature of political economy, and the close relationship economics holds with politics. Fed Chairman Jerome Powell met his longtime critic, President Trump today, to discuss the economy.

The President has been frequent in his criticism of the central bank and its chairman that has led up to the decade long bull-market run, calling Powell a “terrible communicator” and more.

“Everything was discussed including interest rates, negative interest, low inflation, easing, dollar strength & its effect on manufacturing, trade with China, E.U. & others, etc.,” said Mr. Trump.

The central bank suggested that Powell’s remarks in the meeting with the President were consistent with the optimism he expressed last week surrounding interest rates.

“He didn’t discuss his expectations for monetary policy, except to stress that the path of policy will depend entirely on incoming information that bears on the outlook for the economy,” the Fed said.

The central bank has cut interest rates thrice since July, most recently in October to a range between 1.5% to 1.75%. Last year, the Fed raised rates four times last year, causing the massive sell-off that spooked the markets late December ‘18 and early January ‘19.

“It’s very, very important that the public understands that we do our work on a nonpartisan, nonpolitical basis,” Mr Powell told lawmakers last week. “We’ll make mistakes. We’re human. But we will not make mistakes of character.”

Rising Insolvency in Canada

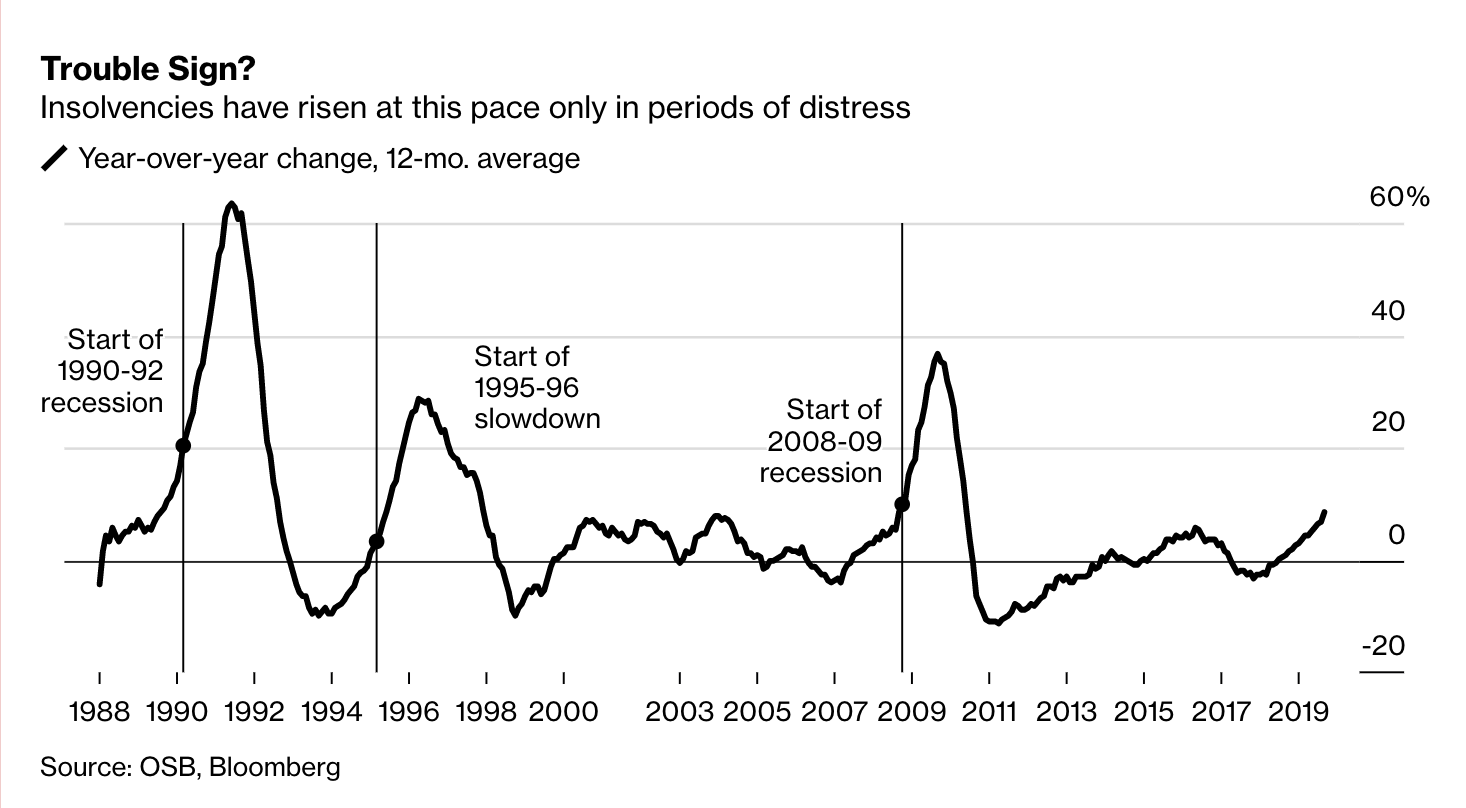

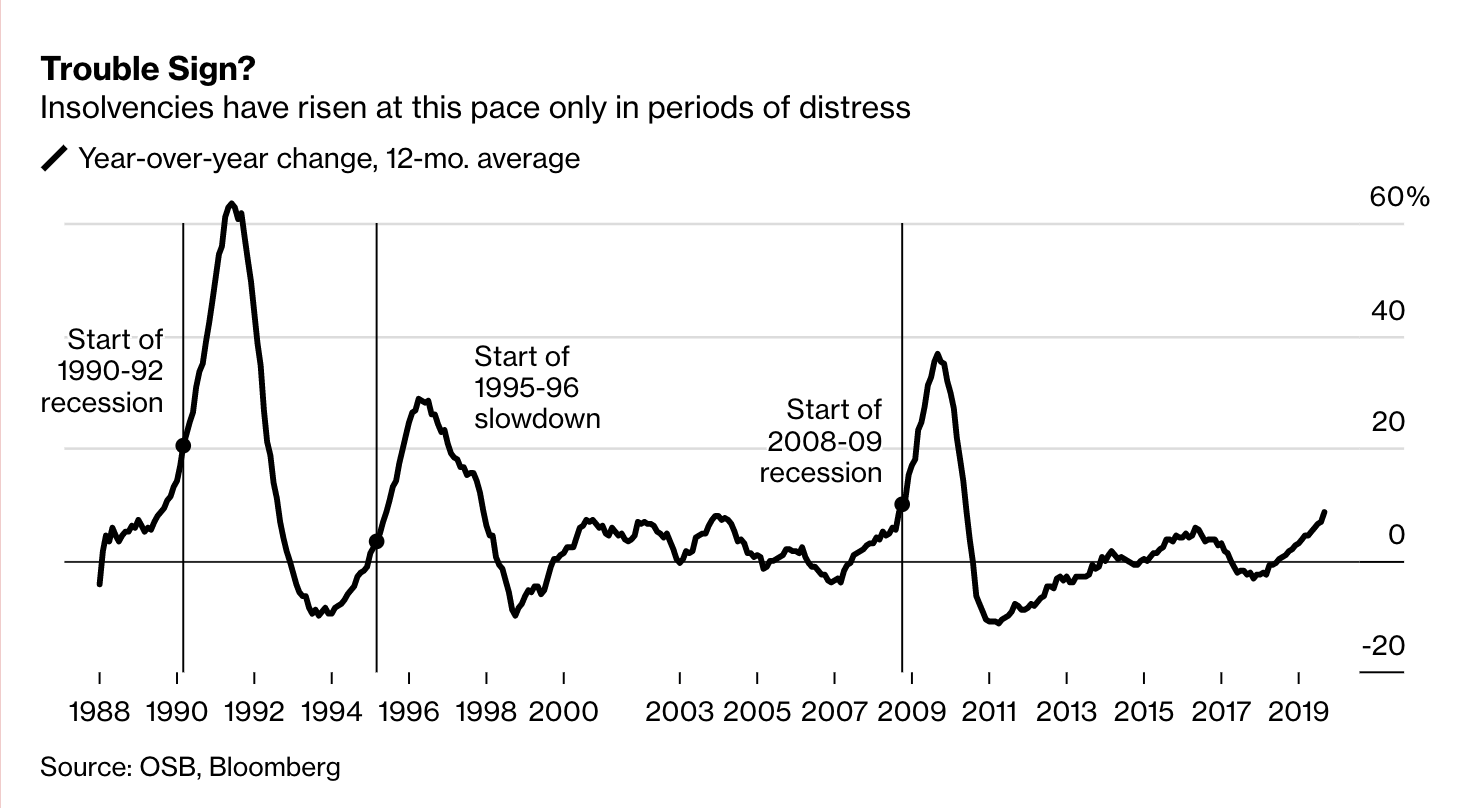

In a recent story by Bloomberg, statistics reveal that more and more individuals in Canada can’t seem to pay down their debt.

Around 11,935 individual consumers filed for insolvency in September, according to the Office of the Superintendent of Bankruptcy – a 19% increase from a year earlier and the biggest gain since 2009.

While the number is still small compared to the time around 2008, it is reflective of cracks in the system that point towards excessive borrowing and overleveraged markets. However, coupled with a strong labour market, rising wages and lower interest rates suggest that borrowers should have more rope than filing immediately for insolvency.

This points towards an important facet in the interpretation of statistics and data – there are always many stories to tell. No statistic exists in isolation and some set of facts that point toward cracks in the economy exists in conjunction with another that attest to its growth. Needless to say, it’s a complex time in the global economy where junk bonds, $20 trillion dollars worth of negative-yielding debt, and the highest record(s) for the Dow and the S&P coexist in the same time frame.

Here’s an interesting story about a hedge fund that lost almost all its money being bearish in a bull market, and is betting it all on an epic crash. Who knows what will happen? Maybe the Dow hits 30,000, or it all ends with a recession worse than 2008.

I’m not a fortune teller, but I will repeat the popular adage : be careful, take your winnings, and cut your losses.

Leave a Reply