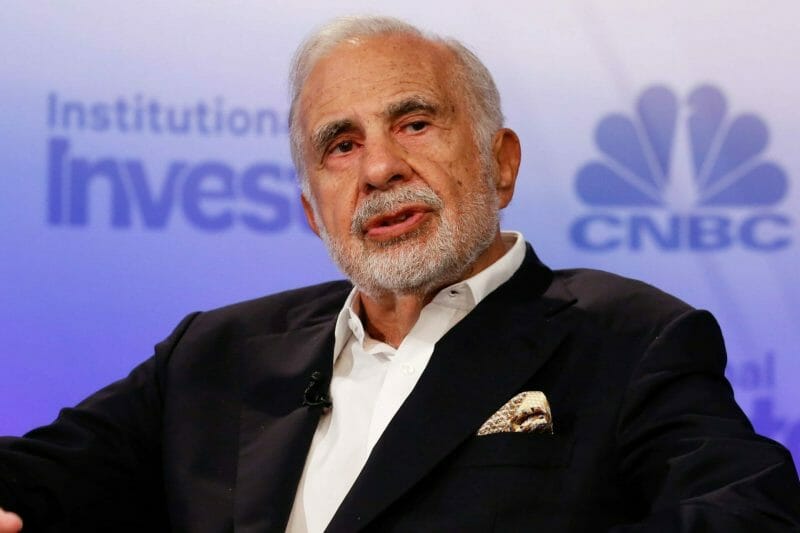

Carl Icahn’s Big Short

Billionaire Carl Icahn is betting against mall owners. He thinks they will be unable to service their debt. A lot many traders have made the same bet and lost millions of dollars, but it’s not something that’s stopping Icahn anytime soon.

Icahn stands to gain as much as $400 million if mall owners run into challenges servicing their debt. Despite suffering some early losses, the billionaire is sure of his short thesis.

You might ask how this trade is really happening, and what might be some of the ways you could get a piece of the action. Hey, I don’t have billions in chump change to make this trade, but if you do, this is how to do it:

The most simplified way of betting against malls would be to short (bet against) the companies that own the real estate asset. Or, you could just follow the money and do what Icahn is doing: trading on (against) the direction of an index called CMBX 6.

CMBX 6 tracks the value of 25 commercial mortgage-backed securities, and you might want to think of this as a basked of 25 such securities. This begs the question, how does a CMBS work?

Let’s begin by looking at a real estate asset – there is some piece of land on which you’ve planned to build a mall. Chances are, you took out a mortgage to finance the construction of a mall on that land. You would want to do this, since, in a low-interest-rate environment, it will be cheaper for you to pay down the debt than inject your existing capital to finish the project.

But, every mortgage needs an underwriter, which means there is probably some bank out there willing to give you money because it thinks that it can earn more from the interest payments on that loan than buying some government bonds.

Now, you might want to put together a bunch of these mortgages in a basked because it might be easier for traders to speculate on $2 billion dollars worth of debt as opposed to $200,000 dollars worth of debt. If you do so, you would create a collateralized debt obligation (a CDO) and not a CMBS.

BUT, if you create a new financial instrument, with some financial engineering, math, and economics, you could create an entirely new security to trade on. This security might have the loan, or the basket of loan, or maybe even a CDO as its collateral. THAT would be a CMBS, where the underlying asset is some related instrument of commercial mortgages.

This is obviously a complex financial instrument that can be structured in very many ways, but the creation of such an instrument essentially provides investors with possible solutions to managing their risk or identifying diverse investment options.

In this case, CMBX 6 is an index of credit-default swaps, insurance contracts that pay off if a company files for bankruptcy. Alternatively, as the probability that the company remains profitable decreases, the price of the insurance contracts increases.

CMBX 6 mimics the performance of these (credit default swaps) securities. If you are an investor and think the malls would default, you would buy these contracts and push the price down for the index. CMBX 6 has been up about 20% year to date, reflecting the growing optimism that investors have about shopping malls, or perhaps the holiday season.

However, malls have increasingly suffered vacancies and falling foot traffic as more and more shoppers are opting for online alternatives as opposed to shopping in a physical store. Icahn is betting that the index will drop, as malls are unable to service their debt. It doesn’t necessarily mean that malls will file for bankruptcy, but can simply mean that their bankruptcy insurance would become more expensive as they lose profitability over time.

US-China Trade War

Hahaha. This story is funny for a couple of reasons, but primarily because it highlights the very intertwined nature of politics with economics. The “phase-one” deal in the trade war is going to use the ‘near-deal’ as a benchmark, which fell apart six months ago.

Both countries are showing signs of softening under the weight of tariffs, and negotiators are under growing pressures to ink the deal and make things certain once and for all. However, the tit-for-tat nature of the tariff war has made it especially difficult for dealmakers to cooperate, for they now have to go over the details of each of the tariffs in place with a fine-toothed comb.

Presently, the countries are negotiating under some version of ‘good faith’, assuring each other that they will reduce tariffs proportionally. However, with the large scale and complex nature of the trade war, even the slightest of errors by policymakers will be enough for the President to go back on his word. The result: a market shaken in less than 280 characters.

What we’re talking about

-

The Winklevoss Twins Gemini Trust gets nifty with new NFT Gateway

-

How MAPS broke from the pack of profit-oriented psychedelic industry

-

LiteLink Technologies ($LLT.C): Using AI and blockchain tech to build the Uber of cargo

-

Sol Global Investments ($SOL.C) 40.7% ownership of Heavenly Rx could pay off big in the future

-

Varian Medical Systems ($VAR.NYSE) unveils new proton weapon in the war against cancer

Leave a Reply