Azincourt Energy (AAZ.V) treated shareholders with back to back news releases in recent sessions. This tiny U308 ExplorerCo is on the cusp of a fully funded $1.2M drilling campaign at its flagship East Preston Project located in the prolific Athabasca Basin of northern Saskatchewan.

The Basin

The Athabasca Basin is to uranium of what Keno Hills is to silver.

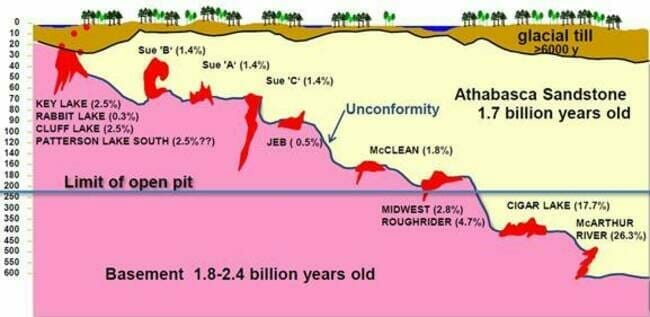

The Basin boasts THE largest, highest-grade U308 deposits on the planet (grades are up to 100 times the world average).

It’s also a top-shelf mining jurisdiction, removed from the geopolitical challenges many miners spar with every step along the development curve.

The Fraser Institute ranks Saskatchewan way up there on their list of top-shelf jurisdictions.

Decades of U308 production history validate the Basin’s lofty status.

The company

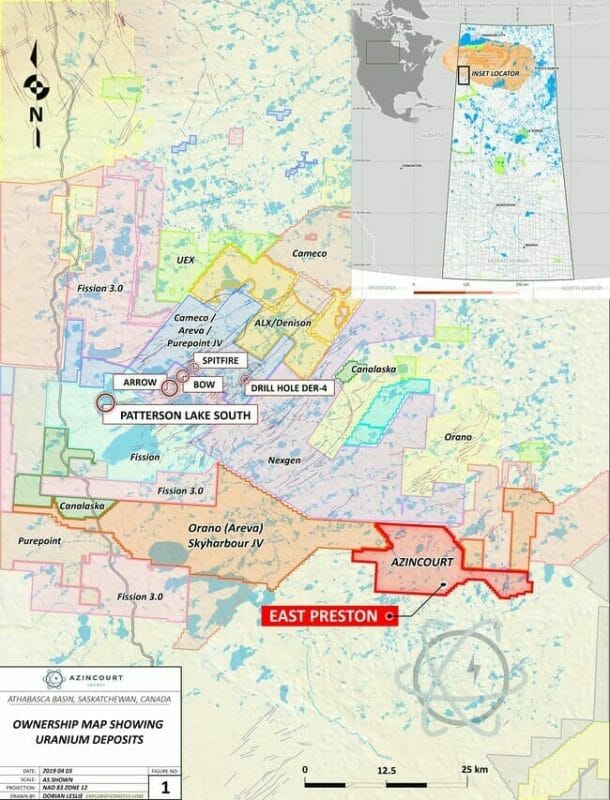

Azincourt is earning a 70% interest in East Preston—25,000+ hectares of geologically prospective Athabasca Basin terrain—a joint venture with Skyharbour Resources (SYH.V) and Clean Commodities Corp (CLE.V).

The news

The company has generated over two dozen A-List targets at East Preston, and a similar number of B-List candidates (the A-Listers boast overlapping geophysical and geochemical features).

Three prospective conductive, low magnetic signature corridors have been discovered on the property. The three distinct corridors have a total strike length of over 25 km, each with multiple EM conductor trends identified. Ground prospecting and sampling work completed to date has identified outcrop, soil, biogeochemical and radon anomalies, which are key pathfinder elements for unconformity uranium deposit discovery.

Drill targets for this upcoming program have been prioritized using the best science available—ground-based EM & gravity surveys, and property-wide helicopter-borne Versatile Time-Domain Electromagnetic/magnetic surveys.

Data received from a recent drilling program was also plugged into the target generation model.

This drilling program, an abbreviated 3-hole campaign cut short last winter, intersected the same rock, the same graphitic content, the same pathfinder elements as NexGen’s (NXE.T) Arrow deposit further to the north-west.

NXE has a current market cap north of $500M, in case you’re unfamiliar with its Arrow deposit.

The targets are basement-hosted unconformity related uranium deposits similar to NexGen’s Arrow deposit and Cameco’s Eagle Point mine. East Preston is near the southern edge of the western Athabasca Basin, where targets are in a near surface environment without Athabasca sandstone cover – therefore they are relatively shallow targets but can have great depth extent when discovered. The project ground is located along a parallel conductive trend between the PLS-Arrow trend and Cameco’s Centennial deposit (Virgin River-Dufferin Lake trend).

It’s important to understand that uranium deposits are often needles in a haystack, even in a prolific setting like the Athabasca Basin.

When exploring the region’s complex geology, holding back the drill rig until the geochem and geophysical signatures are all in alignment is often the key to discovery success.

On the subject of drilling, it can take dozens and dozens of holes to tag a U308 discovery. McArthur River, an Athabasca standout, took 210 pokes with the drill bit to crack.

The application of good science can go a long way towards divining a new discovery in the Basin, but you need someone with a particular set of skills to make sense of it… to piece it all together.

This is where Azincourt may have an advantage over other ExplorerCos in the Basin.

CEO Alex Klenman characterizes Ted O’Connor (P. Geo., M.Sc., B.Sc, and Director) as the company’s secret weapon.

Ted O’Connor P.Geo., M.Sc., B.Sc. is a Professional Geoscientist with over 25 years of experience, predominantly in the uranium exploration industry. He spent 19 years with Cameco, one of the world’s largest uranium producers. He was a Director of Cameco’s Corporate Development group where he was responsible for evaluating, directing and exploring for uranium deposits throughout North America, Australia, South America and Africa. Mr. O’Connor successfully led new project generation from early exploration through to discovery on multiple unconformity uranium projects. Mr. O’Connor was also responsible for opportunity evaluation, acquisition and for managing Cameco’s exploration partnerships aimed at growing and diversifying Cameco’s exploration portfolio in new jurisdictions and other uranium model types. Most recently Mr. O’Connor was CEO of Plateau Energy Metals (TSX.V: PLU), where he oversaw the development of the Macusani uranium and lithium deposits, and is now a Director and Technical Advisor to the company.

The targets

This 2,500 meter drill program will focus on prospective targets in the Five Island Lakes area.

The majority of the proposed holes (up to 15 diamond drill holes) “will test multiple subparallel EM conductors (A-zone and B-zone conductor corridors), in an area of marked structural disruption.”

The Swoosh zone—”a 7+ kilometer long east-west structural lineament with strongly anomalous, spatially consistent geochemical anomalies (lake sediments, radon, soil) and coincident magnetic and gravity geophysical anomalies“—is also likely to see a probe with the drill bit during this campaign.

CEO Klenman:

East Preston is a large and highly prospective uranium exploration project with a comprehensive inventory of compelling drill targets, and we’re eager to begin testing the target zones. Earlier this year a number of factors prevented us from drilling as much as we had planned. The timing of funding, a late start, and the early onset of warmer weather cut short our efforts. However, this upcoming campaign has the benefit of not only adequate funding already in place, but also, we’re significantly ahead of the permitting and preparation process than we were last time. We will test a number of priority targets this time, so we’re excited to get going.

The company will begin pushing a road into the main exploration camp, and then out to the various drilling sites within the next two weeks.

Drill permits are expected shortly—a drill rig will be mobilized to the project in January.

Cue the drum roll…

The potential

This is a company with real discovery potential.

This aggressive $1.2M drilling campaign is fully funded, a detail the market chooses to ignore.

With good people, good science, and good institutional support backstopping this drilling campaign, these sub-nickel shares may represent a low-risk entry point.

The upside, should the drill bit meet the right rock? It depends on a number of variables, but if the grades and widths are there… it could be a Roy Hobbs moment.

We stand to watch.

END

Greg Nolan

Full disclosure: Azincourt is an Equity Guru marketing client.

Leave a Reply