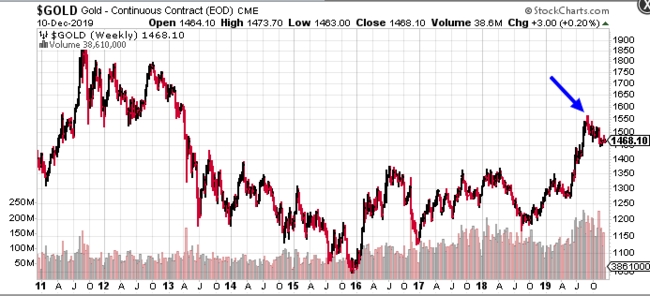

Gold appears to be setting up for a push higher, perhaps a sustainable push as we enter 2020.

From a lowly $1275 in late May, the metal screamed higher topping out at roughly $1570.00 in early September (blue arrow).

That was an impressive run.

$1570.00 marked a six-year high.

We registered our caution in these pages back on September 10th, suggesting that “a correction back to the “$1,400 to $1450 level” might be in the offing.

Gold tested $1450.00 twice last month.

Taking a look at gold stocks, the GDX—an ETF representing the price and yield performance of the NYSE Arca Gold Miners Index—outperformed the metal to the upside and has been consolidating its gains in a manner enormously satisfying to those with a technical bent.

Since topping out in early September, the GDX has formed a nice sideways channel. Note how the $26.00 level has been tested several times without giving way (above chart).

If the GDX breaks below $26.00 in the coming days/weeks, solid support should be found around the $25.00 level (chart below).

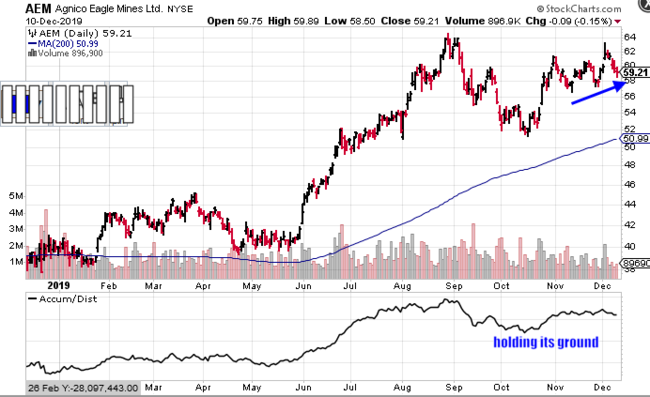

The price chart of my favorite mine builder, Aginco Eagle (AEM.T), is a good illustration of the underlying strength in the gold sector.

The stock is up over 40% year-to-date.

Note the positive slope on AEM’s 200 SMA (blue line) and the altitude of the Accumulation/Distribution line (bottom indicator).

The chart also shows a series of higher lows over the past month-plus (blue arrow), a stair-step price pattern that may augur good things going forward.

The fundamentals

From a fundamental point of view, the backdrop for the metal couldn’t be more favorable: plummeting bond yields, negative interest rates, pervasive geopolitical risk, equity valuations stretched waaaay too far, are all gold friendly.

It’s difficult to imagine a scenario where gold won’t outperform most other asset classes in 2020.

In a recent offering, Equity Guru’s Lukas Kane echoed sentiment out of the Goldman Sachs camp:

We could argue about the collective intelligence of the world’s central bankers, but whatever your opinion, it’s worth noting, they are gold buyers.

“Gold prices will climb to $1,600 per ounce over the next year”, states Goldman Sachs, noting that “central banks are consuming a fifth of the global gold supply“.

“Demand from central banks for gold is biggest since the Nixon era,” stated Goldman, “We like gold better than bonds because the bonds won’t reflect that de-dollarization.”

According to the World Gold Council, Central banks added 156 tons of gold to their reserves in Q3, 2019

The problem with paper

Fact: fiat (paper) money can be rammed through a printing press whenever a central bank (CB) requires liquidity. Of course, a CB doesn’t have to print what it needs—it’s mostly a digital sleight of hand this day n age.

Fact: Gold cannot be rammed through a printing press. It cannot be summoned out of thin air. It is the only currency—yep, I said currency—that cannot be manipulated like fiat paper.

Gold’s role as a currency began in 643 B.C., in Lydia (present-day Turkey).

Around 560 B.C., the Lydian’s stumbled upon a way to separate gold from other metals, creating the first solid gold coin.

Jumping forward a couple of Millenium, in 1861, the first U.S. paper currency rolled off the printing press.

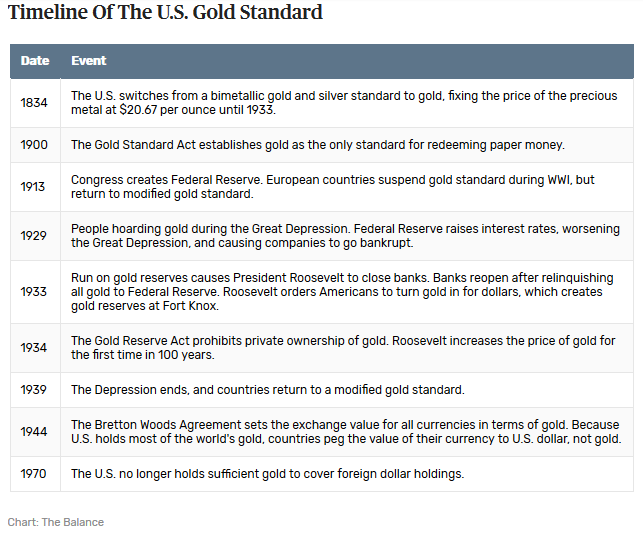

On March 14, 1900, President McKinley signed the Gold Standard Act, establishing a link between gold and every dollar put into circulation. The price of gold was set at $20.67 an ounce. Every dollar bill could be redeemed for 25.8 grains of gold (there are 480 grains in an ounce – you do the math!).

Of course, the number of dollars a treasury secretary could print was entirely dependant on the amount of gold held in his vault. That was a problem, particularly when warmongers entered the fray.

As you probably know, there was a steady unraveling of responsible central bank stewardship over the following decades as we evolved economically:

There wasn’t enough gold in the vault to maintain a proper link between the metal and the number of dollars in circulation.

The Gold Standard was dropped.

U.S. dollar printing presses have been lined up like Bofors guns ever since.

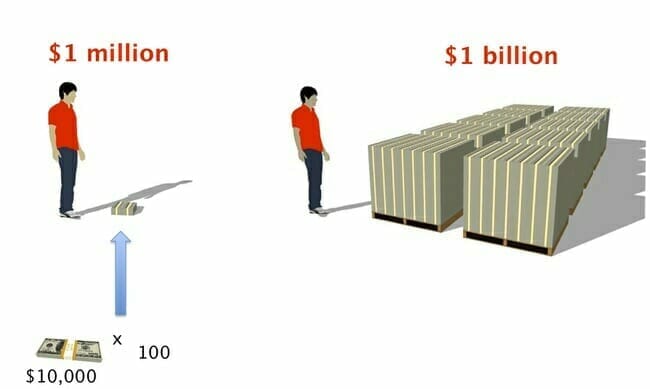

Flash forward a few decades, as of December 2, 2019, the official debt of the United States government sits at $23.1 trillion – $23,104,975,299,129.00 to be precise.

$23.1 TRILLION dollars!

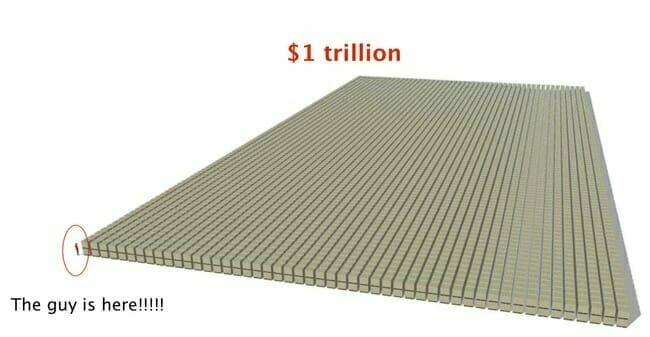

You wanna see what one trillion looks like?

We’ll start with one billion…

The next image illustrates the horror that is the current U.S debt fiasco. And note that this image represents only one-23rd of the amount owed…

Crikey!

This is why we need to take a serious look at gold.

This is why we need to think seriously about owning gold.

Lukas Kane again:

No act of Congress can magically make a tonne of gold appear on the lawn of the White House.

The peak of discovery and production

We’ve examined the concept of Peak Gold in recent months. It’s a compelling theory.

‘We’re right at peak gold’: All major deposits have been discovered, declares Goldcorp chairman

Ian Telfer, one of the better authorities on the subject:

Are we bad at finding it? Or have we found it all? My answer is we found it all.

If Peak Gold is here—if production is in steady decline and new discoveries are unable to pick up the slack—it stands to reason that upward price pressure will intensify.

If it’s really here, it stands to reason that some of the smaller companies we follow—those developing economic deposits—will also experience positive price pressure.

When you couple Peak Gold with lean project pipelines—Producers having dramatically scaled-back exploration spending due to years of tight budgets and challenging market conditions—you have a potentially explosive situation for the juniors with economic deposits on their books.

I’m very gold bullish over here, in case you haven’t guessed. I’m particularly bullish on asset-rich ExplorerCos as they are in all likelihood, sitting ducks.

If you’re new to the junior exploration arena, takeover offers almost always come with fat premiums.

What’s more, if you believe you’re positioned in a company destined to get taken out by a resource-hungry producer, you can sit back and wait for the takeover offer. This is what’s called an end game—being right – sitting tight—allowing the acquirer to set your exit price.

Final thought

One can’t rule out further weakness in gold, perhaps one last flush, as we’re clearly in uncharted waters, economically speaking. But buying on weakness, especially between now and year-end, could pay off handsomely in the weeks and months to come.

We stand to watch.

END

—Greg Nolan

Leave a Reply