Imagine this, if you will: It’s thousands, maybe tens of thousands of years ago. In a swamp in the Pocitos salar basin in Argentina, bubbles rise to the surface. Hot bubbles. Over the millenia to follow, those bubbles would give way to land, then a mountain, then a mountain spewing forth raging hot magma.

Back to now. The magma is a distant memory, and the water has gone, leaving behind an expansive salt flat, but as that volcano pushed through layers of rock, digging its way to the surface, the broken rock it pushed through trapped what would eventually become lithium, holding it among layer after layer of the earth’s crust, broken and compressed and now forming faults in a region where nothing grows.

Geologists love this stuff, because out of chaos comes opportunity. Out of different chemicals and rocks and metals and liquids and pressures come interesting and valuable stuff.

On the north side of this volcano, that valuable stuff has been proven out over several years of expensive work performed by Enirgi Group.

Here’s what they have to say about what they hold:

The Salar core consists predominantly of a thick body of halite (NaCl), well developed and forming a hard cracked and upheaved salt crust (30 to 40 centimeters high), typical of a dry lake (Salar). The phreatic brine level currently lies some 40 to 50 centimeters below the salt crust.

The Salar del Rincón is a very large, mature salar and displays substantial effective porosity and hydraulic continuity within the Upper Fractured Halite resource unit. The Black Sands resource unit also displays significant effective porosity with a lesser degree of verified hydraulic continuity. This Upper Fractured Halite resource unit accommodates relatively high brine extraction rates.

The Salar is situated in close proximity to key infrastructure, including existing natural gas pipeline, electricity, rail and road transport that is required to build and support a large, scalable lithium processing facility. Water can be sourced from tenements owned by Enirgi Group, which is sufficient to sustain long term processing rates.

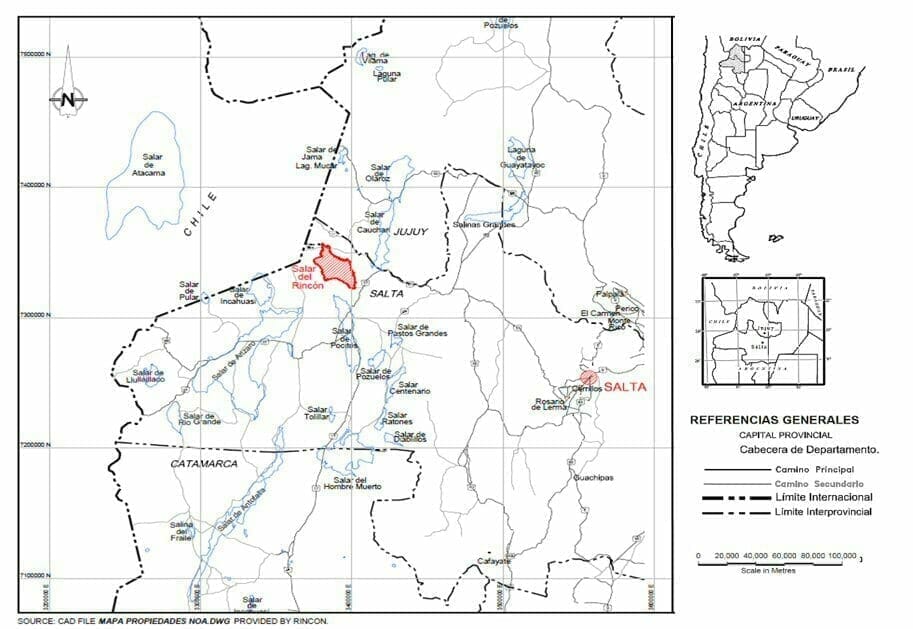

Here’s a map showing where Enirgi’s Rincon project sits.

Now here’s what the expensive, expansive work done by Enirgi showed:

| Mineral Reserve and Resource Estimates | ||

| Probable Reserves | 1.2 million tonnes Lithium Carbonate Equivalent (“LCE”) | |

| Measured and Indicated Resources | 3.5 million tonnes LCE | |

| Inferred Resources | 4.8 million tonnes LCE | |

| Capital Expenditure | ||

| Initial net capital expenditure | $720.1 million (including 8.62% contingency) | |

| Project Economics | ||

| Ungeared After-tax 9% NPV | $1.36 billion | |

| Ungeared After-tax IRR | 30.80% | |

| Payback period | 4.13 years from start of commercial production | |

| Mine Production | ||

| Life of Mine | 24.5 years | |

| Average annual production | 50,000 tonnes LCE per annum | |

| Total cash operating cost | $2,070 per tonne LCE for life of mine | |

So, this is a big deal. It’s a legit, huge, quarter century project that will make billions for its owners, in all likelihood.

So how does this tie into Southern Lithium (SNL.V)?

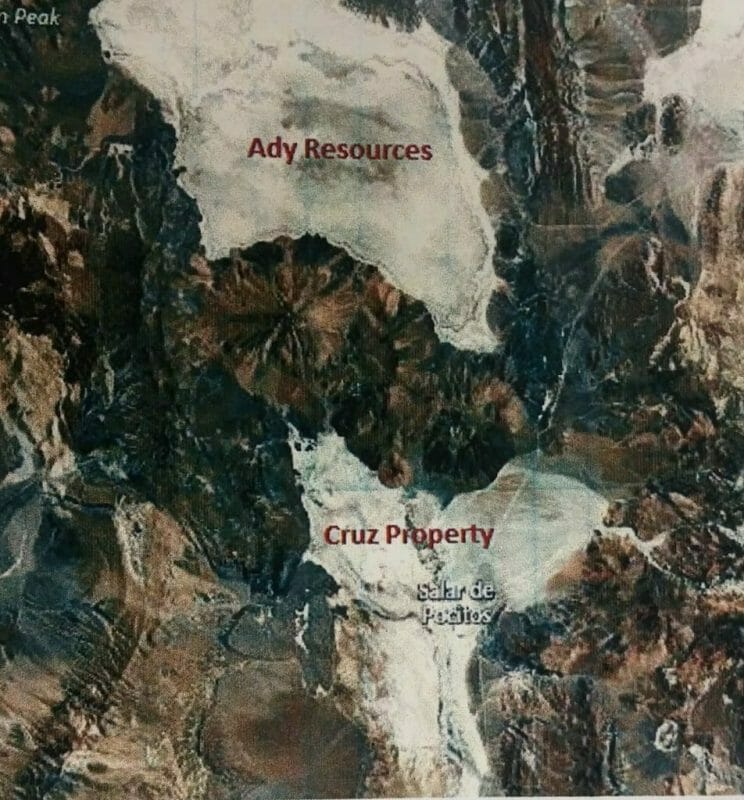

SNL’s Cruz property is ‘the other side of the volcano’. Literally.

You can see the volcano in the photo above, pushing up between the two properties like a hemorrhoid of opportunity. Ady owns the crack. SNL owns the taint.

The likelihood that there’s similar sort of resources to be had on both sides of the mountain is high, in my opinion. Only one drill has been stuck in the ground on SNL’s lithium taint, a single drill hole performed by the government in the 1970’s that, combined with surface sampling from the occasional passing geo, found lithium values as high as 400 mg/L.

SNL execs plan to stick two new holes in the property to support the conventional wisdom that, since the volcano caused the lithium, it’ll show on both sides of the mountain.

If it does, in anything close to what’s seen on the north side, this is a monster. It’ll be Taintzilla.

Now, let’s not put the cart before the horse – right now, the company only has an option to buy 80% of the project. To get there, they have to go definitive on their agreement (which they’ve done), and then:

- Make cash payments totaling $200,000

- Issue Millennial Lithium $100,000 worth of common shares in SNL

Christ, I think I could look under the couch cushions in SNL’s offices and find enough coin to complete that deal.

There’s more, but it’s not a lot more onerous and plays out over time:

- Raise $500k and use it to explore (doing that right now)

- Pay $1 million by October of next year

- Pay $1 million by October the year after

- Get a bankable feasibility study done in the next 3.5 years

Millennial is slated to be the operator of the property, which is fine by the Southern Lithium crew. They rattle off names of connected Millennial folks and substantial geologists tied up with their deal, and my eyes cross. Sure, fine.

But all of that is the amuse bouche. The main course comes when drills enter soil.

Argentina is a big producer of lithium right now, with two-thirds of the world’s supply coming out of that country, Bolivia and Chile (the so-called lithium triangle), but the big players aren’t backward in coming forward about their thinking that Argentina has most of the potential going forward. With infrastructure, political stability, and straight up rock-based potential, companies like Lithium-X have already set pegs down in the country, and in the same Salta Province (salta translating as ‘salt flats’) where SNL’s deal is found.

But the only actual producer in the province today? That’s north of the volcano.

SNL has another property under its wing, over in the Clayton Valley in Nevada, and that would have been enough, in the previous lithium craze of early 2016, to have warranted a many millions valuation above the $9m market cap where SNL is today.

The company share price has moved nicely since the thing went public, running steadily from $0.23 to $0.34 in the last month, with 27m shares out.

Right now, they’re doing a financing at $0.25, which is a nice discount to the market, with a $0.35 warrant for the next 18 months. The share price proper is only one cent below the warrant, so that’s a heck of a deal even if you thought the company was priced appropriately today.

I don’t. If they stick anything close to good holes on that Argentinian volcano side, you’ll be making use of those warrants.

To get in on the deal, contact ir@southernlithium.com.

— Chris Parry

FULL DISCLOSURE: I don’t have any commercial connection to Southern Lithium at the time of writing, but may take part in that financing going forward.

Leave a Reply