*originally published 01-16-23

Medexus Pharmaceuticals (MDP.TO) is a specialty pharma company. They are not biotech. There is no research and development here. Medexus is all about sales and marketing, bringing over drugs that are already licensed in Western Europe and then bringing them to North America. A very smart business model which has seen Medexus carve a niche, and report record breaking earnings.

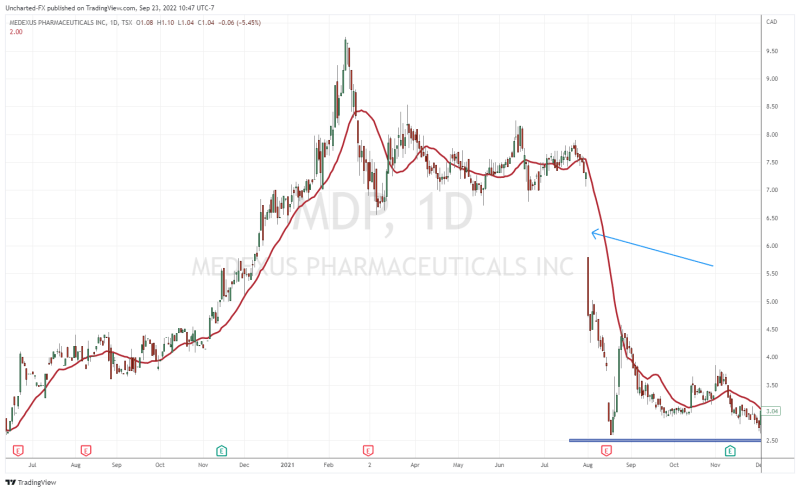

When you look at the stock chart going back about two years, you are probably thinking, “wait Vishal, the stock is trading like a biotech stock with those drops!”. A major press release on September 19th 2022 did see the stock breakdown into printing new all time record lows, with a major -32.99% drop on that said day.

What was the news that saw markets reacting negatively? It had to do with an update on the Treosulfan NDA resubmission. For a second time, the FDA has issued a second notice of incomplete response regarding Medac’s application resubmission for Treosulfan.

To refresh people’s memories, the Treosulfan and the FDA saga began back in August 2021. Medexus was trading above $7.00 when news came out that the FDA asked for further details on the Treosulfan submission. As you can see from the chart, the news saw the stock gap down and plunge, and really has been weighing on the stock as it headed lower.

History may not repeat, but it rhymes.

The Treosulfan news caused another major breakdown as mentioned earlier. But things are shifting on the charts.

We have regained what was once resistance and is now support at $1.70. As long as the stock remains above this zone, we can continue this uptrend.

Back in September 2022, I gave a resistance target of $2.50 from a technical standpoint. This is exactly where the stock saw rejection in its recent move. A recent move backed by fundamentals which we will cover shortly.

For investors, the stock is now well above its support level and awaits a breakout. $2.50 remains the resistance that needs to break for more upside momentum. However, not the downtrend line I have drawn out, and is being respected at time of writing. If Medexus can confirm a close above this trendline, we would have a breakout and strong momentum to take us to the $2.50 zone.

But perhaps we have a fundamental news event which could give us the catalyst for this breakout…

Yes, the Treosulfan news caused a major sell off, but investors need to remember that this is a real company with a strong base business. Medexus Pharmaceuticals is not just a Treosulfan stock, and the market seems to be overreacting to timelines being pushed back. Treosulfan should just be seen as a bonus.

Regarding the Treosulfan drama, it should be noted that Medexus is not playing a part in sending the documents over to the FDA. German company Medac, who holds the commercialization rights to Treosulfan, are the ones in contact with the FDA. Remember, the FDA requests further supporting information to complete Medac’s resubmission but does not require submission of new clinical data. It isn’t like the FDA is going to reject this drug. Treosulfan is approved everywhere else it is sold. The FDA would not get into a back and forth like this if Treosulfan was going to be rejected.

Getting back to the core business. Let’s first take a look at Q2 2023 earnings. Q2 2023 earnings turned out to be the strongest fiscal quarter in company history.

Here are the financial highlights from the strongest quarter in company history. All amounts are in US dollars:

- Record total revenue of $27.7 million, a year-over-year increase of 55%, and a quarter-over-quarter increase of 20%. This represents the strongest fiscal quarter in Medexus’s history. Increased net sales of IXINITY and Rupall and recognition of 100% of revenue from Gleolan sales in the United States starting September 2022 were strong contributors to this substantial year-over-year improvement.

- Adjusted EBITDA* of $4.2 million, a year-over-year improvement of $6.3 million and a quarter-over-quarter increase of $2.3 million. The primary drivers for this substantial year-over-year improvement were increases in revenues, a reduction in research & development costs, and an increase in gross margin.

- Operating profit of $1.9 million, a year-over-year improvement of $6.9 million.

- Net loss of $(2.7) million, a year-over-year change of $(12.8) million, primarily due to unrealized gains on the change in fair value of the embedded derivatives in Medexus’s convertible debentures in the prior year’s net profit.

- Adjusted Net Loss*, which adjusts for the unrealized gains and losses included in net profit (loss), of $2.8 million, a year-over-year improvement of $3.3 million.

- Cash and cash equivalents of $9.6 million (with $10.1 million of total available liquidity) at end of fiscal Q2 2023.

Ken d’Entremont, Chief Executive Officer of Medexus, commented, “This was an excellent quarter for Medexus, demonstrating both the robustness of our product portfolio and our initiatives to improve margins and drive sales. Preliminary results of our IXINITY manufacturing initiative have started to produce improved yields, which contributed to this quarter’s improvements in our gross margins. During the quarter, we delivered organic growth across all our leading prescription products, and completed the transition to full commercial responsibility for Gleolan in the U.S. We are excited to see Gleolan’s contribution over the coming quarters as we execute on our commercial plan, which includes improved sales and marketing initiatives.”

Gleolan, under the Medexus-labelled product, began shipping to customers across the US in August 2022. September 2022 was the first full month in which Medexus recognized 100% of Gleolan net sales. The company is in a position to successfully execute its commercial plan for the drug, including improved sales and marketing initiatives. Medexus expects strong performance from sales of Gleolan over the coming months.

Medexus also implemented a restructuring plan in October 2022 to focus resources on existing products.

Q3 2023 earnings are coming up, and this could be the catalyst for the stock to breakout. Q2 2023 earnings did see the stock move big and recover what is now support at $1.80.

Just last week, Medexus put out preliminary estimates of the company’s revenue results for the fiscal quarter ended December 31, 2022 (the company’s fiscal Q3 2023). And guess what? Another record breaking quarter is expected.

Medexus expects to deliver total revenue between $28.5 million and $29.0 million in fiscal Q3 2023. This will represent another record quarter of revenue for Medexus, and a year-over-year increase of at least 34% and a quarter-over-quarter increase of at least 3%.

An increase in net sales across Medexus’ portfolio is one of the primary drivers for improved revenue:

- IXINITY: Positive trend in sales, reflecting new patient conversions on top of a stable, existing base of patients.

- Rasuvo: Continued strong performance and maintenance of the product’s leading position in the moderately-growing US branded methotrexate market with a limited sales force allocation.

- Rupall: Continued strong demand exhibiting typical seasonality as compared to fiscal Q2 2023, reflecting successful execution of the company’s sales and marketing initiatives and sustaining the product’s strong performance over the five years since launch.

- Gleolan: Continued positive trend in US sales, positioning Medexus to successfully execute its post-transition commercial plan including new sales and marketing initiatives.

In the same press release, Medexus provided updates on Treosulfan and current business strategy.

Following up on Medexus’ last update on Treosulfan in November 2022, Medac, the party responsible for regulatory matters for Treosulfan, has continued to engage with the US Food and Drug Administration (FDA) when it comes to Medac’s resubmission of its new drug application for Treosulfan. After the FDA’s second notice of incomplete response delivered to Medac in September 2022, Medac is primarily focused on establishing the most appropriate approach to addressing the remaining items noted.

Medexus expects it would take Medac up to a year or more to collect and submit the information requested by the FDA. The FDA would then evaluate the completeness of the available information submitted and Medac’s response and, if considered to be complete, then proceed to review Medac’s NDA resubmission.

Medexus believes that treosulfan would make a substantial difference for US patients and therefore continues to urge Medac to take the steps necessary to respond to the FDA’s requests in a timely and complete fashion and fulfill Medac’s obligations under the terms of the Treosulfan license agreement to pursue all commercially viable paths to completing the NDA resubmission.

In the near term, Medexus continues to focus on commercializing its current product portfolio and seeking out additional product opportunities while growing its core business and delivering strong financial results. Which management is doing given past earnings and recent preliminary results.

The prudent investor will see that Medexus’ core business is growing and Treosulfan going forward will be the added cherry on top.

It should also be noted that many investment firms have a buy rating for the stock, including Research Capital with a price target for the stock of $5.50.

Full Disclosure: Medexus Pharmaceuticals is an Equity.Guru marketing client.

Leave a Reply