Either the mining market has turned around, or there’s been some kind of mistake, because Equity.Guru boss Chris Parry just assigned me to cover a company that has earnings.

Concept: The Pick and Shovel Deal

Skip ahead if you’ve heard this one.

In the great San Francisco gold rush of 1849, lots of people got rich making gold discoveries in the California Sierra, and even more people went broke trying. As it all unfolded, comparably respectable fortunes were made by people selling hardware and supplies to the miners and prospectors.

Today, the deposits are long gone; the wealth that they generated has become part of large gold companies like Newmont (NEM:NYSE) and Goldcorp (G.T). The Levi Strauss company, founded to sell the first blue jeans to 49ers, is still around and still based in San Francisco. A private company, they were number 547 in the 2016 Fortune 1000.

Energold (EGD.V) is a security that offers investors exposure to the pick and shovel industry of the modern version of the San Francisco gold rush.

At least, that’s how EGD was first pitched to me in the heady days of the 2011 gold market. Back then, we were all sure that gold would smash through $2000/oz and never look back. In that environment, “mining” companies spread across Vancouver like a fungal infection. Financing was easy to come by. Toronto pension funds and boutique New York and London hedge funds were all acting like retail yo-yos – grabbing high-leverage discovery stocks for fear of missing out.

The whole ocean swelled and the whole food chain rose with it. Mid-major barracudas doing infill drilling on deposits, whales like Goldcorp and Barrick (ABX.T)… money was easy to come by and everyone needed drilling, so rigs came at a premium and Energold had all the cards.

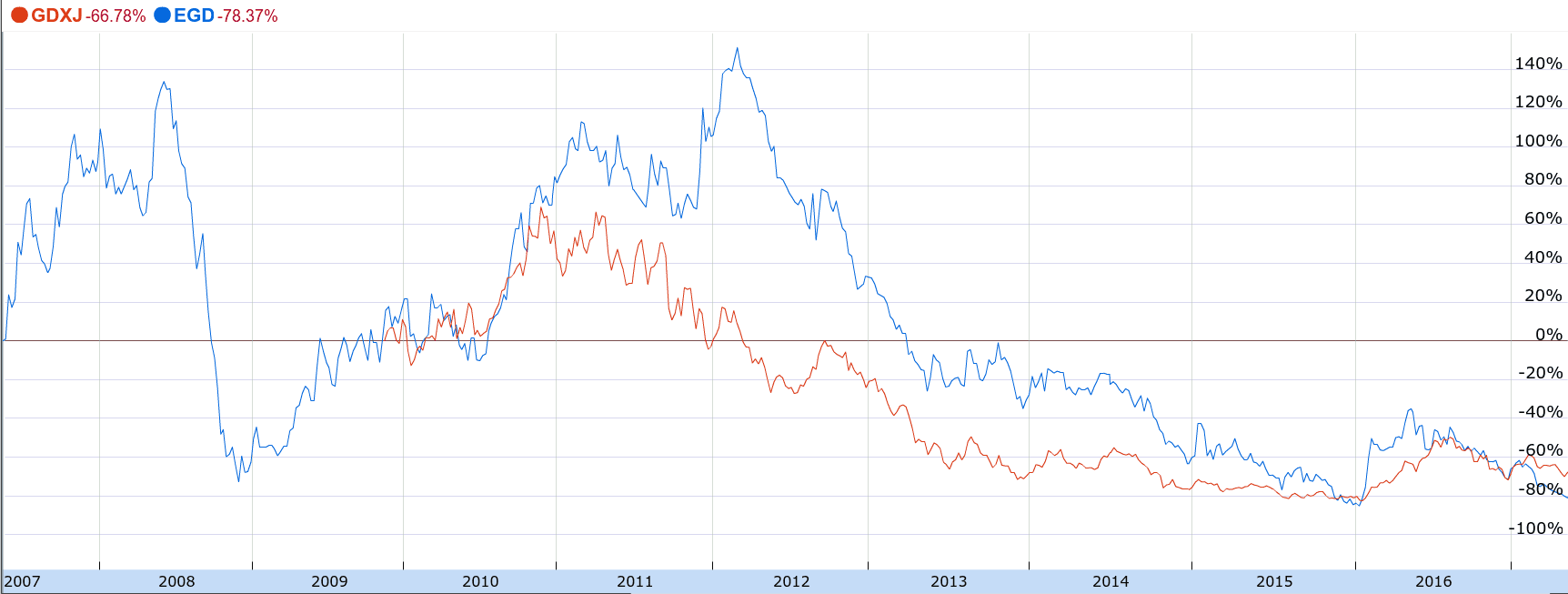

The stock was trading in the $4 – $5 range, a ~$200M market cap.

But the market gods giveth and the market gods taketh away. The tide went out on the junior mining market all at once as the gold price came back to earth. With gold in a bear trend, aggressive exploration no longer carried the potential to justify the bet. The hedge funds and pension funds closed out their trades and acted like they never happened. Funding dried up, and so did wait times for rigs and the premiums that come with them. It wouldn’t surprise me to learn that the EGDs of the world got stiffed by companies who folded while they were on the job.

The 2012-2017 market was tough on Energold, but they soldiered on. They diversified into geothermal, water and geotechnical drilling. They bought a drill manufacturing company in the UK called Dando Drilling International. I haven’t asked why, but it strikes me as a good hedge.

Energold can make clients of both companies who prefer to own rigs and companies who prefer to hire them. Likely, Dando allows them to make practical use of a wealth of accumulated institutional knowledge. They made a push into horizontal drilling in the oil and gas sector, but mining remains the Vancouver company’s bread and butter, so the sector’s troubles follow it.

EGD got beat up. They’ve operated at a loss since 2012 and got pounded progressively harder on the markets as time went on. But this is still a company with revenue, so who cares about its share capital?

There are only 54 million shares out since presently, about 10 million shares more than there were at the 2012 peak (out-of-the-money options and warrants would take it up to 63M shares). They financed with a convertible debtenture in 2014, and paying that off continues to sandbag their gross margins. As an investor, an effective 14% vig on $14 mil in debt doesn’t really bother me in a company with ongoing revenue of $60-80M a year, though it’s sure making it tough for EGD to find the black ink.

But Energold wasn’t built to be an income investment. It was built to ride an epic metals and minerals wave, and that wave might come on this swell.

EGD has a $23M market cap today; well below its $69M book value. They’re re-financing here with another $20M debenture, and $4M worth of warrants. That will bring in some dough and re-finance the existing debenture.

This deal is run by the type of Vancouver mining guys that have staying power and believe in their deal. It’s a good bet that management and related parties are still holding the $3M worth of the last convertible round, which was supposed to convert at $3, because they plan to roll $2.5M of it over into this current offering, which converts at the deb holders’ option, starting when EGD trades at $0.85.

The company owns just shy of 10% of Impact Silver (IPT.V), with whom they share an address. Impact is a neat, clean Mexican precious metals producer that we may be covering soon.

I get the sense that Energold is run by True Believers. They’ve seen resource markets go on unstoppable tears, so they built a company that can’t help but get caught up in that kind of updraft. They’ve maintained it and diversified during times of boring calm, keeping it afloat and moving along respectably, ready to get carried when the ocean moves.

This past Monday, Twitch Finance denizen TorpedoTrading pointed out a non-confirmation between gold and the US Dollar. They’re running in the same direction, and that barely ever happens, so something is bound to break. Since then, increased political turmoil in the US has forced traders to consider that that non-confirmation may represent a reversal, when viewed through a news lens. Spot gold jumped to $1260 today, continuing a bull trend that started in December.

Nobody knows when we’ll see the beginning of the next great resource boom, but Energold is probably a great place to be when it comes.

Position disclosure: I don’t own any Energold, but I think that my inner gold bug might have talked me into taking a position while I wrote this.

— Braden Maccke

Leave a Reply