On June 19, 2017 Potash Ridge (PRK.V) announced an off-take agreement with an established North American fertilizer supplier for 10,000 tonnes per year of Sulfate of potash (SOP). That takes care of 25% of PRK’s annual production from its Valleyfield Project in Quebec.

Valleyfield will take the primary raw material Muriate of Potash (MOP) – and use the proven Mannheim Process to produce high quality SOP and a valuable by-product, hydrochloric acid.

The Mannheim process involves a reaction of potassium chloride with sulfuric acid at high temperatures. The raw materials are fed into a 600ºC furnace. SOP is produced in a 2-step reaction.

It is energy intensive – but it’s like taking a wheelbarrow of gravel and converting it into Chinese jade.

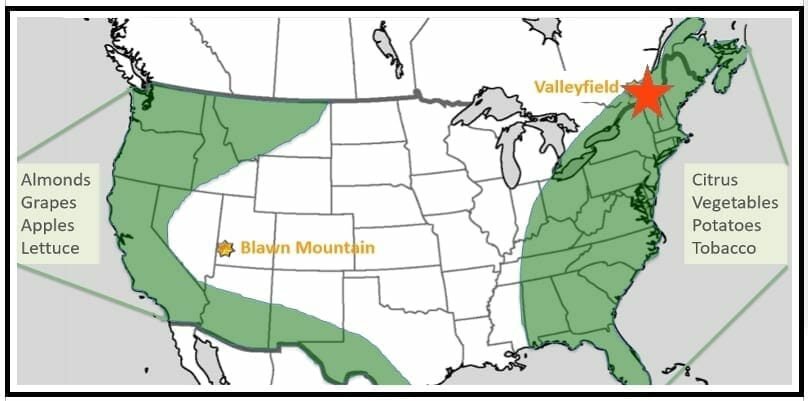

SOP is premium fertilizer with annual demand of 6 million tonnes per year. It is used to boost production of crops including tomatoes, spinach, carrots, cucumber, tobacco, strawberries, avocados etc.

SOP is about 300% more expensive than its more plentiful cousin, MOP.

“The distribution agreement secures a meaningful volume of our production with an established industry partner,” stated Jay Hussey, President of Valleyfield Fertilizer (a wholly-owned subsidiary of Potash Ridge).

PRK is aiming to become the first Mannheim SOP producer in North America. Valleyfield project highlights include:

- Strong government support

- Located in industrial area near Montreal, Quebec

- Low capex (CAD $50 million)

- Facility build time of 9-12 months

- 40,000 tonnes per year

- Very easy to expand production

- Commercial arrangements create barriers to entry

- Technology partner with 20 years experience

The salient point here is that Valleyfield will be easy to finance. Compared to the cost of building a traditional mine – a capex (capital cost) of $50 million is dirt cheap.

It’s like building a house for $120,000 – or buying a coffee for 25 cents.

The capex of the Valleyfield facility is so low it evokes nostalgia.

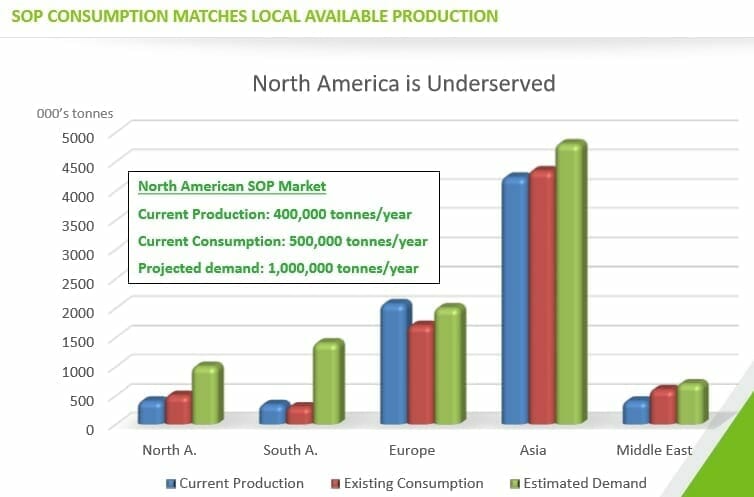

But good construction economics only work if there is strong and reliable demand for the product.

This is why the off-take agreement is important.

In an environment of excess supply or falling prices, there is no incentive for a buyer to enter an off-take agreement. The purchaser can wait for the commodity to get cheaper.

Remember, SOP is a boutique product. 90% of the global market is dominated by MOP which has a high chloride content that can damage fruit and vegetables crops.

There’s a shit-tonne of MOP around, which is why you don’t see a lot of MOP off-take agreements being signed.

An off-take agreement signals buyer’s anxiety about an impending supply squeeze.

At Valleyfield, Potash Ridge intends to build an 40,000 tonne per year SOP plant. The plant will be located about 50 kilometres west of Montreal.

The raw materials can be easily delivered from Saskatchewan to the production facility next to a railway serviced by CN, CP and CSX. The finished SOP product can be shipped via the St. Lawrence River which is on the doorstep of the production facility.

Potash Ridge has engaged Novopro Projects to guide the project to full production. Novopro is a Canadian project developer servicing the mineral and metallurgical industries. Novopro has a track record of success in MOP and SOP processing and HCL circuits.

PRK’s Quebec-based SOP facility will be the first in North America to utilize the Mannheim Process.

Other recent commercial successes for Valleyfield include: 1. Signing a 10-year hydrochloric acid off-take and funding agreement 2. Signing a 5-year deal with a sulphuric acid suppler; 3. Hiring SOP producer Migao to provide technical and construction services.

Potash Ridge’s current key objective is to formalize a debt financing package to fund Valleyfield through to operation.

PRK is also developing an SOP mine in Utah. That’s another monster, bigger capex, different business model, a robust cash-generator. We’ll talk more about that another day.

At current SOP contract prices of about $600/tonne, the Valleyfield off-take deal will generate $60 million in sales.

PRK currently trades at .26 with a market cap of $33 million.

FULL DISCLOSURE: Potash Ridge is an Equity Guru marketing client. We are damn proud of that.

Leave a Reply