We sat down yesterday and had a chat with the CEO of HashChain (KASH.V) a new blockchain cryptocurrency miner that’s about to go public in early December, 2017.

HashChain is so new it’s still waiting to be assigned the “KASH” symbol.

But we’ll keep calling it KASH.

Because it sounds gangsta.

The CEO of KASH, Patrick Gray, is a precocious computer nerd who sold his first tech start-up to Xerox for $220 million – at an age when our idea of innovation was using felt pens to forge hand-stamps at outdoor rock concerts.

Gray owns sCube a niche IT Service provider that focuses on E-Discovery, E-Licensing, Application Development and IOT.

He invested early in Bitcoin and built a cryptocurrency miner in his garage for fun.

According to HashChain’s pre-money website:

With everything becoming digitized day by day, it was only a matter of time as to when money would also become virtualized. With the invention of Bitcoin and its underlying mechanism “blockchain”, our conventional money dealings have become a matter of clicking on a few tabs on our mobile screens, thrusting us into a new era of financial technologies.

Gray admits that 95% of the people he talks to, do not understand the technology.

Unlike most dudes from the tech side – who prefer to tinker with spreadsheets than talk to investors – Gray is on an evangelical mission to explain and educate.

Cryptocurrency is a “digital form of encrypted currency, transferred directly between peers across the internet, with transactions being settled, confirmed and recorded in a distributed public ledger or “blockchain” by a process known as mining.”

Here the five simple steps every investor must know:

1. Initiating a Transaction

For every business exchange to commence, it is necessary for there to be a transaction. A transaction is literally only an exchange of assets between parties A and B.

2. Encrypting Identities

In the blockchain domain, both A and B are in the form of cryptographic keys holding their unique public and private keys.

3. Creating Blocks

As person A starts and locks in a transaction, a block is created which basically contains an encrypted description of the person’s intention to transfer an amount to B.

4. Noding

After an encrypted and secured block is created, it’s broadcasted as a message across the blockchain through to all other nodes in the network. Nodes are basically several computers connected to a single network.

5. Post Verification

Once a block is communicated into the system, the nodes then are responsible to confirm each entry by solving an intricate arithmetical problem connected with it to verify and validate the block and also receive some bitcoins in return.

Miners use rigs – specially designed, high performance computers – to verify the pending transactions (called a block) by deciphering the encrypted digital financial data and linking the new block to the blockchain.

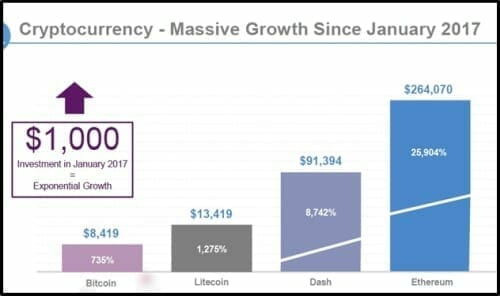

Enough with the techno-speak you say – what about comparables?

Here’s one: on August 11, 2017 we started tracking, HIVE Blockchain (HIVE.V).

Equity Guru principal Chris Parry described it as “a deal coming together with the strong musky aroma of the Frank Giustra posse from Fiore Group, which did phenomenally well recently with Lithium-X (LIX.V), and has now got its mitts into a company called Genesis, that mines Bitcoins and Ethereum for a living, and does so at a scale unsurpassed globally. “

HIVE is up about 300% since then:

Small world co-incidence: HashChain advisory board member, Dan Kriznic was the co-founder and CFO of the aforementioned Lithium X. Mr Kriznic helped take the company public in 2015 and raised approximately $50 million to acquire assets located in Nevada, USA and Salta, Argentina.

LIX is up about 500% in the last two years:

HashChain will be cable of mining a multitude of cryptocurrencies. Its Data centre will have the flexibility to switch between cryptocurrencies to focus computing resources on most profitable coins

KASH has created proprietary software to monitor hardware 24/7 including IP, temperature, hashrate, wattage, fans and memory.

The mining facilities will be located in Vancouver (currently) and Washington (planned Q1 2018) and Newfoundland (planned Q2 2018).

At Equity Guru, we don’t get inside information. And if we did, we wouldn’t write about it. Because it’s illegal and unethical.

But we do sometimes get early information.

And in those conversations with management, we have an opportunity to challenge their ideas – and ask them to defend their objectives.

The CEO Patrick Gray has never run a publicly traded company before.

We asked him if he thought that was a problem, and he said, “I love learning, I love challenges, HashChain is my obsession”.

We asked much tougher questions – about projected milestones, energy costs, geographical diversification, revenue models, defensive strategies against technology shifts.

He had even better answers. We’ll get into those at a future date.

This is a real company, run by people with track records of generating wealth for investors.

You heard it here first: KASH could be the new King.

Full Disclosure: HashChain is an Equity Guru marketing client and we have participated in early financing.

Leave a Reply