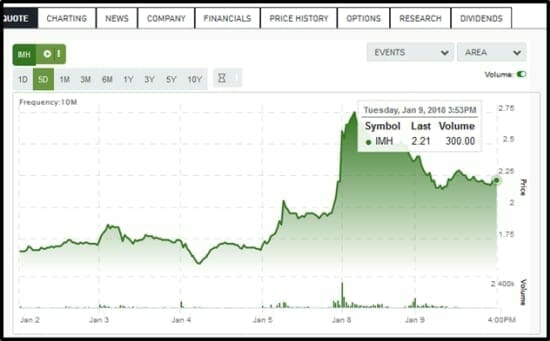

On January 8, 2018 Invictus MD (IMH.V) announced that AB Labs, near Hamilton Ontario has received its Sales License to sell dried marijuana.

AB Labs has 130 kilograms of leaf in its vault. It plans to sell all of its weed in January 2018 to Canopy Growth Corporation (WEED.T) initiating its first revenue stream since inception.

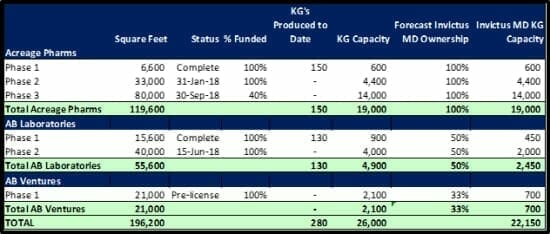

In the same press release, Invictus said that it has signed Letter of Intent (LOI) to make a further strategic investment in AB Laboratories (AB Labs) located near Hamilton, Ontario. This will up IMH’s ownership stake in AB Labs from 33.3% to 50%.

In the proposed deal, IMH will make a direct cash investment in AB Labs for $10 million to be used for the following purposes:

- Expansion of AB Labs’ existing facility

- Acquisition of the land and building at the existing facility

- Purchase of adjacent land and building

- Retrofitting the existing building on the adjacent property

In this new world, AB Labs will have a combined production space of approximately 56,000 square feet.

Invictus MD will also give AB Labs a $2 million line of credit in the event that the expansion costs exceed budget estimates. This announcement proposes a deepening of an existing partnership (management groups of AB Labs and Invictus are already familiar with each other). Never the less, Invictus warns:

The LOI is subject to various conditions including approval of Invictus MD’s board as well as satisfactory completion of due diligence. There can be no assurance that the transaction contemplated by the LOI will complete.

Invictus is a marijuana production pure play. The don’t sell vapes, THC-flavoured Candy canes, and the management doesn’t talk a lot about branding.

True, it does have an 82.5% investment in Future Harvest Development – a Fertilizer and Nutrients manufacturer based in Kelowna, British Columbia.

But the DNA of the company is designed to grow large amounts of high-grade weed, as quickly as possible.

Total 2018 production capacity after various phases of expansion, is expected to be about 26,000 kilograms. According to IMH’s internal projections, net production capacity to Invictus MD will be roughly 22,150 kilograms.

At $7/gram – that is $154 million in sales, which is 88% of the current market cap.

“We started this company in 2014 with the intention of becoming Canada’s Cannabis Company,” stated Dan Kriznic, IMH Chairman and CEO. “AB Labs produces high-quality strains, which will meet the increasing demand in the Canadian marketplace. We also expect to receive a sales license for Acreage Pharms within the first quarter of 2018.”

Invictus owns 100% of Acreage Pharms.

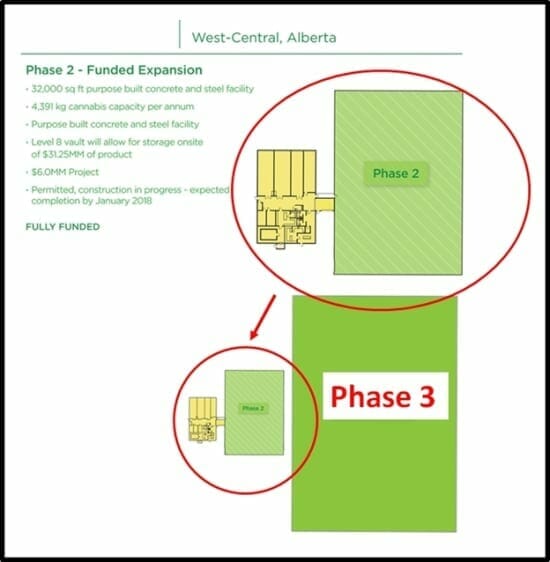

A Licensed Producer, Acreage Pharms has already constructed a 6,800 square foot production facility with an expansion of a 27,000 square feet purpose-built concrete and steel facility. In total, Acreage Pharms controls 150 acres of land.

Alberta has a low cost of production as a result of low energy and water costs. The property is friendly to building as many square feet as required based on the significant demand.

Acreage Pharms expansion profile looks like this:

- Phase I: 6,800 sq ft production facility – Complete

- Phase II: 27,000 sq ft expansion

- Phase III: 76,750 sq ft expansion on existing property – subject to permitting

“Increasing our canopy footprint has been a sharp focus of the Company,” stated Kriznic, “The receipt of AB Labs’ Sales License was another significant milestone and the final and crucial missing piece for AB Labs on the regulatory pathway to becoming a fully licensed producer.”

Given the aggressive production growth profile of Invictus, it may be undervalued – compared to its peers.

On January 8, 2018, Equity Guru principal Chris Parry asked three rhetorical questions:

- Is Invictus worth the same as Matica, a company with two applications on Health Canada’s list, that may never happen?

- Is Invictus worth less than Golden Leaf, which has been a punching bag for two years?

- Is Invictus worth less than Cannabix, which may not have anything actually at all that works in any way, shape or form?

In the last 5 days, IMH has risen 28%.

U.S Attorney General Jeff Sessions is making life harder for state-side weed growers, but as we pointed out last week, “The Trump White House and Sessions DOJ are wholly unprepared for the embarrassing disaster that would come from a court challenge by any of several states where the drug has been legalized for adults.”

Meanwhile, the directive from the Canadian federal government is crystal clear: legalise it.

That wholesale law change is happening on July 1, 2018 (Canada Day).

The Canadian provinces are wringing their hands, trying to figuring out how to distribute marijuana, while maximizing tax revenue and keeping it out of the hands of children.

But the conversation in Canada is “how” not “if”.

The Saskatchewan government just announced that marijuana will be sold by private companies in that province.

Under the new rules, “Saskatchewan will issue about 60 retail permits to private stores located in 40 municipalities and First Nations across the province.”

According to an estimate published in Forbes Magazine:

“The economic impact in Canada could range from $12.7 to $22.6 billion.”

Full Disclosure: Invictus MD is an Equity Guru marketing client and we also own stock.

Leave a Reply