Strong cybersecurity is serious business as more and more corporate networks are criminally penetrated, stealing data or locking it up for ransom. So far in 2023, there have been at least 12 reported large corporate network breaches including Twitter, Slack, PayPal and Mailchimp.

One of the more notable digital break-ins this year involved T-Mobile where the data breach affected approximately 37 million postpaid and prepaid customers. And this isn’t the first time T-Mobile’s data has been compromised. Last year 76 million T-Mobile customers had their data “robbed” by hackers.

As a result of the 2022 breach, T-Mobile promised to spend $150 million USD to amp up security. Looks like it didn’t work. Why? We don’t need more cybersecurity, the whole system needs to change.

Most breaches involve compromised passwords and/or social engineering attacks where hackers gain access by duping employers, network administrators and/or users utilizing methods like malicious emails with bad links that phish data such as passwords.

Plurilock Security (PLUR.V) offers strong cybersecurity solutions without the need of passwords. The company’s frictionless authentication uses novel biometrics to not only guard the door at login, but to continuous monitor in real time for the length of the network session to make sure whoever is at the keyboard is the right one.

These patented behavioral-biometric solutions are coupled with layered identity signals and the whole system is invisible to the user, running silently in the background. No fingerprints, retina scans or dongles are used which not only can be invasive, expensive and limiting, but more importantly, they can be copied.

Plurilock’s strong cybersecurity biometrics include aspects like keystrokes because no two people type the same and it is almost impossible to copy. The whole system is monitored by state-of-the-art machine learning to monitor and identify possible security issues in real time. This leaves the user free to work, while giving the corporation piece of mind that if anything awry were to occur, action can be instantaneous.

Right now, Plurilock is focused on enterprise networks and by focused, I mean they are actively bringing on contract after contract of high-level corporate and government clients. Since the beginning of 2023, the company has announced seven new purchase orders, including one for the U.S. Department of Defense, and seven contract renewals/expansions with existing customers.

Anyone can have a great idea, but true success is in the execution and Plurilock is an executing machine. This aspect comes down to leadership.

CEO, Ian L. Paterson is a 10-year data analytics entrepreneur. He is well-used to landing multi-million dollar contracts and commercializing data science solutions.

Jord Tanner, Plurilock CTO, is a 20-year veteran technologist who was instrumental in scaling a venture-backed data analytics start-up from zero to 500k users before it was sold to eBay.

Under this expert management, Plurilock went from revenues of $0.48 million for fiscal 2020 to $36.62 million for the year ended fiscal 2021. That’s a whopping 7529.17% increase YoY.

It will be interesting to see where the company sits at the end of fiscal 2022 and with the deals continuing to land in 2023, it looks to be another good year for the company.

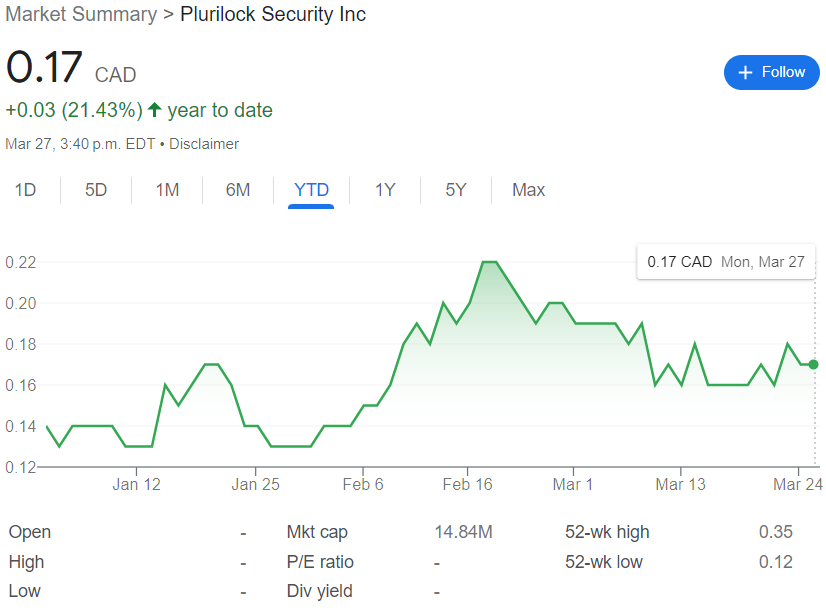

Despite this performance, share price has remained at bargain levels dropping 50% over the last 12 months indicating a disconnect in the market. However this does present a potential investment growth opportunity for investors.

A good idea, great execution and a solid management team makes Plurilock a strong cybersecurity stock option for anyone looking to build their portfolio for the 21st century.

Currently Plurilock trades for $0.17 per share for a market cap of $14.84 million.

*Full disclosure: Plurilock Security is an Equity Guru marketing client

Leave a Reply