What’s next? As Chinese acquirers loom, I’m picking lithium. Chatting with folks at the 2018 Vancouver Resource Investor Conference this weekend, the hot topic on everyone’s lips was, “what’s next, when weed collapses?”.

Granted, some people were only doing the first two words, as the idea of a weed collapse has some looking for the feinting couch, but the notion that we’re headed from blockchain mania to weed mania to something else mania was popular sport.

And I agree, something else is about to step up. In fact, if you look at the historic numbers, weed stocks tend to flatten through most of the year, only to jump at year end. Happened in 2014, 2015, 2016 and 2017.

Which would mean something else looms.

I’m saying lithium, even though some lithium majors just went through a stock fall-off of not insignificant volume.

Why?

Several reasons. First, the Chinese are coming. Having already snapped up Lithium-X (LIX.V) at a 22% markup to the market, another deal was done just before that which I’m now hearing buzz suggesting it could be step one of an all-in takeover of Millennial Lithium (ML.V):

Millennial Lithium Corp. is pleased to announce that the Company has closed on the first tranche of a strategic investment from Million Surge Holdings Limited, a wholly-owned subsidiary of Golden Concord Group Limited, one of the largest integrated energy services providers in China that specializes in clean energy and new energy. Million Surge will acquire a total of 12,000,000 common shares to be issued by the Company in two tranches for the aggregate amount of $30 million at $2.50 per share on a private placement basis.

ML isn’t an outlier. In fact, the Chinese money has been pouring in of late, as that country begins to realize its home stock of lithium is largely low grade, unreliable, and largely unwanted by high end electronics producers.

BEIJING, Jan 17 (Reuters) – China’s Yongxing Special Stainless Steel Co said on Wednesday it would invest 891.2 million yuan ($138.5 million) in a project to produce battery-grade lithium, in a bid to secure a slice of the world’s biggest electric vehicle (EV) market.

The move takes investments announced by Chinese firms in battery-related ventures in the past week to more than 7.8 billion yuan, even though the phasing out of EV subsidies has cast doubt on whether the EV sector can maintain its stellar growth.

Yongxing, which makes nickel alloy and stainless steel wire rods and bars in Zhejiang province, said it initially aimed to produce 10,000 tonnes a year of battery-grade lithium carbonate at a plant in Jiangxi, with start-up due in the fourth quarter of 2019.

The announcement came a day after Ningbo Shanshan, an established battery industry supplier, said it would invest a total of 5 billion yuan to produce 100,000 tonnes a year of high-density lithium-ion battery cathode materials by 2025, with 20,000 tonnes of capacity by the end of 2020.

More:

China has been particularly aggressive in the South American region, which has more than half of global deposits. Both BAIC Group and BYD, two of the largest Chinese automakers are reportedly in talks with Chilean mining entities for deals to cooperate in lithium mining and battery manufacture. Great Wall Motor meanwhile has been eyeing Australian reserves having acquired 3 percent of Australia-based Pilbara Minerals.

So China sees the future is in finding lithium in better places than its backyard. That’s good.

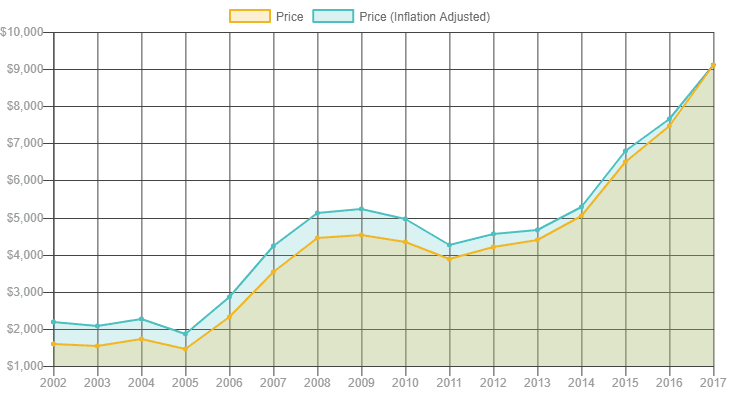

So too is the continuing rise of lithium pricing. While it is traded by contract and thus hard to nail down to an indexed price, available data shows the same sort of price rises now that were occurring when lithium was ‘blockchaining’ a couple of years ago and people were talking about how overheated it all was.

Thus far, the money has drifted toward near term prospects. The $240m all-cash Lithium X deal snapped up brines in Argentina. Millennial is focused in the same place.

But brines, while a short term fix for Chinese (and world) supply shortages, aren’t a long term solution. Because brines? They’re not so high on the grade side, and each one requires solving a technological problem to process.

And lots of land and lots of water, which the guys in the Clayton Valley can tell you is a rough thing to find in a desert sometimes.

This is all a round about way of saying, “look to the spod.”

Spodumene is hardrock-based lithium, and Canada appears to have a bunch of it. This is good for several reasons.

Spod is easy enough to get at, as it shows up in big ass crystals close to surface.

It’s generally of a higher grade and needs less alchemy to process, in that you’re digging and crushing, not sucking and floating. Spod is hosted in rocks called pegmatites.

End users want it.

You remember back when Samsung cellphones were being taken off airplanes? That happened because the current method of drawing varying grades of lithium from 70 different locations in China and tossing it all in one big bucket with graphite from who knows where and cobalt from child labour in the Congo… that’s apparently – who’d have guessed – not the best way to get your energy metals.

Weird.

Spodumene is in demand, because nobody wants their cellphones blowing up and turning your crotch into a fireball not seen since the boys went on shore leave in ‘Nam.

But finding spod companies to invest in is kind of like finding spod itself; You’ve gotta look to Canada and you have to drill down.

There are big players: Nemaska Lithium (NMX.T) and Critical Elements (CRE.V) are working Quebec hard, with Nemaska the most advanced. At the more junior levels, QMC Quantum Minerals (QMC.V), which we’ve written about several times before, has gone on a big stock run with its early stage Manitoba projects. Readers rode that from $0.07 to $1.20+, and there’s been buzz of Chinese interest in that show.

Nemaska more than doubled from July of 2017 to December, before profit taking in January saw it slide. Critical Elements (CRE.V) had a similar run – only it tripled before similar New Year profit haulings.

But one company has sat under the radar for much of that time and only recently began to move upwards.

Clean Commodities Corp (CLE.V) has jumped by more than 50% since the majors went on their slip, and sits at a $14m market cap, compared to $62m at QMC or $47m at Rock Tech Lithium (RCK.V).

I mean, what do you want?

CLE is sitting on (actually, they’re not sitting, they’re working) four lithium projects, one cobalt project, and one uranium gig.

The Phoenix Project is six mineral claims in the Northwest Territories, a short ride from Rio Tinto’s Diavik diamond mine, so it’s blessed with high level infrastructure, including winter roads. CLE acquired that property from North Arrow Minerals (NAR.C). CLE’s Phoenix Project has dimensions too with the Big Bird pegmatite there (one of several at the project) being some 1.2km+ in length.

Torp Lake is a 1000ha+ project in Nunavut, not far from where Sabina is working (who also recently closed some strategic Chinese funding) with a drill-ready lithium-rich pegmatite through a 110m strike length of exceptionally purity.

Those two are nice, and with CLE’s Juliet Lithium Project in Quebec things get really interesting. That one sits adjacent to the Critical Elements’ (CRE.V) Rose Lithium-Tantalum deposit. In fact, if the $200m market cap CRE wants to expand its holdings any, chances are it’ll need to talk to CLE.

And the indicated resource estimate on that CRE plot? 26.5 million tonnes of 1.30% Li20 Eq.

No, YOU shut up.

But we’re not done yet. There’s more:

Vancouver, BC – November 30, 2017 – Clean Commodities Corp. (TSX-V: CLE) is pleased to report that the Corporation has agreed to an arrangement with Cameo Resources Corp. whereby Cameo Resources may earn an 80% interest in the Dumont and Spodumene Lake lithium projects.

“As we actively work to advance our premier portfolio of hardrock lithium assets in Canada, we are pleased to be working with Cameo Resources at the Dumont and Spodumene Lake lithium projects in Quebec. Our recent exploration at the properties provides Cameo with a breadth of opportunities and we are excited to see the continuance of work at the project which is of course in close proximity to [the $700m market cap] Nemaska Lithium,” noted Ryan Kalt, CEO of Clean Commodities.

And then there’s uranium, and their $8M deal with AREVA Resources:

Vancouver, BC – November 9, 2017 – Clean Commodities Corp. (TSX-V: CLE) is pleased to announce that the Corporation’s option partner AREVA Resources Canada Inc. has provided details for an upcoming exploration program at the Preston Lake Uranium Project located in the western Athabasca Basin near NexGen Energy Ltd.’s high-grade Arrow deposit hosted on its Rook-1 property and Fission Uranium Corp.’s Triple R deposit located within their PLS Project area.

And there’s a cobalt project that, frankly, I’m not even going to talk about because you people appear to be just set to ignore it anyway, based one – and I’m going to repeat this in case you missed it earlier – the Clean Commodities Corp market cap of just $14m.

In the weed space, nothing has a market cap of less than $25m anymore. In blockchain, if you know how to program your grandma’s VCR, you’re on a $30m valuation.

Here’s a company with work going on, majors as partners, mid-majors as neighbours, cash in the bank, three sectors covered, and you knuckleheads don’t know about this?

So I collared Ryan Kalt, CEO of Clean Commodities, who I’ve written about a few times over the years because he’s an always unique, sometimes outspoken, never apologetic maverick at the Cambridge House VRIC investor show this weekend. I asked him what’s going on with his collection of interesting energy metals playthings.

The first thing he tells me is, hey, people are taking notice.

“We just pierced our 52-week high, from $0.045 to $0.15 since December, so it’s starting to resonate,” he says.

Which is fair. But it’s still cheap.

“I can say we believe we are undervalued, yes,” says Kalt. “If the corner is being turned, it’s being turned for a variety of reasons, among them being spodumene (and lithium in general) which is in demand. End users want it. So yes, hardrock lithium projects in Canada are attracting a large amount of foreign investment, mostly from Chinese makers of batteries whose businesses literally cease to exist without an adequate supply. Investors are starting to notice this!”

Which means eyes are being cast on places where spodumene is found. Basically, Australia and Canada.

Which means China won’t be stopping at Argentina’s door.

“We think, from an overall industry perspective, that hard rock deposits generally-speaking will have better purity from a processing standpoint than brines, which is why we’re seeing a lot of industry-centric demand for hardrock lithium projects,” says Kalt. “We’re focused on the spodumene associated with hardrock lithium deposits in Canada. Overall, when you look at the market caps of the two lithium subsets, hard rock plays have more capitalization than brine plays.”

“Take Nemaska Lithium as an example,” said Kalt, “it has a larger market cap than all Canadian brine companies rolled into one, and that’s not accidental.”

We know – and I mean know – that the battery sector is only going to blow up in the years ahead, and the metals that go into those batteries are already in shortage, and increasing in price. We know – and I mean know – that there will be acquisitions and investments and JVs and majors looking for quick growth. So we know lithium is going to have another ride at some point.

But there used to be a time when you could just ‘invest in lithium’ and you were good to ride the wave that was drawing in all boats, without thinking too much about what was in the ground, or who might use it, or how hard it might be to get at it, or whether there’s water available to do so.

Now it’s starting to become clear that lithium fans have to pick a side, and that many are looking to rocks over brine.

If that trend continues to blow out (and judging by the crowds at the lithium panel I hosted at VRIC, that’s a good chance of happening), a nice tiny microcap valuation like Clean Commodities Corp’s (CLE.V) could be your next interesting bet.

–Chris Parry

FULL DISCLOSURE: Clean Commodities is an Equity.Guru client. The opinions expressed here are the author’s.

Leave a Reply