As the world shifts towards green energy, lithium exploration has become a crucial component of this exciting transition. Beyond Minerals (CSE:BY) (OTCQB: BYDMF) is focusing on the future by exploring for lithium in Ontario, one of the most significant energy minerals driving this change. Lithium, the lightest metal with a density about half that of water, is primarily used in batteries, ceramics and glass, greases, pharmaceutical compounds, air conditioners, and aluminum production. Its importance is highlighted by the fact that an electric car takes a 20kWh lithium-ion battery, equivalent to 2,500 battery cells.

Why all the fuss?

According to a recent press release, Beyond Minerals has entered into a master services agreement with Bounty Gold Corp. and Last Resort Resources Ltd., two leading prospecting companies in grassroots lithium exploration in Ontario. The company aims to advance the properties through data assessment and grassroots exploration fieldwork starting next month.

“These agreements mean that Beyond will be able to deploy exploration teams on its properties as soon as the conditions on the ground permit,” commented Allan Frame, President and CEO.

Ontario is emerging as a reliable global supplier of responsibly sourced critical minerals. World-class deposits of high purity, low-iron spodumene are currently being discovered and advanced towards production in the province. Beyond Minerals is now the largest greenfield lithium exploration player in Ontario, with a portfolio of 66 properties covering 147,975 hectares.

In a recent analysis, Equity Guru founder, Chris Parry emphasized the significance of Beyond Minerals’ increased land position, saying, “Beyond Minerals now has a significant position in every major LCT Pegmatite district known in Ontario.”

More good news

And that’s not all, in an exciting development, Beyond Minerals Inc. has announced the acquisition of a 100% undivided interest in 179 contiguous mining claims, covering approximately 3,490 hectares (34.9 km2), comprising the North Trout Lake lithium property. The property is located about 30 km southwest of Sandy Lake in Ontario and 9.5 km east of Beyond Minerals’ other lithium properties in the Borland Lake, Favourable Lake, and Gorman River areas of Northwestern Ontario.

The North Trout Lake lithium property is situated close to Frontier Lithium Inc.’s PAK and Spark deposits, as well as its spodumene-bearing pegmatite at Pennock Lake. The PAK deposit has a mineral resource of 9.3 million tonnes, averaging 2.06% Li2O, while the Spark deposit has a mineral resource estimate of 14.4 million tonnes, averaging 1.4% Li2O.

Allan Frame, the new President and CEO of Beyond Minerals, has emphasized that this acquisition aligns with the company’s disciplined approach, focusing on quality assets with extensive geological data available, maintaining financial discipline, concentrating on Ontario assets, and maintaining a share structure favorable to value creation for shareholders. Frame also announced that the company would soon establish a comprehensive lithium exploration program to begin as quickly as possible.

The Property covers approximately 12 km of strike length of a granodiorite sill that reportedly contains numerous pegmatite dikes, varying in size from narrow to 50 ft in width. These dikes occupy up to 25% of the sill by volume near the center of the sill, and at least one white pegmatite is mapped as being hosted within mafic metavolcanics on the Property. With this acquisition, Beyond Minerals’ footprint in the area now totals 5,710 hectares of carefully selected land.

The company is adopting a project-generator model to maximize exploration dollars while minimizing dilution. Partnering on various projects will provide a source of non-dilutive working capital, partner-funded exploration, and long-term residual exposure to exploration success.

Frame commented on this accretive direction, “By adopting the project generator model, our shareholders will be exposed to multiple projects being advanced at once – hence increasing the likelihood of a discovery – with a significant portion of the exploration costs being incurred by our partners.”

Beyond Minerals’ focus on high-quality assets with extensive geological data aligns perfectly with the staking methodology employed by Bounty Gold Corp. and Last Resort Resources.

Jason Leblanc, President of Bounty Gold Corp., also commented, “We believe Beyond Minerals is the right company to now advance these projects forward and deliver further exploration success.”

The company is also proposing a name change to “Beyond Lithium Inc.” to more accurately reflect its focus on lithium assets, pending shareholder approval at the upcoming annual general and special meeting on May 15, 2023. With the world’s largest lithium deposit, the Salar de Uyuni in Bolivia, not currently being mined due to government restrictions, companies like Beyond Minerals are vital for securing the lithium supply necessary for the global transition to green energy.

In an interview with Jody Vance, Frame highlighted the potential of the company’s properties and their acquisition, saying:

“So basically we’ve acquired over 150,000 hectares. And each property acquisition that we made is in an area where there are either known discoveries or really good geology. We’ve done as much research as we possibly could with all the information available. Instead of just pointing on the map and going here and there, we’re pretty selective. So you’ll find every property that we have is near somebody that’s been successful.”

What’s all this mean?

Parry summed up his optimism about Beyond Minerals in a recent analysis, “The guys that are smarter than me, and there are many, will point to these guys and say they know what they’re doing. They’ve been at it for a long time. Their record is in creating wealth.”

So to wrap up, the future of green energy depends on the availability of essential minerals like lithium. Beyond Minerals is positioning itself at the forefront of this revolution, focusing on lithium exploration in Ontario to ensure a sustainable and responsible supply of this critical resource. As more companies follow in their footsteps, we can anticipate a brighter, cleaner, and more sustainable future for generations to come.

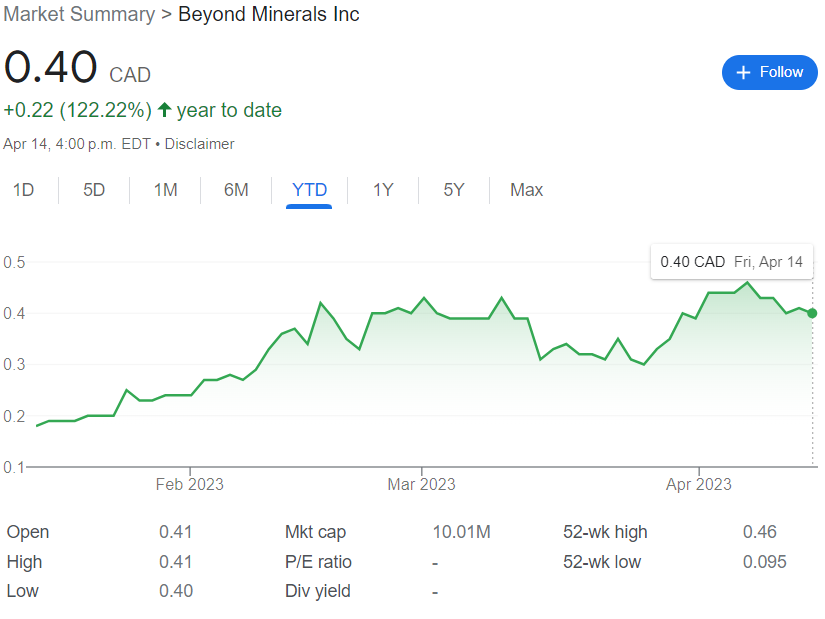

On April 14, 2023, Beyond Minerals traded at $0.40 CAD per share for a market cap of $10.01 million.

Leave a Reply