I’m a big fan of investor education. It’s been the very thing that has helped us grow from ‘guy on a laptop in a cafe’ to a group nearing ten staff with nearing 40 clients. We made the decision at the outset to ignore the grey-haired investor crowd, who already have many people talking to them, and go to the youth investor crowd, which didn’t exist until we started pushing into it, but is now ‘the market’ based on action over the last year in cannabis and blockchain.

One of the things we’ve tried to do in making that education push is illustrate why it’s important to not just buy stock on the open market, but also think about buying it before a company hits the open market.

All your favourites, from the smallest blockchain deal to the largest weedco, started out life as a shell worth a few cents a share, traded between guys with brokerage accounts and fat portfolios.

The brokers love these guys because they’d rather put the work in for five customers and fill a financing than 100.. so you guys never get the call.

We’re changing that.

TERRITORY METALS CORP.

We see a lot of pitches at Equity.Guru from companies that are going public, and some of them are terrible.

“We’re going to raise two million dollars and spend it all on marketing the stock!” Yoinks.

“We’re going to invest in companies in a sector because you’re too dumb to do that yourself!” Jinkies.

“The last six companies we were in went ass up but this one will be different!” Okay.

Sometimes, however, we see a pitch that ticks all the boxes, and some of those boxes are intangibles – that is, they’re not something that can be created, they just are.

What we want to see:

Share structure: Not a ton of shares out (in the case of Territory Metals, around 10m, which means every share bought or sold will have a more volatile impact on share price)

Price: Low enough that we could see appreciation gains that are significant (in this case, a $0.25 financing, which is right in the sweet spot)

Market cap: The lower, the better (in this case, $2.5 million – roughly the cost of a suburban 3-bedroom home in the 604 region)

Track record: Executives that have done it all before and don’t have to explain where it all went wrong last time

A hot sector: We like gold, especially with political weirdness on the horizon

An undervalued resource or product: In this case, a gold property that someone previously spent a bunch of money drilling, but let go when the market soured a few years back

A broad shareholder base: If only three guys are buying in, and one of those decides to cash out, hello crash time. If there are a lot of shareholders, you have protection against that drop.

Territory Metals has no ticker symbol (yet) and it doesn’t have a broad shareholder base (yet), but it does have a website that I thoroughly recommend folks go look at. They’ve spent some money on preparing a presentation that explains the process of building a mine from the ground up, that lays out each step the company will go through in its journey. If you’re not a metals nut already, it’s got a lot of valuable information.

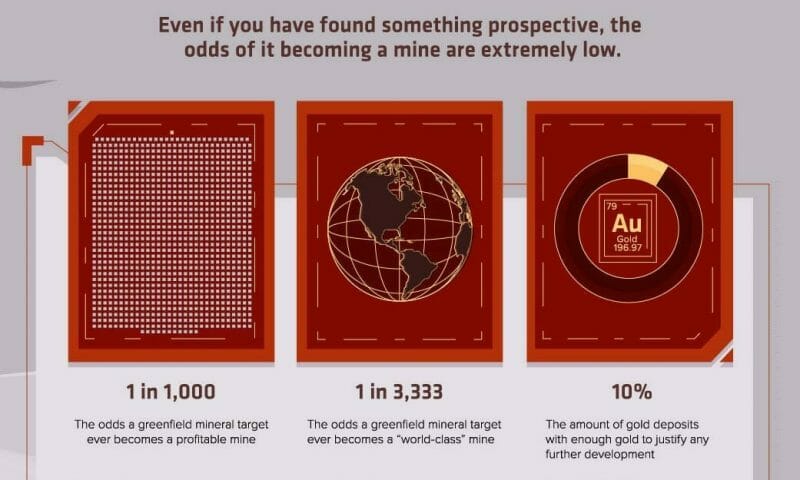

In fact, any corporate presentation that features this passage has my vote as legit right off the bat:

You see, mining is a rough game if you’re looking for steady pension returns. It’s not a business that you just stick money into on one end and wait for dividends on the other side.

It’s a process.

First you find some ground you suspect has ore underneath. Then you walk or fly over the ground and run instruments on it to gauge what’s beneath. Then you get drill permits. Then you raise money so you can afford to drill it. Then you drill it. Then you wait for the drill results to come back. Then, if you’ve hit something nice, you raise more money and likely drill some more.

Eventually, if you keep hitting, you gather all your data and do a Resource Estimate (known as a 43-101), then you go do an Preliminary Environmental Assessment (PEA) and a Feasibility Study that’ll tell you what it’ll cost to put your mine into operation and what you can expect to make back, and then you’d use that to raise tens of millions of dollars to start an actual mine.

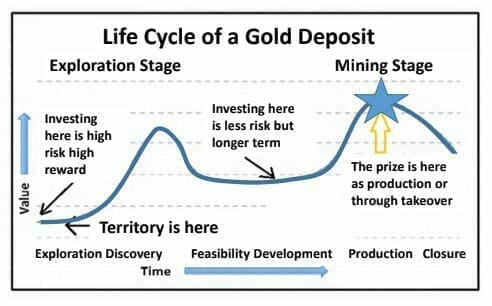

If that seems like a long process to you, you are correct. It’s also a process in which investors churn in and out several times. Some investors like the early stage gamble, others like to get in much later when there’s less risk (and also less value). Your average mining explorer will have several different ‘generations’ of investor roll through, whether or not they ever get to the production stage.

Territory Metals is at the very beginning of that process, and they’re looking for the blue sky investor crowd. High risk, high reward, low buy in, high multiples if they hit anything.

Small addition to that: They want small investors. They want you to take part in their pre-listing financing, because they sat down with us and we told them the TGOD story.

<flashback>

The Green Organic Dutchman (TGOD) is going public any day now. It’s widely believed that a lot of people have cashed in their cannabis stocks so they can have money ready when TGOD goes live.

About eighteen months back, we wrote a story about them on Equity.Guru and called it:

In that article we outlined what a private placement financing is, what it looks like, how it works, what a broker would need from you before letting you in on it, what you get for your money, how warrants work, and what an accredited investor is and how to tell it you’re one of them.

</flashback>

To say it was a success is an understatement. It was one of the most read stories we’ve ever published, and that financing saw the TGOD crew receive some 4000+ financing documents, of which they approved 2500.

Anyone in that financing got their stock at $1.15, with a full warrant at $2.15.

The following year, TGOD ran another financing, this time at $1.65. They got another 1300 little guy investors in on that deal, giving them a pre-public shareholder base of around 4000 people – a number that’s about ten times what your average mature public company on the Venture would boast. That broad shareholder base gives the executive team more time to execute their vision without being sold out by impatient heavies.

Projections for their live listing price range anywhere from $3 to ridiculous, which will mean nice profits for those early guys into the deal, while the open market buyers play roulette and daytrade for pennies.

That’s why you try to get in early, when the valuation is low (the first TGOD financing had a $110m valuation, if it goes live at $3, that’s now a $300m valuation).

So here we sit in our office with the Territory Metals crew, and they’re telling us how they don’t want to dance with the usual stock promoter/daytrader/churner crowd because they’d really like to actually build a company, and they want to be honest and open and upfront with everyone they deal with, and we say… “Buddy, let’s TGOD this thing.”

Here’s what I want from them:

- Access to a financing for everyone who qualifies – anyone who has dollars to invest and the patience to handle a four month hold.

- Absolute truth and integrity – tell the shareholders what the risks are, what the realities are, and where they are on their path to victory at all times.

- To use that money raised for the purpose of progressing. Drill baby, drill.

They have agreed to our request, and so they’re running a small financing for small investors. It’s a ‘positioning round’ to help position the people brokers normally want nowhere near a deal because it’s work to deal with your tiny wagers.

Here’s the financing document. The $125 amount filled in is the minimum accepted. If you’re interested, they’re okay with you crossing that number out and replacing it with a higher one.

[pdf-embedder url=”https://equity.guru/wp-content/uploads/2018/04/Territory-Metals-Subscription-Agreement-for-Subscription-Receipts-Private-Company-distribution.pdf” title=”Territory Metals – Subscription Agreement for Subscription Receipts (Private Company) distribution”]

NOTE: We don’t receive any finders fee for writing about this document, nor linking to this document, nor as a result of any reader subscribing to the financing. We provide it only as an informational service, and recommend that you discuss any investment with a registered financial advisor.

Before you head to that document, head to this one, from Territory Metals’ front page, because it’s a beauty:

Now you’re done with that one, go look at this one, from Territory’s Investor page:

Why did I want you to look over those two visuals?

Because now you’re ready to go read their investor deck.

[pdf-embedder url=”https://equity.guru/wp-content/uploads/2018/04/TerritoryMetalsCorporatePresentationApril2018.pdf” title=”Territory+Metals+Corporate+Presentation+April+2018″]

That investor deck is a masterwork in under-selling, over-educating, and transparency. It’s filled with items like this:

“Territory is here.” Early stage. High risk, high reward. No bullshit.

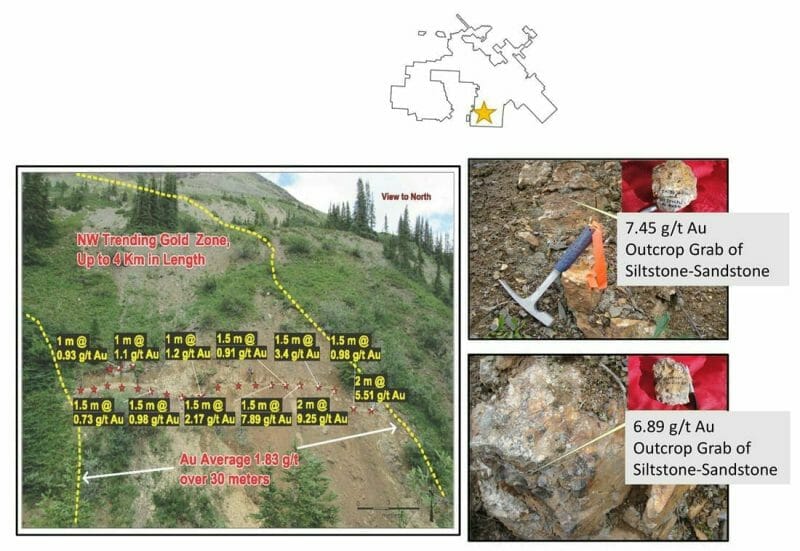

When you look at the images associated with their properties, you don’t find heavy earth moving machinery and grand generic stock images of big pits.

You find grass and rocks, and some of those rocks are shiny.

Those stars are where drills have gone in before (at someone else’s expense), and found gold.

I like the Yukon as a place to do mining business, I like gold as a sector that has legs, I like honesty and integrity but here’s what I really like:

It’s the most important thing in investing, and one of the last things many investors look at. If I had a dollar for every investor question I’ve been asked that was answered with words that included ‘market cap’, I would have a real wallet size challenge to deal with.

Whether your stock goes up or down can be influenced by many things, but ultimately whether the market cap is excessive or smaller than it should be is the guiding light.

We’ve all experienced companies we like, that have strong executives and strong business plans and they’re in strong sectors, and we plonk down money on them and wonder why the stock is suddenly headed in the wrong direction. Why?

Market cap, people.

We’ve seen companies put out news with big percentage gains in revenue and sales numbers and we assume everyone else will love them too but, alas, down goes the share price. Why?

Market cap.

Market cap is life.

So what is market cap?

Market capitalization is the value of the company on the exchange at the current share price. The formula is [# of shares] x [share price] = [market cap].

100m shares outstanding at $1 per share: That’s a $100m market cap.

100m shares outstanding at 10c per share: That’s a $10m market cap.

300 shares outstanding at $2m per share: That’s a $600m market cap.

Simple.

So when stock noobs go on Facebook and say, “What should I be buying, a stock worth $2 or a stock worth $10?”, the answer is not:

Rather, the answer is, “It all depends on the market cap.“

The actual share price is not an indicator of excellence or otherwise. In fact, a lower share price is sometimes a great thing, because if a stock moves from $0.02 to $0.025, that’s a 25% jump, even though it’s only moved half a cent (the lowest possible Canadian tick in a share price). If the stock was at $0.50 originally and moved the same half cent, that’s only a 1% rise.

Conversely, if a stock is moving downward, a lower share price means a bigger percentage drop.

So you have to gauge risk. Am I prepared to risk losing half my money in an afternoon in return for a chance I could maybe double it in the same time?

Institutional investors often can’t touch a stock under $1 for that very reason, and some exchanges, like the NASDAQ, insist on companies staying above that level, even though it might not reflect a poor situation to be priced below that point.

But retail investors, depending on their risk profile, may be really attracted to that high stakes game of roulette that comes with a low share price.

If I invest $1000 into a mutual fund, I might make $150 profit (or 15%) on that investment over a year (less if you subtract fees). But if I buy a $0.10 stock with that thousand, and it rolls to $0.20, I’ll have doubled my money.

This lesson in investing was brought to you by the letter ‘I’.

Why does this matter?

Because early investors often get themselves a better price on companies moving to a public listing than other investors do once the stock has actually gone public.

The earliest people into HIVE Blockchain (HIVE.V), as an example, when it was a shell company, bought stock for $0.015. The next financing round came in at $0.11. Eventually it went public at an open of $0.96 and soon touched $6, making those early guys (if they were holding free trading stock) very happy.

Mind you, the guys who bought on the open market for $0.96 were also happy when things touched $6, because they could sell up at any time. The early financiers sometimes can’t. They might have a four month hold on their stock, they might even have some escrowed for months and years, depending on how early they got in.

But people still go in early on those financings because of one really attractive reason: Warrants.

Wrong Warrant.

A warrant is an agreement by the company that they’ll sell you more of their stock at a set price for a certain amount of time in the future.

For example, let’s say you were investing in a financing today for $0.10 per share. You’ll likely receive a warrant to buy another share, priced at $0.15, for every two shares you purchase in the financing. That warrant can be exercised at any time over the next (let’s say) three years.

If the company’s share price goes up to $0.25, you could exercise your $0.15 warrants by sending the company a cheque, and sell the shares they send you at today’s price – for a $0.10 profit per share.

Are we clear?

SO WE LIKE FINANCINGS.

For me, buying a private placement stock I can’t trade for four months is risky, but having a warrant I can buy for three years mitigates that risk, and leans me in the other direction.

And private financings, though the wait for the company to go public can be long, will generally be priced lower than where the company hits the market later.

Sometimes the company wants to raise money to make a change in the business that will make it worth much more when it hits the open market, so a private placement financing might be how that happens.

TERRITORY METALS HAS A MARKET CAP SIMILAR IN WORTH TO A 3 BEDROOM VANCOUVER HOUSE.

We love that, because the potential for multiple is great. If the company drills and finds good data coming back, that market cap will move hard, and here’s some of the reason why:

- 10M shares outstanding currently (as at February 18, 2018)

- 4M seed shares friends & family (open)

- 14M (estimated) total shares outstanding post seed offering

Pro Forma Share Structure (estimated):

- 5M listing shell

- 15M unit offering upon listing, target May 2018

- 4M vendor share payments

- 38M total S/O post-listing and well financed

This share structure is TIGHT, which is what you want if you want small purchases to bring big moves on the market. If there’s not a lot of stock out there, buying activity drives price up quicker.

Alternately, again, the same goes in the downward direction if selling hits.

Now, one thing I haven’t talked about in great detail thus far is the actual projects Territory has, and I’m not going to. There’s lots of information about those projects, and the high number of assets they hold, on their website. If you’re a mining guy, you already know where to go for that.

And if you’re not a mining guy, the assets won’t make much sense.

So let me put it in layman’s terms:

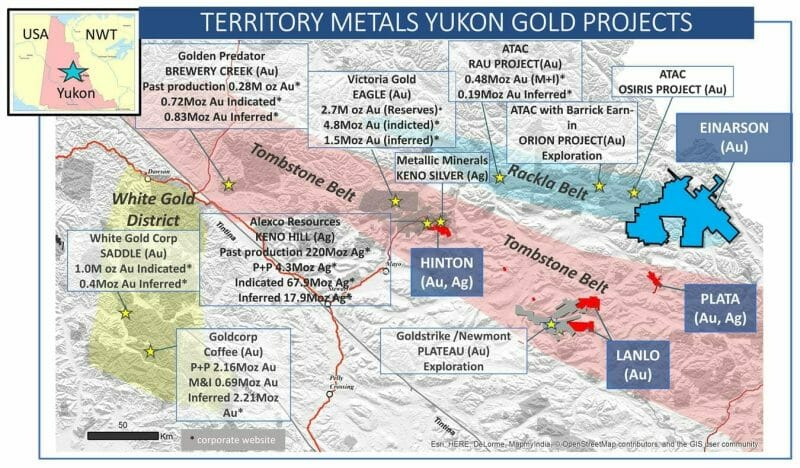

The two key projects are the Einarson gold project and Hinton gold-silver project, both in the Yukon. They are in the thick of where other large mining operators have existing projects.

The red blotch in the middle, and the fat blue blotch on the east side? Those are the Territory Metals targets.

The key here is ‘data’. The Einarson project is 70% owned by Territory Metals, and consists of over 200,000 hectares on which there’s large scale Carlin type gold targets, which are made up of gold that is found in soil and comes from old rivers moving it from its original source. It’s often dissolved into the soil in a way that makes it tougher to find initially, but found over a wide area when it happens.

Territory has a lot of data on this ground: 4,202 silt samples, 20,349 soil samples, and 4,974 rock samples, as well as 15 drill holes. Back when mining was done by guys with picks, it was tough to process all that data. Today, it’s a very different scenario, and the execs at Territory think they can follow the data to find where the gold came from, where it likely flowed to, and where the best place would be to start hauling it in.

The Hinton target is a different deal, in that it has drill-ready high-grade gold targets and multiple undrilled high grade gold-silver veins. They’ve identified 74 veins to this point, and state “creeks draining the property have yielded significant placer gold production and are still being mined today.”

- Drilling PDH23 returned 31.7 g/t Au over 1.5m

- The 21 vein was exposed for 22m in length and returned weighted average grade of 42.5 g/t Au and 319 g/t Ag (to be drilled)

Those are good numbers that warrant a deeper look. So it’s a good thing they’re already permitted for drilling.

And, yes, that was me ‘not going into great detail’ about the properties. They have others that they’re seeking joint venture partners on.

Here’s the thing: Investing is all about lowering your risk. If you can find an outfit that has a low market cap, a high potential upside, a low number of shares out, cash in the bank, lots of data to go through, lots of vein targets, a couple of spin-off options and they’re going to let you in before it even goes public at a nice valuation that’s completely justifiable… well, I’m going in.

You? By all means, chill on the sidelines and wait for more pieces to be put in place. Lower your risk by watchlisting the company and noting as they put out news and data and either miss their targets or hit them regularly. That’s a perfectly valid and smart methodology.

Investing in them now, before they’re even public, has all sorts of risk.

But I’m okay with that.

— Chris Parry

FULL DISCLOSURE: Territory Metals is not an Equity.Guru marketing client, but the author is buying into the financing, and the company is in active discussions to begin a program.

Leave a Reply