In the summer of 2021, many investors lost faith before uranium equities doubled or tripled in the following three months. Those who diamond-handed were beautifully compensated.

Are we about to witness the same in 2023?

Let’s walk through the current scenario:

- Demand for nuclear energy and plans for capacity expansion has only grown.

- The world Uranium requirements are projected to increase from about 165 to (conservatively) 200 million pounds per year until 2030.

- Physical funds like Sprott Physical Uranium Trus and Zuri Invest in Switzerland, indicating interest in the uranium market, are triggers to push the spot market upwards.

- Increasing competition for uranium pounds among financial entities, physical funds, and utilities did not exist prior to this cycle.

- Division between Western and Eastern markets in the uranium industry.

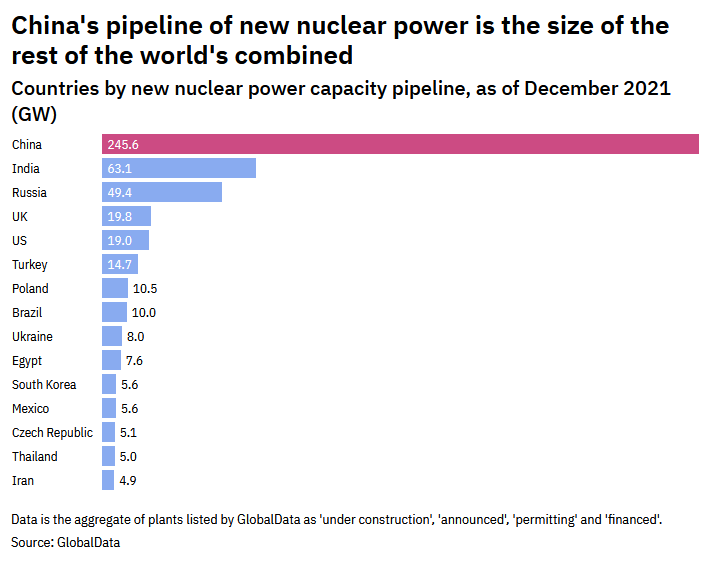

It may be France’s slight change of heart in slowing down their nuclear new builds (they’ve just greenlighted 14 new reactors), or China’s ultra-hungry nuclear program, or India’s and Poland’s contracts, or maybe it’s something else. This is an OLD 18 month pipeline graph for your own entertainment and judgment:

The increase in demand forecasts from the current 165 million lbs to (probably over) 200, does not, we repeat, does not, include the spanking-new tech found in SMR (small modular reactors) – whose first designs are starting to get approval from governments worldwide.

In an ideal world, this fresh demand would be met by increasing production from miners, however, there are very few producers of uranium in the world, and their order books are filling up quickly, as you can see here and here.

Maybe the most immediate factor to move the needle, the new Swiss Zuri Invest fund is raising approximately $100m in order to buy physical pounds in the spot market, and the fund will be able to start buying as early as early June. The Zuri Invest fund plans to buy uranium in the front month settlement and adjust their bids if needed to ensure purchases. The fund aims to provide a trading vehicle that consistently operates at net asset value (NAV), offering investors exposure to uranium without extreme discounts or premiums seen in other funds like Sprott’s.

While they don’t plan to initially take pounds off the market, there might be a possibility of selling uranium in the future.

On a recent webinar, TradeTech’s President, Treva Klingbiel, let slip that rumour has it another FOUR financial players are sitting on the sidelines and prepping to launch their own investing vehicles to get into the uranium spot market.

With the thin physical market, the increasing number of physical funds not surprisingly raises the potential for competition for uranium pounds.

It’s important to highlight that the uranium market is currently at an inflection point after years of dealing with an oversupply from previous decades. We should also consider the term contracting cycle and its potential impact on the spot price, drawing parallels to previous bull markets.

By the way, the term contracting cycle refers to the process of utilities entering into long-term contracts with uranium producers to secure a stable supply of uranium for their nuclear reactors. These contracts typically have a duration of several years. Last year, over 100 million pounds were contracted. This year we have already hit 99 million pounds – and we’re not even on month six!

Let’s also consider the term market and its impact on the spot price during previous bull cycles. In the past, significant term contracting activity in 2005, 2006, and 2007 led to a jump in the spot price, which continued to rise over a period of two-plus years.

On that topic, and to help tighten the market forecasts even further, both US House and Senate committees voted to bar the import of Russian uranium, as reported by Bloomberg on the 17th.

The cherry on the cake is the separation between Western and Eastern markets in the uranium industry. Utilities in the United States and the European Union have voluntarily refrained from entering into new contracts with Russia while still depending on deliveries from existing contracts. This self-sanctioning by utilities has resulted in a clear division within the industry.

To navigate the shipping route for uranium from Russia, alternative paths through Azerbaijan and Georgia are being used to bypass Ukraine and Russia.

We also see a shift in the delivery of pounds from Kazakhstan, with a growing emphasis on supplying the East, particularly through large contracts with China.

The structural deficit in the market suggests that supply shortages are expected to persist.

While Germany has shut down its nuclear reactors, the results have shown eye-watering high energy costs and a carbon-intensive grid. So despite the challenges, overall sentiment towards nuclear energy seems to be improving. There are signs of increasing support for nuclear energy, with more people and countries recognizing its reliability and cleanliness. Diablo Canyon’s extension is an example where opinions have shifted, even in politically left-leaning areas like California. France’s back-to-the-roots move as well, Japan switching on their reactors after a decade post-Fukushima disaster. On and on we see signs that this is a monumental, possibly generation shift towards a cleaner, pro-nuclear present and future.

Investors who have been very impatient are seeing, for the first time in a long time, the spot price move to $54.60, after not being able to break $52 for what seemed like an eternity. As spot price makes a move, the next expected move would be for the equities to reflect this new demand.

There has never been a more telegraphed fundamental move in this asset, with demand steadily increasing and no larger mines coming into production.

The previous spot price all-time-high is an inflation adjusted $200.

Staying in the trade is pure and simple, a reflection of the investor or speculator’s staying power.

Some Interesting Uranium Explorers

Standard Uranium Ltd. (STND.V) is a mining company focused on the exploration and development of uranium resources. Their flagship property, the Davidson River project, is located in the coveted southwest Athabasca uranium district of the Athabasca Basin. The basin is renowned for its high-grade U3O8 resources, with concentrations often 10-100 times higher than in other regions. The Athabasca Basin has been a hotspot for uranium mining, with numerous successful explorations by companies like Cameco. The Davidson River project is particularly promising because it appears to be on the same structural trend that hosts other high-grade discoveries in the region.

Standard Uranium has diligently conducted drilling operations in the four main areas of the Davidson River project, inching ever closer to a major discovery. Through rigorous geophysics and subsequent drilling, they’ve identified graphitic-sulphidic structures in the basement rock – a crucial ingredient for potential high-grade uranium deposits. However, these deposits can often be difficult to locate due to their potentially small footprint or deep location. Yet, this challenge doesn’t deter the company; they are fully committed to the ‘big risk, big reward’ model of exploration.

The company also holds 100% ownership of the Sun Dog project to the northwest of the basin, and will be drilling their Atlantic and Canary projects to the east for the first time in the spring. After these explorations, they plan to return to Davidson River for additional drilling in the summer and fall. To aid their exploratory efforts, they have brought in Goldspot Discoveries and their machine learning technology, a move that adds a promising edge to their operations.

Standard Uranium is also undertaking a non-brokered private placement to raise up to $2,000,000. This will be accomplished through the issuance of non-flow-through units (NFT Units) and charity flow-through units (FT Units). The proceeds raised from this offering will primarily be used for the exploration of the Company’s projects and for working capital purposes, with no proposed payments to non-arms-length parties or for investor relations activities.

Despite the challenges and risks associated with uranium exploration, there’s strong potential for significant returns. With a market cap of just $5.45 million CAD and a share price of $0.03, the company’s stocks could potentially skyrocket in the event of a major high-grade uranium discovery. If such a discovery is made, the subsequent demand from interested parties could trigger a bidding war that could rapidly drive up the company’s market valuation.

Skyharbour Resources Ltd. (SYH.V), a key player in uranium exploration, is steadily expanding its footprint in the uranium-rich Athabasca Basin. With the uranium market poised for an upturn, Skyharbour is well-positioned to benefit from the rising demand for nuclear power. The company boasts an impressive portfolio of eighteen uranium exploration projects spread over 460,000 hectares of mineral claims, making it a formidable contender in the uranium mining sector.

One of the company’s most notable projects is the Moore Uranium Project, which has shown high-grade uranium mineralization in the Main Maverick Zone and significant potential for discovery along the 4.7-kilometer Maverick structural corridor. To date, the project has seen over $45 million invested and over 150,000 meters of diamond drilling in more than 390 drill holes. In 2016, Skyharbour secured an option from Denison Mines to acquire this project and has since met its earn-in requirements.

In addition to the Moore Uranium Project, Skyharbour has also optioned the Russell Lake Uranium Project from Rio Tinto, located nearby, further expanding its exploration potential. The company has established joint ventures with several industry leaders, such as Orano Canada at the Preston Project and Azincourt Energy at the East Preston Project. These partnerships allow Skyharbour to leverage the resources and expertise of its partners while retaining a significant interest in these uranium exploration projects.

Moreover, Skyharbour has a wide range of exploration projects in the Athabasca Basin, ten of which are drill-ready, spread over a whopping 504,356 hectares. Its extensive portfolio includes the Moore Uranium Project, the Russell Lake Uranium Project, and strategic joint ventures with companies like Orano Canada Inc. and Azincourt Energy. The company has also signed option agreements with partners for over $34 million in partner-funded exploration expenditures, along with significant stock and cash payments.

The company has recently received an aggregate CAD $1,551,456.50 from the exercise of share purchase warrants with a strike price at $0.22 since April 1st, 2023. A total of 7,052,075 warrants have been exercised, with the batch of warrants expiring on May 1st, 2023. The overarching goal of Skyharbour is to maximize shareholder value through new mineral discoveries, committed partnerships, and the progression of exploration projects in geopolitically favourable jurisdictions.

Azincourt Energy (AAZ.V) is a Canadian-based exploration and development company with a primary focus on the alternative fuels and energy sector. The company’s core projects are centered on clean energy, conducting uranium exploration projects in the prolific Athabasca Basin, Saskatchewan, Canada, and lithium/uranium projects on the Picotani Plateau, Peru. Azincourt’s flagship ventures include the East Preston Uranium Project, which is developed in collaboration with Skyharbour Resources and Clean Commodities Corp., and the Escalera Group lithium/uranium project in Peru.

Recently, Azincourt announced the successful completion of the 2023 exploration program at the East Preston Uranium Project. Initiated on February 2nd, 2023, the exploration covered 3,066 meters in 13 drill holes, with drilling concentrated on the G, K, H, and Q zones. The program’s main aim was to evaluate the alteration zones and elevated uranium identified in 2022, specifically within the G, K, H, and Q Zones. With extensive hydrothermal alteration and cross-cutting structures being found, along with elevated radioactivity, the results of the exploration are considered significant.

In addition to the East Preston Project, Azincourt has a majority interest in the Hatchet Lake Uranium project, which spans over 13,711 hectares and is located in the underexplored northeast extension of the Western Wollaston Domain within the Wollaston-Mudjatik Transition Zone. This corridor is renowned for hosting most of Canada’s high-grade uranium deposits and all of its operating uranium mines.

Azincourt’s President and CEO, Alex Klenman, expressed satisfaction with the results of the exploration program, remarking on the discovery of hematite alteration and intersecting dravite and other clays as a positive development. The company is eagerly awaiting the lab results of the 687 samples collected throughout the program. With these recent developments, Azincourt is propelling its growth in the alternative fuels and energy sector, leveraging its resource-rich projects in Canada and Peru.

*Full disclosure: Standard Uranium, Skyharbour Resources and Azincourt Energy are Equity Guru marketing clients.

Leave a Reply