We first wrote about NNO (NNO.V) on March 8, 2016, when the stock was trading at .31.

Since then we’ve written about 29 more articles, including: locking down IP, partnering, CEO podcasts, collaborators, wealth creation, innovation, Chinese delegation, technology moats etc.

NNO is now trading at $1.76 – a 460% gain since we wrote the first article.

According to Investopedia, The Valley of Death “refers to the period of time from when a start-up firm receives an initial capital – to when it begins generating revenues.”

We’ve been tracking NNO as it has walked through this treacherous valley – famous for dissolving dreams (and money) in acid.

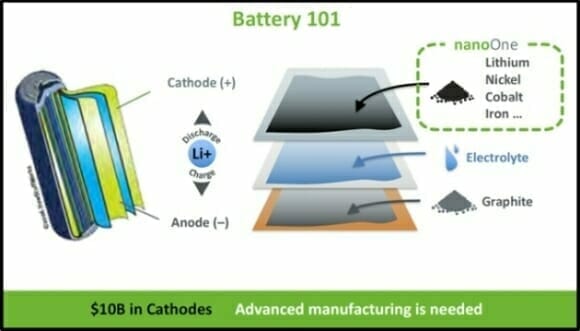

NNO has developed proprietary technology to build a better and cheaper battery. NNO’s scaled process can make cathode materials using the cheaper lithium carbonate in place of the more expensive lithium hydroxide.

It’s like having a patent for tastier, cheaper, easier-to-cook flour – and then receiving a royalty from every loaf of bread baked with that flour.

It could be a game changer.

We are not the only people who think so.

The Chairman of the Board is Paul Matysek – responsible for an astonishing $2 billion in corporate enterprise growth. Matysek owns a bit of NNO stock.

The Canadian government also cut NNO a cheque for $4.6 million.

On June 15, 2018, we toured the Nano One facility – firing questions at CEO Dan Blondal which he gamely answered.

These short videos will get you inside the belly of this battery-tech beast.

Editor’s note: NNO is operating a working pilot factory – so the audio is occasionally compromised by whirring machinery.

Q: Who paid for the pilot plant?

Q: What happens inside the reactors?

Q: How wide is the application of your battery technology?

Q: What is “vertically integrated patent protection”?

Q: How do you test your product for real-world conditions?

Q: What conversations are you having with battery manufacturers?

Q: What is the Blue-Sky story for Nano One?

After a 460% stock price run – we typically advise our readers to take some money off the table.

That’s not happening with Nano One.

Why?

Because we think NNO is emerging out of the valley, into the sunshine.

Investing in Monster Beverage (MNST.NASDAQ), Tesla (TSLA.NASDAQ) or Lululemon (LULU.NASDAQ) as this pre-commercialisation stage would have produced returns-to-date of 900%, 2100% and 3200% respectively.

Full Disclosure: Nano One in an Equity Guru Marketing client. We also own stock.

Leave a Reply