The market has kinda shrugged at it, but The Green Organic Dutchman (TGOD.T) put out news yesterday they’re acquiring a significant European organic CBD oil brand, with associated licensed flower and seed production, consumer product lines, and multi-country distribution.

It’s not a cheap deal, but they’re not buying a pipe dream. They’re buying legit players.

Transaction highlights:

- Acquisition cost of $7.75-million (U.S.) in cash and 1,968,323 restricted Green Organic Dutchman shares currently worth $7.75-million (U.S.) (about $20.4-million combined) with an additional $10.3-million (U.S.) ($13.5-million) cash investment for rapid European expansion;

- Additional performance based incentives of up to $12-million (U.S.) ($15.8-million) for delivery of $32-million (U.S.) ($42.1-million) of earnings before interest, taxes, depreciation and amortization in fiscal 2021;

- European gateway with distribution channels to over 750 million people and sales in over 700 locations across 13 countries;

- Premier selling CBD oil brand Cannabigold, a recognized leader in the European Union;

- 32,000 kilograms of dried flower production from 1,250 acres of cultivation;

- Leading innovative organic brand with diverse, novel product offerings and unique intellectual property.

Ladies and gentlemen, if you liked what Aurora Cannabis (ACB.T) got when it bought Hempco (HEMP.V), this is TGOD’s Hempco.

Hell, this is Hempco this time next year, because HemPoland, the company in question, has actual currently selling products under their own label.

Recent law changes in Canada have made hemp suddenly a much more attractive option for many growers, eager to fill their million square feet grow facilities with something less finicky than straight cannabis. Upcoming changes will likely make outdoor hemp production and full plant processing and consumer product selling more attractive still.

That’s why Aurora went out and got Hempco, even though the company hasn’t been a money machine to date. What they do have is people, facilities, contracted growers, technology, and the ability to scale all of the above. Hell, I have it on good authority that management at Hempco invested in some processing machinery some time ago that wasn’t legal to use under the old rules, because they saw these changes coming and wanted to be ready on day one.

Smart.

But HemPoland is a carbon copy of what Hempco has been doing – only, as a European version.

That brings about advantages a Canadian based hemp solution would struggle to match, namely:

Local distributors

- Austria

- Germany

- Netherlands

- Switzerland

- Czech Republic

- Portugal

- Slovenia

- UK

- Ireland

- Italy

- Estonia

- Lithuania

HemPoland was the first state licensed grower in Poland, and uses that license to do a lot. They have some 600 hectares of hemp currently being grown, largely by third party farmers who make use of the company’s license to grow for them.

In this way, HemPoland can focus on processing, product development, and distribution, which is where the real money is.

And they’ve done well at that.

HemPoland is one of the few companies in the world, let alone Europe, that can extract oil using ‘Supercritical CO2 extraction’ techniques.

These are becoming more and more important as CBD products go from ‘guy cooking with butane in garage and trying not to die in a fire’ to ‘company squeezing drops out of weedstock using CO2‘ to ‘multi-national producing organic pharma products without a trace of extra crap’.

Supercritical CO2 extraction (a type of SFE – supercritical fluid extraction) is an innovative technology referred to as “green chemistry”, as it allows for extraction without the use of any potentially harmful chemicals. The unique parameters of the supercritical state ( so-called “fourth physical state”) make it possible to extract the desired ingredients only, without risking contaminating the extractant. This quality is crucial as hemp is known to easily accumulate from the soil heavy metals and other harmful compounds. Unlike other, simpler techniques supercritical CO2 extraction guarantees that the final product is absolutely pure and safe.

Butane is for pussies.

In 2017, the company produced over 32,000 kg of organic dried flower and 310 kg of organic CBD oils.

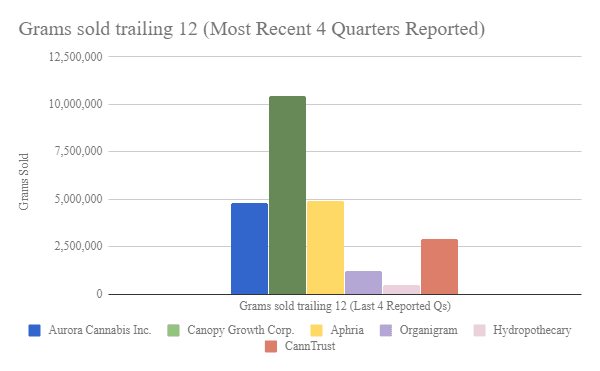

To attempt a clumsy comparison, Canopy Growth Corp (WEED.T), the Canadian leader in grams sold, did 10,400 kg of cannabis flower sales over the last 12 months.

Obviously commercial hemp and cannabis (I know, enthusiasts, hemp is actually a variety of cannabis but let’s keep this simple for the sake of ease of explanation) are not the same product, but in terms of gauging how big this company is, just saying they have 60 employees and sales in 13 countries doesn’t cut it.

They grew 32,000,000 grams of hemp last year.

Here’s what Canada’s LPs did.

THE SUB-PLOT: THERE’S VALUE IN WHAT ISN’T THERE YET

If TGOD has paid a decent wedge to buy a Euro-leading grow/extraction/production facility, I don’t mind that at all, considering they recently raised money to do just that and have a vault load more to spend in future, but there are two things in their announcement that stand out to me, not for what they’re saying, but for what they’re alluding to.

In addition, there is contingent consideration of up to 3,047,722 shares of Green Organic Dutchman currently worth $12-million (U.S.) ($15.8-million) based on delivery of $32-million (U.S.) ($42.1-million) EBITDA in the 2021 fiscal year.

Now, nobody puts anything in an agreement like this that they don’t expect to need. Clearly, HemPoland thinks they’re going to make serious wads of cash in the near future, and wants to be properly paid when that happens. On TGOD’s side, they’re happy to pay for the sort of excellence they’re asking you to invest in.

Then there’s this:

Brian Athaide, chief executive officer of Green Organic Dutchman [said a key component of the deal is], “Gaining market share with CBD products now, in the EU, with over 700 locations, [which] allows TGOD to establish immediate brand awareness across all verticals including infused beverages.”

Note: He didn’t say ‘including pills and bread and vitamin supplements and lotions and sex lubes and ice cream and gummies’, he specifically pointed out INFUSED BEVERAGES.

We’re still watching the dust settle on Canopy Growth’s big Constellation Brands (STZ.NYSE) investment from last week, which gives that company some $5b to go buy, well, anything it wants.

Constellation’s interest is specifically in the infused beverage market. Molson Coors (TPX.B) announced a bullshit deal that doesn’t specify anyone doing anything with Hydropothecary (HEXO.T), while Heineken (HEINY.OTC) bought Lagunitas which is toying with weed water.

Someone’s going to do a deal with Red Bull at some point, bois, and Monster will follow and Budweiser won’t be far behind and Oceanspray will have it rolling with cranberries before too long. Getting your beverage shit together is more important now than it has ever been, because the drink market contains ‘the rest of the human population that doesn’t smoke’ as a demographic, and that’s a pretty thick demo.

I’ll leave you with this, which I think lays it out nicely.

- Aurora bought Hempco to lock down the hemp market that hadn’t yet really evolved yet, legally, until a few days ago.

- TGOD bought HemPoland to lock down the other side of the world’s hemp market.

- Aurora owns a chunk of TGOD

As of yesterday, the Aurora/TGOD pairing dominates hemp, everywhere, period.

Feels to me like that deserves a spot on your watchlist.

— Chris Parry

FULL DISCLOSURE: TGOD is an Equity.Guru marketing client.

Leave a Reply