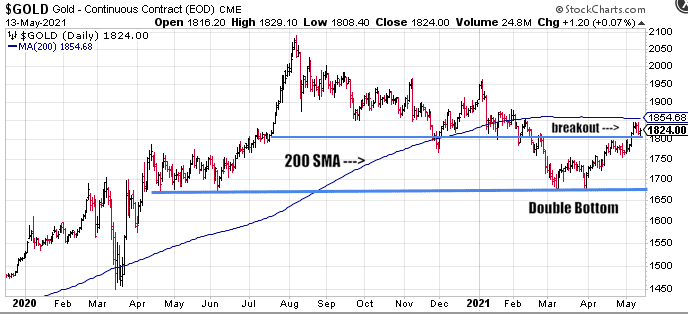

Having busted through stubborn resistance at $1800 last week (a hard-fought 10-week high) and after bookending the month of March with a Double Bottom, Gold is holding on to its gains, settling in above that critical $1,800 line.

The next stop for the precious metal is the 200 SMA at roughly $1854. Once that level falls, $1900 should surrender with little to say.

Last Friday’s jobs number registered the second biggest miss in the report’s history—266,000 vs analysts’ estimates of 990,000 (some economists’ were expecting to see more than 2 million jobs created). This dramatic miss buoyed the precious metal as it removes the threat of the Fed tapering anytime soon.

Experts are worried that sidelined cash from the trillions in (unprecedented) stimulus will come into play creating an inflation scenario that could get outta hand.

Last month the U.S. Labor Department reported a 0.6% rise in its U.S. Consumer Price Index (CPI) for March. That followed a 0.4% rise in February. Consensus forecasts anticipated a 0.5% pop.

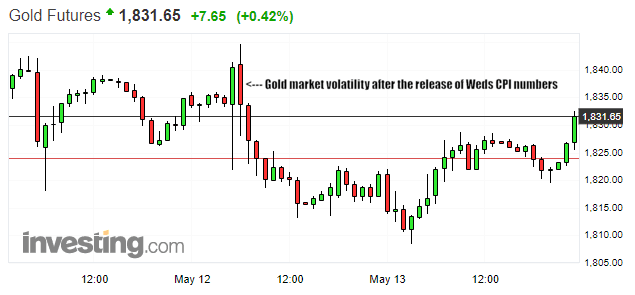

This past Wednesday (May 12th), the report showed Consumer prices rising 4.2% over the 12 months ending in April. This blew away analyst expectations.

Quoting Forbes…

“Overall prices rose 0.8% from March—far higher than the 0.2% economists were expecting, while the core price index, which excludes volatile energy and food prices, rose 3% over the last year—nearly twice the 1.6% figure from March.”

This ranks as the highest annualized reading since the 4.9% pop in the summer of 2008.

The Fed is in the mother of all binds here. It can’t pull the trigger on higher rates (its only real defense against raging inflation). To do so would kill whatever momentum the U.S. economy can muster.

Rising inflation and low interest rates almost guarantee real rates will remain deep in negative territory for the foreseeable future.

It would appear that no matter what the Fed does, it’ll be behind the (inflation) curve.

Wednesday’s CPI numbers should have pushed Gold solidy higher, and they did, for a few minutes anyway…

Despite the lack of follow-through to the upside over the past two sessions, Gold should be a no-brainer in this environment.

Gold Mountain (GMTN.V)

If you are looking for exposure to the precious metal and can appreciate the risk/reward dynamics of the junior exploration arena, Gold Mountain is a compelling speculation—a near-term production scenario boasting a (growing) high-grade resource and significant exploration upside.

Earlier this morning, the Company dropped the following headline:

Gold Mountain Updates Mineral Resource Estimate at the Elk Gold Property

Here, following a successful Phase-1 drilling campaign, the Company tabled a resource update for its flagship Elk Gold Project located in the mining-friendly region of Merrit B.C.

Highlights:

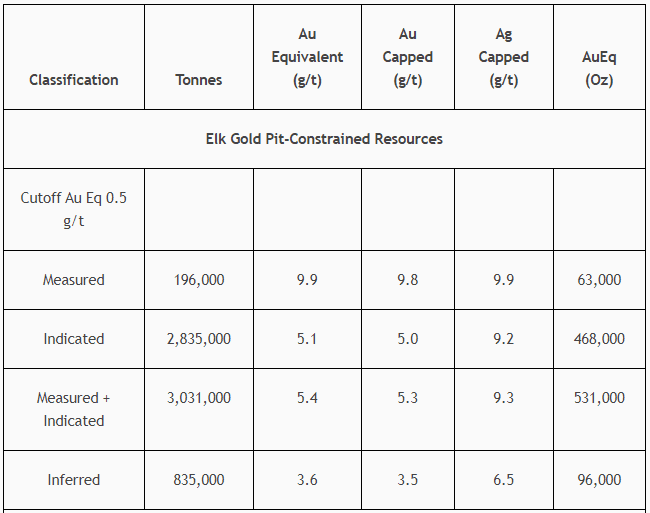

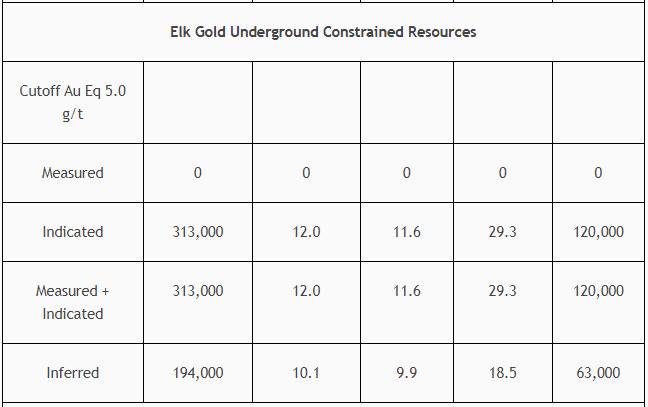

- Gold Mountain increases its resource estimate at its flagship Elk Gold Project to 651,000 oz of Measured & Indicated Resources at 6.1 g/t Au and 159,000 oz of Inferred resource at 4.8 g/t Au.

- The updated resource estimate represents an increase of 43% of Measured and Indicated ounces and 67% of inferred ounces.

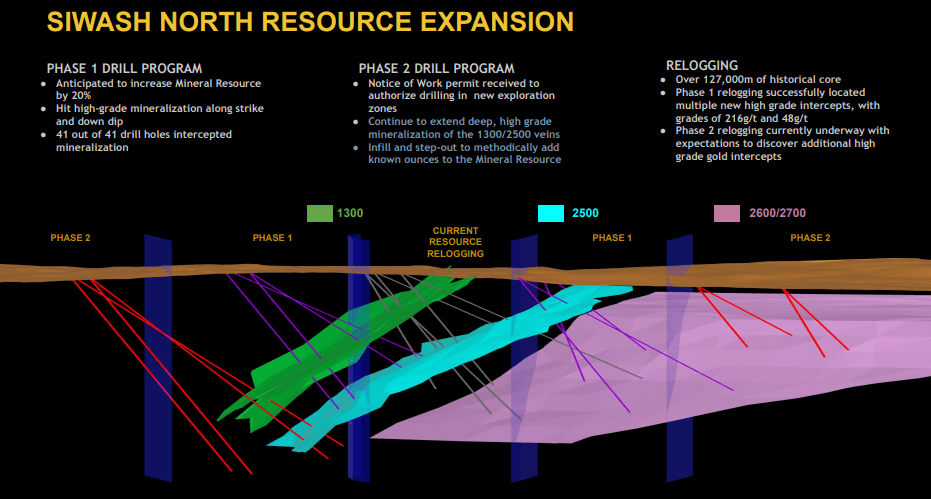

- This update to the mineral resources followed the Company’s successful $1,900,000 Phase 1 drill program that consisted of 8,739 meters of diamond drilling where all 41 holes hit mineralization.

The following table summarizes the Elk Projects total resource:

Note that this resource is divided into two categories, a Pit-Constrained component, and an Underground-Constrained component.

As summarized above, the 41 holes drilled in this Phase-1 campaign succeeded in converting Inferred ounces to the higher confidence resource categories, as well as broadening the global ounce-count.

Another contributing factor to the success of this resource update was a re-logging campaign of historic drill core—the discovery of significant mineralized intervals missed by previous operators.

All in, Phase-1 drilling cost the Company $1.9M. Simple math shows a discovery cost of $7.50 per oz. This nominal cost-per-ounce was rendered possible by a 100% hit rate—all 41 holes in the Phase-1 campaign hit their mark.

The Phase-1 drill program was focused on pushing out the perimeter of the mineralized envelope, targeting the Inferred areas, extending the near-surface veins 400 meters along strike and 175 meters downdip.

The cutting-edge software the Company is using—LEAPFROG—enables them to create a dynamic geological model, one that’s far more comprehensive (and predictive) than the older vein wireframes the previous resource estimate was based on.

To re-log the historic core—over 127,000 meters worth—high-tech tools like the handheld XRF scanner were deployed allowing these geological sleuths to home in on the high-grade intervals missed by previous operators.

In digitizing this historic data and developing a dynamic geological model, the Company was better able to target mineralization. This also enabled them to connect the dots with the more recent intervals tagged in the Phase-1 campaign, establishing continuity, and ultimately growing the ounce-count we have today.

Bottom line: the Company’s use of the latest software and technology—the application of ‘good science’—has been highly productive… and rewarding.

The Company is on a roll.

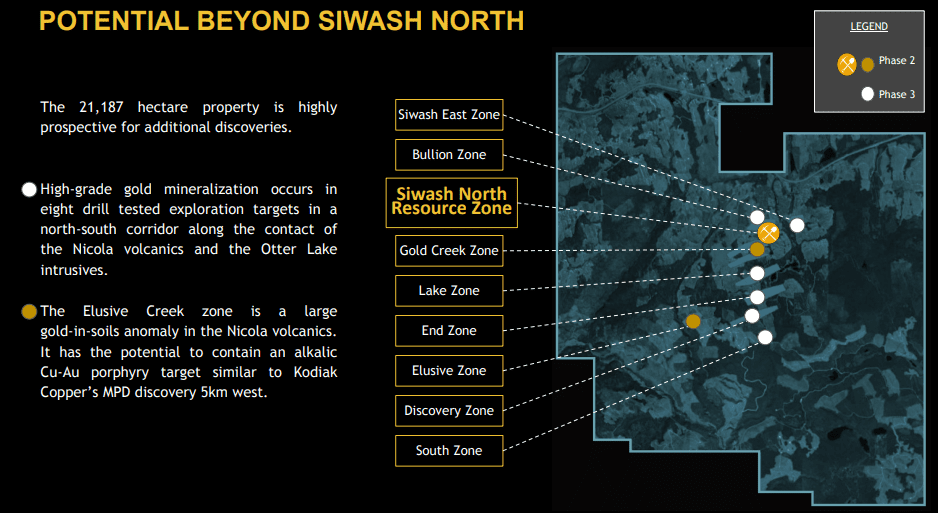

With bolstered confidence, the Gold Mountain crew has set out to probe deeper, and further out across this 16,716-hectare property.

An aggressive Phase-2 10,000-meter campaign is about to kick off in earnest. Crews will be mobilized to the project next week. The drill rig will be turning by month’s end.

This Phase-2 campaign will follow up on the success attained in Phase-1, chasing high-grade vein extensions at depth.

Mineralization encountered during Phase-1 drilling included:

- SND20-029 intercepted 1.42 meters averaging 37.00 g/t Au (including 0.42 meters averaging 124.00 g/t Au);

- SND20-032 intercepted 1.22 meters averaging 16.23 g/t Au (including 0.30 meters averaging 62.20 g/t Au);

- SND20-032 intercepted 1.30 meters averaging 7.95 g/t Au (including 0.30 meters averaging 31.30 g/t Au);

- SND20-033 intercepted 1.3 meters averaging 13.3 g/t Au (including 0.30 meters averaging 56.5 g/t Au);

- SND20-033 intercepted 1.3 meters averaging 4.5 g/t Au (including 0.30 meters averaging 19.2 g/t Au).

If they continue hitting these high grades downdip, the ounces will pile up fast, setting the stage for a resource north of one million ounces.

The following slide is a very good representation of Elk’s subsurface stratum. Note the intended collars for the Phase-2 campaign.

The Company anticipates hitting these vein extensions at roughly 250 to 300 meters depth (drilling success downdip will augment the underground component of the resource base).

“In Phase 1 of Gold Mountain’s drill program, the Company focused on the Siwash North Zone with predictable, step out and infill drilling to methodically add ounces to the resource. The Company hit significant mineralized intercepts in 100% of the 41 drill holes completed at the Siwash North Zone, including high-grade mineralization in the zone dubbed the “Mother Shoot” with grades reaching 124 g/t.”

Regarding the high-grade zones mined by previous operators—zones like the Mother Shoot (economically important to the historic operation)—I pulled the following from my April 14th piece titled Gold Mountain (GMTN.V) tags high-grade gold at flagship Elk Gold Project near mining-friendly Merritt, B.C.

The Mother Shoot zone

In 1992, previous operators mined a 2,040-tonne bulk sample from a zone along the 1300 vein called the Mother Shoot—a zone that averaged a hefty 97g/t Au, a portion of which carried a grade of 137 g/t Au.

This current deep drilling phase was designed to tap the latent potential of this high-grade zone. Having tagged a weighty 1.42m averaging 37.00 g/t Au (including 0.42m averaging 124.00 g/t Au), the test was a resounding success—Mother Shoot’s bonanza grades could add a whole new gear to the current mine plan.

“The initial assay results support the Company’s theory that the Mother Shoot zone extends at depth and maintains its high grade under the resource constraining pit-shell.”

The Company will also focus on Elk’s regional potential.

The Elusive Zone, located approximately 4 kilometers from the Siwash North Zone, will receive a proper probe with the drill bit. Here, historic high-grade soil samples defined an anomaly that could represent a whole new geological setting.

The Company is also accelerating its (historic drill core) re-logging campaign due to the success realized in Phase-1.

“Given the past success of the Phase 1 re-logging of historical core, which unveiled undocumented core samples as high as 216 g/t, Gold Mountain plans to continue to relog and resample core from previous operators in areas identified as high-interest to the Company.”

To date, two new undocumented veins were unveiled—mineralization missed by previous operators:

- 1.2 meters averaging 52.3 g/t Au (including 0.30m averaging 216 g/t Au);

- 0.2 meters averaging 47.8 g/t Au.

The prospect of tagging new zones of mineralization, without mobilizing a drill rig, is an intriguing feature of this play.

As I suggested earlier, 10,000 meters is an aggressive campaign. The Company wants to see this resource pushed well past the one million ounce-count.

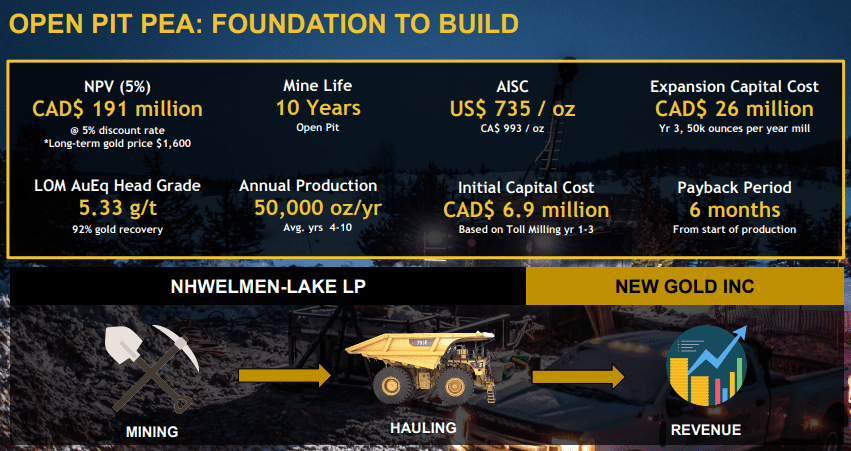

Though the resource may appear modest at first glance, it’s important to understand that these are high-grade, high-quality, and high cash flow ounces.

For a deeper delve into the unique fundamentals underpinning this near-term producer, the following link should bring you up to speed…

This next slide is a snapshot of Elk’s underlying economics as per a September 2020 PEA. Note the $6.9M CapEx and 6-month payback period (high cash flow oz’s, these)…

Final thought

Wrapping up this piece, taking a look at the Gold market in overseas trade—$1838, up nearly $14.00—I suspect that by years end, with the prospect of higher inflation and all the havoc it may wreak, volatility will hath made its masterpiece.

*** notes

- CIM definitions were followed for classification of Mineral Resources.

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- Results are presented in-situ and undiluted.

- Mineral resources are reported at a cut-off grade of 0.3 g/t Au for pit-constrained resources and 3.0 g/t for underground resources.

- The number of tonnes and metal ounces are rounded to the nearest thousand.

- The Resource Estimate includes both gold and silver assays. The formula used to combine the metals is:

- AuEq = ((Au_Cap*55.81*0.96) + (Ag_Cap*0.76*0.86))/(55.81*0.96)

- The Resource Estimate is effective as of May 1, 2021.

END

—Greg Nolan

Full disclosure: Gold Mountain is an Equity Guru marketing client. We own the stock.

Leave a Reply