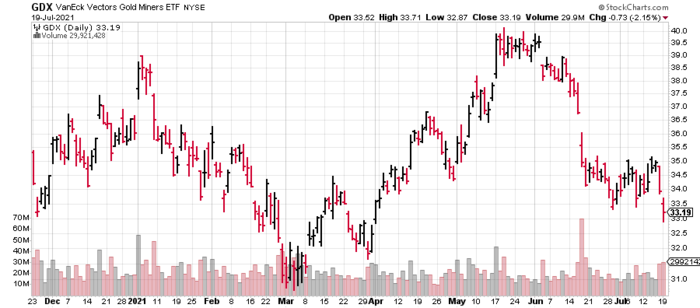

The correction in the resource arena has turned downright nasty in recent sessions. Even the highest quality entities are catching what for, despite the strength in the underlying metal.

This divergence—the metal trading flat to firm versus the shares down hard—is a real anomaly, a real head-scratcher.

For those with sidelined funds looking to enter this wild west of a sector, current valuations represent an opportunity (IMO), especially for those with a long-term bias.

Globex Mining (GMX.V) stands out as one of those high-quality entities referred to above.

- 55.09 million shares outstanding

- $61.15M market cap based on its recent $1.11 close

The Company is expertly helmed by one Jack Stoch, a well-connected industry veteran with a complementary combination of technical expertise and capital market savvy. Interestingly, Stoch was once hailed as THE largest (private) mineral rights holder in the province of Quebec.

Globex has been around for quite some time. Its share structure—never once rolled back since Stoch picked up the reins in 1983—currently stands at just over 55 million o/s (57.8 million f/d).

While some companies blow out their share structure within the first few months of operating as a publicly traded entity, Stoch has remained fiercely protective of Globex’s share count over the decades.

This is a remarkable feat for such a capital-intensive arena.

There’s another alignment of values here—management controls 11.6% of the outstanding common.

If you examine Stoch’s deals, you’ll note that they very often include an upfront component of cash and marketable securities. This is how he keeps the share count low and the company coffers chock-full.

Globex is best characterized as a project bank and incubator

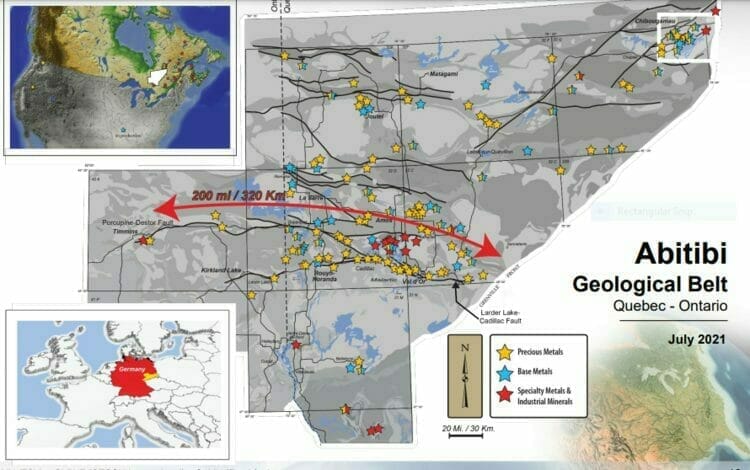

The Company’s operating model involves scouring the landscape along well-established mining camps—the prolific Abitibi Greenstone Belt of Ontario and Quebec for i.e.—acquiring strategically positioned properties on favorable terms, advancing the newly-acquired projects through the application of good science and intellectual input, and then monetizing the asset while retaining a significant royalty interest.

It’s a great game plan, but the key is in the execution.

The Globex project portfolio currently consists of 195 properties, 97 of which are prospective for precious metals, 61 for base metals, and 37 for specialty metals. These numbers are moving targets as there always seems to be a new deal in the works.

Seventy-nine of these properties carry underlying royalties in favor of Globex—4 are active options (cash/share payments, exploration commitments, Gross Metal Royalties). Fifty-four of these properties hold historic or 43-101 compliant resources—40 host past-producing mines.

The past 12 months have been extremely active on the project-monetization / deal-making front for Globex…

- July 21, 2020 – Globex Sells 91 Claims South of the Troilus Gold Mine and Other Updates

- August 10, 2020 – Globex Sells Three Properties to Starr Peak Exploration

- August 25, 2020 – Globex Mining Enterprises Closes Two More Property Deals

- September 22, 2020 – Globex Receives Option Renewal Payments From Excellon

- March 11, 2021 – Globex Agrees to Sell Two Royalties for $13 million Cash and a Significant Equity Stake in Electric Royalties

- March 31, 2021 – Globex: Payments Received, Projects Sold with Retained Gross Metal Royalties

- May 26, 2021 – Globex: Update on Zinc Royalty Sale

- June 9, 2021 – Globex Vends McNeely Lithium Property

- June 14, 2021 – Globex to Sell Francoeur/Arntfield/Lac Fortune Gold Property to Yamana Gold Inc. for +$15 Million

- June 22, 2021 – Globex Completes Sale of Francoeur/Arntfield/Lac Fortune Gold Property to Yamana Gold Inc. for $15 Million

- July 12, 2021 – Globex Sells Tarmac Gold Property to Wesdome

Guru’s Lukas Kane covered the Wesdome deal last week in a piece titled Globex Mining (GMX.T) sells Tarmac Gold Property to Wesdome (WDO.T) after 41.2 grams/tonne gold over 51.1 metres hit at the Kiena Mine Complex

This is how things get done at Globex Central.

This is an extraordinary enterprise model in a sector notorious for its capacity to siphon capital.

Another, more recent deal with an upfront cash/share component…

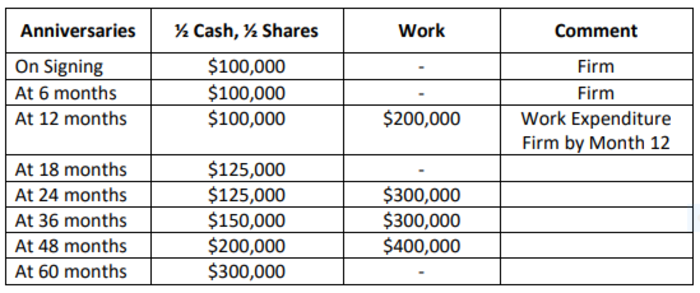

July 19, 2021 – Globex Options Former Eagle Gold Mine

Globex has optioned out its 77-hectare, Eagle Gold Mine Property to Maple Gold Mines Ltd. The Eagle project is located in the Joutel township of mining-friendly Quebec (Quebec is currently ranked #6 on Fraser’s Top Ten list).

Maple has the option to acquire the project for $1,200,000—half in cash and half in shares—over a 5-year period.

Maple will also be required to spend $1,200,000 on exploration over 4 years in order to earn its 100% interest. The terms of the option are as follows:

Importantly, Globex will retain a 2.5% Gross Metal Royalty (GMR) of which 1% may be purchased by Maple for a cool $1,500,000 prior to achieving commercial production.

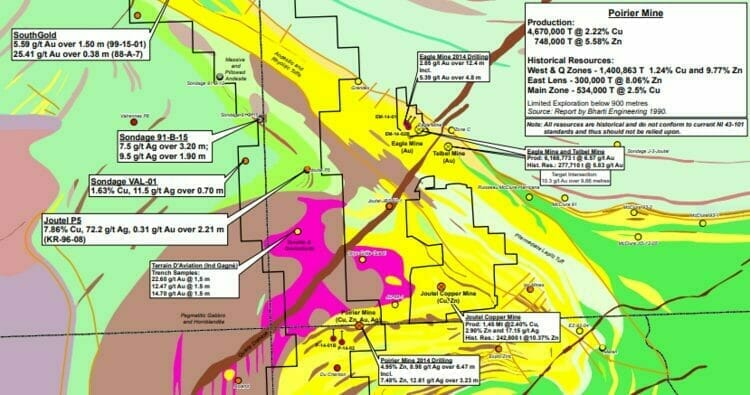

“The Eagle Gold Mine adjoins the historic Telbel Gold Mine which together are reported to have produced 6,168,773 t grading 6.57 g/t Au. Historical resources at the Eagle Mine property are estimated at 277,710 t grading 5.83 g/t Au (Source: SIGÉOM –Cogite number: 32E/08-0005).

Globex continues to hold a large package of claims in Joutel and adjoining Valrennes townships including the historic copper/zinc Poirier Mine which has reported production of 4,670,000 T grading 2.22% Cu and 748,000 T grading 5.58% Zn. A historical resource of 1,400,863 T grading 1.24% Cu and 9.77% Zn in the West and Q Zones, 300,000 T grading 8.05% Zn in the East lens and 534,000 T grading 2.5% Cu in the Main Zone are reported in a 1990 report by Bharti Engineering Associates Inc.”

Nice Cu grades (editor’s note)

“In addition, Globex owns the Joutel Copper Mine which produced 1,167,000 t grading 2.16% Cu between 1967 and 1975 and 372,400 t grading 8.88% Zn from 1972 and 1975 (Source: Dubé, 1993 – ET-90-12). In 1994, Aur Resources Inc. estimated a historic resource of 242,800 t grading 10.37% Zn (Source: Martin and Britt, 1994 – internal report, project # 16706). Globex also owns the Eagle Northwest property consisting of 11 kilometres of the Eagle /Telbel gold localizing horizon extending northwest from just beyond the Eagle Mine, and the historic Gagné mineralized area, located south of the Eagle Northwest property, where trench samples are reported to have returned 0.79 oz./t Au over 5 feet (27.09 g/t Au over 1.52 m), 0.44 oz./t Au over 5 feet (15.09 g/t Au over 1.52 m) and 0.52 oz./t Au over 5 feet (15.09 g/t Au over 1.52 m) (Source: Parent, 1981 – GM37949), and finally the Joutel P5 mineral occurrence where drill hole KR-96-08 returned a 2.21 metre intersection grading 7.86% Cu, 72.2 g/t Ag and 0.31 g/t Au (Source: Caillé, 1996 – GM54483).” ***

Final thought

Expect CEO Stoch’s deal-making prowess to generate more of the same headlines for what I still believe to be… the early innings of an epic bull cycle in all things mining.

END

—Greg Nolan

Full disclosure: Globex is an Equity Guru marketing client.

*** The resources described above are historical and should not be relied upon. A qualified person has not done sufficient work for Globex to classify the historical estimates as current mineral resource under National Instrument 43-101 and CIM Standards for mineral resources and reserves.

Leave a Reply