Most of the news you’re going to find on public companies in the crypto and blockchain space is going to be on mining. Sometimes you’ll see a company on the periphery of decentralized finance, or in the burgeoning sub-sector of cryptocurrency custodianship, but mostly it’s miners. This week isn’t much different. But mining itself also has peripherals and auxillaries that are worth taking a look at, including cryptocurrency miners offering excess electrical output via colocation services, which is an interesting development from the past year.

But before we get started, though, a little aside:

Contrary to popular belief, Bitcoin mining isn’t that difficult to understand.

Companies spend ridiculous amounts of money on the best equipment and the lowest cost of electricity so their wall-to-wall server farms full of computers can compete with those of other companies in a prolonged math-quiz, and the winner gets about $280,000. The company with the best equipment and the lowest overhead stands the biggest probability of winning the price, but outliers do sometimes squeak through.

Then they do it again every ten minutes.

It’s when you start adding the numbers and the jargon that mining becomes almost incomprehensible, so wherever possible, I’ve tried to reduce the necessity of weird blockchain specific jargon or at least explain away the peculiar numbers.

Mostly what you need to know to determine the relative strength of a given company’s bitcoin mining operations are what level of hashing power it has, ranging usually from gigahash (one billion per second) to petahash (one quadrillion per second), and of course what a hash function for crypto is. The really simplified answer for that is the amount of times the network can take a stab at the answer.

Also, keep in mind that the Digiconomist’s Bitcoin Energy Consumption Index estimated that one Bitcoin transaction takes 1,544 kWh to complete, which is the functional equivalent of approximately 53 days of power for the average US household. Awesome. Most of these companies are miles above this threshold, but it’s worth mentioning.

Link Global Technologies gets into crypto-real estate, because why not?

Technically, this next one isn’t about a mining company, but a mining-peripheral, but it’s close enough for government work.

Link Global Technologies (LNK.C) agreed to furnish GSV Futures, a subsidiary of Mission World Group, a privately-based ASIC miner and computing, hosting and cloud-based service provider, with 3,000 Bitcoin mining rigs. The deal has Link designing, building and operating the infrastructure to make sure they have 98% uptime for their mining operation.

The intention here, according to CEO Chuang Simon Liu, is to get up to 80MW by the end of 2021 in Canada.

Mission World Group and their subsidiary GSV Futures offer value-added services like ASIC mining, high-performance computing, hosting and cloud services. They’re private, but considered one of the biggest service providers for computing and mining with green energy. Predictably, Link is an infrastructure and expertise provider for digital mining and data hosting. They find, secure, lease and option for purchase various properties with access to reliable power.

Marathon Digital Holdings is an absolute monster

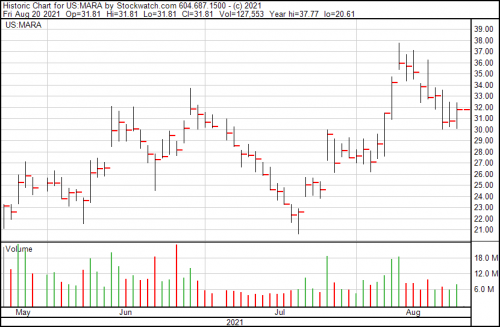

If there’s a post-halving success story in the crypto-mining sector, it’s Marathon Digital Holdings (MARA.Q).

Over the past year, Marathon has rose from a sub-$3 stock barely able to keep its lights on and mining rigs functioning to a veritable giant, riding the Bitcoin bull run to crest at approximately $55 before settling into where they are right now at $30.78. If you bought in back in May, 2020, when we originally started writing about them, then you’re up by x10. You’re welcome, and what are you doing reading this? Go roll around in your money already.

Regardless, their financials are out. Here’s what Sim Salzman, Marathon’s CFO had to say:

“When comparing Q2 2021 to Q1 2021, we grew our revenues by 220% to $29.3 million while generating non-GAAP operating income of $20.1 million. We exited the quarter with $170.6 million in cash and with a total liquidity, defined as cash and bitcoin holdings, of approximately $366.5 million.”

Cryptostar onboards a tenant and picks up more power!

Cryptostar (CSTR.C) got on the hosting agreement bandwagon with a United States-based company earlier this week to offer up four megawatt mining capacity at their data centre facility in Utah. Adding to this point, they’ve also signed a non-binding letter of intent on August 12 for 10 MW of mining capacity to be used in Alberta.

Highlights of the hosting agreement:

- Annual hosting revenues for the company of $720,000 (U.S.);

- Initial term of 12 months, renewing month to month thereafter.

Cryptostar is a Bitcoin miner operating mostly out of Quebec, where the electricity is cheap and mother nature provides free air conditioning for their ASIC-rigs in the winter. The pivot to providing hosting is another revenue stream outside of their usual.

Unlike some of the other crypto miners in this article, which range around the $5 to $50 dollar range, CSTR is an $0.18 stock with a $74 million market cap. They’ve been busy onloading additional revenue streams by using low-cost and often subsidized Canadian hydroelectricity, which they offer to other miners, while they build out their own ASIC fleet. When bitcoin starts bumping again they won’t stay at $0.18 for long.

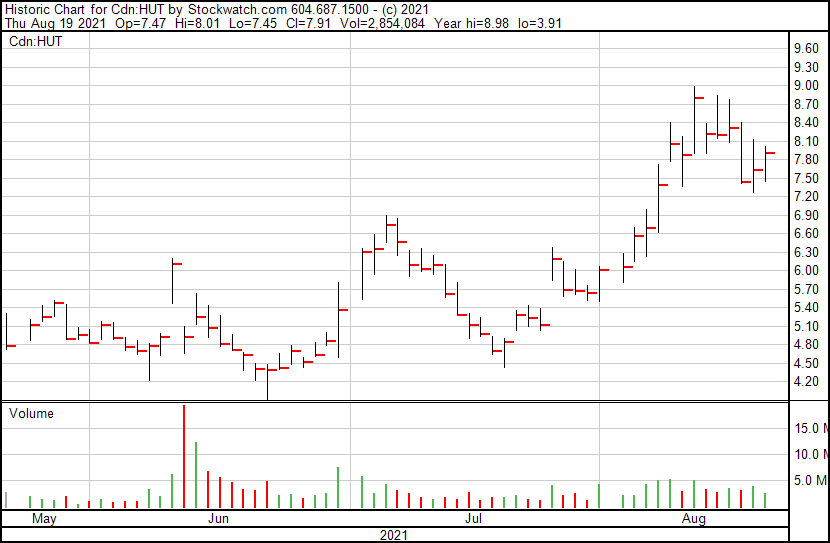

Hut 8 Mining: the only company that can lose $20 million and still make bank

Hut 8 Mining (HUT.T) released their financials earlier this week under a headline indicating they lost $20.43 million in Q2. That’s kind of amusing, if not slightly misleading.

First, Hut 8 and Marathon are direct competitors for the top spot in the hashrate sweepstakes. Hut 8 presently has an installed hash rate of 1.37 exahashes (E/H). Given pending orders, the company has an additional hashrate (including 1,600 gigahash equivalent) bringing their total bitcoin collecting power to 2.7 E/H, which is an absolutely ridiculous number.

Hut 8’s overall strategy is to hold their bitcoin and generate cash using Canadian and U.S. dollars to finance their operations. That way they can avoid selling their Bitcoin stakes. During Q2, they kept all the bitcoin they mined and by June 30, 2021, their total Bitcoin balance was 3,824 with a market value of $166 million. Their present bitcoin balance, including 2,000 bitcoins loaned as part of their fiat yield strategy, is approximately 4,240 bitcoins, with a market value of $245 million.

Basically, they lost money from their standard money making function, but are still up hundreds of millions of dollars in stored digital assets.

“It is gratifying to see the core strengths of Hut 8, namely our people and operational excellence, combine to advance our commitment to building a diversified leader in the digital asset infrastructure space. Hut 8’s disciplined approach to managing our balance sheet, while prioritizing the efficient accumulation of bitcoin, served us well in Q2 2021, and that as we continue to focus on execution, we are well-positioned heading into the back half of 2021 and into 2022,” said Shane Downey, chief financial officer of the company.

Ultimately, it’s a smart move given Bitcoin’s historical volatility. Their 4,240 bitcoins may be worth $245 million today but Bitcoin’s price is down 28.1% from its all-time high, and present trends have the asset class in the green. It’s the same reason you don’t buy pizza (or anything else) using Bitcoin, because it might be worth a fortune tomorrow.

BTCS expands with DeFi coin – Tezos

Blockchain tech company BTCS (BTCS.OTCQB) added Tezos (XTZ) to their blockchain infrastructure operations this week. Tezos, if you’re unfamiliar, is a decentralized blockchain primarily used for smart contracts and decentralized applications. It’s crypto is XTZ. It has a market cap of $2.75, which puts it firmly at number 45 by market cap, and raised $232 million in 2017, which was a big deal at the time.

BTCS is a different kind of miner. Instead of the energy demanding proof-of-work consensus model used by Bitcoin (and plenty of other coins) above, they focus on leveraging the Proof-of-Stake blockchains by processing and validating transactions, thereby closing the block and getting the crypto as a reward. As a business model, it’s not going to be as lucrative as mining Bitcoin, but the OPEX and CAPEX are decidedly lower.

The way XTZ’s governance works is that it lets users to vote through a Liquid Proof-of-Stake consensus mechanism called ‘baking.’ Users can either become bakers themselves or delegate their baking abilities to other folks to earn XTZ rewards for the protocol. BTCS deployed its own XTZ nodes (or computers involved in staking). There are presently 400 bakers providing network security and 135 projects developing on XTZ. These range from decentralized applications (dApps) to decentralized finance (DeFi) and of course, non-fungible tokens (NFTs).

At present, the company is building a staking-as-a-service platform to give users the option to stake and delegate crypto through a non-custodial platform.

Digital Asset Managers, NFT’s, and tigers, oh my!

Crypto and blockchain are more than just consensus mechanisms and mining. After the crypto’s mined, it needs to go somewhere and more and more we’re seeing companies arise to handle things like custodianship, and tokenization. You’ll even see the intersection of the esports, cannabis and blockchain industries reflected below. So let’s get started with…

Currencyworks’ latest merger is crafty bid for debt relief

Blockchain based Currencyworks (CWRK.C), which develops tokens for the esports and peer to peer gaming market, sold their interest in SbetOne to VON republic, an e-sport reward platform.

VON Republic (which stands for Victory or Nothing) will use sBetOne’s assets and the skills and abilities of currencyworks to continue to build out their rewards and gaming using blockchain technology.

Check out these three points, though:

- Separately, all convertible debt plus interest in sBetOne’s books of approximately $824,000 as of June 30, 2021, has also been converted into shares in VON Acquisition at a deemed value of seven cents per share (30-per-cent discount as per the terms of the convertible debt).

- As a result of this merger, Currencyworks has no debt remaining on its consolidated financial statements that related to the convertible debt associated with sBetOne and has ended up with approximately 8-per-cent ownership in VON Acquisition for its 5,902,174 shares in VON Acquisition at a deemed value of $472,173 (U.S.).

- Currencyworks will provide licensing, technical and continuing support services to VON Acquisition for a base price of $16,500 per month.

Sneaky.

Galaxy Digital opens a Galaxy DeFi Index Fund

Decentralized finance is one of the fastest-growing sectors in crypto. It bring financial services on-chain, giving participants the ability to borrow, lend and exchange assets on blockchains governed by smart contracts instead of through often all-too-human intermediaries. It’s an excellent example of Satoshi Nakamoto’s vision—a trustless economy, where transactions eliminate counterparty risk through technological mediation.

Now Galaxy Digital Holdings (GLXY.T) has launched their Galaxy DeFi Index Fund to track the performance of the newly launched Bloomberg Galaxy DeFi Index. The new fund will give institutional investors access to returns based on DeFi’s performance using a simple and secure operation with exposure to the largest, most liquid portion of the DeFi crypto market. The fund is seeded by NZ Funds, a wealth management firm with over $2 billion in New Zealanders’ savings.

“Galaxy continues to pioneer inroads for institutions seeking exposure to the innovation happening within the crypto ecosystem,” said Steve Kurz, partner and head of asset management at Galaxy Digital. “The blockchain-based infrastructure behind DeFi is maturing at an accelerating rate and clear examples of how this new technology can disrupt financial services are emerging in real time. Our unique DeFi Index Fund provides investors with institutional-grade exposure to the future of financial services.”

Global Cannabis rewards their people with high tech NFT tulips

Global Cannabis Applications (GCAC.C) will be handing out non-fungible tokens (NFT) to everyone who holds GCAC tokens on August 31, 2021, at 9 a.m. EST. You might get an image or maybe artificial-intelligence generated art (that sounds… terrifying), but regardless, they’re going to airdrop in something that’s one of a kind and exclusive to GCAC token holders.

Sure.

“We are blockchain and want to showcase how our blockchain not only maintains the truth of our cannabis products, but it also allows Efixii users, and our SaaS grower community, to join the NFT revolution. Using the Efixii Ethereum blockchain, users can publish creative works for the whole world to see. And, just like the awesome artwork in this one-off NFT airdrop for GCAC token holders, the Efixii blockchain community can offer their art for sale on the biggest NFT marketplaces in the world like OpenSea, Rarible or Mintable,” said Brad Moore, CEO.

Personally, I can’t wait for this high tech tulipmania craze to go away, but they made sales of over $3.8 billion and it doesn’t look like it’s going to happen anytime soon.

Graph Blockchain’s new NFT platform good to go!

Graph Blockchain (GBLC.C) New World NFT platform finished its test of one million simultaneous users within the app on August 12, 2021. This is text number two, the first of which they performed on August 4th, in which they tested 100,000 users with zero errors, and a response time of 0.84 seconds, latency of the same and operating 18,013.43 requests per second, displaying the platforms ability to scale.

That means the company’s NFT platform will be able to handle up to a million different people at a time.

Graph Blockchain Inc.’s New World NFT (non-fungible token) platform successfully tested one million simultaneous users within the app platform on Aug. 12, 2021. Come get your NFT’s.

“We had no doubt that the platform would successfully test 1 million users. We prioritize due diligent research and development and in doing so we’ve been able to build a streamlined, lightweight platform. Our efforts have rendered successfully and we’re more than confident to be able to withstand a world-class, world-scale platform that can be enjoyed by the masses,” states co-founder and head of the app’s development, Jay Pizarro.

The app should launch in mid-September.

—Joseph Morton

Leave a Reply