Trust me when I say this; while this is a story about a mining explorer, I promise you it won’t be boring or filled with impenetrable terminology, even if you don’t know the first thing about mining.

ESPECIALLY if you don’t know about mining.

Look, investing in mining can be a challenge. What you’re doing is betting the following:

- That there’s metal under the ground

- That the people involved will locate that metal, by drilling it, taking magnetic images, walking over it with a pickaxe, taking photos from a satellite, getting a shaman to use divining rods – whatever they can come up with a budget for.

- Those same people will be able to raise money on the results of their search, get permits together from the government, and ultimately figure out how to begin production.

Those three items can take ten years, so in realistic terms, most investors are not betting on more than one of the above happening while they’re attached to the stock. They roll in for a bit, hopefully see some stock price accrual, and generally move on before the company shifts from exploration to permits to wheels turning.

So what you’re really betting on in mining exploration investment is PROGRESS.

I’ve never, in my life, made a mining company investment at stage one and held it to stage three. I come in hot when I’m almost certain good times are coming, then get out when I’ve made my nut.

So if I tell you Altan Rio Minerals (AMO.V) is confident they can get a mine stood up in their Australian property, the correct response is ‘who cares?’ What I’m looking for is that they’ll figure some positive moves out next week, and next month, and the month after. And in that world, I want two things.

First, a chart like this:

And second, execs at the company reaching out to me..

To be clear, that chart isn’t a runaway success – yet. It shows me there’s not a lot of trading activity, that the stock is just bobbling along, and that folks out there aren’t yet familiar with or excited by the deal. That said, THAT’S WHEN I WANT IN.

Why would I want to be coming into the deal after it’s started to rise? I want it now, when nobody out there is hoarding cheap stock, and when the stock price has found a bottom – and here’s why..

Because they’re talking to me about getting the word out.

The way this process normally goes is:

- The company goes quiet for a bit

- The insiders buy their own stock on dips in share price, not too much at once, just a little on the regular

- After a few months when the company is in good shape and the news can’t be held back and work is about to be done, they reach out to guys like me to share the story to a wider audience.

ALTAN RIO IS IN PLAY.

Our Greg Nolan had a two-hour interview with this leadership team last week, and I did an hour before that. We both came away suitably impressed. This company has a CEO who knows how to pitch, a project that looks very tasty, and they’re located literally at the center of gold production in the world today. If you fell out of a plane in Kalgoorlie, Western Australia, chances are you’d die of ‘gold impact.’ If you like watching mining reality shows on Discovery, and apparently many do, you’ve seen the landscape and a few of Altan Rio’s neighbours into the bargain.

As Greg points out, Western Australia is a gold mining hub and, as a mining jurisdiction, is without peer. Getting a mine up in BC is like pulling teeth. Getting one up in Montreal is like getting a backrub.

But in Australia? As I said in the Equity.Guru investor roundtable last week, if you applied to open a gold mine in a daycare, the Western Australian government will hold the kids down while you drill.

The action in Australia is at a place called the Yilgarn Craton.

It takes up about half of Western Australia and as you can see in the photo below, its a monster location for those looking for gold.

That red box pointing to the Southern Cross Nth? That’s where Altan Rio has grabbed some land, right in the likely connection between two existing plays.

In the mining business, this is called ‘closeology’, as in if your neighbour is pulling gold out of the ground an earthmover, and the neighbour on the other side is pulling it out with conveyour belts, there’s every chance you’re standing above more. Sometimes companies play closeology as a means of flipping cheap land they happened to claim first to someone who wants it more. Sometimes it’s a means of attracting investors who missed the meteoric rises next-door in years past.

But sometimes it’s a means of de-risking your play and increasing your chances of landing your drills in a good spot.

In this situation, there’s a great case to be made to suggest there’s much to be found.

Back in the day, prospectors chased gold mineralization along surface, exploiting the low-hanging fruit, rarely mining to depths greater than 50 meters. When these early miners ran out of near-surface ore, they pulled up stakes and moved further along trend, chipping away at the shallow easy pickings.

This makes a lot of sense. I mean, if you can drive a bulldozer over a property and scrape up a few hundred grand in ore, and there’s more ore down the road, and more still beyond that… why would you ever dig?

Well, one reason: Today, gold prices are at $1800 per ounce.

Five years ago, prices were at $1200. A decade ago, under $1000.

At $1800, a lot of previously passed over land is suddenly VERY tasty, and so groups like Altan Rio are going out to find locations that, at current pricing, really work.

Nolan again:

In more recent years, access to these unexplored areas along the [Frasers-Corinthian Shear Zone] was restricted by farmers cultivating crops in the region. Altan Rio management has been successful in bridging the gaps between exploration efforts and these hard-working agrarian types. Now, for the first time, all of that prospective geology that lay buried, unprobed, unexploited, is seeing the business end of the drill bit. “Game on” might be an appropriate response in light of this current development.

So what are the neighbours up to?

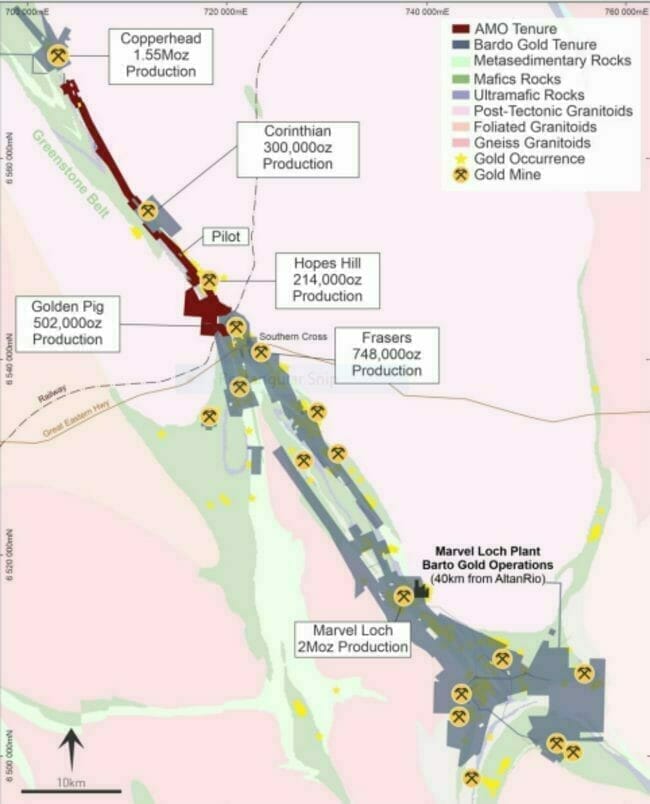

The red part is Altan Rio.

The pickaxes are where production has been going on.

The Marvel Loch in the southeast corner? This is what that looks like.

That’s a fat mill right up the road, which saves Altan Rio having to pay for and build their own.

Worth noting: Barto isn’t a stranger. Altan Rio is involved in an exploration and mining agreement with Barto.

Nolan a third time, because he’s on fire..

Geologically, there’s little difference between the southern half of this goldfield—where over a dozen mines have produced in excess of 10M ounces—and Altan Rio’s northern half, where production stands at only 2M ounces.

There’s no reason Altan Rio’s ground—roughly 30 kilometers of vastly under-explored Southern Cross terra-firma—can’t hold a similar mineral endowment… and then some.

From here on, if you’re looking for technical info, you can’t do better than Greg’s piece, so I’m not going to try to replicate what he’s already done. Here’s what I will say:

- RISK THAT THE GOVERNMENT WONT PERMIT THE PROJECT: Minimal

- RISK THAT THERE’S NO GOLD UNDERGROUND: Minimal

- RISK THAT THEY WONT FIND TARGETS TO DRILL: Zero, they’ve got five targets now

- RISK THAT THEY’LL RUN OUT OF PLACES TO DRILL: Low, they’re sitting on 27 sq kms of land

- RISK THAT THIS MOB DOESN’T KNOW HOW TO GET A GOLD MINE UP: None. Since Paul Stephens was appointed CEO, this company has cranked out deals, partnerships, drilling, and evidence they’re up to, and engaged in, the work of building out a gold mine.

This deal is set up perfectly and I’m buying in. If you see the trading volume picking up, yeah, that’s literally me and my guys at Canaccord and Mackie sucking up the cheap stuff while its still cheap.

It’s a $24m market cap, and I think that’s super undervalued. People I trust agree.

Your turn.

— Chris Parry

FULL DISCLOSURE: Altan Rio is an Equity.Guru marketing client

Leave a Reply