Gold is currently trading around USD $1,750/ounce – down $70 in the last month and down $170 in the last 12 months.

The current macro argument for high gold prices hinges on the accelerating degradation of fiat currency (paper), through money printing.

The same argument was in vogue in ten years ago. Many pundits predicted gold would spike to $5,000/ounce. That didn’t happen. Gold investing has turned out to be an extended seminar in patience.

Once again, this week the U.S. government has run out of money, and Congress is working furiously to resolve the government debt showdown.

Maybe the U.S. – and the rest of the world – can kick the debt can down the road forever with no consequences.

If that turns out not to be true, aggressive little explorers like Falcon Gold (FG.V) will benefit from a stampede into precious metals.

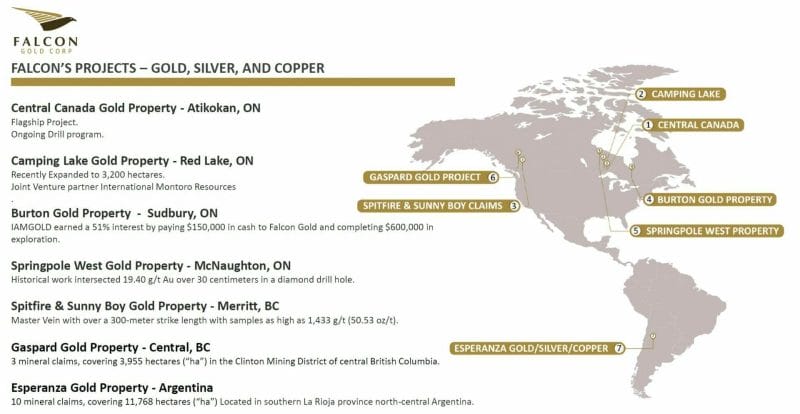

The company’s flagship asset is its Central Canada Gold Project (CCGP), located roughly 160 kilometers west of Thunder Bay Ontario (in proximity to Aginco Eagle’s Hammond Reef deposit).

Central Canada Gold Mine History:

- 1901 to 1907 – Shaft constructed to a depth of 12m and 27 oz of gold from 18 tons using a stamp mill.

- 1930 to 1934 – Central Canada Mines Ltd. installed a 75 ton per day gold mill. Development work included 1,829 m of drilling and a vertical shaft to a depth of 45 m with about 42 m of crosscuts and drifts on the 100-foot level. In December, 1934 the mine had reportedly outlined approximately 230,000 ounces of gold with an average grade of 9.9 g/t Au.

- 1935 – With the on-going financial crisis of the Great Depression, the Central Canada Mines was unable to fund operations and the mine ceased operations.

- 1965 – Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft.

- 1985 – Interquest Resources Corp. drilled 13 diamond holes totaling 1,840m in which a 3.8 ft intersection showed 30.0 g/t Au.

- 2010 to 2012 – TerraX Minerals Inc. conducted programs that included line cutting, geological surveys and 363 m of drilling.

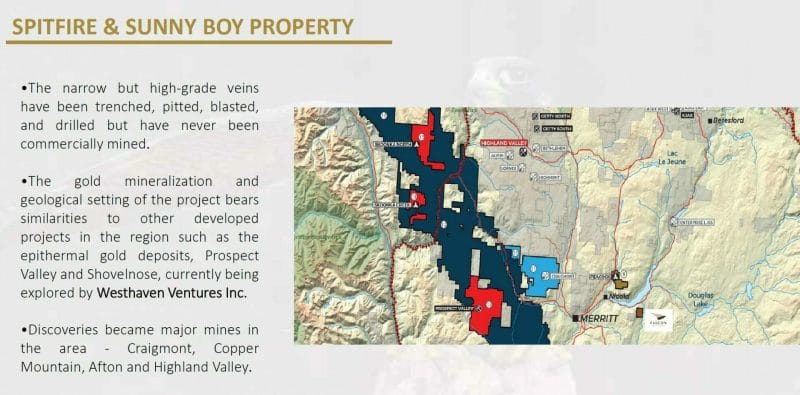

On September 22, 2021 announced that an exploration crew have been sent to the high-grade Spitfire-Sunny Boy Project, near Merritt, B.C.

FG’s 2020 Phase 1 program identifying gold mineralization over a 300m strike length.

Highlights of the September 2020 sampling program was a 2.2m channel sample that averaged 59.8 g/t Au which included a 1m channel sample that assayed 122 g/t Au on the Master Vein. Additional highlights are tabled below.

“We are thrilled to finally send exploration crews to follow up on our original findings from last year. We believe the nature of the veining conforms to a low sulfidation epithermal deposit type model that could host world class gold grades. Our initial phase confirmed the potential of bonanza type gold mineralization.

The second phase is a more aggressive follow up testing the vein systems along strike, near surface using shallow drilling. Multiple veins were identified in 2020 and we aim to verify and confirm their high-grade nature along exposed strike lengths.”

– Karim Rayani, Chief Executive Officer

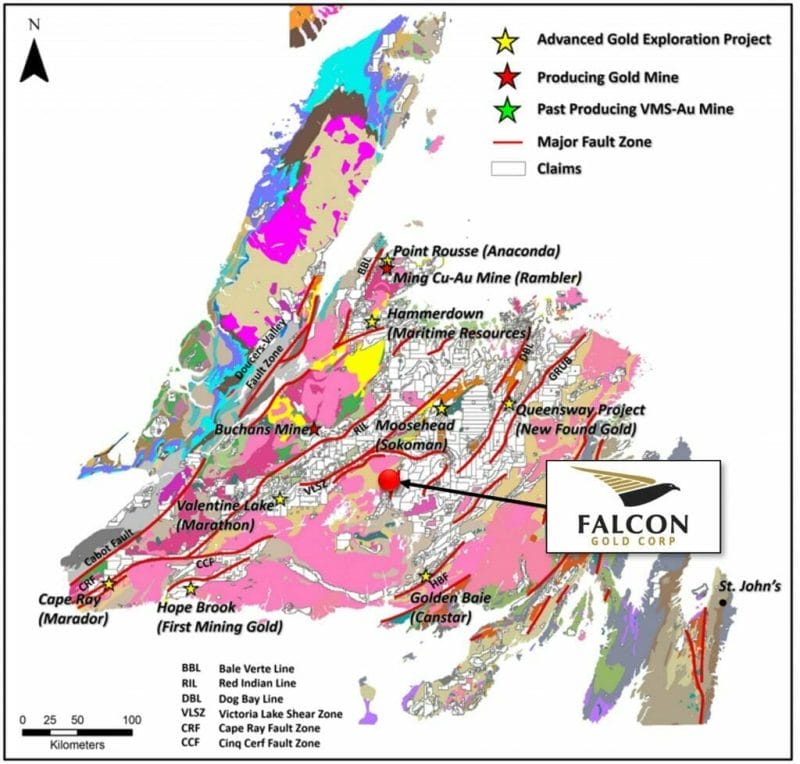

On September 9, 2021 Falcon announced it has staked 91 claims totaling 2,275 hectares located in the Great Burnt base-metal rich greenstone belt in central Newfoundland.

The Great Burnt greenstone belt is host to the Great Burnt Copper Zone with an indicated resource of 381,300 tonnes at 2.68% Cu and inferred resources of 663,100 tonnes at 2.10% Cu.

Recent drilling in 2020 by Spruce Ridge Resources reported 8.06% Cu over 27.2m

The Great Burnt greenstone belt also hosts the South Pond A and B copper-gold zones and the End Zone copper prospect within a 14 km mineralized corridor.

On July 13, 2021 Falcon Gold (FG.V) announced that it has acquired a significant land position within the Hope Brook Area, Newfoundland.

“When considering both policy factors and mineral potential, the province [Newfoundland & Labrador] is the 8th most attractive jurisdiction in the world for mining investment (out of 77 jurisdictions),” reports The Fraser Institute on April 8, 2021.

“The province went from 50th in 2019 (when considering only pure mineral potential) to 11th in 2020,” continued The Fraser Institute, “Much of the province’s current mining activity is in iron ore, nickel and copper. However, gold discoveries in the second half of the year might explain why investors now view the province as a premier mining investment destination.”

Newfoundland and Labrador’s mining sector employs almost 6,800 people and generates more than $4.3 billion in gross value mineral shipments.

In this August 1, 2021 video, Crux Investor’s “Family Office Investor” Matthew Gordon conducts an excellent wide-ranging interview with Karim Rayani, CEO of Falcon Gold.

“Most of the money we get goes directly into the ground,” stated Rayani, “We’re sitting on just shy of $700,000, which is not a lot of money. However, we’re very careful how we spend money. So, our next phase of drilling in in Ontario is already paid for.”

“Falcon’s objective is to go after projects that have been sitting dormant,” added Rayani, “The current priority is drilling the central Canada project. We’ve had some delays with the forest fires. When the fires are clear, we’ll announce drilling, we’ll do another 2,000 to 3,000 meters.”

“Insider Selling” is considered a negative leading share-price indicator.

“The fear is that insiders know better than average investors what’s really going on at a company,” reports CNN Business.

Conversely, “Insider Buying” is considered a bullish leading share-price indicator.

A visit to “Canadian Insider” reveals that, Falcon Gold CEO Karim Rayani has been loading up on his own company, at the same prices you or I pay.

“The COVID pandemic has added $24 trillion to the global debt mountain over the last year a new study has shown, leaving it at a record $281 trillion and the worldwide debt-to-GDP ratio at over 355%.” reported Reuters.

“If they (Democrats) want to tax, borrow, and spend historic sums of money without our input, they’ll have to raise the debt limit without our help. This is the reality,” stated Senate Minority Leader Mitch McConnell.

Falcon Gold has a market cap of CND $10 million.

Any sustained gold-price appreciation is likely to cause a sharp upward re-valuation of the FG’s share price.

Full Disclosure: Falcon Gold is an Equity Guru marketing client.

Leave a Reply