Skyharbour is a company we watch closely here at Equity Guru. While we wait on news from the big show—additional drill results from the Company’s flagship Moore Uranium Project in the prolific Athabasca Basin of northcentral Saskatchewan—news is filtering in from other areas of The Basin.

Perhaps best characterized as a cash-rich Athabasca Basin land baron, Skyharbour holds an extensive portfolio of projects beyond its flagship property, all strategically located—all boasting significant discovery potential.

In order to push these projects further along the exploration/development curve, management deploys the Prospect Generator Model (PGM), where strategic partners fund exploration and make cash/share payments for a majority stake in the project.

Multiple irons in the fire via these partner-funded programs = multiple shots at a new discovery.

Recent developments on the PGM front

On October 6th, the Company updated developments at Hook Lake.

The Hook Lake Uranium Project (previously known as ‘North Falcon’), located 60 kilometers east of the Key Lake Uranium Mine, is a joint venture (JV) with Valor Resources.

Back in December of 2020, Skyharbour inked a deal with Valor where the ASX-listed explorer can earn up to 80% in the 25,846-hectare project by spending $3,975,000 over three years—$475,000 in cash payments and $3,500,000 in exploration expenditures.

To seal the deal, Valor issued 233,333,333 shares to Skyharbour, upfront. Those shares are now worth roughly CAD $4M.

Extraordinary U3O8 surface values encountered along the northern edge of the property amplify the discovery potential at Hook Lake.

“In October 2015, on the northern side of the property at the Hook Lake target, Skyharbour reported that it had confirmed the presence of high-grade uranium mineralization with up to 68.0% U3O8 in a grab sample from a trench. The trench is referred to as the Hook Lake U-Mo showing and was the focus of the Company’s Summer 2015 field program which consisted of detailed prospecting and vegetation sampling. Skyharbour randomly selected three grab samples from the Hook Lake showing to verify historic results and these grab samples returned 68.0% U3O8, 35.7% U3O8 and 29.8% U3O8.”

The fact that previous operators were unable to locate the source of this high-grade surface material adds an element of intrigue to the project.

Valor began contributing to Skyharbour newsflow when it mobilized a field crew to the project earlier this year.

An August 31st headline…

These additional high-grade surface samples fortify Hook Lake’s potential.

Highlights from the Zone S Prospect:

– 59.2% U3O8, 499g/t Ag, 5.05% TREO (11,797ppm Nd2O3 + Pr6O11 and 1,825ppm Dy2O3), 14.4% Pb (Float sample)

– 57.4% U308, 507g/t Ag, 3.68% TREO (8,562ppm Nd2O3 + Pr6O11 and 1,676ppm Dy2O3), 14.5% Pb (Rock chip sample)

– 46.1% U3O8, 435g/t Ag, 2.88% TREO (7,054ppm Nd2O3 + Pr6O11 and 1,139ppm Dy2O3), 8.8% Pb (Rock chip sample)

– 6.92% U3O8, 0.81% TREO, 2% Pb (Rock chip sample)

– 6.42% U3O8, 1.17% TREO, 1.8% Pb (Rock chip sample)

“A total of 57 samples were taken from across the Hook Lake Project with assay results now having been received. The results are highlighted by the assays from the Hook Lake (or Zone S) prospect which confirmed the reported historical high-grade uranium mineralization. A total of seven rock chip samples were taken from a historical trench located at the Hook Lake prospect, with four of these samples returning high-grade uranium assays (>6% U3O8) as well as highly elevated rare earth (>0.5% TREO*), silver (>50ppm) and lead (> 1.8%) assays.”

The setting at Hook Lake is reminiscent of Fission Uranium (FCU.T) back in 2012—high-grade boulders were traced up ice, leading to the Triple R discovery… a discovery that opened up the whole western side of the Athabasca Basin.

The October 6th press release:

Here, Valor lays out its exploration plans for a Hook Lake drill campaign—a follow-up to the fieldwork completed back in August.

Highlights:

– Planning of diamond drilling program at Hook Lake Project well advanced;

– All necessary permits in place for diamond drilling program to commence;

– Drilling to test at depth and along strike from historical trench at Hook Lake / Zone S Prospect where recent surface sampling returned assays of up to 59.2% U3O8, 5.05% TREO, 507g/t Ag, and 14.5% Pb;

– Diamond drilling to also test targets at West Way Prospect;

– Drilling set to commence in December 2021 with a program of at least 2,500 meters proposed;

– Project Geologist seconded from Dahrouge Geological Consulting.

Aside from the outstanding U3O8 grades, note the elevated REE, Silver, and Lead values.

George Bauk, Valor’s Executive Chairman:

“Following on from the results published in August 2021 and desktop reviews being undertaken, we are pleased to be finalising the upcoming drill program scheduled for December. We will be targeting three key areas to begin with and look forward to the results as they come to hand. Over the past month with the increase in the spot uranium price we have seen an unprecedented land grab in the Athabasca Basin. Most of the Basin has been pegged which highlights the excitement and prospectively of this area. We have seven projects in and around the Basin that demand exploration attention.”

As noted above, drilling will revolve around the Zone S Prospect in an effort to locate the source of the high-grade surface material collected during previous field campaigns.

All the necessary drill permits are in hand. All relevant stakeholders, including the First Nations communities, are in the (consultation) loop.

To minimize the environmental impact, this program will be supported by helicopter.

“Final drill hole locations are currently being determined with historical drilling data being digitised and compiled and integrated into a 3D geological model over the Zone S target area. The Hook Lake high-grade uranium (and rare earth) mineralisation is interpreted to be located at a dilational trap/jog which has formed at the intersection of a northeast-southwest trending shear zone and a possible north-south trending structure (potentially a re-activated Tabbernor fault structure). Besides the downdip and down-plunge potential of the immediate Hook Lake target, there is potential for further structural targets of this nature along strike to the northeast and southwest from the Hook Lake prospect.”

This first pass campaign is scheduled to commence in December with 10 to 15 holes for 2,500 to 4,500 meters.

Aside from Zone S, the West Way Prospect will also see the business end of the drill bit (recent surface samples graded up to 0.64% U3O8 and 3.4% Mo at this target).

Valor is using good science—a combination of geochem and geophysics—to push Hook Lake further along the curve.

Mann Lake

During a recent chat with Skyharbour’s CEO, Jordon Trimble, I learned that the Company is working its PGM on multiple fronts, and if successful, news could drop by year-end on one or more of its available properties in The Basin.

Again, multiple irons in the fire via partner-funded programs = multiple shots at a new discovery.

On October 18th, there was a new development on the PGM front:

Here, the Company announced an option agreement with Black Shield Metals (BDX.C) where Black Shield can earn up to 75% in the 3,473-hectare Mann Lake Uranium Project.

Mann Lake Uranium Project Summary:

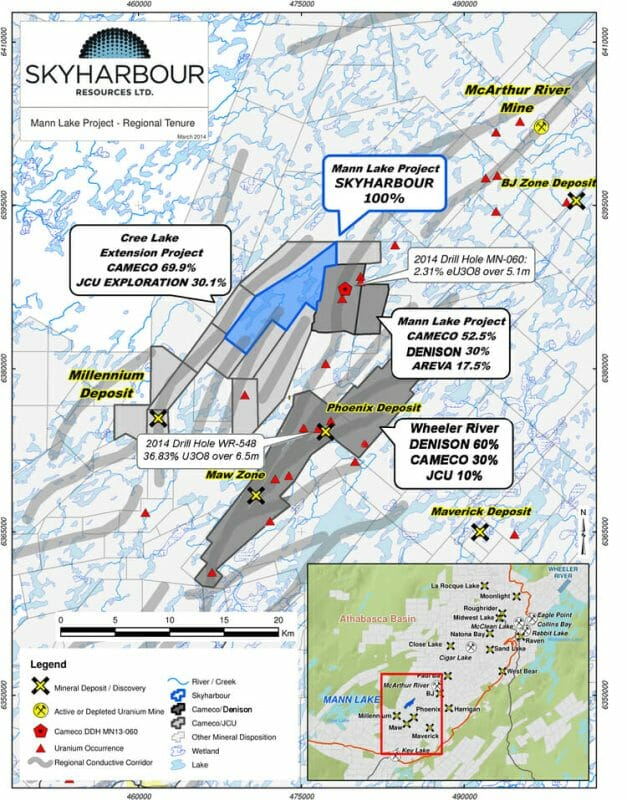

Mann Lake is located in the eastern Athabasca Basin, roughly 15 kilometers to the northeast of Cameco’s Millennium uranium deposit and 25 kilometers southwest of the McArthur River Mine.

This is an upscale neighborhood—McArthur River is THE largest high-grade uranium deposit on the planet.

Mann Lake is also adjacent to the Mann Lake Joint Venture operated by Cameco (52.5%), along with partners Denison Mines (30%) and Orano (17.5%). Denison Mines acquired International Enexco and its 30% interest in this adjoining project after a 2014 winter drill campaign tagged high-grade, basement-hosted uranium mineralization.

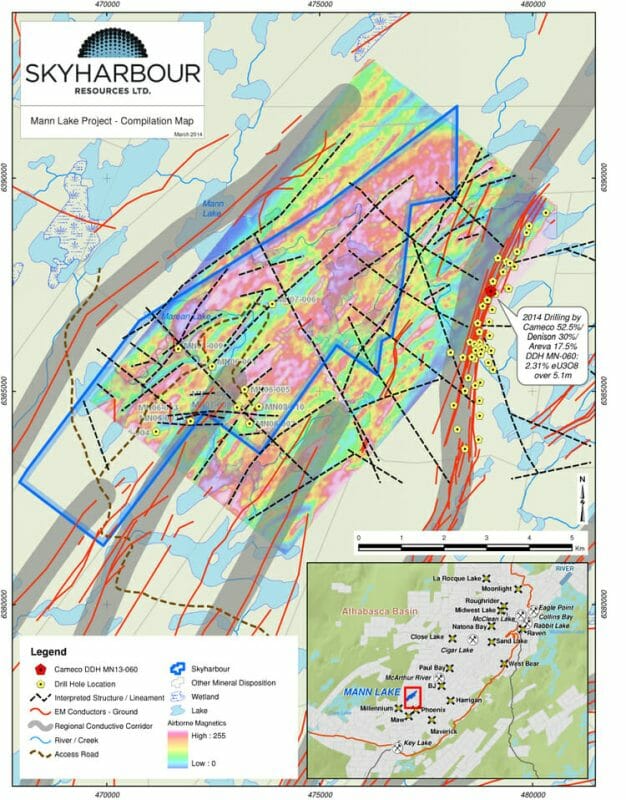

In 2014, Skyharbour carried out a ground-based EM survey focused on a 2 kilometer long aeromagnetic low which coincided with basement conductors derived from earlier EM surveys. Confirmation of a broad, NE-SW trending corridor of conductive basement rocks (likely graphitic metapelites) was the upshot from this round of geophysics.

“The Mann Lake Uranium Project has seen over $3 million of previous exploration expenditures consisting of geophysical surveys and two diamond drill programs totaling 5,400 metres carried out by Triex in 2006 and 2008. The geophysical surveys identified graphitic basement conductors and structural corridors containing reactivated basement faults. These features trend onto the adjacent ground operated by Cameco. The 2006 diamond drill program intersected a 4.5 metre wide zone containing anomalous boron (with highlight values of up to 1,758 ppm B) in the sandstone immediately above the unconformity in drillhole MN06-005. Boron enrichment is common at the McArthur River uranium mine, and along with illite and chlorite alteration, is a key pathfinder element for uranium deposits in the Athabasca Basin. In the same drill hole, altered basement gneissic rocks with abundant clay, chlorite, hematite and calc-silicate minerals were intersected about 7.6 metres below the unconformity and contained anomalous uranium, including up to 73.6 ppm over a 1.5 metre interval. Background uranium values are commonly between 1 and 5 ppm.”

The terms

Black Shield’s price of admission: CAD $850,000 in cash and CAD $1,750,000 worth of Black Shield common shares (based on the 20-day VWAP at the time of issuance).

The terms are as follows:

– $100,000 in cash and $250,000 worth of Black Shield common within five days of putting signatures to paper;

– $250,000 in cash and $500,000 worth of Black Shield common on the first anniversary;

– $250,000 in cash and $500,000 worth of Black Shield common on the second anniversary;

– $250,000 in cash and $500,000 worth of Black Shield common on the third anniversary.

Black Shield is required to incur a minimum of $4,000,000 in exploration expenditures on the Property as follows:

– $1,000,000 in exploration expenditures on or before the first anniversary of putting signatures to paper;

– $1,000,000 in exploration expenditures on or before the second anniversary of the signing of the Option Agreement;

– $2,000,000 in exploration expenditures on or before the third anniversary of the signing of the Option Agreement.

In the event that Black Shield spends, in any of the above periods, less than the specified sum, it may pay to the Optionor the difference between the amount it actually spent and the specified sum before the expiry of that period in full satisfaction of the exploration expenditures to be incurred. In the event that Black Shield spends, in any period, more than the specified sum, the excess shall be carried forward and applied to the exploration expenditures to be incurred in succeeding periods.

Immediately on Black Shield satisfying all of the conditions, Black Shield will be deemed to have exercised the Option and to have earned a 75% interest in and to the Property which will vest to Black Shield subject to the net smelter returns royalty (“NSR Royalty”). A NSR Royalty of two and a half percent (2.5%) is payable to a third party of net smelter returns from minerals mined and removed from the Property (payable pro-rata based on ownership interest in the Property).

This is a good deal for both companies.

Skyharbour gets an immediate cash injection of $100k and $250k worth of BDX common (you do the math—BDX has swung between $0.25 and $0.55 in recent sessions).

And it moves Mann Lake forward right from the get-go as Black Shield is committed to spending $1M within the first year (there’s nothing to stop them from accelerating the spend-cycle).

Final thought

After correcting and consolidating some of the steep price trajectory registered earlier this summer, the stock is now testing those recent highs.

Additional assays from their 100% owned flagship project—where a fully-funded, (twice) accelerated drill campaign is probing unconformity and basement-hosted targets along the 4.7-kilometer long Maverick Structural Corridor—could drop at any time.

These results are highly anticipated. On September 14th, the Company released one of the highest grade intercepts discovered to date at the Maverick East Zone: Hole ML21-03 tagged an impressive 2.54% U3O8 over 6.0 meters from 276.0 to 282.0 meters (including 6.80% U3O8 over 2.0 meters from 278.5 to 280.5 meters).

We stand to watch.

END

—Greg Nolan

Full disclosure: Skyharbour is an Equity Guru marketing client.

Leave a Reply