Heavy Metal

The zombie genre has been done to death, no pun intended. With this in mind, the robot apocalypse appears to be the next best thing. From the Terminator franchise to video games like Horizon Zero Dawn, Five Nights at Freddy’s, and Generation Zero, robots have been depicted as the enemy. Thus, an era of technophobes was born, trembling at the thought of what will transpire if Boston Dynamics continues to abuse their robots.

Joke aside, robots are already a part of our daily lives. Some of the most common examples of robotics include Artificial Intelligence (AI) products like Amazon Alexa, Siri, and Google Home. In addition to helping around the house, robots have also found their place in fields like medicine, defense, and entertainment, to name just a few. Given the versatile nature of robotics, there is a growing demand for our metallic friends.

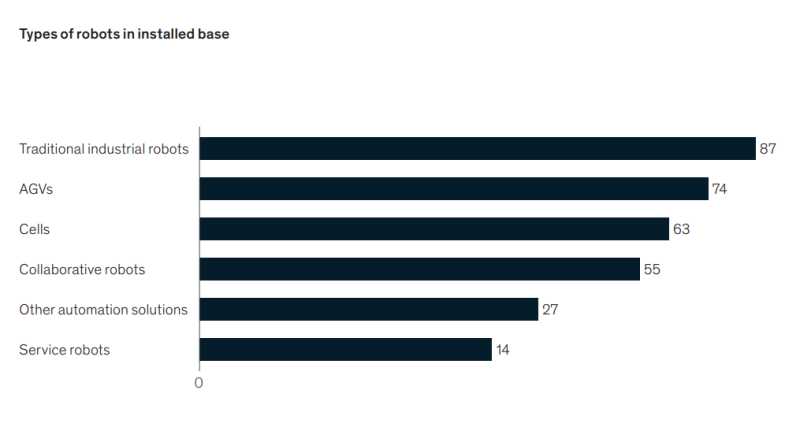

In fact, there were approximately 12,000,000 robotic units worldwide in 2020. In the same year, the number of robotic units sold rose to 465,000, surpassing the previous all-time high in 2018. By 2022, this number is expected to reach 584,000. Furthermore, the effectiveness of AI and Machine Learning (ML) is attractive for businesses looking to increase productivity, safety, and quality.

As a result, 88% of businesses worldwide plan to adopt robotic automation into their own infrastructure. Having recently gone to a sushi joint with robotic servers, this statistic doesn’t sound too outlandish. If you must know, a robotic girlfriend is where I draw the line. Leading the charge, China had 310,000 industrial robotic installations in 2021, representing the highest in the world.

Comparatively, the United States (US) secured third, with 46,000 installations. Speaking of China, let’s talk about a company that recently entered into an agreement with a company to expand Robotics as a Service (RaaS) in China’s Greater Bay Area.

Guardforce AI Co. Ltd.

- $35.529M Market Capitalization

Guardforce AI Co. Ltd. (GFAI.Q) is a globally integrated security solutions provider focused on the development of robotic solutions and information security services. The Company’s solutions and services are intended to compliment Guardforce’s established secured logistics business. By integrating multiple functionalities of its products, the Company has rolled out RaaS solutions for numerous service industries, including:

- Public Health

- Education

- Transportation

- Franchising

- Hospitality

- Real Estate

Currently, Guardforce has partners in Singapore, Malaysia, Thailand, Hong Kong, and Macau. Now that I have mentioned it a few times, let me explain what Robots as a Service (RaaS) is. RaaS provides flexible solutions for organizations that are thinking of integrating robotics into their business but do not have the knowledge or equipment to maintain robotic equipment.

To be more specific, RaaS allows businesses to receive the benefits of robotic process automation by leasing robotic devices and accessing a cloud-based subscription service, similar to Software as a Service (SaaS) models.

With this in mind, powered by big data and the Internet of Things (IoT) technology, Guardforce’s GFAI Intelligent Cloud Platform (ICP) provides businesses with access to an intelligent, convenient, and safe robotic management system. In addition to robot management, ICP also offers cloud advertising, data management, and statistics. Regarding the Company’s robotic product offering, Guardforce offers:

- Concierge Robot: contactless temperature screening, attendance management, 27″ display that supports advertising remotely

- Spray Robot: effective mist disinfection for sanitization, performs tasks automatically, autonomous navigation, autonomous charging

- Air Disinfection Robot: disinfects over a vast area, uses harmless purifying substances enabling coexistence, autonomous navigation, 18″ display, autonomous charging

- Delivery Robot: contactless indoor delivery service, anti-collision system, autonomous navigation, elevator integration, autonomous charging

Personally, I think Guardforce’s products are incredible, however, the technophobe inside of me has a few questions. For starters, the Company’s Air Disinfection Robot uses hydroxyl (OH) radicals for air purification. With this in mind, what safeguards are in place to prevent tampering? Since Guardforce is the supplier, I would imagine it is the responsibility of the Company to refill OH radicals when necessary. If that’s the case, then I just answered my own question.

Latest News

On March 11, 2022, Guardforce announced that it has signed a definitive agreement to acquire Shenzhen Keweien Robot Service Co. Ltd. (SZ) and Guangzhou Kewei Robot Technology Co. Ltd. (GZ). This acquisition, which is planned to close by the end of April 2022, is expected to serve an integral role in the growth of Guardforce’s RaaS business initiative.

The acquisition purchase price of USD$10,000,000 will be paid in a mix of cash and restricted ordinary shares of the Company. In particular, 10% will be paid in cash, with the remaining 90% paid in restricted ordinary shares of Guardforce. Each share will be valued at USD$4.20. Nice.

Keep in mind, SZ and GZ are based in the Greater Bay Area, which is one of the fastest-growing economic regions in China. Furthermore, Shenzhen and Guangzhou are ranked among the top 10 largest Chinese cities and among the 30 largest cities globally. Let’s not forget that SZ and GZ derive revenues from AI robotic services. That being said, the acquisition of SZ and GZ will significantly expand Guardforce’s portfolio of robotic solutions.

Additionally, on March 1, 2022, Guardforce announced that it has established a strategic partnership with SBC Global Holdings Inc. (SBC). This partnership is expected to enable Guardforce to accelerate its entry into US markets with its robotic and technology solutions.

For context, SBC provides autonomous robotics solutions across numerous sectors, including schools, airports, and real estate. With decades of combined management experience, SBC is focused on increasing the asset value of commercial properties while attracting and maintaining valuable tenant shares.

“By establishing this strategic partnership, the crucial U.S. market is now also included in our portfolio. As stated previously, this partnership is part of our commitment to work closely with the right businesses around the world with the goal of expanding the reach of our services and solutions,” commented Lei Wang, CEO of Guardforce.

As part of this partnership, Guardforce will establish a wholly-owned US subsidiary and will commit additional resources to its development. Furthermore, the Company will work closely with SBC to meet the growing demand for robotics and accelerate overall market penetration. Under this agreement, SBC will also refer all of its existing clients to Guardforce on an exclusive basis.

Financials

According to the NASDAQ, for the year ended December 31, 2020 (FY2020), Guardforce had cash and cash equivalents of USD$8,414,000, compared to USD$6,079,000 on December 31, 2019. The Company’s total assets and liabilities for FY2020 were USD$35,975,000 and USD$38,185,000, respectively. During the same period in the previous year, these numbers translate to USD$39,290,000 and USD$38,029,000 respectively.

Regarding Guardforce’s revenue, the Company achieved total revenue of USD$37,649,000 and a gross profit of USD$6,275,000 for FY2020, compared to total revenue of USD$38,571,000 and gross profit of USD$4,643,000 for FY2019.

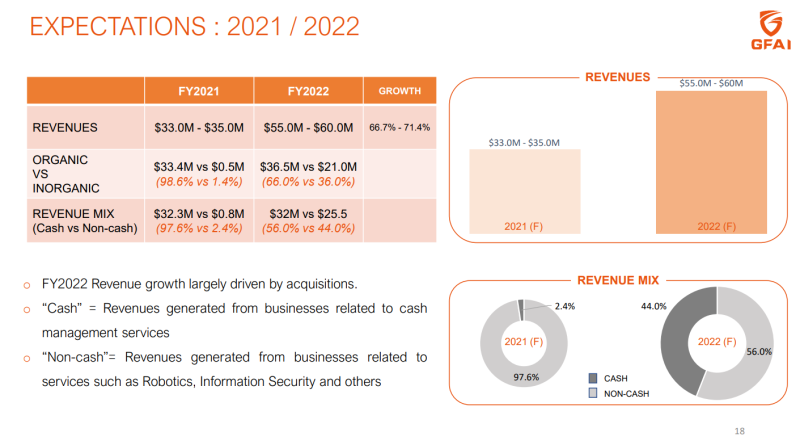

In total, as of December 31, 2020, Guardforce reported a net loss of USD$3,126,000 compared to a net income of USD$54,000,000 on December 31, 2019. As announced in the Company’s latest press release, Guardforce expects its FY2022 revenue to be USD$55-60 million, representing a growth of more than 66% as compared to 2021.

Guardforce’s entry into the US will also position the Company to capitalize on the growing demand for robotics in North America. According to Gartner, the US IoT Robots Revenues and Communications spending is estimated to reach approximately $6.5 billion with an installation base of roughly 1.7 million units by 2028.

Guardforce’s share price opened at $0.9461 today, up from a previous close of $0.5375. The Company’s shares were up 86% and were trading at $1.00 as of 12:46 PM EST.

Leave a Reply