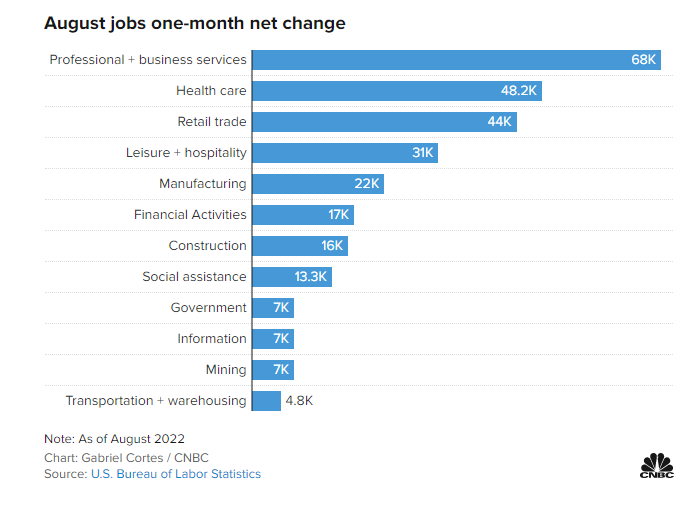

US nonfarm payrolls (NFP) was the anticipated data point for this week. NFP rose by 315,000 jobs in August just below the estimate for 318,000. This is well off the 526,000 print in July and is the lowest monthly gain since April 2021.

The unemployment rate rose to 3.7%, two-tenths higher than expectations. Average hourly earnings increased 0.3% for the month and 5.2% from a year ago.

“The market will like the broad-based gains in jobs as both goods-producing and services jobs rose in August,” said Jeffrey Roach, the chief economist for LPL Financial.

Lots of eyes are still on leisure and hospitality. 31,000 jobs in this category were added this month, but this number grew to 95,000 in July. The sector is still 1.2 million short of its pre-pandemic level.

The markets are reacting positively to the NFP news with all major US indices up green at time of writing. NFP data come under more scrutiny given Powell’s remarks about the strong employment data not hinting at an economic slowdown or recession even with two consecutive lower GDP prints.

The heat map of the S&P 500 is a welcome sight for sore eyes. All green after days of red.

News

Starbucks (SBUX) names a new CEO. Restaurant industry outsider Laxman Narasimhan will join the company in October and step into the CEO role in April. Interim CEO Howard Schultz will stay on the board and act as an advisor. Starbucks’s investor day is coming up on September 13th in Seattle.

Russia vows to halt all oil exports to countries to impose price caps on Russian oil. This comes after the G7 outlined a plan to impose price-caps on Russian oil.

Cathie Wood and ARK are loading up on Nvidia. The flagship ARK fund bought $31 million worth of Nvidia, and ARK autonomous technology and robotics ETF (ARKQ) bought $4 million worth of shares, its first foray into Nvidia. The ARK next generation internet ETF (ARKW) bought $5 million worth of shares.

Lululemon Athletica stock rallied 10% after the retailer reported earnings and sales which beat market estimates. The company said they are seeing ‘momentum’ in sales.

US factory orders dropped sharply in July. This is the first decline after nine straight gains. Orders for manufactured goods fell 1% in July.

Canadian Stock News

Advanced Human Imaging (NASDAQ: AHI) has entered into a definitive agreement to acquire Wellteq Digital Health (WTEQ.CN). Wellteq shareholders will receive 1 ordinary share of AHI for every 6 Wellteq common shares held. Wellteq shares are up 275%.

Petroteq Energy (PQE.V) has announced the closing of a private placement offering. The company will raise gross proceeds of $900,000 US. The stock is up 38%.

Jade Power Trust (JWPR-UN.V) announces proposed sale of its renewable asset portfolio. The company has entered a binding share sale agreement with Enery Power Holding GmbH, an Austrian based renewable energy company with operations throughout the Czech Republic, Slovakia and Bulgaria. The purchase price under the purchase agreement is approximately $71 million Euros or $93.7 million CAD. The stock is up 11%.

Billionaire investor Eric Sprott has announced a 18,240,750 common share purchase warrants of AbraSilver Resources Corp (ABRA.V). Mr. Sprott beneficially owned and controlled 62,481,500 Shares and 18,240,750 Warrants representing approximately 12.6% of the outstanding Shares on a non-diluted basis and approximately 15.7% on a partially diluted basis assuming the exercise of such Warrants. Shares are up 9%.

Trillion Energy (TCF.CN) received a price increase for the sale of natural gas from its SASB gas field to US $30.68/Mcf effective September 1st 2022. This is a 47% price hike and the company attributes the price increase to a supply squeeze caused by the Nord Stream pipeline shut down.

Chart of the Day

From a technical standpoint, natural gas is looking to drop. Natural gas has been ranging around $9.50 for a few trading weeks. After a long uptrend, a range tends to be exhaustion hinting at a drop lower. Watch for a move to $7.50, although from a fundamental standpoint, winter is coming for Europe.

Leave a Reply