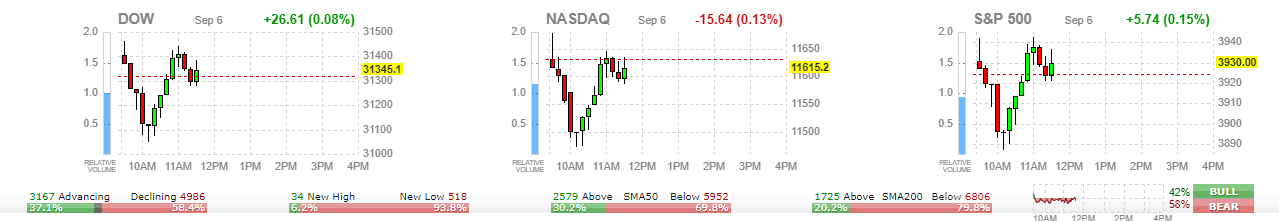

We are now in September which is historically the worst month for stock markets. Markets are currently mixed:

The Dow Jones and the S&P 500 have turned positive at time of writing and the Nasdaq is looking to join in. However, the downwards trend still remains strong.

This week kicks off what is going to be a major month for central banks. Interest rates will be rising in the month of September, and traders will be tuning in to the press conferences to determine whether central bankers will be hawkish or dovish. Or in simple terms, whether central bankers will continue to raise interest rates aggressively, or slow down and approach rate hikes in a more pragmatic approach.

All of this culminates with the big Federal Reserve FOMC meeting on September 20th and 21st.

We kicked off with the central bank of Australia. The RBA raised interest rates by 50 basis points, taking rates from 1.85% to 2.35%. Financial media is having a difficult time in determining whether the RBA is signaling more rate hikes, or if their language signals a ‘wait and see’ approach.

Next in line comes Canada, with the Bank of Canada expected to raise interest rates by 75 basis points taking rates from 2.5% to 3.25% on Wednesday September 10th.

We end this week with the European Central Bank who are also expected to raise interest rates either 50 or 75 basis points. This one is highly anticipated given all the issues Europe is dealing with from rising energy prices to Italian bond yields rising. Especially since Europe is way behind the curve when compared to other western central banks.

These rate decisions will cause volatility for markets, especially the Fed rate decision later on in September. Markets will assess the rhetoric and determine whether the inflation trade is on or the recession trade is on.

News

Russia has cut off gas supplies to Europe indefinitely. Russia claims punitive economic sanctions imposed by the West are responsible for the indefinite halt to gas supplies via Europe’s main pipeline.

UK energy bills are rising and many Britons are signing a petition to boycott energy bill payments as a 80% price hike draws closer. Britain’s new Prime Minister Liz Truss is now under pressure to announce new energy relief measures.

OPEC+ has surprised analysts with an output cut. OPEC+ will implement a small production cut of 100,000 barrels per day to bolster prices beginning in October. This comes a month after OPEC+ decided to raise oil output by the same amount to lower prices. This is seen as a political statement and a symbolic message.

Canadian Market News

RAMM Pharma Corp (RAMM.CN) has acquired leading European hemp manufacturer HemPoland from the Green Organic Dutchman Holdings (CSE:TGOD) for cash consideration of CAD $1.2 million. The stock is currently up 25% with over 787,000 shares traded.

Billy Goat Brands (GOAT.CN) intends to change its name to GOAT industries LTD. The company will continue to trade under the same ticker. The Name Change will further re-enforce GOAT’s recently announced capital deployment, diversification, and alpha generation mandates. The stock is up 22% with over 2,000,000 shares traded.

Lifeist Wellness (LFST.V) announced its Canadian cannabis business has successfully brought a second new product category to market, namely shatter. The first new product in the new category, in-house branded Roilty Wedding Shatter, has shipped to retailers in Saskatchewan and is a key part of CannMart’s focus on higher margin revenue streams with the goal to improve profitability. The stock is up 19% with over 2,000,000 shares traded.

Benz Mining Corp (BZ.V) has successfully completed a CAD $12 million brokered private placement to accelerate critical mineral and gold exploration on the emerging greenstone belt in northern Quebec. The stock is up 18% with over 246,000 shares traded.

Japan Gold (JG.V) has announced that Barrick Gold has selected 6 projects from the Barrick Alliance portfolio to continue as included projects in the second evaluation phase under the strategic alliance agreement between Japan Gold and Barrick. In addition, Barrick will be continuing their Initial Evaluation Phase on three project areas that were added to the Barrick Alliance following its formation. Japan Gold will continue to provide full support and management of the Included Projects under the Barrick Alliance. The stock is up 13% with over 194,000 shares traded.

Chart of the Day

The US Dollar strength continues and we have broken above the key 110 level. Can the Dollar hold above? If so, a strong dollar has huge ramifications for stock markets and the financial world in general. A stronger dollar puts pressure on other currencies and hits those emerging market currencies who have large US dollar denominated debt. Is this indicating that money is running into cash? Investors are preparing for a more hawkish Fed? Could it be European and Asian wealth leaving and running into the US? Or could this be a combination of all three?

Leave a Reply