From a technical analysis perspective, it appears as if natural gas has bottomed. Is it now time to go long natural gas?

I am approaching this from a trading/medium term perspective. From a long term/investing perspective I do believe natural gas has a promising future. Liquified natural gas (LNG) has been making recent headlines given the situation in Europe. The ‘blowing up’ of one of the Nord Stream pipelines means that Europe will likely be importing a huge amount of LNG from the United States.

Just know that natural gas is very volatile, hence the name the ‘widow maker’. Great amounts of wealth are either made or destroyed due to these volatile moves. Remember this guy who lost all his clients money due to a volatile move in natural gas:

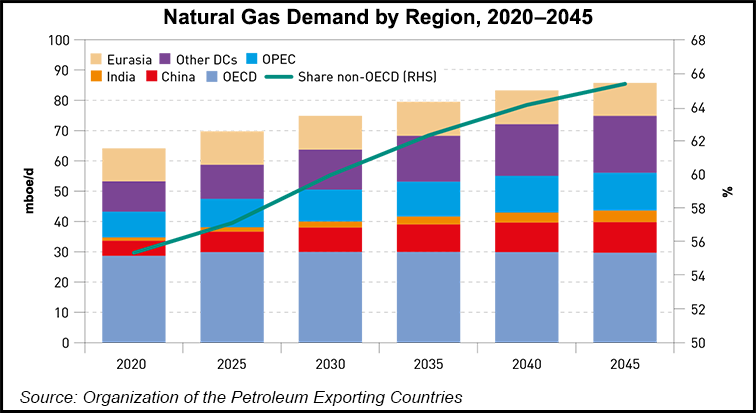

However demand for natural gas should continue to grow in the coming years which will benefit natural gas stocks.

Now let’s get to the chart.

Readers of my work here on Equity Guru, and viewers of my videos on our Youtube channel probably know why I am practically salivating from the mouth. I love this set up as a reversal trade.

Natural Gas dropped and confirmed a reversal set up with a break below $5.50 on December 22nd 2022. The catalyst? The European energy crisis was averted due to a warm Winter weather forecast. Well, it turned out Europe had their ‘warmest Winter on record’. No energy shortage problems, and Europe had enough storage of natural gas to make it through Winter.

From a technical perspective, it appears as if the shorts have taken their profits around the $2.50 zone. Natural Gas began to range for consecutive days after a major drop. The range looked to have failed as natural gas broke down on February 17th 2023. But note what happened.

Instead of holding resistance on the retest and heading lower, natural gas rallied. The rally took us back above the breakdown zone triggering a fakeout or false breakdown. Tons of stop losses have been taken out and we have had five green days in a row.

From a technical perspective, I see many confluences here pointing to a new uptrend in natural gas. These include a false breakdown, a close above the lower high at $2.65, and a cross above my moving average. As long as natural gas holds above $2.50, this new uptrend will remain in play with my first target coming in at $3.50.

So what are some fundamentals which could drive prices higher? Sure, geopolitics with things escalating in Eastern Europe could play a role in causing energy to rise as a whole. However, we did not see much reaction when the Nord Stream pipeline exploded.

The focus should be on supply and demand. I spoke to a friend who works in the natural gas space and this is what he told me in regards to being bullish natural gas:

Short-Term NG POV:

Freeport LNG restart underway will be a key asset to help balance the currently sloppy long NG markets in the US. Currently running at about 50% of capacity but expected to get to around 66% in coming weeks. 100% operating rates expected by May. Assumption is that LNG exports will be strong as the world has become very short on waterborne NG supply in the post Nordstream 1 world. Anticipating that NG will recover back towards sustainable levels around $3 with this additional demand. Risk today is that there is still too much US NG supply coming off recent drilling even with the incremental demand produced by Freeport LNG. I also believe that the EU manufacturing sector is waiting for Freeport to return online before they have the confidence to restart assets.Long-Term POV:

Recovering global manufacturing demand will set LNG prices in China and Europe. Given recent ending of covid lockdowns and signs of recovering in China, I am anticipating LNG prices to start to get very bullish. Given that China manufacturing demand also calls upon supply from low energy cost regions such as the US, anticipating a pickup in US industrial demand for NG as well. Since Europe still desperately needs the LNG, also anticipating a bidding war that will quickly lift EU (TTF) and China NG (JKM) markets, which will leave room for US LNG prices to rise and potentially could start pulling US NG prices up with it. Risk here is that there is still too much inventory of physical goods floating around to incentivize production to restart, although publicly available data suggests that excess inventories have reduced and again there could be too much supply to really allow US NG prices to rise with any spikes in global LNG markets.Wildcards:

Short-term NG prices are still heavily influenced by weather events (heating) and power demand (cooling, alternative power supplies e.g. wind/solar).

A pretty good analysis and rundown if you ask me. This is one of those opportunities where both the technicals and the fundamentals are aligned. A winning combination.

Leave a Reply