Go to YouTube and search XRP. First of all, you may run into my video which I will post below. But notice the titles. Many of them are celebrating the latest fundamental news which came out last week and saw XRP close over 70% higher on the day. Titles of “How much XRP do you need to retire”, “XRP to explode”, “XRP to $100”, and titles referring to banks loading up on XRP. The takeaway? This is big news for the crypto markets, and the retail crowd is loving it.

In this article, I will break down the charts and present two possible scenarios going forward. But before we jump into the charts, let’s go over the fundamental news.

Last week, news came out that a New York judge delivered a watershed ruling for Ripple determining that XRP was “not necessarily a security on its face”. Ripple has been fighting the SEC for 3 years over allegations that two of Ripple’s executives conducted an illegal offering of $1.3 billion worth via sales of XRP. Ripple disputed the claims saying XRP cannot be considered a security but is more akin to a commodity.

This case against the SEC saw Ripple lose a customer and investor in MoneyGram, a US money transfer giant, and saw UK based investor Tetragon, dump its stake in Ripple.

But now the big debate is whether this ruling will now see big money return to XRP. Mainly the banks.

For those who follow the cryptocurrency, you know it is quite divisive. XRP is touted as the bankers coin. Ripple uses blockchain in its business to send messages between banks, kind of like a blockchain-based alternative to Swift. XRP is a cryptocurrency that Ripple uses to move money across borders. The company uses the token as a “bridge” currency between transfers from one fiat currency to another – for example, U.S. dollars to Mexican pesos – to solve the issue of needing pre-funded accounts on the other end of a transfer to wait for the money to be processed moving money in a fraction of a second. Whereas Bitcoin has a cap in supply, XRP does not.

Some say that XRP will play a central role in the world of central bank digital currencies and the mass adoption of digital currency being the banker’s coin. Because of this, some hardcore crypto enthusiasts believe investing in XRP is investing in a world where the big institutions control and monitor your money and spending. A centralized digital currency world, whereas the premise of crypto originally was to be decentralized and out of the hands of big government, big banks and big corporations.

And with this win, Stu Alderoty, Ripple’s general counsel, has said that American banks will return to Ripple and use its On-Demand Liquidity (ODL) product:

“I think we’re hopeful that this decision would give financial institution customers or potential customers comfort to at least come in and start having the conversation about what problems they are experiencing in their business, real-world problems in terms of moving value across borders without incurring obscene fees,” Alderoty told CNBC Friday.

“Hopefully this quarter will generate a lot of conversations in the United States with customers, and hopefully some of those conversations will actually turn into real business,” he added.

Other analysts believe that the ruling is just a partial victory. The judge stated that some sales of the token did qualify as securities transactions. For example, about $728.9 million of sales of XRP to institutions the company worked with did qualify as securities, the judge said, stating there was a common enterprise, an expectation of profit. Some analysts even say the ruling does nothing for regulatory clarity.

While XRP is bound to move on any new follow up fundamental news and headlines, the chart is showing an interesting story.

XRP broke out above $0.55 and this breakout and close was highly significant. XRP has rejected this resistance zone multiple times going back to 2022. What was once resistance now becomes support and as long as XRP remains above $0.55, a new uptrend remains intact.

In terms of market structure, this breakout is key. Note that XRP was in a downtrend with lower highs and lower lows before then shifting to a range. All markets move in three ways: downtrend, range and an uptrend. The breakout above $0.55 confirmed the end of the range and very likely, the beginning of a new uptrend where traders and investors can expect multiple higher lows and higher highs.

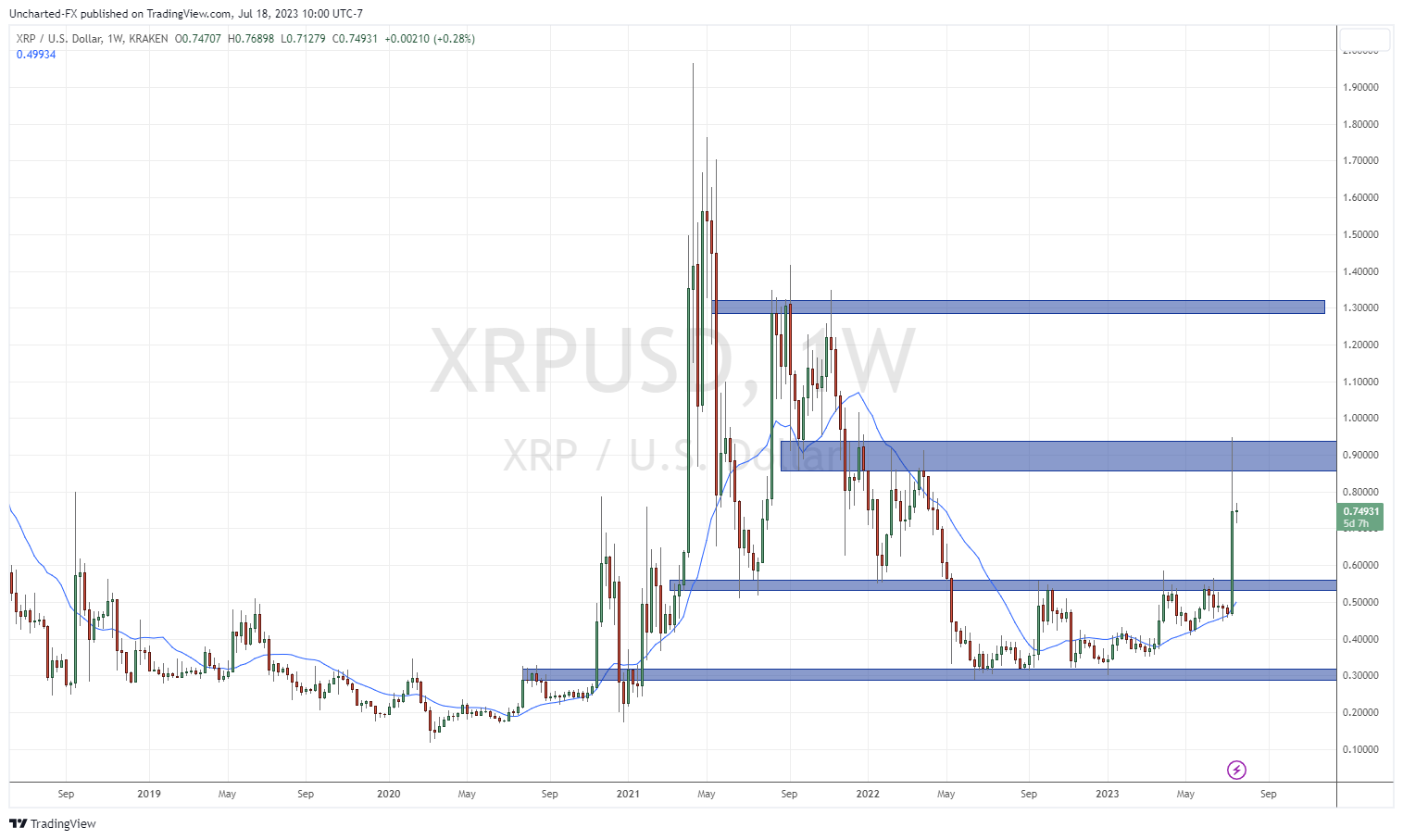

If we zoom out to the weekly chart, you will see some important levels highlighted. First off, on the larger time frame, you can see how important the breakout above $0.55 was. Secondly, notice where price hit on the news before selling off. The $0.90-$1.00 zone is a major resistance zone. It was the first target for traders, and going forward, XRP will need to confirm a close above this resistance zone to continue the run up to $1.30.

So what comes next from a technical perspective?

XRP could retrace and retest the $0.55 zone. This is normal when it comes to breakouts. This corrective phase would see buyers step in near or at $0.55 and then see XRP continue its uptrend. If instead XRP closes below $0.55, it would signal a false breakout or fakeout, and would be extremely bearish for XRP.

But what about acting now?

This is where we can use the intraday charts to our advantage.

As you can see, XRP is just ranging on the intraday after its big move. From a momentum perspective, you would expect continuation. But then again, XRP’s first target resistance zone has already been met in the one day explosive move. Perhaps this is why a move lower to retest $0.55 is much more likely.

BUT if you want to jump in, I would wait for the previous lower high on the intraday to be taken out. In this case, this would be the $0.80 zone. If we can get a 1 hour close above this price level, it would be a good sign that the corrective phase is over, and XRP will continue its run higher.

If we do not get this break and close, then the move down to $0.55 remains in play.

Before I sign off, I just want to highlight the chart of Bitcoin. The cryptocurrency also had a major breakout and move recently which took us straight to a resistance zone. Bitcoin has been unable to breakout above it and it has been a few weeks. It is more likely that Bitcoin will retrace and pullback in a corrective phase.

XRP is riding on fundamental news, but that momentum seems to be running out of steam. In that case, XRP may just move with the crypto momentum and market as a whole. And charts of Bitcoin and other cryptos suggest a move lower.

Leave a Reply