More money-printing – one of the macro arguments in favour of higher gold prices – is on the near-term horizon.

“Janet L. Yellen, President-elect Joseph R. Biden Jr.’s nominee for Treasury Secretary, will tell lawmakers at her confirmation hearing on Tuesday that the United States needs a robust set of fiscal stimulus measures to get the pandemic-stricken economy back on track and that now is not the time to worry about the nation’s mounting debt burden,” stated the New York Times.

“Ms. Yellen’s support for a large stimulus package comes as Mr. Biden prepares to push through a $1.9 trillion relief plan once he assumes the presidency”.

“Right now, with interest rates at historic lows, the smartest thing we can do is act big,” said Yellen, “In the long run, I believe the benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time.’”

Rumours of the death of gold may have been exaggerated.

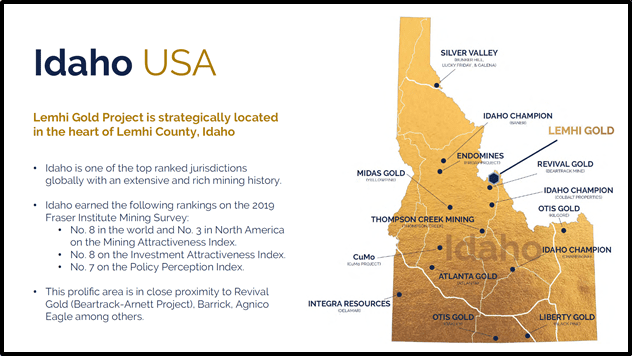

On January 19, 2021, Freeman Gold (FMAN.C) announced that it has begun metallurgical test work on its 100% owned Lemhi Gold Project located in Idaho, USA.

Freeman Gold’s flagship property comprises 30 square kilometers of highly prospective land.

The mineralization at the Lemhi Project consists of shallow, near surface primarily oxide gold mineralization that has seen over 355 drill holes but remains open at depth and along strike.

FMAN is working towards de-risking the asset and producing a maiden NI 43-101 compliant resource estimate based on brownfield and greenfield exploration.

”The historical resource estimates at Lemhi range between 500k and one million-plus ounces of oxide material,” reported Equity Guru’s Greg Nolan on January 14, 2021,” The contrast in these estimates was due to property boundary constraints that seesawed over time.”

“A recent consolidation of many of the key claims in the region resolved those issues. This was a real heads-up move and a clear display of management’s deal-making savvy,” continued Nolan.

In order to advance process development at Lemhi, a 2021 preliminary metallurgical testing program is being conducted at SGS Canada Inc.

“Metallurgy is the science and technology of metals and alloys,” states Science Direct, “Process metallurgy is concerned with the extraction of metals from their ores and the refining of metals.”

Reading a press release about “tribology” “aqueous corrosion” and “vacancy diffusion” is not going to quicken the pulse of most retail investors.

But this nerdy stuff is important because unfavorable metallurgy can make it impossible to extract the target mineral at a profit.

Favorable metallurgy can radically improve the numbers on the bankable feasibility study.

This study is focusing on leach response, as well as investigate optional procedures, including froth flotation, primarily for deeper less oxidized material, and for establishing conceptual design and operating parameters for crushing, grinding, and leaching circuits.

This work is part of Freeman’s integrated technical program to advance towards a production decision.

A comprehensive review of the historical information and test work conducted by previous operators has been completed.

Freeman’s metallurgical team has designed a preliminary test work program to follow-up and enhance gold recoveries, ultimately leading to a project flowsheet for the Lemhi Project.

Freeman Gold is using samples from both historical and fresh drill core from the 2020 exploration drill program.

“We have a very strong foundation of metallurgical test work from previous operators of the Lemhi project which indicate excellent recoveries using conventional leach technologies,” stated Will Randall, FMAN President & CEO, “This body of work has saved us considerable time and money in designing a metallurgical program that will point us toward the optimal process and recovery parameters at Lemhi.”

As part of our 2020 drill campaign, FMAN completed a large diameter diamond drill hole which generated material for the testing program which will be conducted at SGS Canada.”

A review of metallurgical evaluations by previous owners of Lemhi has shown that gold recoveries respond well to conventional processing techniques.

Past engineering studies have also shown that Lemhi has the potential to be developed into an open pit, heap and/or tank leach operation.

Historical test work (1990s) showed gold recovery ranged from 70%-90%, with best results obtained using a crush size of 80 percent minus 8 mesh (2.4 mm).

Bottle roll testing simulated tank leach response, resulted in optimized gold recoveries in the mid-90% range.

The results vary based on the head grade and lithology of the samples, along with test conditions used, most notably particle size and leach retention time.

In general, the historic metallurgical information shows good to excellent leach response over wide spatial areas and depth of the known gold mineralization.

Running drill programs concurrent with metallurgy test work will provide clarity for FMAN shareholders going forward.

The company is answering two important questions: 1. What’s in the ground? 2. Can we extract it profitably?

“In a sector facing the likelihood of Peak Gold (Gold: uncharted waters – the technicals, the peak of discovery, the opportunity) and lean project pipelines, Lemhi may fall prey to a resource-hungry predator—a producer looking to bulk up its mineral inventory,” stated Nolan.

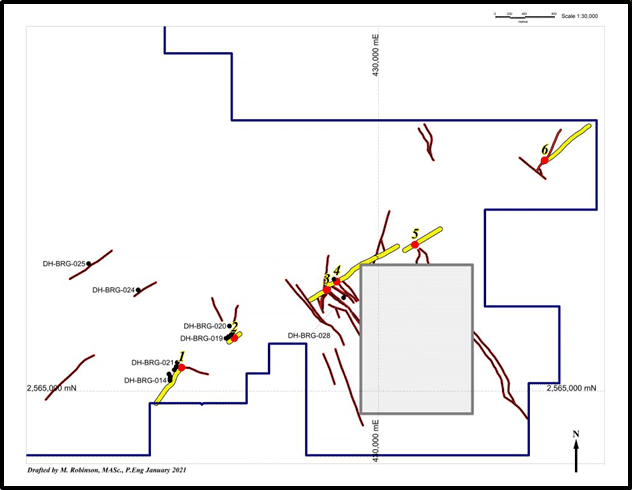

On January 19, 2021 Brigadier Gold (BRG.V) updated its diamond drill and surface sampling results from ongoing Phase I exploration at its Picachos gold-silver project, Sinaloa Mexico.

Brigadier’s Picachos asset contains four mining concessions, covering 3,954 hectares of land. That’s about 80 X the size of Vancouver’s Stanley Park.

In the southeastern region of Sinaloa state, Mexico, the Picachos mine workings are accessed by approximately 20 km of roads internal to the property.

The drill program is planned for a minimum 5,000 metres in approximately 40 holes targeting four high-grade gold-silver veins.

Drill Targets:

- San Agustin mine: underground channel sampling by prior operator returned average grade of 81.22 grams per ton (g/t) gold and 73.36 g/t silver across 1.2 meters (June 1997).

- Values of 185 g/t gold were cut across the bottom of a production shaft.

- Mochomos vein: historic rock chip-channel yielded a result of 18.5 g/t gold and 570 g/t silver across half a meter.

- Los Tejones vein with values of 28.6 g/t gold, and 114 g/t silver across approximately a meter.

- Fermin vein with values of 268 ppm silver and 0.3 g/t gold across 1 meter.

On January 19, 2021 Brigadier announced that it has now completed 3085 metres of diamond drilling in 28 holes on the Picachos Project. Assays are available for 20 holes and samples from the remaining holes are in-progress at SGS Laboratory in Durango.

Drilling highlights include:

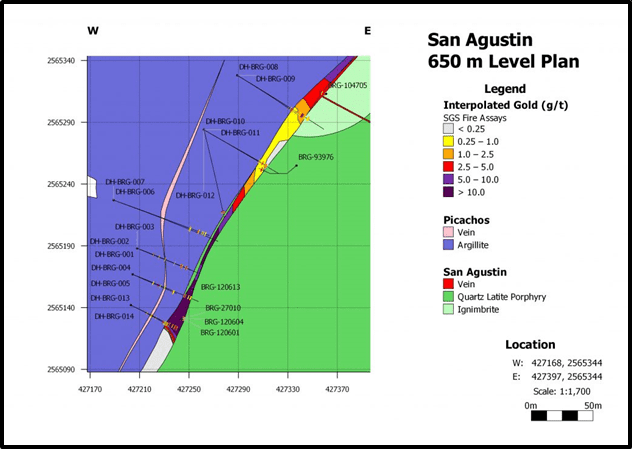

- 9.49 g/t Au and 24 g/t Ag across 3 meters (88 to 91 m) in DH-BRG-008

- 6.24 g/t Au and 79 g/t Ag across 3 meters (122.5 to 125.5 m) in DH-BRG-009

- 7.03 g/t Au and 110 g/t Ag across 3.5 meters (137.5 to 141 m) in DH-BRG-012

- 6.75 g/t Au and 44 g/t Ag across 2.5 meters (108.5 to 111 m) in DH-BRG-014

“The structure is persistent and strongly mineralized,” stated BRG’s Geologist and Qualified Person Michelle Robinson about the San Agustín results, “Although our sampling with a diamond drill is not perfect due to the challenging sub-surface conditions, it definitely indicates a robust gold-bearing vein of substantial width and strike length of over seven kilometers.”

“I look forward to expanding the depth and strike length in 2021, as well as continuing the exploration of the rest of the CVS (Colomeca Vein System), particularly in the central Cocolmeca area where a swarm of northwesterly trending veins intersects the east-north-easterly trending Cocolmeca Vein System,” added Robinson.

“We are impressed with the speed in which Michelle and her team is de-risking the Picachos Project and increasingly demonstrating its regional scale potential,” stated Ranjeet Sundher, Brigadier Gold President and CEO.

Sundher plans to “aggressively move forward to further define the Colomeca Vein System while also beginning examination of the large copper-molybdenum porphyry target located on the northern part of the Property.”

Here, Equity Guru’s Jody Vance talks with Sundher about the company’s mission.

Of the 28 holes drilled to date, fourteen (1704.28 metres) were drilled to test the San Agustín Vein, 10 holes (1029 metres) tested surface exploration targets defined by trenching, 2 holes (168.5 metres) tested under the historic San Antoñio Mine and one hole tested under the historic La Gloria Mine.

San Agustín and San Antoñio represent two gold-rich, polymetallic mineral chutes about 2.5 kilometres apart on Brigadier’s regional-scale Cocolmeca Vein System (CVS), and La Gloria historically produced gold from a northwesterly trending vein roughly orthogonal to the CVS.

The CVS has been defined at varying levels of certainty along the east-northeasterly trending diagonal of the Picachos Project for more than seven kilometres. Six surface rock chip-channel results that help define the location of the CVS include:

- 4.89 g/t Au and 67 g/t Ag across 5 metres (trench BRG-104705) from San Agustín (PR dated 24 November 2020)

- 1.85 g/t Au and 4 g/t Ag across 10 metres (trench BRG-120920) at Los Tejones prospect pits, centered 1 kilometre northeast of San Agustín

- 347 g/t Ag, 0.1 g/t Au and 5.2% Cu across 1.0 metres (historic trench MTA-15953) at Guayabo, 2.4 kilometres northeast of San Agustín

- 44.09 g/t Au and 47 g/t Ag across 0.8 metres (historic trench MTA-19856) at San Antoñio, 2.5 kilometres northeast of San Agustín

- 5.25 g/t Au and 74 g/t Ag across 1.2 metres (trench BRG-27012) from the road to La Botica, 3.7 kilometres from San Agustín

- 1.9 g/t Au and 98 g/t Ag across 1.6 metres (trench BRG-25220) from El Pino, 5.8 kilometres northeast of San Agustín (PR dated 14 September 2020)

Overview map of surface results 1 to 6 (above) on the surface trace of the CVS, highlighted in yellow.

Locations of 2020 diamond drill sites are marked in black circles labeled DH.

Holes 26 and 27 are below trench site 4 (MTA-19856).

Some results from quartz veins and veinlets in the hanging wall to the San Agustín Vein are:

- 2.71 g/t Au and 24 g/t Ag across 2 meters (54 to 56 m) in DH-BRG-003

- 0.6 g/t Au and 34 g/t Ag across 2 meters (52 to 54 m) in DH-BRG-005

- 0.73 g/t Au and 27 g/t Ag across 4 meters (51 to 55 m) in DH-BRG-014

Figure 2. Long section of the San Agustín Vein, looking west northwesterly, showing principal results from diamond drilling, underground and surface sampling completed by the Company in the fall of 2020.

This section displays data from 12.5 meters in front of and behind the plane of the page.

The 3,954 hectare Picachos Gold-Silver Property is centered over the historic “Viva Zapata” National Mineral Reserve, Sinaloa, Mexico, approximately 4 hours by road from the city of Mazatlan.

Picachos features over 160 historic mines and workings, and at least 46 veins including San Agustin.

“The Picachos Project’s location, situated 25 kilometres equidistant from two recent bonanza grade discoveries of Vizsla Resources and GR Silver and along the same mineralized trend, positions Picachos Project as an exciting opportunity for Brigadier shareholders”.

- Lukas Kane

Full Disclosure: Freeman Gold and Brigadier Gold are Equity Guru marketing client.

Leave a Reply