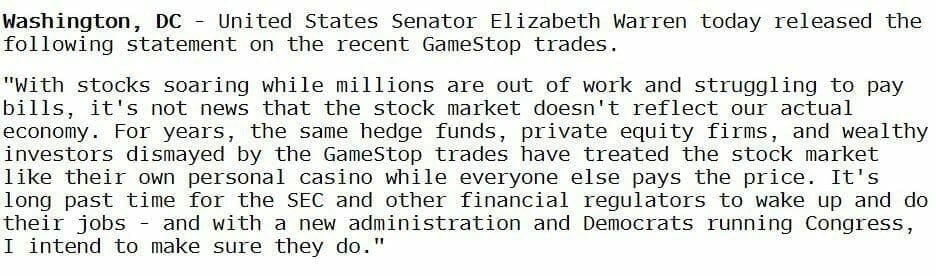

A friend said his Twitter timeline today looks like the last 15 minutes of the movie Trading Places, and he’s right. In what may have been the world’s most effective troll event, Reddit users at r/wallstreetbets got together and decided the insane level of short selling on some companies by billionaire finance bros might be a nice target for group buying.

They were right a few months back when they made Hertz Car Rentals (HTZ.NYSE) worth a bunch of money and shook the souls of short sellers just before it got delisted, and they were more right this week when they made Gamestop (GME.NYSE), a tragic shopping mall-based video game reseller basketcase that does business only with grandparents who don’t know games aren’t distributed on discs anymore, worth more than $20 billion.

Let’s just let that sink in – Gamestop is a Fortune 500 company today.

On CNBC and Fox Business and the usual places guys who wear bow-ties talk about how to exploit the system for their personal profit, suddenly the talk is about how it should be illegal for the poor folk to screw over the upper classes by coordinating their buying.

Yeah? Well you fuckers wrote the rules, now you get to play by them.

The ramifications have been large and immediate.

The poor suits. (Insert baby crying voice) pic.twitter.com/du4qlN637X

— Dave Portnoy (@stoolpresidente) January 27, 2021

BOOM.

The knock on effect is, the markets are hard down today as the big boys get nervous.

Allow me to quote myself here.

What’s happening now with the market and $GME is, the first movers were Reddit bros, then came the noobs, then came smart investors who could see the tide rolling in and the progressive influencers, now we’re seeing Wall St join in, while bitching about being last to the table.

— Chris Parry ™ (@ChrisParry) January 27, 2021

That’s what it comes down to. When I invest in a stock and see it get penetrated sideways by big short seller firms for no other reason than it’s had a good run and might be too undercapitalized to defend itself, I take that on the chin.

When I see a company I like that needs money take on a financing deal that includes lending its stock to the financier, so that financier can short it and increase its percentage on the way down, that’s on me. I take the risk when I play the game.

When I buy a stock and know the exchange is allowing companies to see my buy before it lands, bet against it, and shave my margin without risk, I know that is happening and accept it, begrudgingly, as the price of doing business.

And when I try to short a stock, but can’t without paying a massive premium, because my broker won’t be able to short it themselves if I borrow their shares, that’s the ‘little guy tax’ and I pay it if I want to play.

But if I’m betting on a GREAT company and it runs for a bit, the first thing that happens is big money comes in to fuck it, short it, drive it down, and then offer it expensive financing to get out from under the boot.

— Chris Parry ™ (@ChrisParry) January 27, 2021

So now we’re in the upside down times, when retail investors have figured out they have some power if they coordinate, and now the ruling class wants to tell us we should stay in our fucking lane and not mess with their scam. They’re on TV right now saying how it should be illegal for us – you and me and a million of our friends – to say, ‘you know what? Let’s buy Tootsie Roll (TR.NYSE) and see if we can make it pop.’

They think it should be fine for them to borrow 140% of the shares in existence for Gamestop and short it to hell, and that we should be somehow restricted from buying that stock and forcing them to cover. It doesn’t matter if GME is a good business or not, any more than it matters that Tesla (TSLA.Q) is worth more than the combined market caps of Chrysler, Ford, GM, Boeing, and the Ginger Beef Company (GB.V) (yes, there’s actually a ginger beef company, and it’s up) while doing a tiny percentage of those companies’ business.

Tesla makes the bow-ties money. And the naked shorting on Gamestop did too, until recently.

The markets are run and operated by people who wear suspenders and vacation in the Hamptons and who tell themselves they came by it all honestly because they’re the smartest and best people, but the reality is – it’s all a casino, and they’re playing with marked cards.

This is Fight Club, and Wall Street, which has been fighting dirty and smoking guys for years, just got LAID THE FUCK OUT by a skinny emo teen, and now wants the rules changed.

Guaranteed: Every short selling fund is closing out their positions this morning out of straight fear.— Chris Parry ™ (@ChrisParry) January 27, 2021

“How dare you!” yell the 1%ers, as they’re asked to play by the rules they set.

“This sort of coordinated insanity cannot stand! These people aren’t experts! Someone will get hurt!”

Newsflash: Someone gets hurt every day. You’re just pissed that it’s you this time, HedgeBro.

Let @Chamath lay it down for you.

Chamath Palihapitiya pounding out the boomers on CNBC right now.

TELL IT! $GME $AMC $BB $EXPR $NOK pic.twitter.com/JnbhNWCoDN— Chris Parry ™ (@ChrisParry) January 27, 2021

If you think that this will all end with hedge funds being bailed out by the government, I’m not so sure this time.

Let’s be clear – at some point, these fast moving LULZ stocks will come back to earth and someone will be left holding the bag. As happened with Hertz, Gamestop will shrivel and die, and my investment today in Express Inc (EXPR.U) and Tootsie Roll will end. There will undeniably be some who are slow to get out and quickly lose their money.

But when you’re talking about a barista losing the $300 he put into GME, that is now worth $3000, the chance he might ‘only’ get out with $600 of that in a few days is a lot less important than the $11 billion some short fund has to hand over now.

Several years ago, when a girl I liked put shit on me for doing business with mining companies, I said, ‘if you want to change Wall St, you don’t do it by protesting, you do it by buying Wall St.’

Today, Reddit made a hedge fund go broke.

We’re here.— Chris Parry ™ (@ChrisParry) January 27, 2021

Welcome to the party, kids. The keg is in the kitchen. Make yourselves at home.

— Chris Parry

Leave a Reply