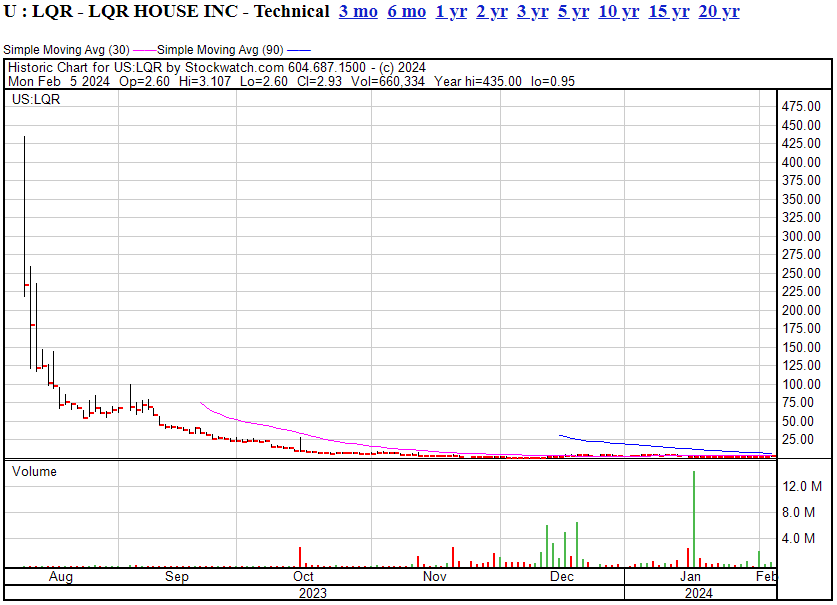

Liquor e-commerce platform LQR House (LQR.Q) made a bold but carefully worded announcement in January of this year that seemed like one of the greatest deals ever.

A $1 per share dividend.

LQR House Inc., a niche e-commerce platform specializing in the spirits and beverage industry, is pleased to announce that the Company’s Board of Directors will convene a meeting to deliberate on the proposed distribution of a special dividend, demonstrating its commitment to supporting shareholders of record.

The meeting, scheduled for Friday, January 12, 2024, will focus on the potential distribution of a special dividend of up to $1.00 per common share to eligible shareholders. This decision reflects LQR House’s ongoing efforts to enhance shareholder value and recognize the loyalty and support of its investor community.

The devil is in the details here. While it ‘looks’ like a dividend announcement, the company was actually saying they’re thinking about it. Retail investors didn’t note the difference, and that appears by design.

Most companies don’t press release a dividend until it has been confirmed. I’ve not seen a public company put out a news release that it was ‘proposing’ a dividend of ‘up to’ any figure at all, ever, because proposals are emptier than letters of intent.

I mean, I could ‘propose’ that I give Charlize Theron a 6-month romantic getaway and $2.3 million to spend at the hotel gift shop, but until she says yes (and I deliver $2.3 million), I’m unlikely to be justified in talking about my plans in public.

But hey, LQR House CEO Sean Dollinger is committed to delivering for shareholders.

As a forward-thinking company dedicated to creating value for its stakeholders, LQR House has consistently strived to align its strategies with the interests of its shareholders. The proposed special dividend underscores the Company’s confidence in its financial position and outlook, as well as its commitment to delivering returns to investors.

That’s a bold strategy, Cotton, let’s see how it worked out for them.

One month later, the dividend had… changed:

[LQR] announces the declaration by its Board of Directors of a 50% stock dividend (i.e., issuance of one additional share for each two shares held by a shareholder on the record date) for distribution to all of the Company’s shareholders of record at the close of business on February 12, 2024. The Company’s Board of Directors declared the dividend at a follow-up meeting board meeting to discuss a previously proposed cash dividend of up to $1 per share and reflects the Board’s commitment to shareholder value and its belief in the Company’s prospects.

Yo, WHAT? No cash?

Not mentioned in that news release is the minor detail that those ‘special dividend’ shares come with a SIX MONTH HOLD.

That is, on February 11 all the LQR shares you own can be traded at will, but on February 12 one third of your shares will be locked up until August.

And what’s more, it’s for your own good! You should be happy about this! Sean Dollinger is ‘showing you appreciation.’

“We believe that the Board’s unanimous decision to declare this stock dividend demonstrates our commitment to rewarding shareholders. Despite the deferral of the earlier proposed dividend, our dedication to giving back to our supporters remains unwavering. The Board reconvened on January 30th with the shared goal of showing appreciation to those who have stood by us. Importantly, this stock dividend will have no dilutive impact on LQR House’s current shareholders.”

You see that, kids? You didn’t LOSE the $1 dividend, it’s just undergoing a ‘deferral’ and you get a whole bunch of free shares (that you can’t sell and that hold no more value than your old shares).

Let’s be clear, this is a stock split, not a dividend.

And stock splits don’t traditionally come with a hold period.

They’re usually used to bring down the price of a stock so it’s more affordable to retail investors, not to prevent investors from selling their paper for half a year.

In addition, they don’t usually follow a 60:1 stock rollback, which is what LQR did this past November, to get their share price back over NASDAQ listing eligibility requirements.

Oh, and also they’re launching an NFT, so “HODL YOUR STONKS” or some shit.

RUG PULL CENTRAL:

If this all seems, I don’t know – weird – trust your instincts.

The TL/DR here is LQR stock has been pounded into a fine dust for much of the last year, and Dollinger’s go-to when that happens is that it’s nothing to do with his company’s underlying value, rather it’s all to do with short sellers.

It’s ALWAYS short sellers.

August 2023: LQR House Inc. (NASDAQ:LQR), a visionary marketing company [my emphasis] focused on becoming a prominent force in the alcoholic beverage sector, announces the engagement of, and collaboration with, the Law Offices of Holiday Hunt Russell, a distinguished litigation firm based in Fort Lauderdale, Florida, to lead an initial inquiry into potential instances of naked short selling or other market manipulation concerning common shares of LQR House.

With its ticker symbol LQR trading on NASDAQ, LQR House is committed to transparency and maintaining the integrity of its stock dynamics. The Company and its expert legal team will proactively share evidence of and records of activity with pertinent authorities, including the Department of Justice and Securities and Exchange Commission.

Much like that news release about the board ‘proposing’ a $1 per share dividend, there was absolutely no follow-through on this one either. The lawyers would never be referenced again, there’d be no follow-up, let alone ‘proactively shared evidence’ with the authorities. It was vapor-ware; a veiled warning not to short the stock perhaps, maybe an effort to make investors think they were 100% on the case, or a fluffy effort to make the argument that the stock could only possibly be down because people were doing illegal things…

Ultimately, it was bullshit.

A PATTERN REPEATING ITSELF:

Dollinger’s companies follow the same framework every time.

- He starts with an e-commerce platform applied to the hot sector of the minute (weed in 2018, plant based in 2020, booze in 2022).

- He hypes hard and runs the stock up, but generally goes so hard that the company quickly struggles to justify its valuation.

- When itthe stock downturns, the downturn is hard, and he blames short sellers – which may or may not be true, given the fast run-up.

- When ithe downturn continues, he institutes share buybacks, shareholder rewards for agreeing not to sell, and weird new products to distract retail

At Dollinger’s earlier companies, Namaste (now Lifeist) and PlantX, short sellers were always the problem, and anyone who said disagreeable things about said companies ‘had to be a short seller’. To combat those shorts, Dollinger would dole out favours for shareholders if they held their stock.

At Namaste, the reward for not selling your stock during a pronounced downturn was a Montreal nightclub ‘nurse themed’ party.

At LQR, the same reward comes in coupons for discounts on booze.

At Namaste, constant announcements of stock buybacks were a thing. At LQR, same same.

At Namaste, weird new product rollouts were constantly announced, if not delivered. Like a cookbook.

At LQR, the weird new product, about a year too late, is an NFT platform through which you can apparently buy and sell liquor. Because you couldn’t possibly do that without a … token?

Then there’s the flash in the pan bullshit, like claiming your website is using AI because it has a recommendation algorithm (like any Shopify website), or claiming ‘analysts’ are recommending your stock with a 5900% increase in their price target because they haven’t updated their targets since your 60:1 rollback.

I mean, Jesus, is anyone watching the road here?

HOW IT BEGAN IS HOW IT CONTINUES:

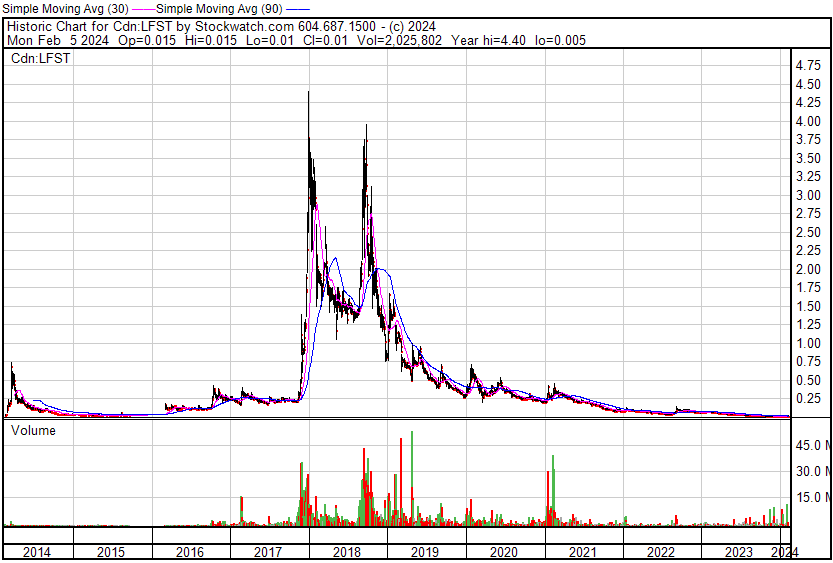

Back in the day around 2016, when Canadian cannabis companies were rocketing on the back of empty promises and super-hype, there was no weed-CEO more pumpy than Sean Dollinger of then-Namaste, more recently-Lifeist (LFST.C).

I said (a lot) the stock was destined to crash, and ultimately it did, for the reasons I noted.

Here’s the timeline of that stock.

Credit where it’s due, Dollinger knows how to fuel a run. But it’s the stuff following, where you have to justify your market cap, that he dives headlong into trouble.

Dollinger was accused of all manner of shady business back in the Namaste days, from selling personally held assets to his company for inflated prices to the questionable ‘nurse party’ for folks who committed to hold their stock even as the price plummeted. Dollinger would eventually get paid to go away, after dueling lawsuit threats, and those stepping up to helm his former company would spend years trying to rebuild.

Dollinger and I battled often because his company was just ass and he was bad at running it, even worse at running it cleanly, and everything I said was shown to be correct in the end, but his inglorious exit at Namaste wouldn’t be his last.

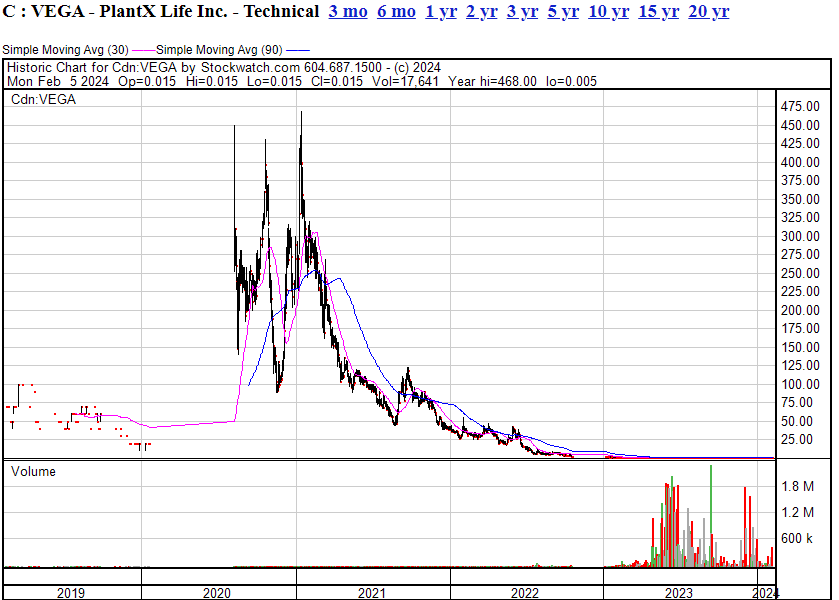

He quickly jumped into the plant-based foods fad when that was a hot ticket for a hot minute, and, well, PlantX Life Inc (VEGA.C) quickly spiked as per usual, and ended up in a distinctly Dollingeresque manner, as per usual.

On this one, I didn’t spend too much time on it because I figured everyone pretty much knew who the dude was, or should have, so if they fell prey they were on their own. In fact, we even wrote about news because, for mine, everyone gets a chance to show they’ve learned something.

But.

So when I realized LQR House, a company I’d invested in pre-IPO in 2021, on the recommendation of a broker who’d called the deal a slam dunk, was to bring on Dollinger as CEO in 2022 with the IPO still not completed, I wanted out so hard it hurt.

But wanting out and getting out are two different things. Before I could be freed, Dollinger did what Dollinger does.

RUG PULL #1:

The IPO would take months longer than anticipated, and in the meantime the stock was slated to be rolled back 4.5:1 to get it over the NASDAQ $1 stock price requirement.

When the rollback actually happened, it landed on 6:1, or a $5 per share launch, which took said broker by surprise. “There was absolutely no reason for us to be given the wrong info,” he told me.

Having lost confidence in the deal, he recommended a quick exit which I happily approved.

When LQR House stock finally listed, it immediately traded hard downwards from $5 as folks like me fought to get out of the thing. I got out at $1.08 and it felt almost like a profit just to be free. I ran away and didn’t look back – until today.

What I found was less a dumpster fire and more a dumpster filled with radioactive fish carcasses and 4 feet of sun-baked shit.

Thank god I bailed on day two.

RUG PULL #2:

If you’re wondering why that stock chart shows a $435 high, that’d be because the stock did ANOTHER rollback last year, this one 60:1, in November.

RUG PULL #3:

See dividend promise.

I just listened to a Twitter Spaces broadcast where Dollinger answered softball questions from folks really amazed that their CEO is ‘so unique’, but this is the same playbook we’ve seen twice before, to Armageddon-like results.

LQR is down 99.5% from its debut. That’s not down to short sellers, that’s down to sellers.

Sure, there may be plenty of short selling interest, but the way to combat that isn’t to force investors into not being able to sell their stock (while claiming you’re doing the a favour), it’s to run a successful business.

On that front, the company is in flames. Last quarter ending September 30, 2023, the company did $170k in revenue and had a net loss of $5.54 million.

Fish in a barrel, bros.

— Chris Parry

FULL DISCLOSURE: No dog in the fight, not a holder, not a short seller, just a journalist pointing out the bleeding fucking obvious. My brothers and sisters, take your loss and don’t get caught in this stock with no means of exit.

Leave a Reply