US inflation ticked up in February 2024 driven by higher rent and gas prices. The current market narrative is that, “stock markets are rising because investors are betting that interest rates are heading lower”. In fact, this is being used to explain the rise in gold, and somewhat bitcoin as well.

The consumer price index (CPI) rose 0.4 per cent last month after climbing 0.3 per cent in January. Gasoline and shelter, which includes rents, contributed more than 60 per cent to the monthly increase in the CPI. The annual increase in consumer prices has slowed from a peak of 9.1 per cent in June 2022, but progress has stalled in recent months.

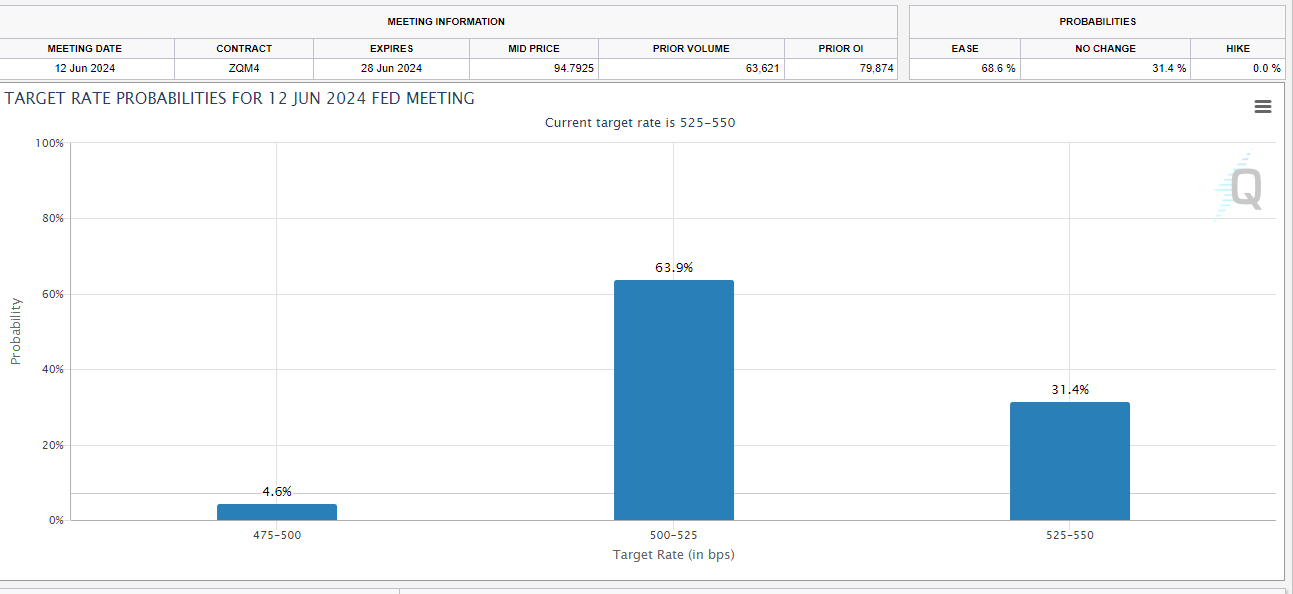

But what if inflation continues to persist? Will investors begin to become a bit more cautious on rate cuts? It is turning into one of those games where some doubt on HOW many rate cuts. Inflation persisted in January which changed investor expectations of a rate cut in March. Before February’s inflation data, markets anticipated a 70% chance of the Fed cutting rates in June. Let’s take a look at the probabilities now:

Probabilities show that markets anticipate a 68.6% chance of a rate cut at the June meeting. So is sticky inflation something the markets are worried about? Nope.

“Inflation was a little hotter than expected, particularly core inflation which is still significantly above the 2% target. The market seems to be shrugging it off which is a little surprising.”

“We’ve got a trade-off. If the Fed has to cut aggressively it’s because the economy isn’t doing so well. So the flip side of that is that the economy is strong. We may still have inflation but .. maybe the market is a little more focused on the idea that a soft landing is looking less likely and that we’re looking at a no landing scenario where growth slows down but we wouldn’t see a recession.”

Says Melissa Brown, Managing Director at Simcorp.

BRIAN JACOBSEN, CHIEF ECONOMIST, ANNEX WEALTH MANAGEMENT, MENOMONEE FALLS, WISCONSIN “While energy and transportation services were hot, food, new vehicles, and medical care services were not. Depending on who you ask, this report isn’t too shocking. Powell’s super-core inflation decelerated from the super-hot January reading, so that’s reassuring. Inflation has been concentrated mostly in the South with that region’s inflation coming in at 3.7% while the Northeast has had inflation of 2.4%. The Fed wasn’t planning on cutting next week anyways, so this report doesn’t change the discussion they’ll have around the table.”

Confusing, yes I know. Will they cut or will they not? It depends on those inflation numbers BUT the Fed does not want to disappoint the markets. With rate cuts being baked in, it is more likely the Fed does cut by 25 basis points in June. But, there are still a few more months until June… and a few more inflation data points till then. Anything can happen which could change fed cut probabilities.

But what is important to realize is that even with inflation persisting, markets are seeing current rates as the peak for interest rates. As in the next move in rates WILL be a cut, not a hike.

But if one other monthly reading comes in hot then perhaps the markets will see a new trend… and not just a data point.

The S&P 500 continues moving higher and printed new record highs yesterday. Today, the S&P did not do too much and perhaps a pullback due. However, the uptrend strongly remains intact meaning pullbacks are likely to be bought.

The Nasdaq is beginning to range and many are saying the move in Nvidia is the reason why. But, the current higher low remains intact, thus the uptrend remains intact.

Similar to the Nasdaq is the Dow Jones. This market has also ranged and is now waiting for a break in either direction.

The US Dollar broke a recent uptrend line hinting at a new downtrend. I am watching for a lower high here since the DXY broke below the 103.80 zone. This means another leg lower is likely as long as the DXY remains below 103.80.

Meanwhile Gold and Bitcoin keep on going. Check out my recent article on gold and my thoughts on this move and why it is happening.

And I want to leave you off with this chart:

Oil is coiling.

If oil breaks out substantially, then the next resistance comes in at $94. And if so, I can imagine that market and inflation expectations may begin to shift. This is a very important chart to watch.

Leave a Reply