When gold prices are climbing—whether due to inflation fears, geopolitical tension, or central bank moves—you’ll inevitably see folks squawking on TV and social media saying, “PLAY GOLD! GOLD IS IT! ZOMG GOLD BRO!”

Except for Jim Kramer, who’ll say gold is horrible as it doubles in price, beause he’s always wrong. But I digress.

To put this in perspective, let’s cut to The Juice.

Buy gold miners if you believe in gold. On average, the miners produce gold at $1400 cost ( all in) … #WhyPayRetailWhenYouCanBuyWholesale https://t.co/2bO8Jl8xJc

— Frank Giustra (@Frank_Giustra) April 22, 2025

Out of the ground at $1400 and sold for $3400 is decent margin, especially when it’s up from $2600 just four months back.

For the average retail investor, this can be a confusing time because ‘playing gold’ can take several forms, and not all of them are as simple as yelling “BUY BUY SELL” down the phone like folks do in the movies.

There are several smart ways to get gold exposure, each with their own strengths, risks, and timelines, so this article is intended to help you chart a path forward in the short, medium, and long terms, as gold prices rise and fall and rise again.

BULLION IS FOREVER

For the most conservative investor, physical gold is the classic move. It’s tangible, private, and eternal. Gold bars, bullion coins like the Canadian Maple Leaf or American Eagle, and allocated storage in vaults (like through Kitco or BullionVault) are all well-established paths for the grampa investor and doomsday prepper alike. You’re not chasing returns here so much—you’re preserving wealth in a manner that will survive both political revolution and zombie apocalypse.

But remember, physical gold doesn’t pay dividends, and liquidity can be clunky if you’re having to use it to buy bread or pay alimony or talk a post-apocalyptic raider off your fortified front porch. It also brings storage and insurance costs which, while not arduous, will eat into your returns, especially as you get no returns until you or your descendants sell the stuff.

KEEP IT SIMPLE, SISTER

For something more liquid and easier to manage, ETFs like GLD (SPDR Gold Trust) and IAU (iShares Gold Trust) offer a way to track the gold spot price directly through your brokerage. These funds are backed by physical gold, are highly liquid, and avoid the mess of delivery or custody. They’re great for portfolios that need a hedge or a temporary gold allocation, but they don’t give you any leverage—when gold goes up 10%, these go up around 10%, minus a small management fee.

ETFs are the go when your grandma has seen a Facebook video yelling that if she doesn’t get into gold her grandkids will hate her, and she’ll die alone working in a Congolese coal mine to keep her rent paid. Buying an ETF is easier than setting the clock on her VCR, but the profits will be chill for the most part.

DADDY WANTS A STEAK DINNER

If you’re chasing upside, gold mining stocks offer leveraged exposure. When gold prices rise, miners often see profit margins grow faster than the metal itself, which can turbocharge returns.

Large-cap names like Barrick Gold (ABX.TO) or Newmont Corporation (NEM) are relatively stable and pay dividends, making them a good core holding. Mid-tier producers like Agnico Eagle (AEM) or Alamos Gold (AGI.TO) give more torque without jumping fully into high-risk territory.

THE HELL WITH STEAK, WE EAT LOBSTER OR NOTHING

For adrenaline junkies and high risk high reward speculators, junior explorers like Snowline Gold (SGD.V), Rupert Resources (RUP.T), or West Red Lake Gold (WRLG.V) offer the potential for 5x returns—but also carry significant drill risk and funding risk. These companies have some heft to their back office, can raise money and apply it to substantial projects, and will see a far more exponential rise if/when they produce physical gold.

But they’re also early stage, may come with some hiccups as they progress, and may never get to the level you hope. With the explorers, you’re trading the safety of knowing that gold will definitely emerge from the company for the higher risk of assuming that it will.

I’M SCARED, WHAT NOW?

For a more balanced play, royalty and streaming companies are a favorite among savvy gold investors. These firms don’t run mines themselves. Instead, they finance miners in exchange for a share of future production—often at a fixed low cost. This shields them from operational blowups while still giving upside to rising gold. Top picks here include Franco-Nevada (FNV.TO), Wheaton Precious Metals (WPM.TO), and Sandstorm Gold (SSL.TO). They don’t rise as fast as junior miners in a full-blown gold rally, but they hold value much better in downturns.

Then there are the thematic funds—baskets of miners or precious metal plays bundled into a single ETF. GDX (VanEck Gold Miners ETF) gives exposure to the big producers, while GDXJ targets juniors. These ETFs let you spread out your risk and still ride the gold wave. Just watch the holdings—some “precious metal” ETFs sneak in copper or battery metal plays, which can dilute the gold thesis.

THE KIDS LIKE THESE OPTION THINGS

The kids also like eating Tide pods, so don’t be too rushed to imitate them.

For sophisticated traders or those with a VERY short-term attention span, gold futures and options offer leverage and flexibility, but the risk of loss is real and fast.

These are better left for hedging or experienced hands but, who am I kidding, you’re already googling the term so let’s go on a side track and try to save your kid’s college fund.

WHAT IS OPTIONS TRADING?

Options are contracts that give you the right, but not the obligation, to buy or sell a stock (or other asset) at a specific price, before a set expiration date.

They’re used to speculate, hedge, or boost returns with limited upfront cost.

Two Main Types of Options:

-

Call Option

-

Right to buy a stock at a set price (the strike price)

-

If the stock goes up beyond the strike price, you profit

-

-

Put Option

-

Right to sell a stock at the strike price

-

If the stock goes down from the strike price, you profit

-

Terminology:

The Contract

One Option Contract = 100 Shares

If you buy 1 call option on ABC at $50, you’re controlling 100 shares of ABC at that strike price.

The Premium

The premium is the price of the option.

If a call costs $2, the premium you pay $200 (2 x 100).

In-the-Money vs. Out-of-the-Money

-

In-the-money: The option has intrinsic value. (e.g., stock is $60, call strike is $50)

-

Out-of-the-money: It doesn’t (yet). (e.g., stock is $45, call strike is $50)

Expiration

Options aren’t forever. They expire—and once they do, they’re worthless if not in-the-money.

But you don’t have to wait until they expire to make your money.

You can:

-

Exercise them (buy/sell the stock)

-

Or more commonly, sell them for profit before expiry

Why Trade Options?

-

Leverage: Control more shares with less money

-

Hedging: Protect against losses in your main holdings

-

Speculation: Bet on movement without buying the stock

-

Income: Sell options to collect premiums (e.g., covered calls)

Risks

Let’s be very clear, most options traders lose money. You can be a dumb investor in ETFs, stocks, bullion, and just about everything else, but options trading is work. It can be a minute to minute ordeal and the market has a way of moving against you even when you’re certain it shouldn’t.

-

Buyers risk 100% of the premium paid

-

Sellers (especially of naked calls/puts) face unlimited risk

-

Complex strategies require understanding volatility, time decay, and pricing

Personally, I don’t think you’re up to it. Though I like high risk, high reward, I don’t like all or nothing.

For mine, junior explorers that are close to production are the play when gold is on a run.

Near term explorers are generally battle tested, they’ve managed to navigate capital raising to get to that point, and done enough exploring that the bigger players are watching, if not participating.

Think of a mining explorer as a racehorse setting out for its first race. It may well win that race against other debutants at its level and, if it does, it’ll progress to the next level up and, if you’re lucky, it’ll win again.

But to get to production is like that horse getting enough wins in a row to make it all the way to the Kentucky Derby.

You can make absolutely make money on it along the way with small, smart bets, but betting on one coimpany early and expecting it’ll go all the way is a really risky proposition.

Better, in my opinion, to look at horses close to that level, that have a substantial track record, that can still turn a great profit in those next few races.

SHOW ME SOME POTENTIAL BEAUTIES

West Red Lake Gold Mines Ltd. (TSXV: WRLG)

West Red Lake Gold Mines is focused on restarting the high-grade Madsen Gold Mine in Ontario’s Red Lake district. The mine, previously operated by Pure Gold Mining, was acquired by West Red Lake in 2023. With a history of producing nearly 2.5 million ounces of gold, the company aims to resume operations by mid-2025 and has iconic mining magnate Frank Giustra along for the ride, so raising capital won’t be hard.

ESGold Corp. (CSE: ESAU)

ESGold is a $27m explorer advancing its Montauban Gold-Silver Project in Quebec. As of April 2025, the company has commenced on-site construction and assembly, marking a significant step toward near-term production, right as the global gold market is going on a run. When gold prices are up, that doesn’t benefit distant=term producers much, but folks who are months – maybe a year – from pulling gold out of the ground are right in the weet spot.

Maple Gold Mines Ltd. (TSXV: MGM)

Maple Gold Mines is a $36m explorer developing the Douay and Joutel gold projects in Quebec’s Abitibi Greenstone Belt. Recent drilling at the Nika Zone intersected 2.05 g/t gold over 108.6 meters, indicating potential for a high-grade, bulk-tonnage deposit. Agnico Eagle owns some and recently increased their stake.

First Mining Gold Corp. (TSX: FF)

First Mining is focused on the development of the Springpole Gold Project in northwestern Ontario and the Duparquet Gold Project in Quebec. Springpole is one of Canada’s largest undeveloped gold projects, with a completed pre-feasibility study and ongoing permitting processes, as well as First Nations agreements. First Majestic has a silver stream deal with the company that has helped progress it.

Canadian Gold Corp. (TSXV: CGC)

Canadian Gold Corp. is a $55m gold explorer advancing the Tartan Mine project in Manitoba. In March 2025, McEwen Mining Inc. became a strategic shareholder, acquiring a 5.9% stake to support the exploration and development of the Tartan Mine. They’re now into phase 4 drilling and expanding their zone, with plans to double the drillzone going forward.

CLOSER STILL:

These companies have commenced early stage production and are positioned for significant growth through expansion and optimization, which is ideal for a moment when gold prices are running:

Fortuna Mining (NYSE: FSM)

Operating multiple gold mines across West Africa and the Americas, including the Séguéla Mine in Côte d’Ivoire and the Lindero Mine in Argentina. The company has demonstrated consistent production growth and is exploring further expansion opportunities.

SSR Mining (TSX: SSRM)

With operations in the U.S., Canada, and Turkey, SSR Mining expects to produce 410,000 to 480,000 gold equivalent ounces in 2025. The company is investing in growth projects, including the Hod Maden project in Turkey.

Aris Mining (TSX: ARIS)

Operating the Segovia Operations in Colombia, Aris Mining reported Q1 2025 gold production of 210,000 to 250,000 ounces. The company is focused on expanding its resource base and optimizing operations for increased output.

Americas Gold and Silver Corporation (TSX: USA)

Operating the Galena Complex in Idaho, the company has identified new high-grade silver-copper veins, such as the 049 Vein, which are being integrated into near-term production plans.

AND FINALLY:

From the Equity.Guru story feed,. one company that’s just started producing, and another that is making its way to that point, both in Colombia.

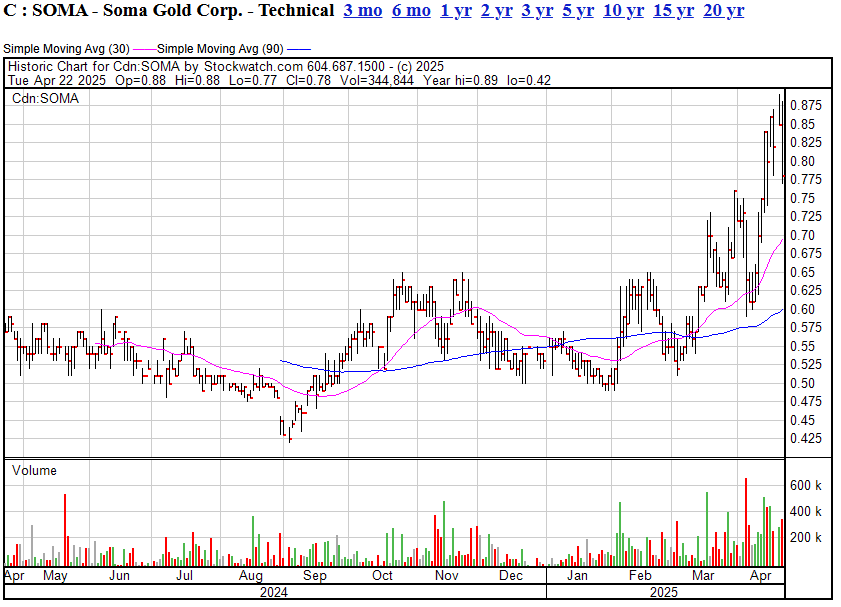

Soma Gold Corp. (TSXV: SOMA)

Headquarters: Vancouver, Canada

Headquarters: Vancouver, Canada

Primary Operations: Antioquia, Colombia

Market Cap: Approximately CAD $36.2 million

Stock Price: Around CAD $0.39 (as of the latest available data)

Overview: Soma Gold Corp. is a Canadian mining company focused on gold production and exploration in South America. The company’s principal operation is the El Bagre Gold Mining Complex in Antioquia, Colombia, which comprises an operating gold processing plant and the Cordero underground mine. Additionally, Soma owns the adjacent El Limon Project, a past-producing underground mine with a processing plant capacity of approximately 225 tonnes per day. The company also holds exploration properties, including the Tucuma Project in Brazil and the Nechi, Zara, and Otu projects in Colombia.

Financial Highlights (H1 2024):

- Revenue: $42.03 million

- Adjusted EBITDA: $13.87 million

- Adjusted Net Income: ($613,070)

- Long-Term Debt: $28.6 million

Recent Developments: Soma has been actively expanding its mineral rights in Colombia, increasing its property package along the Otu Fault to 41,427 hectares. The company continues to focus on optimizing its existing operations while exploring new opportunities for growth.

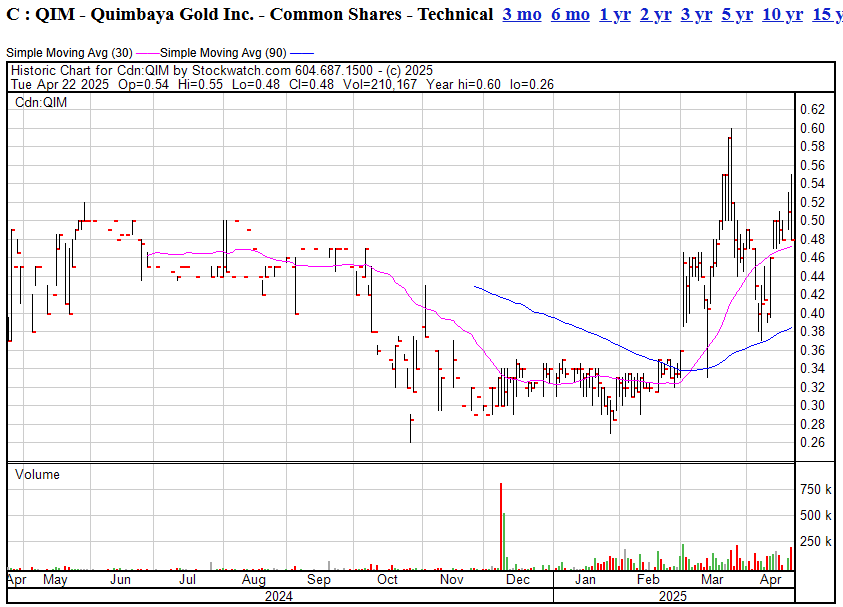

Quimbaya Gold Inc. (CSE: QIM | OTCQB: QIMGF | FSE: K05)

Headquarters: Toronto, Canada

Headquarters: Toronto, Canada

Primary Operations: Antioquia, Colombia

Market Cap: Approximately CAD $10.6 million

Stock Price: Around CAD $0.35 (as of the latest available data)

Overview: Quimbaya Gold Inc. is a Canadian-based gold exploration company with a focus on discovering and developing mineral properties in Colombia. The company holds three main projects in the Antioquia Department:

- Tahami Project: Located in the Segovia-Remedios mining district, adjacent to Aris Mining’s Segovia mine, one of the highest-grade gold mines globally.

- Berrio Project: Situated in the Puerto Berrio region, an area with over half a century of medium-scale mining activity.

- Maitamac Project: Located in the Abejorral region, featuring mesothermal veins and potential porphyry gold-copper systems.

Strategic Partnerships: Quimbaya has entered into a partnership with Independence Drilling, Colombia’s largest drilling company, securing 100,000 meters of drilling over five years through a share-based agreement. This collaboration aims to accelerate exploration activities across Quimbaya’s projects.

Recent Developments: The company has completed final payments on four Tahami contract concessions and announced warrant extensions to support ongoing exploration efforts. Quimbaya’s management team brings extensive experience in exploration, corporate finance, and project development, positioning the company for potential growth.

TO SUMMARIZE:

Smart Strategy Summary:

| Gold Phase | Best Play |

|---|---|

| Early gold price rise | Royalty companies (e.g., FNV, WPM), GLD |

| Mid gold price rally | Mid-tier/junior miners (e.g., AGI, SGD) |

| Peak hype | Rotate out of juniors, hold ETFs like GDX |

| Inevitable pullback | Accumulate physical gold, large caps |

— Chris Parry

FULL DISCLOSURE: Nobody has paid me to be included in this piece, because every market awareness budget is tiny and everyone is scared of their own shadow, even though gold is going apeshit and now is the time to blow your own horn, cowards.

Leave a Reply