The cold hard fact of things is, there are more places in the world where gold has been, or is, dug out of the ground with rusty hand tools than there are commercial mining operations.

As much as big gold mining companies spend a lot of money looking for the stuff, they walk away from a lot of places where gold sits because, to get a mine up costs a lot in time, money, political capital, and community building effort, not to mention the luck required to hit a vein that’s economic enough to dig into at large scale.

So a lot of it is never touched, or is quietly picked through by artisan miners, who break their backs for scraps and move on to the next pile of rocks when the trail is lost.

In Northern Chile, there are vast mountain ranges pockmarked with the scratchings of those artisans, of historic rock-crackers long since passed and their progeny several generations along, still trying to make a go of it. The big mining companies of the world will sometimes send geologists out to these remote places, to sample historic digs and talk to locals, to walk lands rarely walked, take a few readings with machines that go ding, and see if there’s anything worth grabbing that the others missed.

That’s what happened recently at a project called Polaris, where Newmont and B2Gold heard there was a particular plot that had been historically mined a hundred years ago and then, more or less, forgotten.

The big boys were interested. But they didn’t get the land.

No, that glory went to a small Canadian exploration company.

Halcones Precious Metals (HPM.V).

The big boys were surprised they came second in the race for Polaris, and more surprised still that the person selling the claim didn’t demand a fat cash amount for it.

No, he wanted to be paid in shares of the buyer.

And when he got those shares, he bought more at the first opportunity, diving into a subsequent capital raise.

The seller didn’t want to let go of the land entirely, and he didn’t want to sell to a multinational tha might sit on the claims for years while it got distracted by other targets.

The seller wanted someone to execute on this property, and to be a part of their group when they did.

The Setup:

- Ticker: TSX-V: HPM

- Project: Polaris, Northern Chile

- Stage: Drill-ready, geos on-site, 2,000m program already funded

- Share Structure: 295m fully diluted, but 25% insider held

- Permitting: Local rules say they can drill 39 blocks as long as the land owner is okay with it, so no permit delays

- Targets: 3.9 km mineralized trend, with surface grades up to 55 g/t Au

- Average Hole Depth Planned: There are plenty of outcrops at surface so depth isn’t required – they’ll go down to 200m

- History: 17 known previous mines in the project area, small operations extracted 5 tonnes p/mth for ten years in the 1970s.

- Majors Sniffed: Newmont, B2Gold did early due diligence but couldn’t close

The Geology:

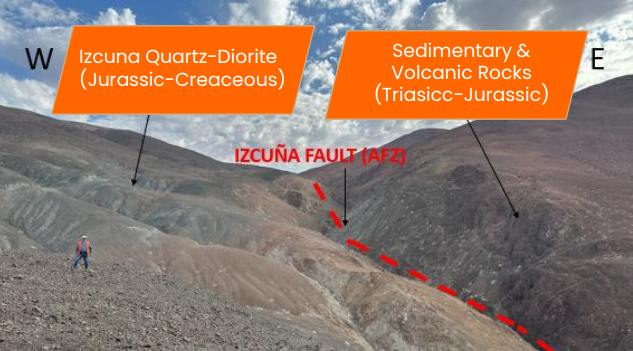

Polaris sits on 5,777 hectares in Chile’s Coastal Belt — about 150 km south of Antofagasta and 4 km from the Pacific Ocean. The zone’s tied into the Atacama Fault Zone, which has a long history of spitting up metals. The gold here is structurally controlled, hosted in quartz veins and stockworks associated with Jurassic-Cretaceous quartz-diorite and overprinted volcanic-sedimentary rocks.

Let’s be clear – there’s nothing here but rocks and dust (those two white blips below are commercial pickup trucks), so environmental concerns won’t be a major issue.

The system is classic — vein and breccia zones, some historical mining, and plenty of artisanal workings. But the real interest lies in the stockwork-hosted mineralization: gold spread through fracture systems, sometimes low grade, sometimes not, but pointing toward potential for bulk tonnage mining.

How did it get here?

On the east side of the Izcuna fault is volcanic rock. On the west, quartz-diorite. Whenever that fault moves, and it does move, it cracks open the western side, where gold finds its way through the rock.

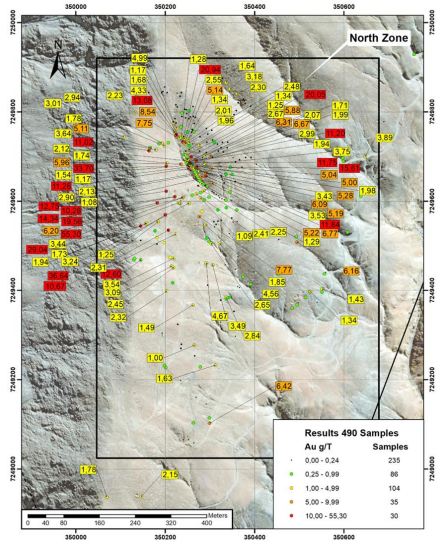

30 surface samples returned assays above 10 g/t gold, and though Polaris has never been drill tested, despite a history of mining in the area, it shows high grade at surface.

The yellow spots in the map above show where sampling picked up gold.

The orange spots picked up more gold. The red spots picked up GOOD gold.

Surface work has already mapped stockwork zones up to 250m x 500m in size, and the trend is open in both directions. A single channel returned 1.21 g/t over 85m. That’s not bonanza, but for a near-surface open pit in Chile with no permitting hangups? That’ll do.

The History:

Pre-1900, there was an abundance of local mining in the area but precious little actual exploration.

Early 20th century poke-and-shift digs focused on high-grade quartz and breccias, but didn’t have the tech to go deep or after finer gold. There’s evidence of bonanza grades from this time but a lack of attention paid to micro-fractures that, today, are easier to get at and process.

In the 1970’s, small operations extracted 5 tonnes p/mth for much of the decade, but almost all of that previous work was at or near surface.

Why? Because that’s where the easy to get at stuff was. Why dig when you can pick?

So when surface samples were conducted recently and found good gold still left about. the opportunity became clear; modern mining methofds have never seen this place up close, and may just open the lid the artisans loosened.

The Reward Side:

- High-Grade Gold at Surface: 30+ samples >10 g/t, with top hits at 55 g/t and 35 more between 5–10 g/t, and over 100 above 1 g/t. It’s there.

- Bulk-Mining Potential: This isn’t just about veins. Stockwork zones could open the door to low-cost, scalable mining.

- No Permitting Bottlenecks: 39 pads authorized under the land deal. Drill now, not later.

- Vendor Took Shares, Not Cash: And they doubled down in the last financing. That’s real alignment.

- Majors Already Kicked the Tires: Newmont and B2Gold both swung and missed. That means the system checks early stage boxes.

- Low Cost Drilling: Short holes (avg. 10–200m), using RC rigs. This isn’t blowing $3M to “try something.” It’s low cost validation.

- Low Elevation Geography, Year Round Access: No camp required, geos renting a house nearby, Antofagasta ports just 150 kms away, running and setup costs stay low.

- Copper Showings: Copper assays averaged 1114 ppm, which shows copper present in the south zone.

- Exploration-Geared Team: Parkinson (CEO) brings both Bay Street and Falconbridge pedigree. Arseneau (COO) has 40 years in Latin America.

And the Risks: (Let’s Not Kid Ourselves)

-

No Resource. Yet.

This is still pre-discovery. If the drilling misses, it’s a fizzle not a bang. -

Dilution Overhang

295m shares. Not tight. But a lot of that was used to get the asset away from major hands. 2% net smelter royalty i also due the sellers. -

Exploration Risk

Surface grades don’t guarantee continuity. Fault systems can be erratic. Veins pinch and swell. -

Political Risk – Chile

Stable overall, but environmental and tax regimes are tightening. Could add future cost. -

Water

Long-term development will need water. The coast is close, but desalination is expensive. Not a problem yet, but when the time comes that it becomes important, it’ll mean you found something important. -

Microcap Volatility

Thin trading, low volume, and few eyes — for now.

So What?

Here’s the pitch:

You’re buying just before the drills turn.

- They have surface gold.

- They have access.

- They have funding.

- They have targets.

- And they have a plan.

I like the early stage nature of this, without it being a complete hit-and-hope. We know there’s gold there, and has long been gold plucked off the mountainside, but the kicker here is whether modern exploration methods can pull enough of a resource estimate together to make this a district scale beast.

If they hit continuity across even a handful of short RC holes, this goes from sleepy microcap to early-stage discovery in a Tier 1 jurisdiction — with grade, scale, and infrastructure already baked in.

If they miss? It’s a paper cut. You knew the risk.

But if Polaris delivers? You were there first and get to ride the rocket.

— Chris Parry

FULL DISCLOSURE: I provide consulting services to Soldaire Investments, which is an investor in this company. In the weeks ahead of the time of writing, I may buy stock in HPM on the open market. Consider me conflicted.

Leave a Reply