Disclaimer: This article has been paid for by Zefiro Methane Corp. See disclosures at the bottom of the page.

Disclaimer: This article has been paid for by Zefiro Methane Corp. See disclosures at the bottom of the page.

Give me a minute here, I guarantee you’re going to learn something and be happy you did.

There are thousands of abandoned and orphaned oil wells in Alberta.

-

An abandoned well is an unused well owned by a company that is responsible for their maintenance and clean-up.

-

An orphaned well was once owned by a company that is now defunct, which makes its maintenance and clean-up the government’s problem.

The reason you’d remediate an old oil well is, they leak methane.

In fact, they leak a lot.

They leak the gas into the air, into the land, and into the groundwater.

Typical orphaned or abandoned wells will emit between 0.04 and 0.13 metric tons of methane per year but high-emitting “super emitter” wells can leak >1–5 metric tons/year.

Converted to CO₂-equivalent:

- A well leaking 1 ton/year ≈ 84 tons CO₂ equivalent/year

- A super-emitter at 5 tons/year = 420 tons CO₂ equivalent/year

- The first well Zefiro worked on to generate credits would leak 98,000 tons of CO2 equivalent over 20 years, which is 4,900 tons of CO₂ equivalent a year

Now you can argue about whether you think climate change is a massive problem or ‘just a problem’, but nobody needs tons of carbon dioxide equivalent leaking from tens of thousands of holes across the province into the air, land, and water supply.

We can probably all agree we should fix that.

Well, the Canadian governement tried to over the last few years, by setting aside a billion dollars to make a dent in the problem.

Unfortunately, the government chose not to attach any strings to that money. In fact, more than half of that money went to large energy companies, to help offset the cost of doing their own recovery work and, two years on, even with that money in hand, it’s been reported that not a single well has been remediated in Alberta during thst time.

Not one.

The main problem, outside of the conflict involved in paying energy companies to fix things they own, is that the work is difficult, requires real sector knowledge, and usually involves several different scientific experts, specific equipment, and multiple levels of admin, something almost no company has the facilities to pull off solo, even if they wanted to.

In short, nobody seems to know how to do it.

I mean, other than me.

HOW TO FIX AN ORPHANED WELL:

HOW TO FIX AN ORPHANED WELL:

1. Site Identification & Ownership Verification

-

Locate the well using public or proprietary databases.

-

Confirm it is “orphaned”—i.e., no viable operator legally responsible.

-

Obtain regulatory permission to intervene.

2. Site Inspection & Methane Leak Assessment

Use tools like optical gas imaging (OGI), methane sensors, and wireline surveys to:

-

Measure leak rate

-

Identify leak source (surface vs. subsurface casing)

-

Assess structural integrity

3. Well Evaluation & Engineering Plan

-

Review historical records (drill logs, casing diagrams).

-

Conduct downhole diagnostics (via wireline or mast truck).

-

Design a Plug & Abandonment (P&A) plan

-

Determine the number/location of cement plugs

-

Determine tools needed for casing removal, milling, or expansion

4. Permitting & Notifications

-

File abandonment plans with the state/province oil & gas regulatory agency.

-

Notify local stakeholders if required (landowners, Indigenous groups, municipalities).

-

Secure environmental clearances if applicable.

5. Well Remediation / Plugging Operations

-

Remove surface equipment (wellhead, tank battery).

-

Clean out the wellbore (fluids, debris, tubing).

-

Set cement plugs at key depths to permanently seal the well.

-

May use specialized casing expansion tools to close off methane pathways.

6. Surface Restoration

-

Grade and re-contour the land.

-

Remediate contaminated soil, if present.

-

Replant native vegetation or return land to prior use (e.g., agriculture or forest).

7. Post-Abandonment Monitoring

-

Re-inspect the site for methane (OGI or handheld detectors).

-

Submit final reports to the regulator documenting full remediation.

Let’s be honest, even if the likes of Cenovis ($18m in grant money) and Husky Energy ($12m in grant money) gave a rats ass about cleaning their wells, they’re going to need outside help to navigate all that. It’s just not their core business.

But it is Zefiro Methane Corp’s core business.

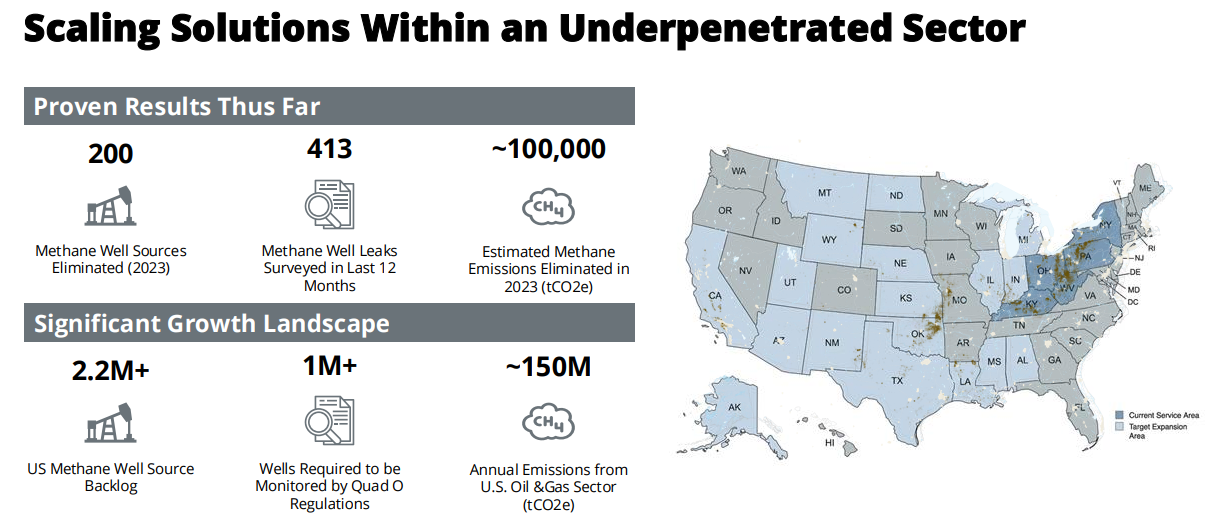

Zefiro’s core engine is methane abatement—specifically the plugging and remediation of abandoned oil and gas wells in the US – and soon Canada.

These wells leak methane, a “super pollutant” 80+ times more potent than CO₂, over decades if left unabated.

Zefiro makes money by:

-

Winning state and federal grants to do the cleanup.

-

Winning oil company contracts to do the cleanup.

-

Selling carbon credits based on the emissions they’ve prevented, through verification registries like the ACR.

-

Locking in presale agreements with major buyers (e.g., Mercuria and EDF Trading) using ISDA contracts.

And they DO ALL THE WORK.

They don’t have to subcontract anything, because they own the operational layer via subsidiaries with decades of experience in the field, like Plants & Goodwin (P&G) and Appalachian Well Surveys (AWS), giving them direct control over fieldwork, quantification, and offset generation.

ZEFI is doing the work right now, earning money while doing so, and then effectively double-dipping by selling premium carbon credits once that work is done.

Carbon Credit Strategy

Zefiro’s advantage lies in origination. While many players trade credits by reducing pollutants in a given area of their business, few can remove pollutants entirely from a site, and generate carbon credits from scratch.

Zefiro takes something others will pay them to remove, and then get paid a second time by others who want their credits to offset their own pollution:

Detects leaks → stops the leaks → verifies the emissions avoided → registers the impact as carbon credits → sells them.

-

Is targeting the methane-specific market, which commands premium prices due to high climate impact.

-

Benefits from a growing supply-demand imbalance in high-integrity offsets—especially ones tied to methane reduction, which Fortune 1000 companies increasingly favor for net-zero goals over ‘plant a tree in a country full of tree’ programs with negligible real world impact.

Acquisition and Integration Strategy

Zefiro’s growth is fueled by aggressive, strategic acquisitions:

-

Plants & Goodwin, a 50+ year old firm with best-in-class well plugging ops, brought credibility, client relationships, and scale.

-

Appalachian Well Surveys strengthened Zefiro’s methane detection capabilities and expanded their tech/data advantage.

They’ve built a solid base in the Appalachia region, where the number of orphaned wells dwarfs what you’d find in Alberta, but are now pushing for geographic diversification, expanding from Appalachia into Oklahoma, Texas, Louisiana, and Canada—where IIJA funds and international offset needs converge.

Their integration plan relies on three internal pillars:

-

People – hiring and retaining domain veterans.

-

Processes – institutionalizing workflows for everything from site ID to carbon issuance.

-

Platforms – digitization, automation, and counterparty tech to support scalable offset trading.

Says the DOI:

“The US federal government, through the Department of the Interior, addresses orphaned wells through programs like the Federal Orphaned Well Program, which provides funding to states and tribes for plugging and remediating these abandoned oil and gas wells. The Infrastructure Investment and Jobs Act (IIJA) and the REGROW Act, part of the IIJA, provide substantial funding for orphaned well plugging and related activities. The Department of the Interior also plays a key role in ensuring the effective implementation of these programs and in issuing guidance to states and tribes.”

Those programs are not small, but the job they have before them is far bigger than current funding can cover.

Upside Outlook

Zefiro’s growth is underpinned by:

-

$4.7B+ in state/federal well cleanup funds now being deployed.

-

EPA’s Quad O rules mandating leak monitoring—which is an emerging service line for Zefiro.

-

Global expansion—Canada and Gulf states are looking for methane abatement partners to hit carbon neutrality targets.

Five Selling Points

-

Massive TAM + Mandated Demand

Over 2 million known abandoned wells in the US, with a $435B estimated remediation liability. This isn’t just a growth opportunity—it’s an unavoidable one for regulators. -

Vertically Integrated Efficiency

Zefiro controls the entire value chain—from locating methane leaks to plugging wells and monetizing offsets—cutting out intermediaries, keeping costs low, and margins high. -

First Mover Advantage in Carbon Credit Origination from Methane Abatement

Carbon offset buyers prefer methane reductions due to their high climate impact. Zefiro is already originating credits, with deals inked with Mercuria and EDF Trading. -

Strategic Acquisitions Backing Proven Revenue

Acquisitions of P&G and AWS give Zefiro a 50-year track record and operational reach across Appalachia, Oklahoma, and beyond. $24M in nine-month revenue shows early traction. -

Regulatory Tailwinds + IIJA Pipeline

Zefiro has already won ~25% of IIJA-initiated P&A contracts in its regions, and new EPA rules (Quad O) further mandate methane monitoring, opening a monitoring-as-a-service angle.

THE RISK: Almost purely political.

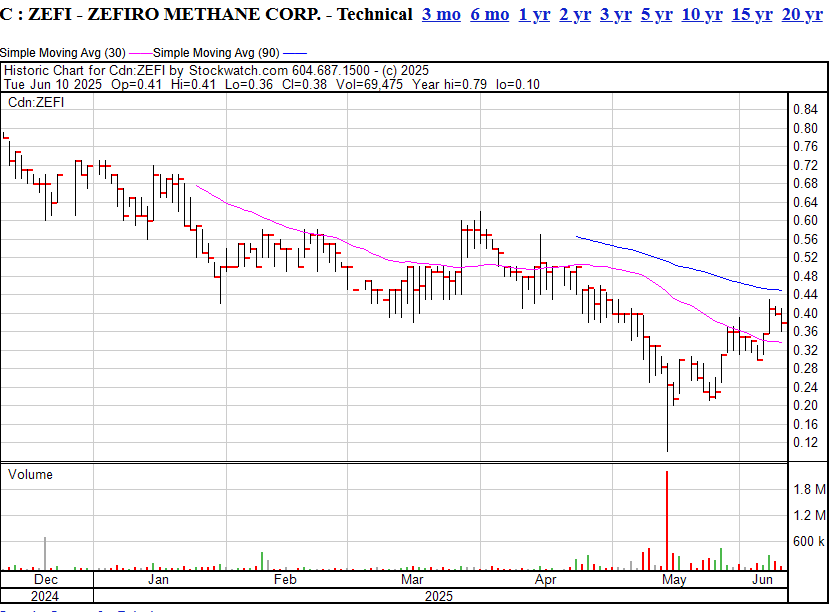

Recently, when US President Donald Trump rolled in with a desire to quit paying for anything the previous government was paying for, the fat $435b in grants mentioned above were kyboshed… for a time.

That saw ZEFI stock drop hard, but the situation was quickly corrected when a group of states – including a load of red states – took the government to court looking to have that money restored – and won.

At issue – even state governors that lean towards ‘anything climate related is bullshit’ bristle at the idea of leaving uncapped oil wells to leak into their populations.

Let’s be clear; Trump’s move was a setback for Zefiro.

They’d raised money at $0.50 per share not long ago, were sitting pretty at $1.70, then lost a lof of that profit from folks involved the financing taking their wins, while Trump’s machinations presented significant headwinds.

That’s part of the reason they’re looking north for future contracts. While the Appalachians are their bread and butter, and no nation will be able to outrun their methane concerns for long, clearly regional diversification is worth the effort.

And let’s make no mistake – the Canadian market is getting important, and quickly.

- Abandoned oil and gas wells bring fear of leak dangers

- Oil and gas insolvencies surge to 3 year high

- Number of orphan wells in Alberta will soon double as controversial oilpatch bankruptcy settled

Shares of Zefiro have been pushing higher recently, now that the overhang of financing shares has been traded away.

A double in a month is a nice turnaround from the pain insiders felt earlier in the year when Trump was throwing elbows.

Where does it go from here?

Two things:

1. If you, like me, prefer to have some portion of your portfolio devoted to things that are profitable AND MAKE THE WORLD BETTER, this is a watchlist stock.

2. If you honestly don’t give a damn about gas pollution, carbon gases, breathable air, et al, there’s still an interesting play to be had by a company that earns $24m over three quarters while sitting at a $28m market cap.

— Chris Parry

FULL DISCLOSURE: Equity.Guru/Parry Research has an agreement with Zefiro Methane Corp and may purchase stock in the company. EG/PR does not make buy/sell recommendations but you should consider any coverage in which we show the Equity.Guru client company badge as being potentially conflicted, and any investment you make in a public company as having inherent risk. This content was approved by the company before publishing.

ISSUER-PAID ADVERTISEMENT. ZEFIRO METHANE CORP., or the “Company,” has or will pay Equity.Guru/Parry Resarch (“Publisher”) in cash $4,000 for marketing services, including advertisements. This advertisement is part of those issuer-paid marketing services. This compensation should be viewed as a major conflict with Publisher’s ability to be unbiased.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured company and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, government regulations concerning potash production, the size and growth of the market for potash, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

Leave a Reply