Lithium Ionic (LTH.V) is positioning itself as Brazil’s next major lithium producer, and that’s not just a tagline — they’re making meaningful strides.

With strong economics at their flagship Bandeira project, rapid resource growth, and an ESG strategy aligned with global standards, the pieces are falling into place.

But as with any pre-production story, there are hurdles.

Here’s a breakdown of what’s working and what still needs tightening.

What’s Good

Bandeira Project is the Star

The Bandeira project anchors the entire company. It’s been fully scoped with a 2024 Feasibility Study showing a post-tax NPV of $1.31 billion and a 40% IRR. The economics are solid: a 14-year mine life, 178,000 tonnes per year of spodumene concentrate production, and $286 million in average annual free cash flow once in operation.

Cost-wise, it’s lean — $444 per tonne operating cost puts it in the first quartile of global producers.

Well-Positioned in Brazil’s Lithium Valley

Their projects sit within one of the fastest-growing lithium districts globally, flanked by significznt projects in Sigma and CBL. Infrastructure is already in place — hydro power, roads, port access — and Brazil’s permitting regime is quicker than peers.

Recent “priority status” from the state government should help accelerate licensing.

Rapid Resource Growth

They’ve gone from zero to 68.6 million tonnes of global lithium resources in about three years, including:

-

27.3 Mt @ 1.34% Li₂O (Bandeira)

-

19.4 Mt combined @ ~1% Li₂O (Baixa Grande/Salinas)

-

15.9 Mt @ ~1% Li₂O (Outro Lado)

That’s a 21 Mt lithium carbonate equivalent (LCE) total, with more upside to come. Regional anomalies near Bandeira haven’t even been drilled yet.

Progress on ESG

Lithium Ionic is building with sustainability in mind. The mine plan includes dry stack tailings (which reduces water and environmental risk), and the company has joined ESG initiatives like IRMA and the UN Global Compact. Their first sustainability report came out in 2023, and they’re using ONYEN software to track their ESG metrics.

In short: They’re being responsible, which helps grease the wheels locally.

Funding Starting to Line Up

They raised US$20 million via a royalty deal with Appian, which includes a five-year buyback clause. More importantly, the US Export-Import Bank has issued a letter of interest for up to US$266 million — enough to fund 100% of the project CAPEX.

If that finalizes, it removes a huge financing overhang and a TON of risk.

What Needs Work

Still Pre-Revenue

Q1 2025 results showed a $2.7 million loss, with working capital dropping to $13.5 million from $19 million at year-end. While cash burn is under control, they’re not generating revenue and will need either EXIM funding to come through or another equity raise. If they go to market again, dilution is a risk, but capital hasn’t proven difficult to come by yet.

Jurisdictional and Legal Risks

While Brazil is improving on the permitting front, it’s not risk-free. The company is currently fighting a legal battle over a reduced land area on one of its Bandeira claims, but that’s nothing that’ll prove a major hurdle to the project proper. Emerging markets gonna emerging market..

Royalty Buyback Could Become Expensive

The Appian deal provides needed capital, but if Lithium Ionic wants to regain full economics, it’ll cost them US$67.5 million within five years. That’s a steep hurdle, especially if lithium prices or project margins soften, but on the other hand it moves things forward for them.

Execution Risk

Construction is planned to start in the second half of 2025, with production in 2026. Timelines like these are aggressive, and many similar projects experience delays. The mine plan is also evolving, with a new Feasibility Study due later this year to incorporate recent drilling. Assume, while the company is pushing hard, it’ll likely take longer than hoped to get to the finish line.

Contingent Liabilities Are Piling Up

Several agreements — including those for the Vale, Clesio, Borges, and Neolit assets — come with milestone-triggered payments, bonuses, or warrants tied to NI 43-101 resource declarations. These are not yet accrued, but if the company delivers, these obligations could become material fast.

Conclusion

Lithium Ionic is a classic pre-producer with a lot going right — great rocks, low costs, government support, and a tight timeline to production. If they hit their permitting and funding milestones, this has all the makings of a high-margin lithium story in an emerging Tier 1 jurisdiction. But nothing’s built yet. Execution will be imperative. Still, it’s one of the better-positioned juniors in the lithium space right now and, though there are always risks, the company has done what it said it would a year ago.

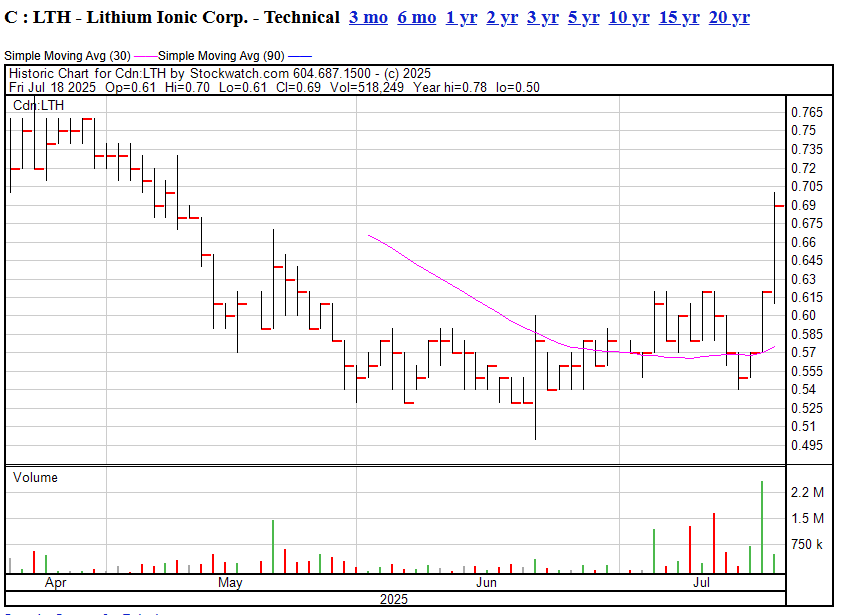

Stock took a hit in April after it had expanded the resource by 32%, in your typical ‘sell the news’ scenario, but things have been ramping up in the last month, from $0.50 to $0.70, so support is building.

— Chris Parry

FULL DISCLOSURE: No commercial interest

Leave a Reply