SPONSORED GUEST POST BY PETER EPSTEIN:

SPONSORED GUEST POST BY PETER EPSTEIN:

Word on the street is that generalist funds are looking at metals & mining companies, possibly reducing exposure to highly-valued tech names. This makes sense as many S&P500 sectors are doing poorly.

Astute readers will say, sure but generalist funds will only buy the largest mining companies, not pre-production names. That sentiment ignores what’s truly happening. The mid-tiers, wanting to be acquired by Majors, will be buying top-quality project & juniors.

Well established juniors & producers will make tuck-in acquisitions of projects/companies in which they already have good reasons to care. That means even early-stage companies benefit from a commodities bull market.

Better still, due to tariff concerns, trade wars & the loosening up of permitting, projects in the U.S. are looking especially attractive. A company that stands out as meaningfully undervalued, and highly prospective is Prismo Metals, with a CAD 9$M valuation (C$0.12/shr.)

It doesn’t hurt that Prismo has a strong mgmt./board/technical team. Chief Exploration Officer (CXO) Craig Gibson has 30+ years’ of hands-on experience in mineral exploration & corporate leadership, renowned for technical expertise & entrepreneurial vision.

He’s a Director of Garibaldi Resources, a Certified Professional Geologist, and a QP under NI 43-101. Mr. Gibson is NOT an armchair geo, he’s out in the field kicking rocks A LOT.

CEO Alain Lambert is a corporate lawyer by background with over 35 years’ experience. He’s learned a great deal about metals/mining juniors since co-founding Prismo in 2018. Alain has an extensive network of investors, bankers, analysts & IR professionals.

Mr. Lambert acts as an advisor to public & private companies regarding financings, M&A, debt structuring & IPOs. Throughout his career, Mr. Lambert has served as a director & member of audit & governance committees of small & medium-sized private & public companies.

Advisor Dr. Peter Megaw is best known as co-founder of MAG Silver & Minaurum Gold. He and his team are credited with MAG Silver’s Juanicipio discovery in the famous Fresnillo District (for which he won the Thayer Lindley Award), and Excellon Resources’ Platosa Mine.

He has 35+ years’ experience exploring for Ag/Au in Mexico, is a Certified Professional Geologist, and author of numerous scientific publications on ore deposits and is a frequent speaker at academic & international conferences. Dr. Megaw also received other awards as well.

Like Lambert & Megaw, advisor Steve Robertson has 35 years’ experience focused on precious metals & copper exploration in N. America. He has co-founded & managed several mining exploration companies. He was instrumental in the development of Infinitum Copper, & Sun Metals.

Prior, he spent 24 years at Imperial Metals, a mid-tier mining company involved in the

development and operation of five mines, primarily in British Columbia. He designed & executed many exploration programs including the highly successful deep drilling at Red Chris.

That’s four heavy hitters working on a C$9M company, most companies this size have zero or one! Why are these guys involved? The assets are high-quality. Prismo is surrounded by very substantial companies at its four projects.

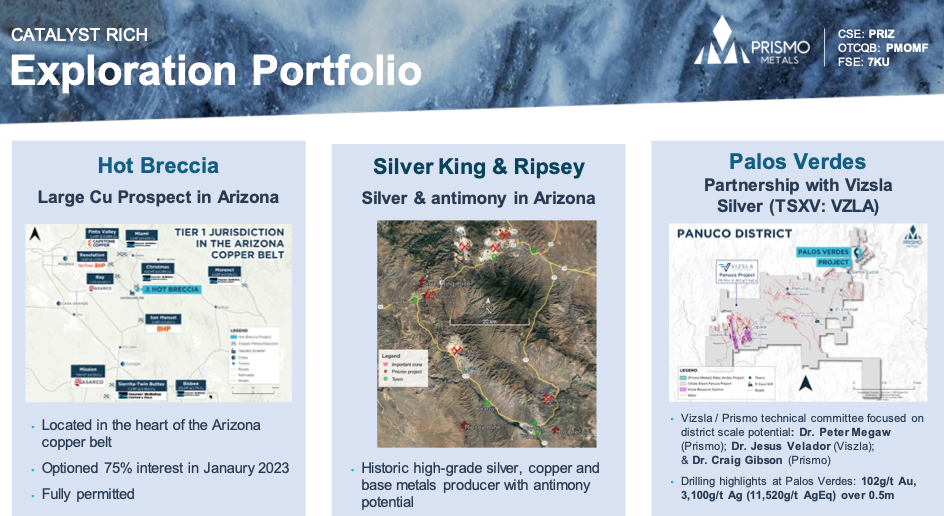

For the past several years, the focus has been on Palos Verdes in Mexico and HOT Breccia in Arizona, but market conditions did not allow management to properly advance HOT Breccia last year.

Prismo’s rockstar team excited over Silver King & Ripsey…

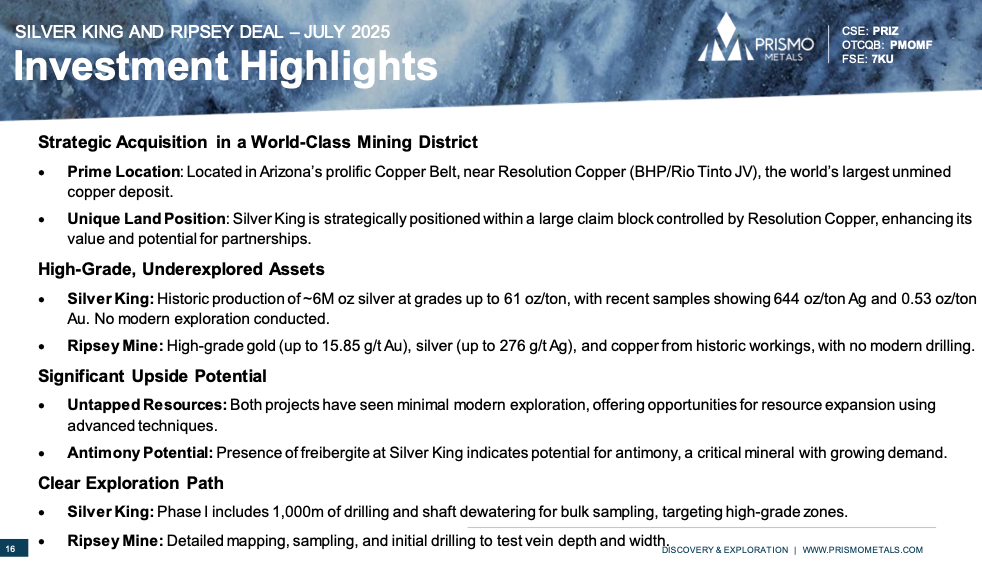

Therefore, in July, the team pivoted by obtaining options on up to 100% of the nearby, past-producing Silver King (“SK“) & Ripsey projects. Both are or will see detailed mapping & sampling programs at surface exposures, and in accessible workings.

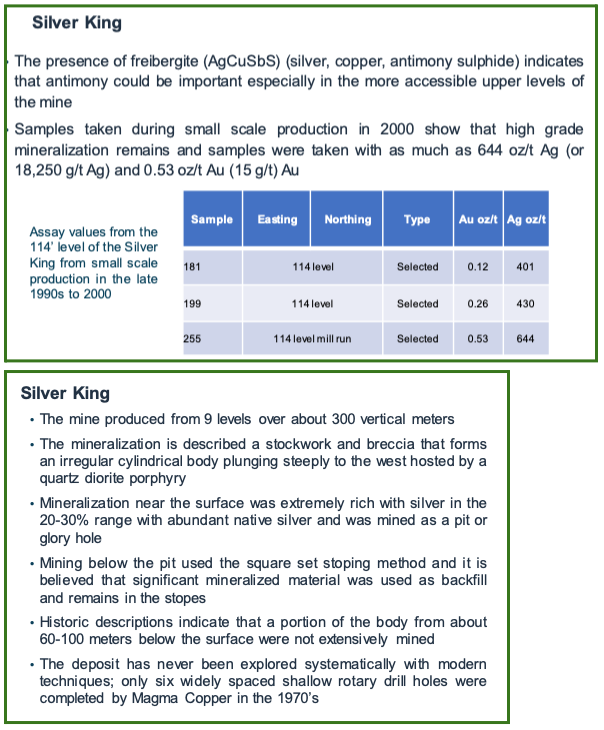

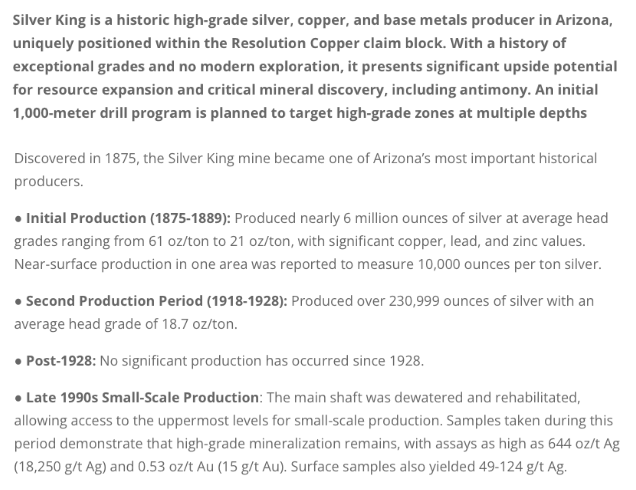

Discovered in 1875, the SK was one of Arizona’s most important producers. It has a history of exceptional grades, yet there’s been no modern exploration. It presents significant upside potential for resource expansion and new discovery, including antimony.

Mineralization at SK is hosted by the same rock sequence that hosts Resolution Copper, but exposed at surface, not covered by the thick sequence of volcanic rocks covering Resolution. President Aldcorn commented,

Having toured SK, (along with the Ripsey mine) with CXO Gibson in early August, the prevalence & scale of historic & current producing mines in the district was truly impressive. Acquiring a past-producer with virtually no modern exploration in such close proximity to world class deposits is a rare opportunity for Prismo Metals.

SK produced ~6M ounces from 1875 to 1889 at average head grades ranging from 61 to 21 ounces/ton, with significant Cu, Pb & Zn values. An initial 1,000-meter drill program is planned to test the main pipe-like body at four elevations and laterally.

Already there’s promising news. Exploration work recently identified two unknown veins, one at a large mine dump ~300 m south of the SK mine shaft. Preliminary analysis shows Pb, Ag, Cu & Zn.

A first batch of samples has been submitted, with results expected later this month. Dr. Gibson commented,

We believe this may have been the location of significant Ag production. Several veins & prospect pits occur 300 m along strike to the NE to a point near the SK glory hole… this is the first time we have observed mineralization similar to the SK deposit outside of the historic mine, providing an exciting new exploration target.

Past-producing Ripsey mine, strong recent grab samples…

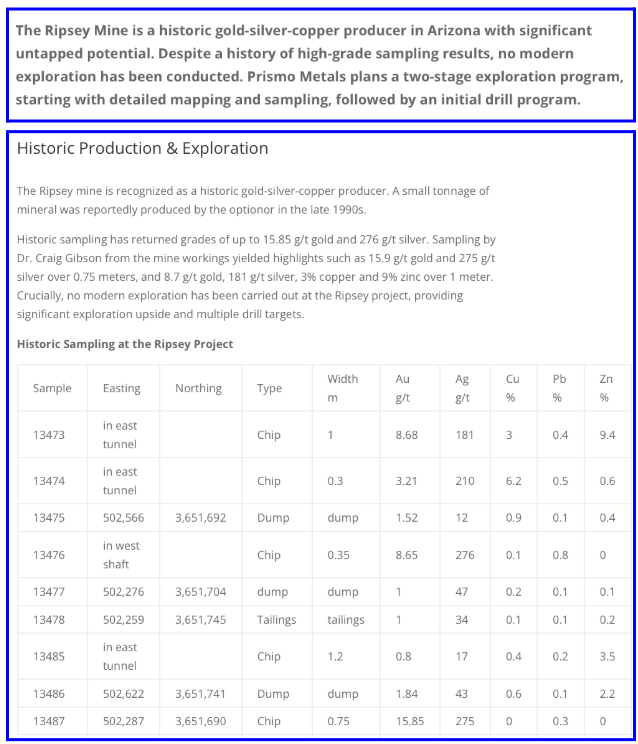

The Ripsey mine is an historic Au-Ag-Cu producer ~20 km west of Hot Breccia. Tunnels & shafts on several levels were developed along a vein over ~400 m of strike length, 160 m vertically.

The best grab samples by Dr. Gibson yielded a notable [15.9 g/t Au + 275 g/t Ag over 0.75 m] and… [8.7 g/t Au + 181 g/t Ag + 3.0% Cu + 9.0% Zn over 1.0 m].

No modern exploration has been done at this site, providing significant exploration upside & multiple drill targets.

Palos Verdes surround on 3 sides by Vizsla Silver

Switching briefly to Mexico before circling back to Arizona, Palos Verdes is an intermediate-stage Ag play in Sinaloa, Mexico. It’s a small land package, but completely surrounded by Vizsla Silver, one of the world’s top Ag juniors.

Vizsla is up +120% ytd and last week secured a US$220M loan commitment to develop its project despite only being at PEA stage. Talk about a vote of confidence! Vizsla is now a C$1.6B company.

If it wants Palos Verdes, which in my view it will, I believe Vizsla could comfortably afford to pay C$10+ million, especially if in shares of VZLA. Relations between the two companies are good, the COO of Vizsla is a Director at Prismo.

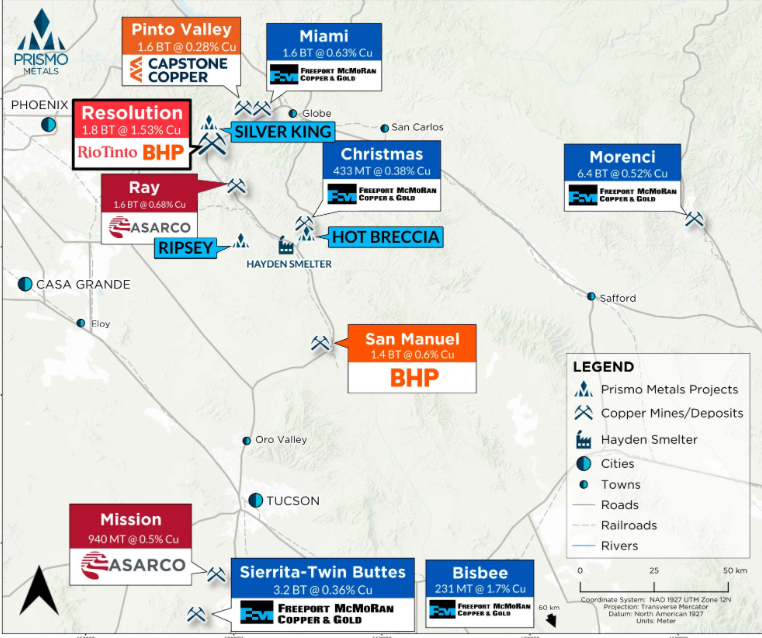

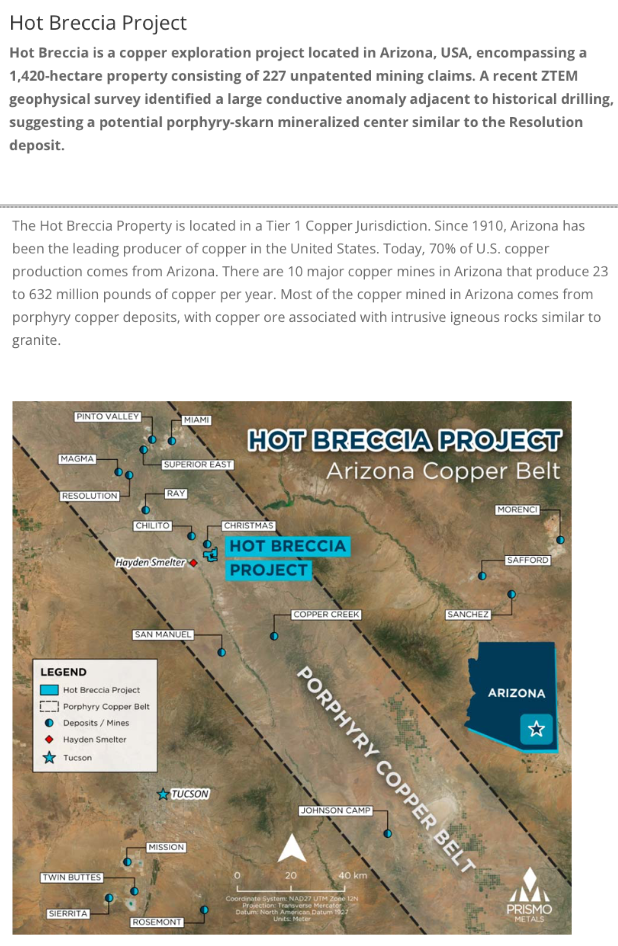

Moving on to the U.S., another important asset is the 1,420 hectare HOT Breccia project in Arizona near SK and Ripsey. Arizona is a tremendous location for Cu development & production. Grupo México/Southern Copper, Freeport McMoRan, Rio Tinto, BHP, HudBay Minerals, Ivanhoe Electric, Capstone Copper and others have interests there.

HOT Breccia could be a Company-Maker

HOT Breccia is in the heart of the prolific Arizona Copper Belt between Tucson & Phoenix. Grupo Mexico’s Asarco subsidiary has the Ray Cu complex, of which the Hayden smelter just a few km to the north of HOT Breccia.

The past-producing Christmas mine within 5 km. The simple average Cu grade of the mines/projects shown above is 0.71%. CXO Gibson provided an excellent quote form this Aug 28th PR,

“It lies in the world-famous Arizona copper belt, between several very well understood, world-class mines including Morenci, Ray & Resolution. Hot Breccia shows many features in common with these neighboring systems, most prominently a swarm of porphyry dikes and series of breccia pipes containing numerous fragments of well copper-mineralized rocks… from considerable depth. Prismo ran a ZTEM survey last year that identified a very large conductive anomaly directly beneath the breccia outcrops…”

With the 2nd half of the 2020s likely to be favorable for hard assets, commodities, metals/mining operations, especially Cu/Ag/Au, especially in the U.S., Prismo has the right team in the right place at the right time.

DISCLOSURES — Peter Epstein of Epstein Research [ER] owns shares in Prismo Metals acquired in the open market. [ER] has no existing business relationship with Prismo, but did write a few articles in 2023-24. In the future, Mr. Epstein will consider inviting Prismo Metals to become an advertiser on [ER], but no implicit or explicit agreement has been reached.

Leave a Reply