See disclosures at bottom of the page.

See disclosures at bottom of the page.

A few weeks ago, Brazil Potash (GRO.NYSE-Am), which we’ve written about a fair deal, announced an off-take agreement.

The deal was a big one and gets GRO a big step closer to production, just the latest of a series of big deals that are moving them forward.

Now, as an investor, I like being in a stock when they announce big news, mostly because that’s a great time to take some profits.

But if I’m not already there when the big news drops, there’s a secondary target that keeps the deal in play for me for a few days, and that’s the point when folks like me have finished selling it off and the stock has dipped as far as sellers can justify before it’s just too tasty to resist buying back.

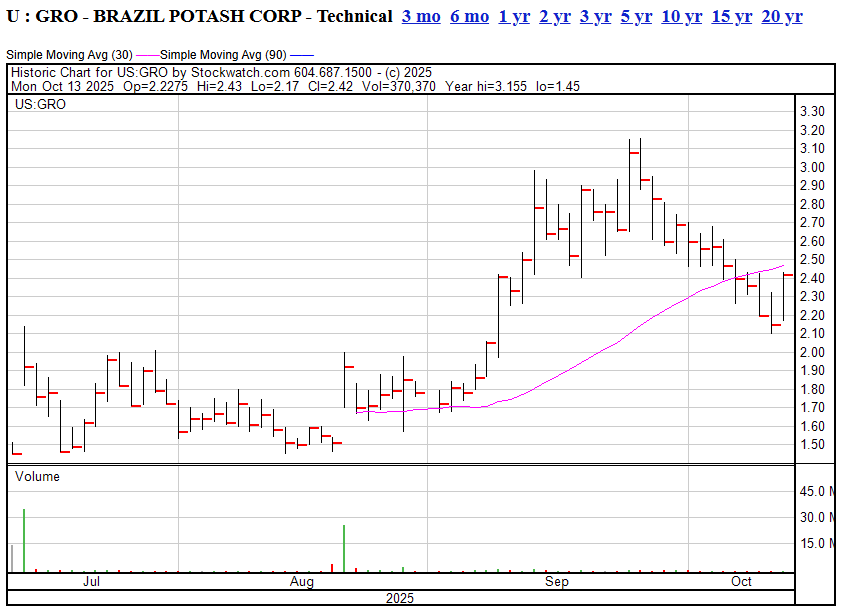

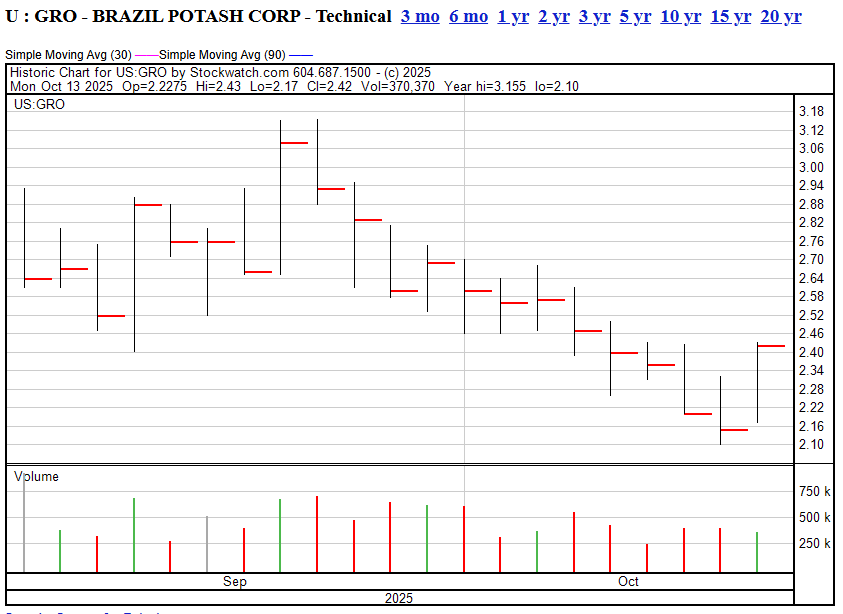

GRO hit that today.

GRO was chugging hard in September as the company talked up the deals it was negotiating, and on the 20th of that month, the first such off-takw deal dropped to the public.

It was followed by a predictable ‘good news’ rise, then a fall-off as profits were taken.

And why wouldn’t you take profits? From $1.70 to $3+ in a few weeks? You could believe Brazil Potash was headed for multi-year greatness, but a near double in a few weeks means a hotel upgrade for the family over Thanksgiving. Get in my wallet!

Such up-down moves happen often on the back of a month-long rise, and though nobody likes to see a stock come off the top too hard, when the fundamentals of the company haven’t changed at all, you can have confidence that buying back in on the dip has merit.

Last week, GRO was a $124m company.

This week, with nothing having changed at the pointy end, it was suddenly an $84m company, good for nearly a 40% discount.

On that, the tide turned. The selling slowed and folks began to look at $2.10 as a nice re-buy spot, and up went the stock to $2.38 today, a 12.6% rise with a sizable gap between bids and asks suggesting volatility is afoot. In fact, if you look at the trading volume on the day, you can see that big move wasn’t on epic volume at all, indicating that another big news day will be VERY interesting.

The Deal

From an investor standpoint, this announcement is a major commercial de-risking milestone for Brazil Potash and its flagship Autazes Project in the Amazon basin; a project designed to make Brazil self-sufficient in a mineral it currently imports almost entirely.

What Happened

Brazil Potash signed a 10-year, take-or-pay offtake agreement with Keytrade Fertilizantes Brasil, a subsidiary of the global fertilizer trader Keytrade AG.

Keytrade has agreed to buy up to 900,000 tons of potash per year from the Autazes mine once it begins production. This follows an earlier deal with agribusiness giant AMAGGI, bringing total locked-in sales to roughly 1.45 million tons per year — about 60 percent of total planned output.

A take-or-pay contract means the buyer pays for the product whether or not they take delivery, giving the producer guaranteed cash flow and helping unlock project financing. These agreements are crucial precursors to securing loans or partnerships to actually build the mine.

Why It Matters

-

De-Risking and Financing Power:

With over half of future production already sold under binding terms, Brazil Potash now has predictable long-term revenue. This makes it far easier to attract debt and equity financing to fund construction, which could cost several hundred million dollars. - Strategic Advantage for Brazil:

Brazil imports about 95 percent of its potash. Producing it domestically cuts transport costs, reduces geopolitical risk, and fits squarely within the government’s National Fertilizer Plan, which prioritizes food security and local production. -

Environmental and Logistical Edge:

The project will move fertilizer by barge through existing Amazon river routes, slashing trucking emissions and logistics costs. Brazil Potash estimates this could avoid 1.4 million tons of CO₂ per year. - Revenue Stability and Upside:

Pricing will be tied to market levels but includes profit-sharing and marketing fees, aligning incentives between Keytrade and Brazil Potash. The company also retains flexibility to sell the remaining 40 percent of output into the spot market, capturing higher prices when they occur.

Investor Takeaway

This deal moves Brazil Potash from concept toward bankability. With 60 percent of sales committed and negotiations underway to push that above 90 percent, the company has cleared one of the biggest hurdles for large-scale mining projects — credible customers. Investors can view this as a strong signal that institutional lenders and strategic partners will soon follow, positioning Brazil Potash as a cornerstone domestic fertilizer supplier in one of the world’s largest agricultural economies.

Leave a Reply